September 23, 2010 - Bring on the Conspiracy Theories!

Featured Trades: (QUANTITATIVE EASING II), (BEN BERNANKE), (TBT)

SPDR Gold Trust Shares ETF

iShares Silver Trust ETF

Market Vectors Coal ETF

1) Bring on the Conspiracy Theories! There is a wonderful conspiracy theory propagated by Tea Partiers that has been making the rounds in the financial markets for the past several months. In a desperate attempt to salvage the November election, president Obama has ordered Fed governor Ben Bernanke to flood the system with $2 trillion of liquidity. This is the QEII you have been hearing so much about. The move will give the economy a much needed shot in the arm that will enable the Democrats to retain control of both houses of Congress. Two more years of Obamanomics will then follow.

The only problem with this theory is that it is complete hogwash. For a start, Ben Bernanke is a Republican originally appointed by President Bush. Then there is Fed independence to consider. The board of governors is well stocked with enough conservatives, like Richard Fisher (click here for my chat with him), to make such a politically inspired maneuver impossible. If the Fed weren't set up this way, it would become a political football kicked back and forth with every election. Congress would order the stimulus machine to be stuck permanently in the 'ON' position.

You also have to ask the question of whether QEII will make any difference at all to the economy. With banks desperately seeking to deleverage and unwilling to lend, the level of interest rates today is truly irrelevant. The 35 million homeowners with negative equity, about 25% of the total, certainly aren't going to be refinancing anytime soon. Much of the drag on the economy springs from the sorry state of the real estate market (click here for 'Years of Pain to Come In Residential Real Estate'), so there is little the Fed can do, unless it starts buying millions of houses and burning them down.

Personally, I think the American central bank is out of bullets, and that any such gestures would amount to pushing on a string. Believe me, I have been watching the Japanese do this for 20 years, to no effect. There is one thing the Fed does understand, and that is that any QEII implemented now would be highly inflationary down the road. This fits nicely with my (TBT) recommendations.

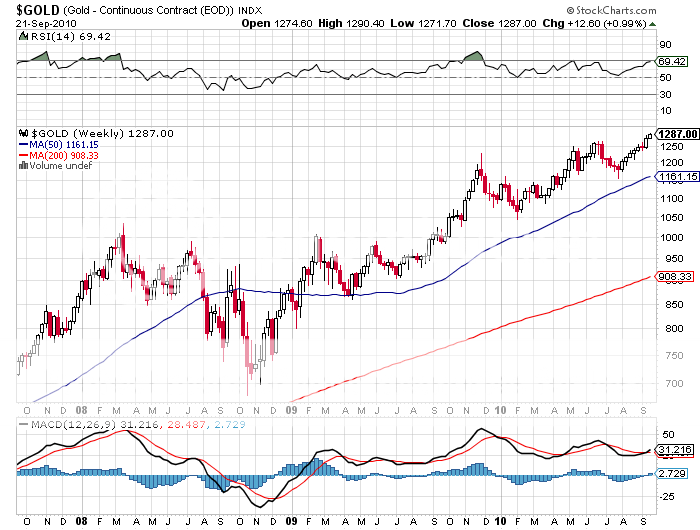

But hey, as I learned in my journalism days, never let the truth get in the way of a good story. My late editor at The Economist, the brilliant Peter Martin, taught me that belief will trump fact every time. Facts change, opinions don't. That totally works for me, because this theory on the true motivations of the Fed is driving cash into hard assets at an unprecedented rate, commodities and companies that I have been pounding the table about for the past 18 months. I made that call because it dovetailed nicely with global macroeconomic trends which I see continuing for another decade. Most people get invited to dinners. I get invited to mines.

If the market wants to run the prices of my assets up for the wrong reasons, I say bring it on! The dollars I am making as a result are just as good at the bar.

This is What a Chart Should Look Like

Great News for Hard Assets