September 2, 2011 - Itching to Get Into Corn

Featured Trades: (ITCHING TO GET INTO CORN),

(CORN), (JJG), (DBA), (POT), (MOS), (AGU), (CAT), (DE)

2) Itching to Get Into Corn. Long term readers of this letter know that I have long been banging away on the fact that the world is making people faster than the food to feed them. According to the World Bank, the world's population is expected to jump 2 billion, from 7 billion to 9 billion in the next 40 years. Half of that increase will come in the arid, food deficient Islamic world.

This is happing when the rate of increase of the world's agricultural productive capacity is rapidly declining. Ancient aquifers everywhere are falling, thanks to 'water mining', especially in India, Saudi Arabia, and the American mid-west. Insects have become immune to modern pesticides. The dividends of the 1960's 'green revolution' have reached diminishing returns.

The soil in many farmlands, especially in emerging markets, have become depleted, thanks to the overuse of advanced fertilizers, often contaminating local water supplies. Much food is still lost to waste in countries like India, where a primitive distribution and storage system see up to one third of its annual crop eaten by rats or rotting in silos. Oh, and has anyone heard of global warming?

The American corn crop this year has been particular interest. Huge rains hit during the spring and delayed seeding. Then a draught struck in the summer, with some states, like Texas, receiving no rain at all. Yields have plummeted. Approximately 86 million acres are planted with corn this year, producing some 1.299 billion bushels. But in recent weeks, yield estimates have been shrunk from 152.8 bushels per acre down to 151 bushels, and some farmers tell me that the 140's are in the cards.

Trading corn has been a nightmare this year, thanks to the Department of Agriculture, which has published enormous swings in crop expectations. China has thrown the fat on the fire, stepping in out of nowhere with enormous purchases of this essential foodstuff to deal with draught conditions back home.

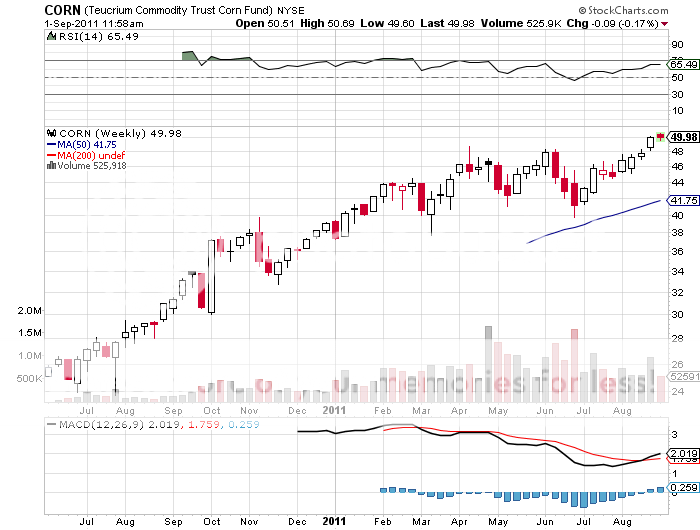

That has created a roller coaster price for corn, with both limit up and down moves seen since January. I was hoping that during the August financial crisis, we would get a nice 30% pullback and a great entry point. It was not to be. After only a 6% hickey, it was off to the races again. The great thing about the ags in general is that they will move independent of all other asset classes, making them a great diversification play. This year has been no different.

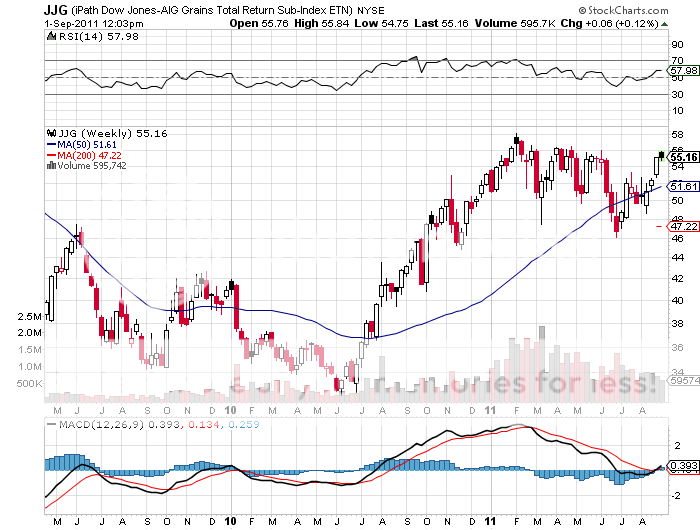

As I write this, we are backing off of new multiyear highs at $7.75 a bushel. At least $9 a bushel seems to be in our immediate future, and $10 could be achieved with a spike. Strong corn prices have been pulling up other food prices as well, such as wheat and soybeans, and next time you buy a cup of coffee, you better not look at the price.

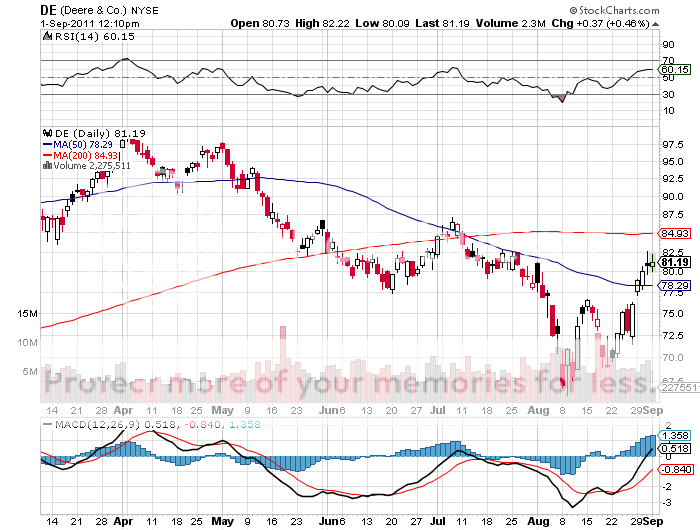

This all paints a rosy picture for the entire agricultural space. The corn ETF (CORN) is an easy vehicle to play this, if we ever get another pullback. Wheat and soybeans can be bought through the Chicago futures. Another good trading vehicle is the iPath Dow Jones-AIG Grains Total Return Sub index ETF (JJG), a basket of several grains. The PS DB Multi sector Agriculture ETF (DBA) also works also works. The fertilizer and seed companies should be bought, like Potash (POT), Mosaic (MOS), and Agrium (AGU). Equipment makers Caterpillar (CAT) and John Deere (DE) also have plenty of potential.

And the nice thing about food trades is that if they go wrong, you can always take delivery and east your positions. Anyone for a refrigerated rail car of pork bellies?

-

-

-

-

-

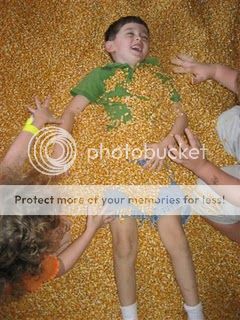

Can't Get Enough Corn