Self-Drive to Higher Prices

If you thought prices couldn’t go any higher and a reversion to the mean is in store, you are painfully wrong.

Sure, maybe you might catch the low inventory 10% sale on the old model, but I can guarantee you that the next iteration will be aggressively pricing itself higher.

If you think your next iPhone will be cheaper than the last, then please give me a call, I would love to debate.

Let me just lay down this one caveat by saying even if inflation falls to 5-7% and the administration calls it deflation or what-not, the aggregate inflation over the past few years will be felt at the individual level, but at the algorithmic stock market trading level, 5-7% is better than 9.1% meaning the stock market will slingshot higher.

Remember that trading is controlled by the algos, it’s around 87% of trading in 2022.

Pulsating price increases are on the menu at EV bellwether Tesla (TSLA) and my best friend Elon Musk’s company.

Elon announced just over the weekend that the price of Tesla’s Full Self-Driving system (FSD) will increase by $3,000 next month, the second time it has risen in price this year.

I can almost guarantee you there will be a 3rd increase by Christmas and 4th increase early in 2023.

That’s just the word out there on the streets.

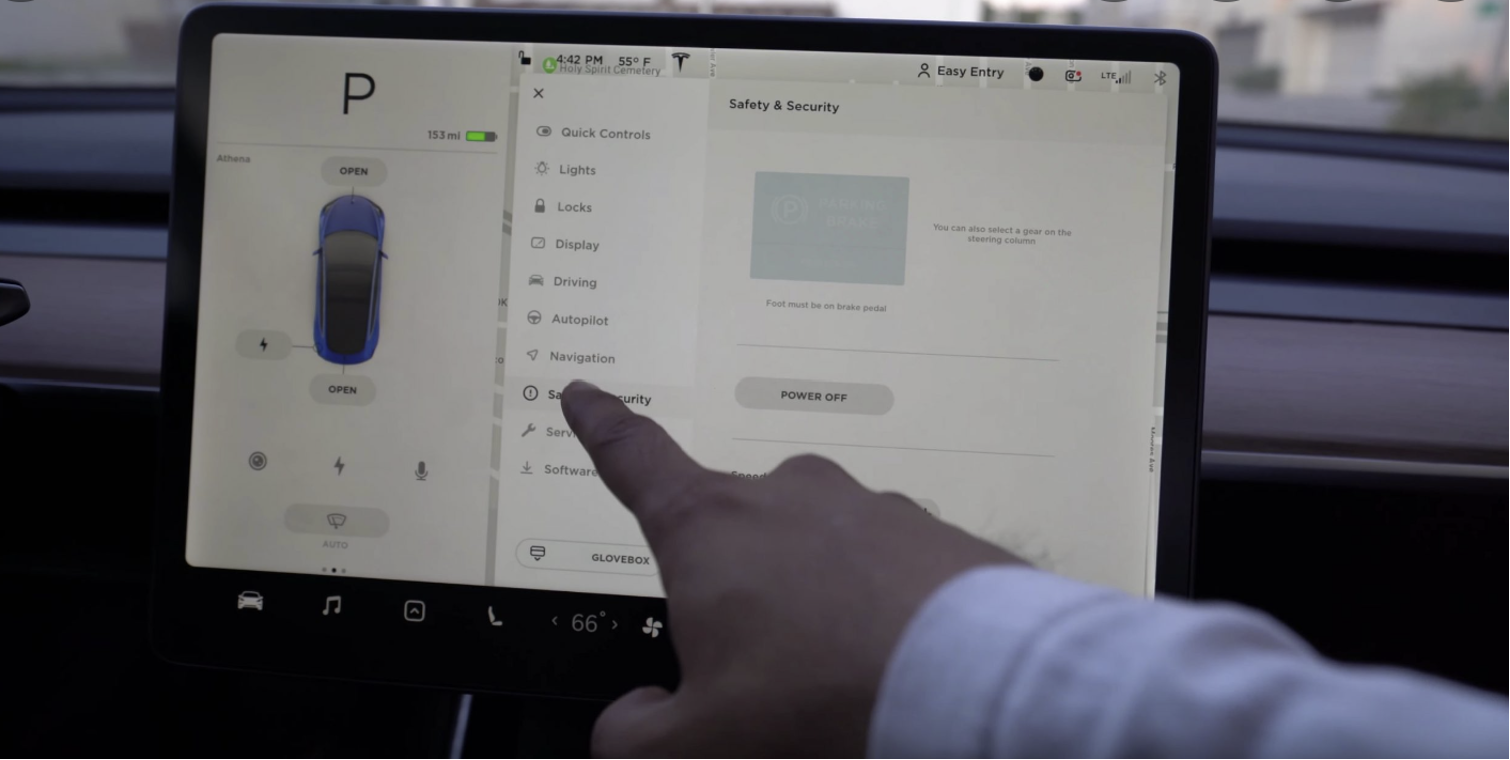

Tesla began rolling out its FSD Beta software update release version 10.69. Consumers will see the price rise as of Sept. 5.

Every new Tesla vehicle comes with a driver assistance package called Autopilot, which the company says aims to reduce the driver’s overall workload.

That package contains features such as “Traffic-Aware Cruise Control” through which Tesla vehicles can automatically detect stop signs and traffic lights and automatically slow the vehicle down, as well as “Autosteer.”

These rely on eight external cameras fitted in the vehicle along with “powerful vision processing,” sensors, and various software to ensure the vehicle remains within a clearly marked lane and at the same speed as surrounding traffic.

Currently, Tesla’s FSD software costs $12,000 or consumers can purchase a subscription of $199 per month.

Since Tesla’s FSD system began rolling out in 2019 at a price of $5,000, Musk has regularly increased the price. In 2020 it jumped to $10,000 and in September 2021, it rose again to $12,000.

The strategic gambit sees no end.

Very much like the price of a dozen eggs at the grocery store, prices aren’t going down anytime soon.

Any short price reduction is met with a huge price increase in the future.

Technology is feeling many of the same headwinds such as supply chain headwinds, wage spirals for tech developers, stock compensation not logically based on lower stock prices, diminishing returns of technology, cash crunch on balance sheet, and explosive interest rates.

What does this all mean?

Technology, again like current Manhattan rental prices, becomes a luxury.

Your monthly broadband price will become more expensive upon signing the next contract.

Your iPhone and MacBook will get more expensive by the tune of 30%.

Your streaming subscriptions will become more expensive like Disney Plus and Hulu’s $4 per month price hike.

US tech companies producing these must-have items will pass 100% of cost increases to the end consumers knowing the end user cannot progress career and life without critical technologies.

Tech has checkmated us and more importantly, they bask in their strategic position.

Long-term they will still be very successful with much higher stock prices even if Google’s ad revenue tanks in the upcoming recession.

Tech will come back because it always does, and the US economy will not be in a never-ending recession once rates go back to 0.

Naturally, if this scenario plays out, only the Goliaths prosper, and everybody gets wiped out which is why we are seeing tech start-ups going to hell in a handbasket.

When observing the cream of the crop venture capitalist Marc Andreesen deliver $350 million to fantasist Adam Neumann to become a property manager, it’s clear that there are not enough good ideas in tech now and that interest rates are still way too low.

PREMIUM SOFTWARE FOR A PREMIUM CAR