September 24, 2009

September 24, 2009

SPECIAL END OF CIVILAZATION ISSUE

Featured Trades: (OBAMA),

(BERNANKE),

(TBT), (PCY)

2) I spent the evening with David Wessel, the Wall Street Journal economics editor, who has just published?? In Fed We Trust: Ben Bernanke's War on the Great Panic. I doubted David could tell me anything more about the former Princeton professor I didn't already know. I couldn't have been more wrong. Bernanke was the smartest kid in rural Dillon, South Carolina, who, through a series of improbable accidents, ended up at Harvard. He built his career on studying the Great Depression, then the closest thing to paleontology economics had to offer, a field focused so distantly in the past that it was irrelevant. Bernanke took over the Fed when Greenspan was considered a rock star, inhaling his libertarian, free market, Ayn Rand inspired philosophy. Within a year the landscape was suddenly overrun with T-Rex's and Brontesauri. He tried to stop the panic 150 different ways, 125 of which were terrible ideas, the remaining 25 saving us from the Great Depression II. This is why unemployment is now only 9.8%, instead of 25%. The Fed governor is naturally a very shy and withdrawing person, and would have been quite happy limiting his political career to the local school board. But to rebuild confidence, he took his campaign to the masses, attending town hall meetings and meeting the public like a campaigning first term congressman. The price of his success has been large, with the Fed balance sheet exploding from $800 million to $2 trillion, solely on his signature. The true cost of the financial crisis won't be known for a decade. The biggest risk now that having pulled back from the brink, we will grow complacent, and let needed reforms of the system slide. How Bernanke unwinds this bubble will define his legacy. Too soon, and we go back into a depression. Too late, and hyperinflation hits. Let's see how smart Bernanke really is.

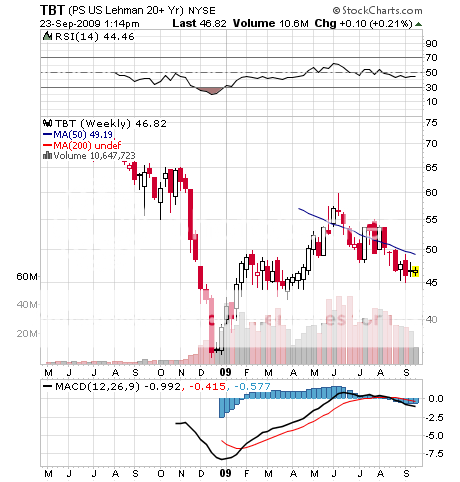

3) Reviewing the current political and monetary landscape, I would be remiss, irresponsible, even negligent, if I didn't revisit one of my favorite ETF's, the Proshares Ultra Short Treasury Trust (TBT). This is the 200% leveraged bet that long Treasury bonds, the world's most overvalued asset, are going to go down. While the Fed is going to keep short rates low for the indefinite future, it has absolutely no direct control over long rates. The only political certainty we can count on is the continued exponential growth in the supply of government bonds of all maturities. Like all Ponzi schemes, their eventual collapse is just a matter of time. It's simply a question of how many greater fools are out there (sorry China). Look at how they are trading now. We currently have the greatest liquidity driven market of all time, and the ten year is only eking out a 3.40% yield, pricing in near zero inflationary expectations. The average yield on this paper for the last ten years is 6.20%, a double from the current level. Get the yield back up to 5%, a distinct possibility in 2010, and that takes the TBT from the current $45 to $70. Sure, we may get a sideways grind in yields for a few months, which will be expensive due to the mathematic idiosyncrasies of the 2X ETFS. But a security that is unchanged if I am wrong, and doubles if I am right is the kind of risk/reward ratio that I will take all day. And I believe that in my lifetime Treasuries may lose their vaunted triple 'A' rating and be priced closer to subprime (warning: I am old). That could enable the TBT to deliver the holy grail of trades, your proverbial ten bagger.

4) Mea Culpa: On September 22, I wrote about the Invesco PowerShares Emerging Market Sovereign Debt ETF (PCY), claiming that it offered a currency play. Oops, it doesn't. Several readers have correctly pointed out that the PCY only invests in dollar denominated debt. That makes its 125% run in a year even more amazing, as it was prompted purely through an improvement in credit quality.