September 2, 2010 - Some Feedback on South Africa

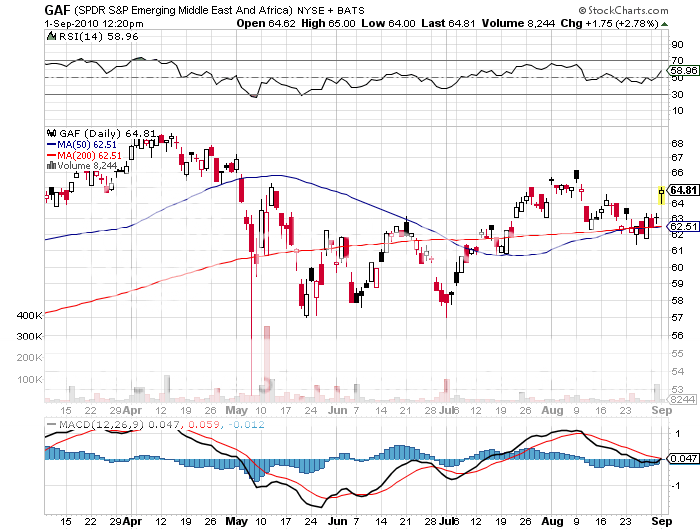

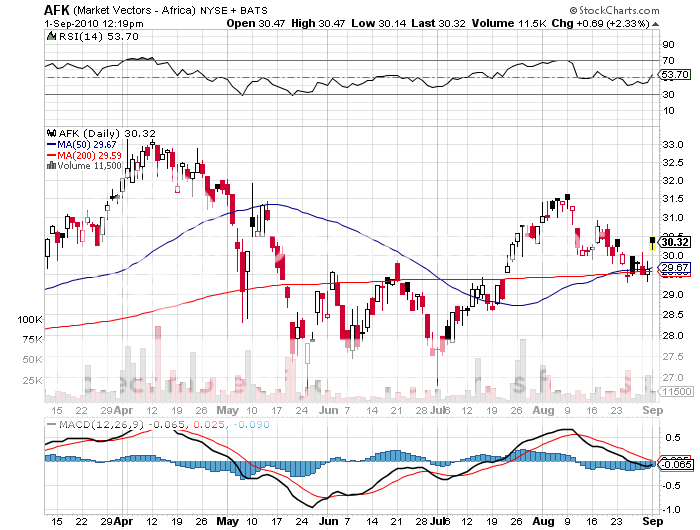

Featured Trades: (AFRICA), (EZW), (AFK), (GAF)

2) Some Feedback on South Africa. The great thing about the Internet is that sometimes it gives you back more than you put into it. In response to my piece on South Africa (EZW) a few days ago and my other work on Africa generally (AFK), (GAF) (click here for 'Feel Like Investing in a State Sponsor of Terrorism' ), a flood of data poured in bolstering my arguments in favor of the dark continent.

Africa has a population that approaches India and China's, possibly making it the next cheap labor market. Some 60% of the planet's remaining uncultivated land is there, which is why China, Libya, and Saudi Arabia have been pouring billions into agriculture there. Africa has 40% of the world's gold reserves and 10% of its oil reserves, with massive deposits of coal and other key resources.

If you have any doubts about Africa, take a look at the direct investment that has been pouring into the banking sector in South Africa in recent years, the most stable and best capitalized industry on the continent. HSBC has gobbled up Ned Bank, Barclays has gobbled up ABSA Bank, and China has taken a 20% stake in Standard Bank, probably the best run institution is the sector. Having been a four decade observer of the global financial system, I can tell you from experience that the changing of the guard in the banking system often presages major long term bull markets. You want to follow the smart money here.

Despite all this, only 3% of global direct investment finds there way there. Prices? are so low and earnings leverage so great that any dire political risks you can come up with, and there are definitely some out there, have got to already be priced in. It's just a matter of time before the markets address this imbalance.

Is Africa a Sleeping Giant?