September 19, 2011 - Bill Ackman's Hong Kong Dollar Play

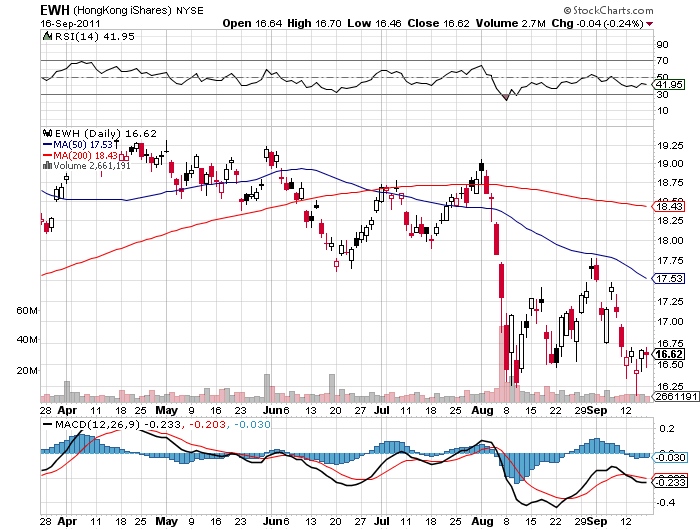

Featured Trades: (BILL ACKMAN'S HONG KONG DOLLAR PLAY), (EWH)

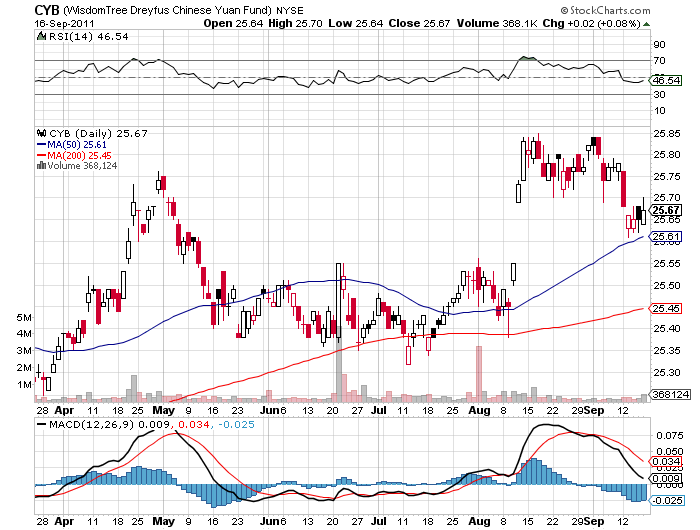

2) Bill Ackman's Hong Kong Dollar Play. You are all well aware of my love affair with the Chinese Yuan (CYB), which I expect to appreciate substantially in coming years off the back of China's continuing economic miracle. Bick Ackman, of Pershing Square Capital Management fame, has come up with his own variation, that of piling on a leveraged long in the Hong Kong dollar.

I often tell investors that Hong Kong is the way to play China if you want to sleep at night. As a holdover from its days as a British Crown Colony, which ended in 1998, it still employs largely western style accounting and corporate governance standards. Blowups of the variety that we are seeing in mainland companies, like Sino Forest, are much less common.

The Hong Kong economy is growing at a 6% annual rate, with 5% inflation, and a 3% unemployment rate. These are numbers that any developed country finance minister or politician would kill for. But because of an accident of history, the Hong Kong dollar has always been pegged to a foreign currency, first the British pound, and for the last 27 years, the US dollar. So while it's economic policy is, in effect, made in Beijing, monetary policy is determined in Washington. This can't last.

Since the peg was established in 1983, Hong Kong has risen from an up and coming frontier market with almost laughable volatility to a triple 'A' credit. (A close friend of mine received an Order of the British Empire from Queen Elizabeth for engineering the scheme). Despite this stellar performance, the peg has made the Hong Kong dollar one of the weakest currencies in Asia. It really should be trading on par with the Singapore dollar, which has been moving from strength to strength for similar reasons. Let it float, and you could see a very rapid 30% appreciation from its current 12.84 cents.

Ackman has taken his position in the form of highly leveraged over the counter, out of the money call options that do not trade on any exchange, and were most likely custom written by a major investment banks. There is no Hong Kong dollar ETF, and the Hong Kong iShares ETF (EWH) gives you exposure to both the currency and local blue chip equities.

Big hedge funds can do as Bill did and buy some custom options, although this is an expensive way to do it. Those with large credit lines can put on this trade through the interbank market where you can get 10:1 leverage. Individuals are limited to buying outright cash in Hong Kong dollars, or invest in the ETF and take the equity risk as well, where the long term prospects are excellent.

The Hong Kong currency could be dragged up by any move by China to float the Yuan, which is just a matter of time. But recent leaks from senior officials at the People's Bank of China suggest that this is at least five years off.

Bick Ackman is not that patient. He expects the Hong Kong dollar to go ballistic within the next 12-18 months, which is the maturity of his options position. Longer than that, and he will simply roll forward the position when it expires. When is the next potential trigger? Next April, when local elections may tempt bold moves on the monetary front.

-

-

-

A Peg Worth an OBE