Salesforce Knocks It Out of the Park

It’s been a grueling winter for tech stocks and countless number of positive earnings reports have fell on deaf ears.

Will the bloodletting stop?

Not if Salesforce (CRM) has something to say about it!

And if you thought that tech’s secular tailwinds had vanished, this latest earnings report confirmed that software stocks are alive and are as potent as ever.

That is why I have identified software stocks as the best tech play in the current late-stage economic cycle.

At the Mad Hedge Lake Tahoe Conference, I clearly telegraphed that companies do not pour capital into capex for large and risky projects at this late stage, they search for the additional incremental dollar by arming their staff with optimal and efficient software programs to squeeze more juice out of the lemon.

Salesforce is a great example of this.

Moving forward, Salesforce is on the A-team of the software squad, and ideally positioned to harpoon any whales that come near their boat.

Companies are looking to double down on software initiatives at this point which is another reason why annual IT budgets have shot through the roof.

I have met countless CEOs who guide thousands of staff throughout branches around the world and they told me that one of the big in-house additions has been integrating Salesforce as the main customer relationship management system deleting legacy systems of yore that have pooped out.

The switch bears fruits immediately with operations supercharged like a 5-star high school football prospect on his first month of ‘roids.

Simply put, everything just works a lot better with access to this software.

What CEO wouldn’t want that?

Even more salient is that Salesforce has promoted itself as the emblematic tech growth stock promising to smash $16 billion of annual revenue by next year.

I love that Salesforce commits to ambitious sales targets and always delivers the goods.

A talking head on a prominent financial TV show went on record saying that Apple is the key to the tech narrative perpetuating, I would completely disagree with this statement.

Everyone and his mother have absorbed that Apple iPhones sales have plateaued, I am honestly sick of hearing the same story in the news over and over again.

That is why Apple has been trying to morph into a software and service stock. They are doing a great job at it by the way.

The real conclusive acid test to the tech story are these high growth software stocks because they should be the ones outperforming at this stage in the economic cycle.

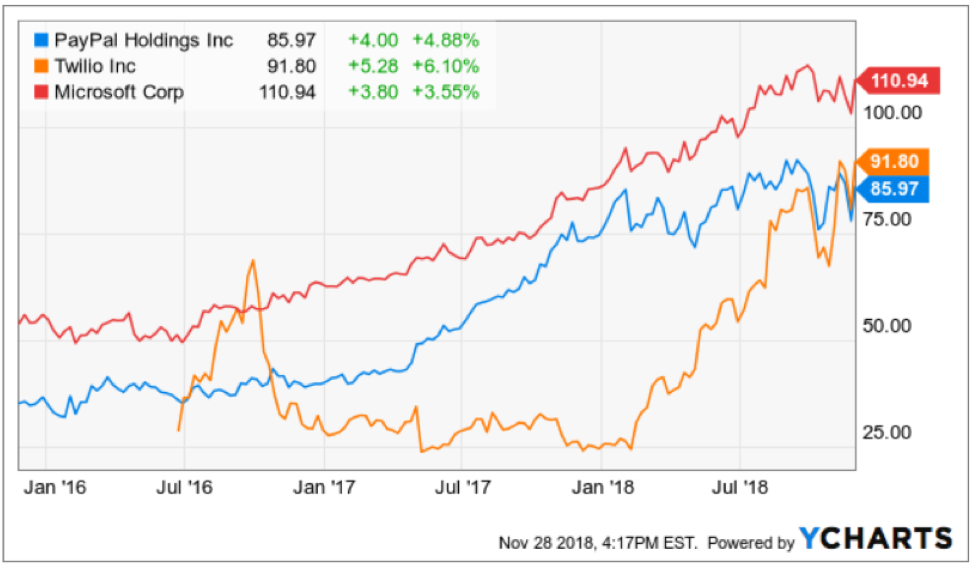

If companies tilted towards software like Salesforce, Twilio (TWLO), PayPal (PYPL), Microsoft (MSFT), and Adobe (ADBE), just to name a few of the crown jewels of software stocks, start laying eggs then I would admit the tech story is dead.

But it’s not.

Salesforce is poised to continue its ascent and that basically means quarterly sales growth in the mid-20s for the foreseeable future.

There is an addressable market of $200 billion and the pipeline is rich as ever could be.

Salesforce has really turned the corner with free cash flow and profitability. It was only a few years ago they were turning in heavy losses, but this new Salesforce will be even more profitable as the network effect makes the sum of the parts and each add-on cloud-based software tool even more valuable.

Companies just love the breadth of functionality that Salesforce offers and their pension for product enhancement is really owed to CEO Marc Benioff who never shies away from calling his peers out and never cuts corners.

In fact, Marc Benioff is one of the good guys in an increasingly rotting Silicon Valley, part of this has to do with him growing up as a local lad in Burlingame, just a stone throw from his newly built palatial Salesforce Tower gracing downtown San Francisco’s picturesque skyline.

Benioff has more skin in the game as a local and publicly supported Proposition C, effectively a bill that would charge a homeless tax on big earning corporations in San Francisco.

Benioff has also promised to fund any subsequent legal attack that attempts to unravel this homeless tax putting his money where his mouth is.

Benioff noted that he has seen no softness in the macro spending environment.

And even with all the crazy headlines spinning around in the media, there has been no material impact from any supposed peak or downshift in the business environment.

Not only is Salesforce dredging up SME deals at a fast rate, they are quickly targeting the big kahunas.

The number of deals generating more than $1 million was up 46% YOY in the third quarter.

The volume of $20 million-plus relationships is also growing significantly.

In the past quarter, Salesforce renewed and expanded a 9-figure relationship with one of the largest banks in the world.

Salesforce is able to upsell their cloud tools to customers and these firms eat up the Einstein built-in functionality that uses artificial intelligence to improve the existing software.

North America comprised 71% of total revenue which is why this software company will reap the rewards for any extension of this economic cycle because they are largely domestic and best in show.

Salesforce beat and raised its outlook calming the frayed nerves of investors looking to dump software stocks.

Just look at the billings growth that was anticipated at 19%, Salesforce smashed it by 8% coming in at 27%.

Not only are they scooping up new customers, but renewals have been just as robust.

The truth is that Salesforce can’t roll out enough cloud-based software products to meet the insatiable demand.

All of this backs up my thesis that software stocks will be the outsized winners of 2019.

The FANGs are not dead, I rather hold an Amazon (AMZN) or Apple (AAPL) long term if I had the choice.

But at this stage, investors should be piling into all the crème de la crème software stocks.

Avoid them at your peril.