September 22, 2009

September 22, 2009

Featured Trades: (PCY), (LQD), (ARI), (FSQU), (CLNY)

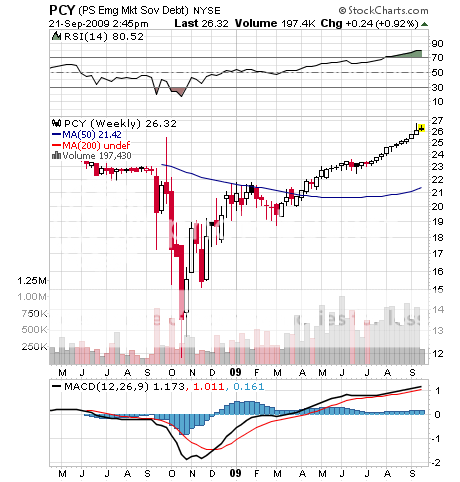

1) A number of readers have asked me to come up with a safe, high yielding investment in which to hide out in case the equity markets swoon again. That means they are looking for a security that offers a high fixed return, denominated in a strong currency that will benefit from future upgrades that will boost the principal over time. All of that is another name for the Invesco PowerShares Emerging Market Sovereign Debt ETF (PCY). The fund has 40% of its assets in bonds issued in Latin America and 31% in Asia, with the bulk of the maturities exceeding ten years. The two year old fund now boasts $340 million in market cap and pays a handy 6.42% dividend. This beats the daylights out of the nine basis points you currently earn for cash, the 3.40% yield on 10 year Treasuries, and still exceeds the 6.42% dividend on the iShares Investment Grade Bond ETN (LQD), which buys predominantly single 'A' US corporates. The big difference here is that foreign bonds have a rosy future of further credit upgrades to look forward to. It turns out that many emerging markets have little or no debt because until recently, investors thought their credit quality was too poor. No doubt a history of defaults in Brazil and Argentina in the seventies and eighties is at the back of their minds. With US government bond issuance going through the roof, the shoe is now on the other foot. A price appreciation of 125% over the past year tells you this is not exactly an undiscovered concept. Still, it is something to keep on your 'buy on dips' list.

2)The vultures are circling the embattled commercial real estate industry, ready to swoop down and devour the carrion before it's dead. A trio of REIT IPO's have hit the market this week looking to buy real estate for pennies on the dollar, as well as the bargain basement debt of other troubled REIT's. JP Morgan, Citibank and Barclay's launched their Apollo vehicle (ARI). Bank of America and Morgan Stanley came out with a new security called Foursquare (FSQU). Not to be outdone, Bank of America, Merrill Lynch, Goldman Sachs, and UBS followed up with their Colony (CLNY) instrument. This is a classic example of new equity coming in and taking ownership of assets where the previous owners have gone to money Heaven. Commercial real estate lending exploded from $1 trillion in 1988 to $3.5 trillion in 2007, and some $2 trillion of that has to be refinanced this year. Takers are few, with banks reeling in leverage ratios, insurance companies gun shy, and the collaterized debt markets in intensive care. The TALF is expiring at year end. Did I hear someone shout 'Bail Out?' Many listed REIT's will only survive because their rules limited them to mere 2:1 leverage, and were able to raise $16 billion in new equity since March. That has helped propel the Dow Jones REIT Index ($DJR) up 84% from the lows. More highly leveraged private investors and regional and community banks not so constrained are choking on their holdings, and many are limping on by letting mark to market rules fall by the wayside. This is why I am not recommending bank stocks or REIT's at these levels. The new vulture issues may be another story. I was involved in a strategy at Morgan Stanley to Hoover up Houston office buildings on the cheap in the wake of the early eighties oil bust. The lucky investors got a tenfold return on their capital.

3) I was somewhat saddened when I saw US Treasury owned General Motor's new chairman, Ed Whitacer, Jr., who admits he knows nothing about cars, herald the rebirth of his new employer with the announcement of a new 60 day warranty program. I'll tell you what is the big problem of US auto industry. My dad was a lifetime GM customer, religiously buying a new Oldsmobile every five years. Once he even flew to Detroit for a factory tour, and drove his new trophy home. Thirty years ago I told him he was doing GM no favors by buying their cars, and the only way to force them to improve a tragically deteriorating product was to buy better made German and Japanese vehicles. This was right after the State of California required auto makers to install seatbelts on new cars, which the industry fought tooth and nail. Airbags and ABS brake systems were still a decade away. His response, 'I didn't fight the Japanese for four years so I could buy their cars.' (He was a Marine at Guadalcanal, and worshipped the Continental radial engines on his Stewart tank). GM's problem is that my Dad passed away eight years ago. Of the original 17 million WWII veterans, 1,500 a day are dying, there are only one million left, and few of those buy new cars. All of them loved Detroit because it built great the Jeeps, tanks, trucks, and half tracks that brought them home from harm's way. Their kids prefer German, Japanese, and Italian vehicles, and their kids will buy Korean, Chinese and Indian electric cars. GM never understood this. It is no coincidence that the US industry's problems really accelerated with the passing of the 'greatest generation.' During the last 35 years, when Japan's share of the US car market climbed from 1% to 40%, I begged Detroit to mend its ways and build a quality, price competitive product that Americans wanted to buy. The answer was always the same; 'Nobody can tell GM how to build cars.' Now there's no one left to listen.