September 18, 2009

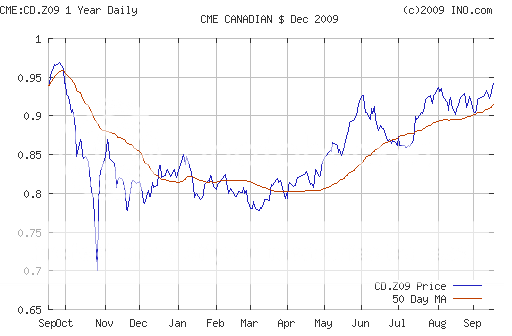

September 18, 2009 Featured Trades: (CANADIAN DOLLAR),

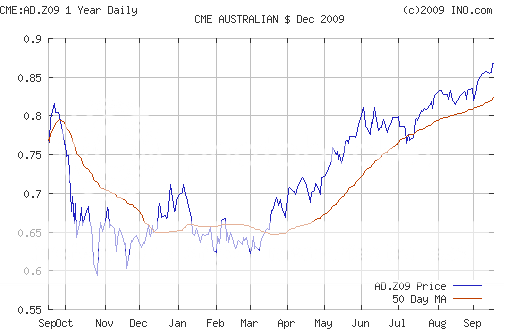

(AUSTRALIAN DOLLAR),

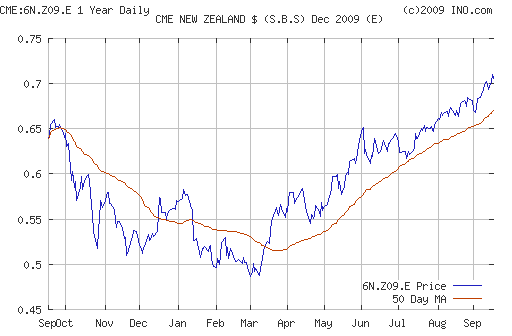

(NEW ZEALND DOLLAR),

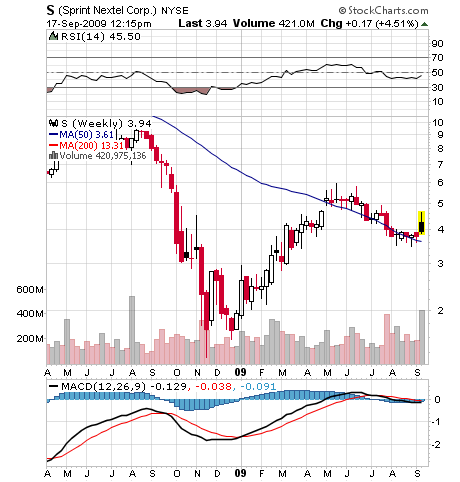

(CBS), (SIRI), (HTZ), (RAD), (M), (LVS),

(AMD), (AMR), (CAL), (WHEAT), (GOLD)

1) It?s all about the dollar, which I have hated all year (click here for my call ). The assured onslaught of federal debt issuance headed our way will be the overriding investment consideration for traders and portfolio managers for the next decade. That will knock the stuffing out of the greenback against every currency except the Zimbabwean dollar, and even that will rally when you get a regime change. There was once an argument that foreigners piled into these currencies to capture a huge yield pickup, but even that advantage is now gone. The soggy buck also explains a lot of what is going on in our stock market, with companies earning most of their from increasingly wealthy foreigners, like those in technology, energy, and commodities. As I write this, I am looking at new one year highs for my favorite picks of the former British crown colony currencies of the Canadian (up 14% YTD), Australian (up 26% YTD), and New Zealand (up 23% YTD) dollars (for my $ report click here ). There bounteous resources, Anglo-Saxon contract law, an almost common language, and vibrant ports make them the safe bet of choice. It?s just a matter of time before the loony hits parity, to be followed by the Aussie dollar, and then the kiwi.

2) Fear of law suits prevents most analysts from publishing lists of short selling targets. But the Audit Integrity Co., a forensic accounting firm,?? regularly posts lists of public companies they believe may go bankrupt (see http://www.auditintegrity.com). Many of their picks reflect the accelerating shift from the old economy to the new economy. With offices in New York and Los Angeles, they look at leverage, market position, debt, and their own proprietary indicators. Another red flag are the legal shenanigans that companies resort to when coming out of a recession, like writing off large amounts of good will. In the media space CBS (CBS), Sirius XM Radio (SIRI), and Hertz Global (HTZ) are at risk. In the consumer field, Rite Aid (RAD), Macy?s (M), and Las Vegas Sands (LVS) made the list. Advanced Micro Devices (AMD) is the largest tech company to warrant scrutiny. Airlines, always a favorite of bankruptcy mavens, include American Airlines (AMR), and Continental (CAL). Sprint Nextel (S) tops the list of telecom companies. Better take that portfolio out and give it a good scrubbing.

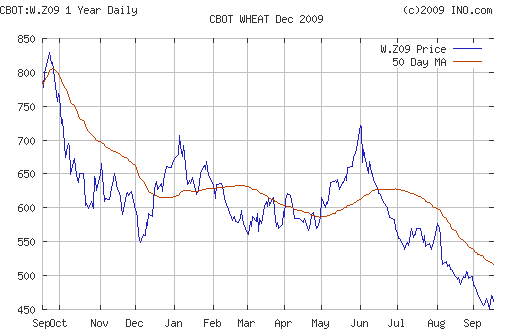

3) Flip flopping?? weather forecasts triggered a vicious rally in wheat, and may have put the bottom in for the beleaguered grain (see my call to buy December wheat under $5 by clicking here ). Fears that an early frost was going to hit, and then wasn?t, triggered the volatility. The near limit up moves also seen in corn and soybeans all had an end of move flavor to them. The market chatter was all about hedge fund short covering. The sad truth is that the last impoverished farmer has thrown in the towel and sold his crop for whatever he could get to pay for next year?s seed and fertilizer. The silos are now bulging. Whatever the case, there is a shot at a couple of bucks of moves up here in the next several months. I certainly prefer buying bushels here than stocks here. If you need help on how to execute, don?t be shy and e-mail me at madhedgefundtrader@yahoo.com, and I?ll get you set up. There is no pure wheat ETF.

4) Brace yourself for the impending gold shortage. Gold shortage? Yup. With the launch of the eighth gold ETF this yesterday, the ETFS Gold Trust (SGOL), total ETF holdings of the barbaric relic reached?? 54 million ounces worth $55 billion, more than total world production in 2008. Last year, South Africa suffered its steepest decline in gold production since 1901, falling 14%, to a mere 232 tons. It now ranks only third in global production of the yellow metal, after China and the US. Severe electricity rationing, a shortage of skilled workers, and more stringent mine safety regulations have been blamed. Choked off credit has frozen the development of new capital intensive deep mines, as it has for everybody else. Rising production costs have driven the global breakeven cost of new gold production up to $500 an ounce. In the meantime, the financial crisis has driven flight to safety demand for gold bars and coins to all time highs. Last year, the US Treasury ran out of one ounce $50 American Gold Eagle coins, now worth about $980. Competitive devaluations by almost every central bank, except Japan, mean that currencies are not performing as the hedge that many had hoped. It all has the makings of a serious gold shortage for the future. Could last year?s downturn be a blip in the eight year bull market? Now that we are solidly over $1,000, kissing $1,025 last night, the match could hit the fuel dump at any time.

QUOTE OF THE DAY

?Chance favors the prepared mind,? said the great French chemist, Louis Pasteur, who through a series of accidents discovered pasteurization, a vaccine for rabies, and the germ theory of disease.