Red Hat's Trip Down the Yellow Brick Road With Linux

When a marvelous company with cutting edge technology keeps chugging along, you do not have to wonder why the heck its shares are surging.

This is the case with Red Hat (RHT) who is trading at an all time high even after a broad based correction.

The extraordinary development of this earnings season is the broad-based strength that second tier tech companies, the Non-Fang's, have displayed beating and raising guidance amid the backdrop of rising rates and inflation.

This is what happened when FANG share prices run too far, too fast. The Niagara Falls of cash pouring into the technology sector cash need other companies to spill into.

The pioneering Linux operating system company has exhibited emphatic strength after the tech sector led the equity recovery from the precipitous correction earlier this month and the Nasdaq has gained back almost all of its losses.

The broader market is concerned about higher remuneration costs and runaway inflation. Rising wages will inflict severe damage to wage bills.

Look no further than bitcoin software engineers who accept entry level positions of over $100,000/year and autonomous vehicle engineers who start out at net $300,000/year and quickly scale to $450,000/year because of the severe talent shortage in Silicon Valley.

Luckily, the Mount Everest wage levels are justified when gross revenue per employee is steadily gushing upwards such as at Red Hat. Technology companies are almost the only ones that can afford these wage hikes because they have the earnings to justify them.

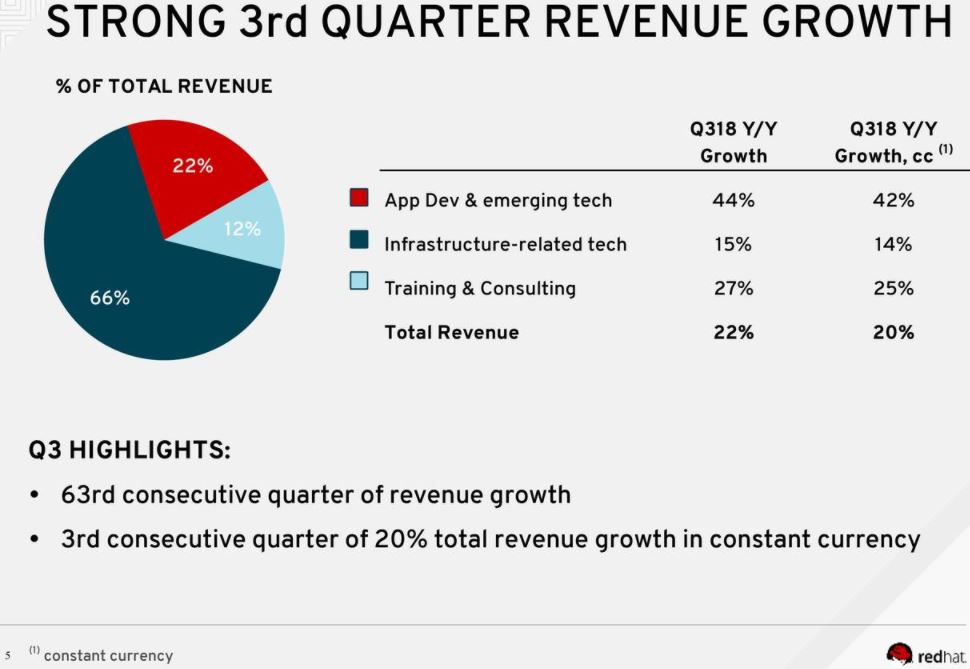

In the company's latest earning's report announced, revenue was up a bubbling 22% YOY. Application development and emerging technology subscription revenues registered at $162 million, up 44% YOY.

Operating cash flow was up 18% YOY at $160 million. Upcoming earnings project accelerated revenue growth.

Red Hat (RHT) has been one of the many recipients of the secular growth trend of tech and is making all the right moves to command praise from industry analysts.

Similar to Amazon (AMZN), the company still trades relative to future growth projections and does not trade on bottom line performance - PE multiples are irrelevant.

A headquarter in Raleigh, North Carolina would have been a death sentence 15 years ago, but the city has turned into one of the hippest tech nerve centers for blossoming millennials.

It's affordability, low cost of living and abundance of high paying gigs has lured in young professionals in droves.

The research triangle circuit of Raleigh-Durham-Chapel Hill that feeds off of Duke University, NC State University, North Carolina-Chapel Hill and Wake Forest, give employers a formidable opportunity to cultivate an expansionary talent pool to cherry pick from.

