September 1, 2010 - My Equity Scenario for the Rest of 2010

Featured Trades: (SPX)

S&P 500 Large Cap Index ETF

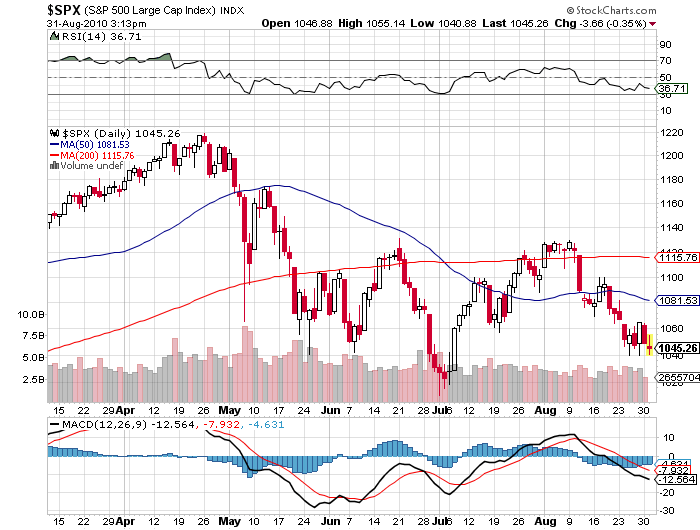

3) My Equity Scenario for the Rest of 2010. Not a day goes by when I don't fall down on my knees and thank the heavens that I avoided equities for much of this year (click here for 'I'd Rather Get a Poke in the Eye With a Sharp Stick Than Buy Equities' in January). Trading in American stocks this week is a sloppy, low volume, conviction free affair as everyone waits for an August non-farm payroll figure they know will be terrible. Good thing I focused on the grains, the Canadian and Australian dollars, emerging market equities and debt, junk bonds, precious metals, rare earths, and a few special situations like BIDU, POT, AGU, and MOS.

That report could be the stick that breaks the 1038 support which has held for 3 ? months and takes us down to my long standing 950 target for the S&P 500 (click here for 'Why There is No Place to Hide in This Sell Off'). Gold's positively virile action today, where it touched $1,250, just shy of an all time high, tells you that September is not going to be a pretty picture.

Historically, stock markets are weak for the six months going into midterm elections. The April 25 top on the SPX neatly fits that time table. In every election since 1950, markets then rallied for six months after the midterms, setting up for a nice year end rally.

The catalyst for the move will be the removal of the elections themselves as an unknown. With the two political parties at contemptible, diametrical, even hateful? extremes, elections these days have a much larger impact on financial markets than they have in the past.

End September will also bring the next round of earnings reports, which should be pretty good. After all, firing people to boost productivity and profitability is the winning business model of 2010. A 950 SPX gives you a PE multiple of 10, the lowest it has been for years. For you technicians out there, 950 also happens to be a key Fibonacci level.

I have often said that markets will do whatever they have to do to screw the most people. Getting as many as possible maximum short in September, then running the markets for the rest of the year, fits the bill nicely.

Thanks Goodness I Avoided Equities This Year