September 22, 2011 - Do the Ratings Agencies Need New Typists?

Featured Trades: (DO THE RATINGS AGENCIES NEED NEW TYPISTS?),

(TLT), (BAC), (C)

3) Do the Ratings Agencies Need New Typists? If there were ever a deep lagging indicator, it is a downgrade by a ratings agency. While the housing market peaked in 2006, these despised institutions didn't get around to marking paper down from triple 'A' to junk until four years later.

Then in August, Standard and Poor's downgraded US Treasury bonds. Since then, they have gone up like a rocket, with the yield on the ten year bond plunging from 2.8% to an eye popping 1.86%. Could it be that this is a simple typo? Did an underpaid and errant typist confuse the word 'down' for 'up'?

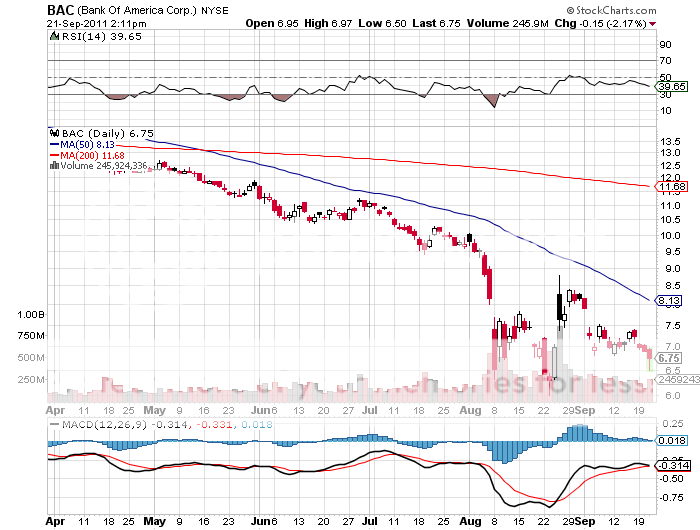

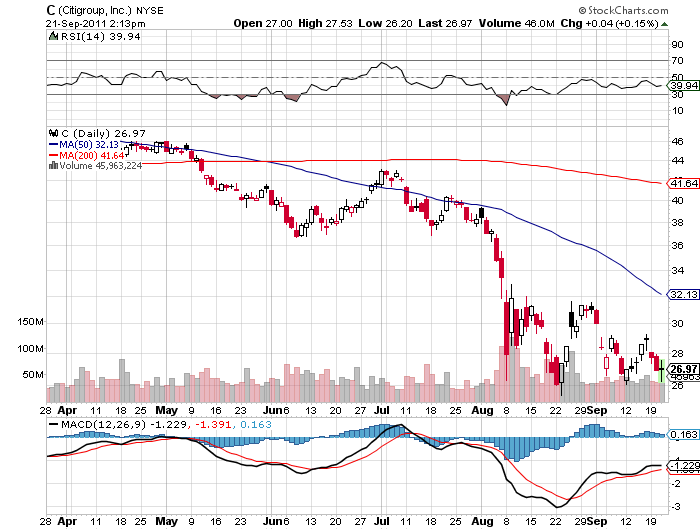

Today, I hear that Moody's downgraded the major banks, including Bank of America (BAC) and Citigroup (C). I have since been flooded with emails from readers asking if they should be going short banks here. I respond that it's too late, that they're an hour late and a dollar short, and that they missed the boat. Shorting (BAC) is something you do at $12, as I recommended on national TV last spring, not here at $6. The risk reward ratio here is not good.

Part of the reason behind the Moody's move is that they have completely lost faith in the American political system. I totally sympathize with them. The Republicans now have a vested interest in crashing the economy so they can blame it on Obama and win the presidency.

So there is zero chance of a TARP 2 getting through the congress in the next financial crisis and saving the banks once again. Tough luck if you and I are unwilling passengers in this demolition derby. Can you blame investors for throwing up their hands in disgust and walking away from equities, as they appear to be doing in large numbers?

Here is another way to look at the banks. Much of the bank meltdown that has occurred since February is due to the enormous Treasury bond rally. The incredibly flat yield curve that has resulted, squeezes the free lunch that the banks have been relying on to recapitalize themselves. So shorting banks here is the risk equivalent of initiating new longs in bonds at these levels. Neither is a good idea.

Does Moody's Need a New Typist?

-

-

-

No Matter What Happens, Blame It On Obama