The main arteries, I-85 and I-40, marry all these metro areas together making North Carolina well positioned to facilitate distribution.

Red Hat development is bound to open source software and Linux operating system offerings. Other know-how and expertise come in the form of virtualization, middleware, cloud, and storage technologies that equip a successful enterprises software business.

The extensive training and consulting they provide reverberates down to their revenue at 12% growth.

Red Hat Enterprise Linux (RHEL), an operating system platform outperforming in hybrid cloud environments ensures a healthy infrastructure.

Red Hat JBoss Middleware, a key for developing, deploying, and managing applications; integrating applications, data, and devices; and automating business processes in hybrid cloud environments is another application on offer.

The stamp of supreme quality was validated when Red Hat joined forces with Alibaba (BABA) Cloud. The certification process required the completion of distribution of Red Hat's software.

It will be jointly available for both firms' customers, ISV's (Independent Software Vendor) and 3rd party developers to boost their infrastructure with a cost-effective, fluid solution.

With Alibaba Cloud's global audience, having Red Hat Enterprise Linux on Alibaba Cloud Marketplace offers customers better results from a platform capable of deploying enterprise cloud architectures to exponentially expanding business demands of digital transformation.

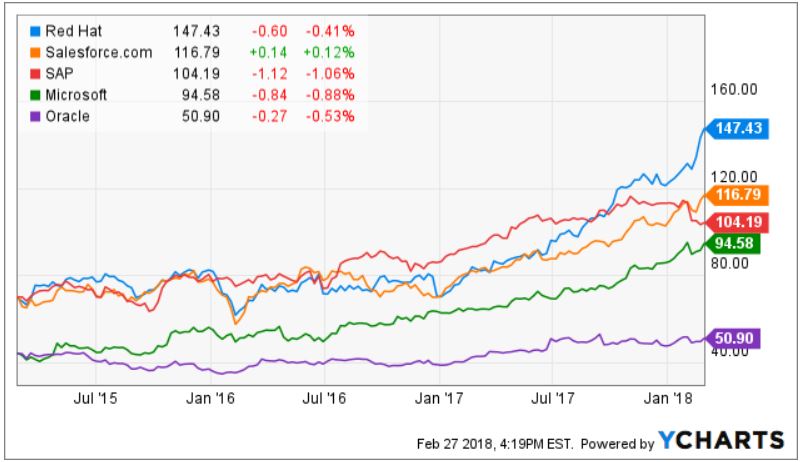

Red Hat, which compete with Oracle (ORCL), Microsoft (MSFT), Salesforce (CRM), SAP (SAP), and VMware (VMW), are in an enterprise cloud arms race and management sense they cannot back down from their pursuits. As with many before them, evolve or go extinct.

Red Hat has used their unique understanding of Linux and open source to consummate a mixed cloud product around OpenStack. This process began in 2014 as CEO, Jim Whitehurst firmly understood Red Hat could not flourish with Red Hat Enterprise Linux alone.

By becoming specialists in the open source sphere, it gave Red Hat the perfect podium to offer their cloud products. The Linux system and cloud software feed off each other and the recently acquired JBoss middleware layer that is required to hold these two together act as another revenue stream.

Jim Whitehurst has convincingly noted that the current offerings will easily see them march above $5 billion total annual revenue up from the less than $3 billion annually they procure today.

Salesforce's sheer size represents the 800-pound gorilla in the room, but Red Hat is advancing nicely and regularly surpasses growth targets which crucially sustains positive investment sentiment.

Open source projects are the new normal and will progress because of the diverse community of stakeholders that are particularly keen in making the software succeed.

It's important to recognize that open source outperformance will create better products globally and holistically advance the enterprise software market.

Open source software has the long-term vigor to outlast proprietary developers that aren't as committed. If products are continually improving, they become being incredibly sticky inside the ecosystem.

Red Hat has positioned itself smartly and share the lucrative pickings with others in its peer group.

Red Hat has prospered in a brave new world where business is catering to tech to enhance product levels and service explaining why Walmart (WMT) is turning into a tech company.

Red Hat is still ubiquitously famous for building a fresh version of Linux, specifically, an enterprise version, but it has begun reaccelerating with tools on their Linux platform such as cloud and container products that will pad profit margins.

These existing clients that already use RHEL (Red Hat Enterprise Linux) will continue to thirst for the new add-ons that harness innovative technologies.

Red Hat's share price is on a tear in 2018, already up over 17% and over 60% over the last 365 days. Use the next entry point to splurge on Red Hat.