September 16, 2010 - Japan Draws its Line in the Sand for the Yen

SPECIAL GOLD ALL TIME HIGH ISSUE

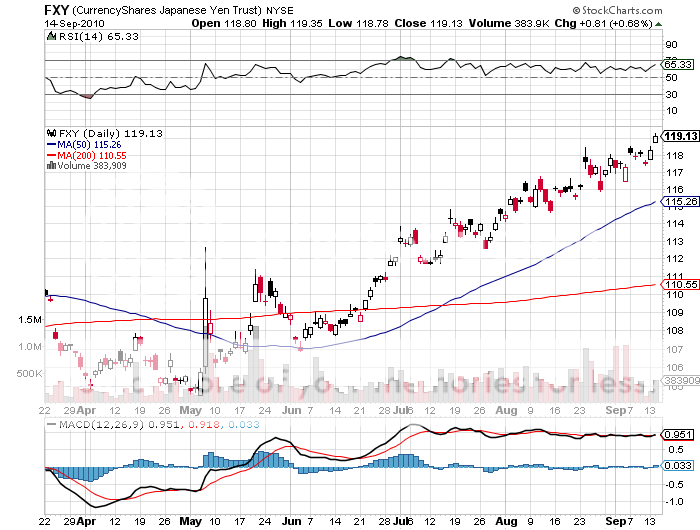

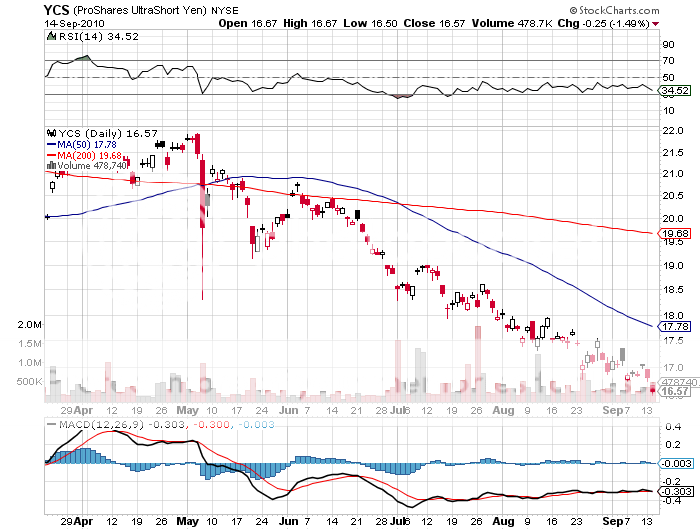

Featured Trades: (YEN), (FXY), (YCS)

ProShares Ultra Short Yen ETF

3) Japan Draws its Line in the Sand for the Yen. The Bank of Japan ambushed the foreign exchange market, gaping the yen three hands from the high ?82's to the ?85's by dumping hundreds of millions of dollar in a matter of minutes. It is the first time the central bank resorted to such a drastic move in six years.

As a career dollar/yen trader, I have seen this movie play many times. Wait for the market to take on a maximum position short, slam the market the other way, literally taking the money away from the speculators through trading losses. The first several attempts usually fail, and traders pooh pooh the effectiveness of such a strategy. But in the end, the government always wins out, as it can print unlimited amounts of money for free.

Sure there is an inflation risk down the road if the BOJ does this in an unsterilized manner. But after two decades of deflation, I doubt if anyone in Japan can even spell inflation.

Japanese prime minister Naoko Kan set up this move by handily beating challenger Ichiro Ozawa for control of the ruling? Democratic Party of Japan (DPJ) in elections on September 14. There was a time in my life when I could go on for pages about the intricacies of the factional infighting that is going on in the sushi bars of Nagato-cho, where the country's government is located. That time is long past, and I'm sure you don't care anyway. Suffice to say that from the foreign exchange market's point of view, inaction won and intervention lost.

While it is Kan's officially stated policy to weaken the Japanese currency, bold action seemed unlikely in the confusion and chaos that now ruled supreme in the government. A challenge of a sitting prime minister only three months after a successful election is unprecedented in Japanese politics. This emboldened speculators and momentum players enough to push the yen up to a new 15 year high of ?82 and change, and they clearly had ?80 in their sites. It also spurred China to step up its purchases of JGB's as a reserve asset, further pouring gasoline of the flames. In the meantime, the strong yen is wreaking havoc on the country's export oriented economy, with companies are marking down profit forecasts by the day.

Capturing profits in such high risk, volatile conditions as these is way beyond my pay grade. You really need a 24 hour global trading desk with several million dollars of IT back up to do this. I think the big play setting up here is on the short side. I continue to believe that the yen, along with Japanese government bonds and the 30 year US Treasury bond are the world's most over valued assets, and will be the core shorts of most hedge funds for the coming decade. To understand why, please review my earlier work (click here for 'Why the World's Worst Economy Has the World's Strongest Currency'? and click here for 'Who's Been Buying All Those Japanese Government Bonds').

We may not have seen the peak in the yen yet, but this is starting to resemble what a peak looks like.

Japan is only Praying for a Weaker Yen