An eCommerce / eGaming Behemoth to Look At

Do you want to invest in the 3rd most downloaded app in the shopping category globally for 2020?

Well, you can.

And that’s not all this company does, there is more.

This tech company is also part of a wider portfolio that includes Esport assets.

Sea Limited (SEA) is listed on the Nasdaq stock exchange under the ticker symbol SEA.

SEA, previously known as Garina, is headquartered in Singapore and serves the South East Asian and Latin American markets.

In both the fourth quarter and for the full year, Shopee, SEAs ecommerce division, was ranked the No. 1 in the shopping category across Southeast Asia and Taiwan by average monthly active users, total time spent in-app on Android, and the downloads based on App Annie.

Initially, SEA was a communication platform for video gamers, before distributing games made by Tencent for the Southeast Asian audience.

The company then went on to produce its own in-house game, Free Fire, which became an international phenomenon on the company's first try out of the gate.

Free Fire was once again the top-ranked mobile-only video game and the top-ranked battle royale video game on YouTube in terms of views.

It was also the third-ranked game overall on YouTube by view count. Free Fire-related content recorded over 72 billion view count across YouTube globally over the course of the year.

The game was also named the Esports Mobile Game of the Year at the Esports Award 2020.

They have the in-game titles to accumulate the eyeballs in its ecommerce division.

SEA's ambition went well beyond video games, and the company then launched Shopee in 2015, along with SeaMoney, its digital financial-services arm around the same time.

Shopee has been a winner, overtaking early e-commerce players in the region just as Southeast Asians began to adopt e-commerce at a larger scale.

The pandemic then hit just as Shopee was overtaking its rivals, leading to meteoric growth last year.

It continued to invest in its fintech ambitions by buying Jakarta-based bank Bank BKE. Acquiring a bank signals SEAs ambition to become a swiss army knife of financial services beyond mere e-commerce payments.

Second, Sea Limited has also entered Latin America in a dramatic fashion.

After starting with a small e-commerce presence in Brazil in 2019, Shopee just launched its app in Mexico in February.

The launch signaled that SEA is targeting Latin America for the next phase of incremental growth, where e-commerce is underpenetrated, and where it can cross-market effectively with the many Free Fire players in the region.

Moreover, Latin America has an even bigger population than Southeast Asia, with 2019 GDP of $5.2 trillion, versus Southeast Asia's $3.6 trillion.

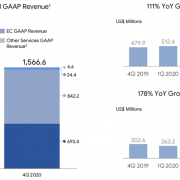

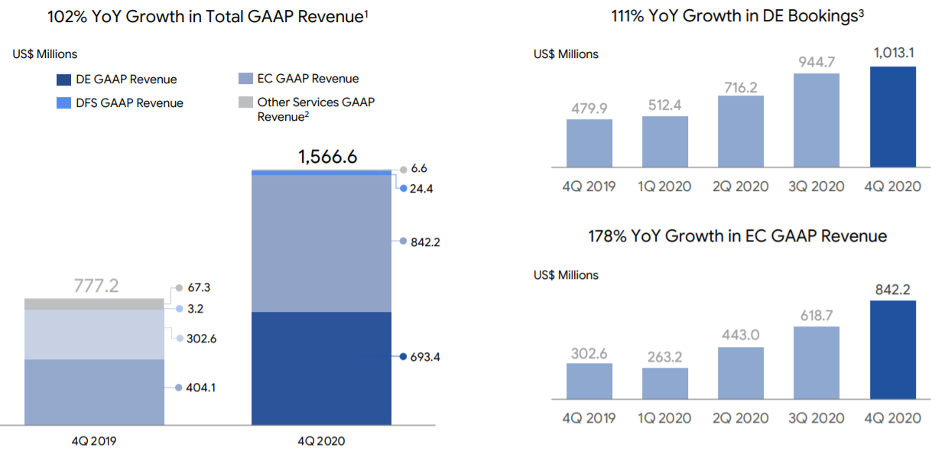

The recent performance is quite breathtaking, to say the least with total revenue increasing 102% year on year to $1.6 billion in the fourth quarter, and 101% year on year to $4.4 billion for the full year of 2020.

