September 30, 2024

(CHINA INFLATES WHILE THE U.S. TROUNCES INFLATION)

September 30, 2024

Hello everyone

WEEK AHEAD CALENDAR

Monday Se,pt. 30

9:45 a.m. Chicago PMI (September)

10:30 a.m. Dallas Fed Index (September)

1:55 p.m. Federal Reserve Chair Jerome Powell speaks on the economic outlook at the National Association for Business Economics’ annul meeting in Nashville.

Earnings: Carnival

Tuesday, Oct. 1

5:00 a.m. Euro Area Inflation Rate

Previous: 2.2%

Forecast: 2.0%

9:45 a.m. S&P PMI Manufacturing final (September)

10:00 a.m. ISM Manufacturing (September)

10:00 a.m. Construction Spending (August)

10:00 a.m. JOLTS Job Openings (August)

Earnings: Lamb Weston, Nike, McCormick & Co.

Wednesday Oct. 2

8:15 a.m,. ADP Employment Survey (September)

9:30 p.m. Australia Trade Balance

Precious: A$6.009B

Forecast: A$6.1B

Earnings: Conagra Brands

Thursday Oct. 3

2:30 a.m. Switzerland Inflation Rate

Previous: 1.1%

Forecast: 1.1%

8:30 a.m. Initial Claims (09/28)

9:45 a.m. PMI Composite final (September)

9:45 a.m. S&P PMI Services SA final (September)

10:00 a.m. Durable Orders (August)

10:00 a.m. Factory Orders (August)

10:00 a.m. ISM Services PMI (September)

Earnings: Constellation Brands

Friday Oct. 4

8:45 a.m. Hourly Earnings preliminary (September)

8:30 a.m. Average Workweek preliminary (September)

8:30 a.m. Manufacturing Payrolls (September)

8:30 a.m. Nonfarm Payrolls (September)

8:30 a.m. Participation Rate (September)

8:30 a.m. Private Nonfarm Payrolls (September)

8:30 a.m. Unemployment Rate (September)

Welcome to October, a traditionally turbulent month in the markets. Many see the markets approaching exhaustion, and poised for a pullback of 5% to 10% before the bulls reassert themselves. (That’s a great time to scale into stocks where you want to add weight).

But maybe that is just wishful thinking on their part, so they can add to their portfolio. The market still shows a good bullish structure. Any pullback should be seen as an invitation to scale in.

The release of the US Personal Consumption Expenditures (PCE) Index for August showed annual inflation came in at 2.2%, lower than the expected 2.3% and certainly a step down from July’s 2.5%.

The US Dollar Index (DXY) retreated to 100.40 on the news release and should continue to gradually fall toward the 100 zone.

With inflation cooling, and the 50bps rate cut behind us, the chatter is now about what the Fed is going to do in November. Will it be 25 or 50 bps?

The Fed Chair Powell speech on Monday may give us an inkling what the numbers will be later in the year, so investors will be listening closely.

Policymakers and Investors are laser-focused on the health of the jobs market, so the September jobs report released this Friday will be monitored closely. Now that the Fed seems to have conquered inflation for now, it will turn its attention to the labour market.

Last Tuesday, China’s central bank unveiled a large stimulus package designed to restore confidence in the troubled housing market and to lift the country’s sluggish economy.

Among Beijing’s moves: A cut in short-term interest rates, allowing banks to hold less money in reserves, lower interest rates on existing mortgages, and a plan to inject billions of dollars of liquidity into the stock market.

China’s flailing economy has slowed construction in the country. But the stimulus announcement last Tuesday gave many stocks a lift. Caterpillar (CAT) and Freeport-McMoRan (FCX) jumped by late Tuesday trading. Luxury retailers also posted good gains.

Despite the positive immediate impact, most economists believe the stimulus package won’t be enough to lift China’s weak domestic demand. More measures will be needed to bring about significant improvement in China’s economy.

We have held Xpeng (XPEV), a Chinese EV company, in our portfolio since March this year. It has rallied well in the last couple of weeks and should continue to rally into year-end & into 2025.