This was mainly driven by rapid rate growth in SEAs e-commerce business as they continue to grow tools to better serve users' needs, as well as the growth of the digital entertainment business, especially self-developed game Free Fire.

The proof is in the numbers.

To sustain the momentum in Esports, in the fourth quarter, Phoenix Labs, SEAs triple-A gaming studio based in Vancouver, is adding new offices in Montreal and Los Angeles, alongside its existing - existing bases in Vancouver and Seattle.

Shopee reported 1 billion gross orders, up 135% year on year, and a gross market value (GMV) of $11.9 billion, an increase of 113% year on year resulting in quarterly revenue growing 178% year on year to $842.2 million.

Shopee continued to rank first in Indonesia by average monthly active users, total time spent in-app on Android, and the downloads in the shopping category in the fourth quarter and the for the full year of 2020.

For the full year of 2021, SEA currently expects bookings for digital entertainment to be between $4.3 billion and $4.5 billion, representing 38% year-on-year growth.

Sea Limited also expects that revenue for e-commerce could be between $4.5 billion and $4.7 billion, representing 112% and year-on-year growth as a mid-point of the guidance.

A tech company that grows revenue from $4.38 billion to a projected $9 billion by end of 2021 has caught my eye but there are some major caveats.

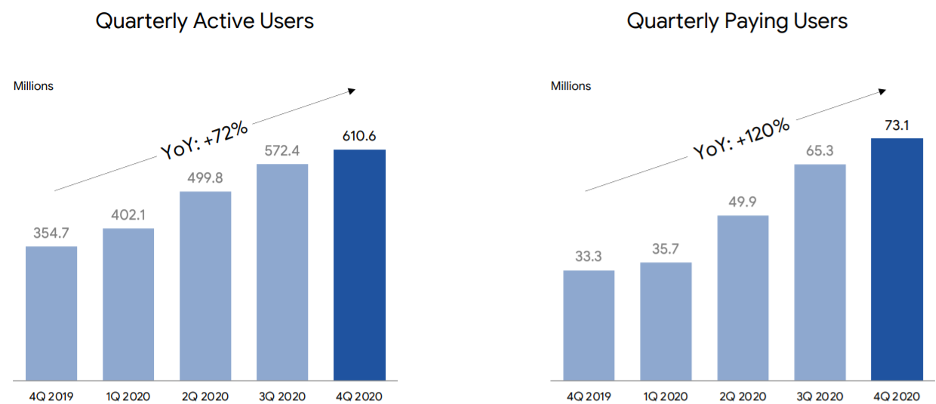

The first major eyesore is the gigantic losses.

Granted, net losses are only half as bad as Uber, but they have a track record of badly missing earnings projections as well.

This would lead me to suggest that the company is not being managed properly if they consistently forecast earnings that are unattainable.

I am quite discouraged by the lack of future profitability rhetoric by management in their earnings call.

Next, they are targeting markets of Latin America and South East Asia that aren’t as lucrative as the North American markets.

Granted, North America is cornered by local incumbents, but that doesn’t change the fact that consumer purchasing power in Mexico, Brazil, and Indonesia is low.

Being a foreign company, regulatory risks are now the order of the day as well.

In the past 365 days, the underlying stock has risen around 500% validating the trajectory of this tech group as a real ecommerce and digital gaming force.

The stock year to date is only up 20% suggesting the pace of appreciation is plateauing and even though annual revenue is projected to double in 2021, I do believe there will be consolidation before the next leg up.

Cut it up any way you want, in a market that pays a premium for big loss-making tech firms, the over 100% in projected revenue growth in 2021 delivers exactly what the tech market desires.

But like other growth stocks ROKU, the ride up will be exhilarating and rocky because unpredictable earnings results are part and parcel of high beta tech stock’s inner workings.

Readers looking for global exposure in a volatile tech name taking advantage of the emerging ecommerce story, take a look at Sea Limited on a meaningful pullback.