MARKET UPDATE

S&P500

Uptrend still in progress. Last week the market reached its long-standing inverse Head & Shoulders upside target of 5,735. If we look at the market through an Elliott Wave lens, the S&P500 is still interpreted to be rallying within a Wave 5 move from (the August 5th low of 5,119), and actually has the potential to reach the mid 6,400’s over the next weeks/months before the market reaches total exhaustion.

Support = 5670/5640

Lower Support level = mid 5,500/5,400

GOLD

Further upside potential. Gold can rally to $3000 and beyond in the weeks/months ahead.

Support = $2,630/$2,600

Next Resistance = mid $2,700’s.

SILVER

Silver will also rally well. Keep scaling into the recommended precious metal stocks regularly (every month) and go long LEAPS on any significant pullbacks.

Zooming out to clarify the bigger picture on gold, we can see gold is headed for $10,000+ by 2030.

BITCOIN

Rally in progress.

Bitcoin completed a complex correction with its August 5th low of $49, 577. Since that time, we have seen the coin advance in its Wave 3 move.

Initial target is $68,250/$68,500 & then ~ $70,000.

I am looking for Bitcoin to soon break out of its bullish flag pattern with a strong rally to the upside.

Zooming out to look at the bigger picture, Bitcoin still has the potential to extend toward the $127,000 level over the coming months, and there are targets way beyond that in the coming years.

Short term support = ~ $64,200/$62,350

PSYCHOLOGY CORNER

CONRFLICTS CORNER

Israel has killed Hezbollah’s leader, but this may bring us one step closer to an escalation in the conflict and draw in other nations.

QI CORNER

QUIRKY CORNER

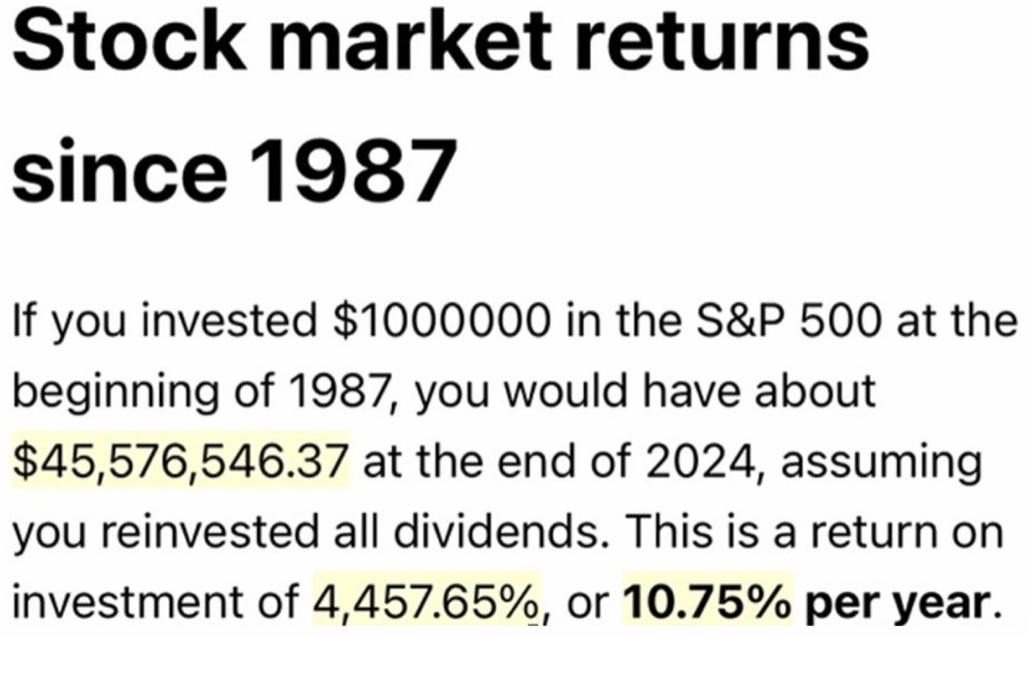

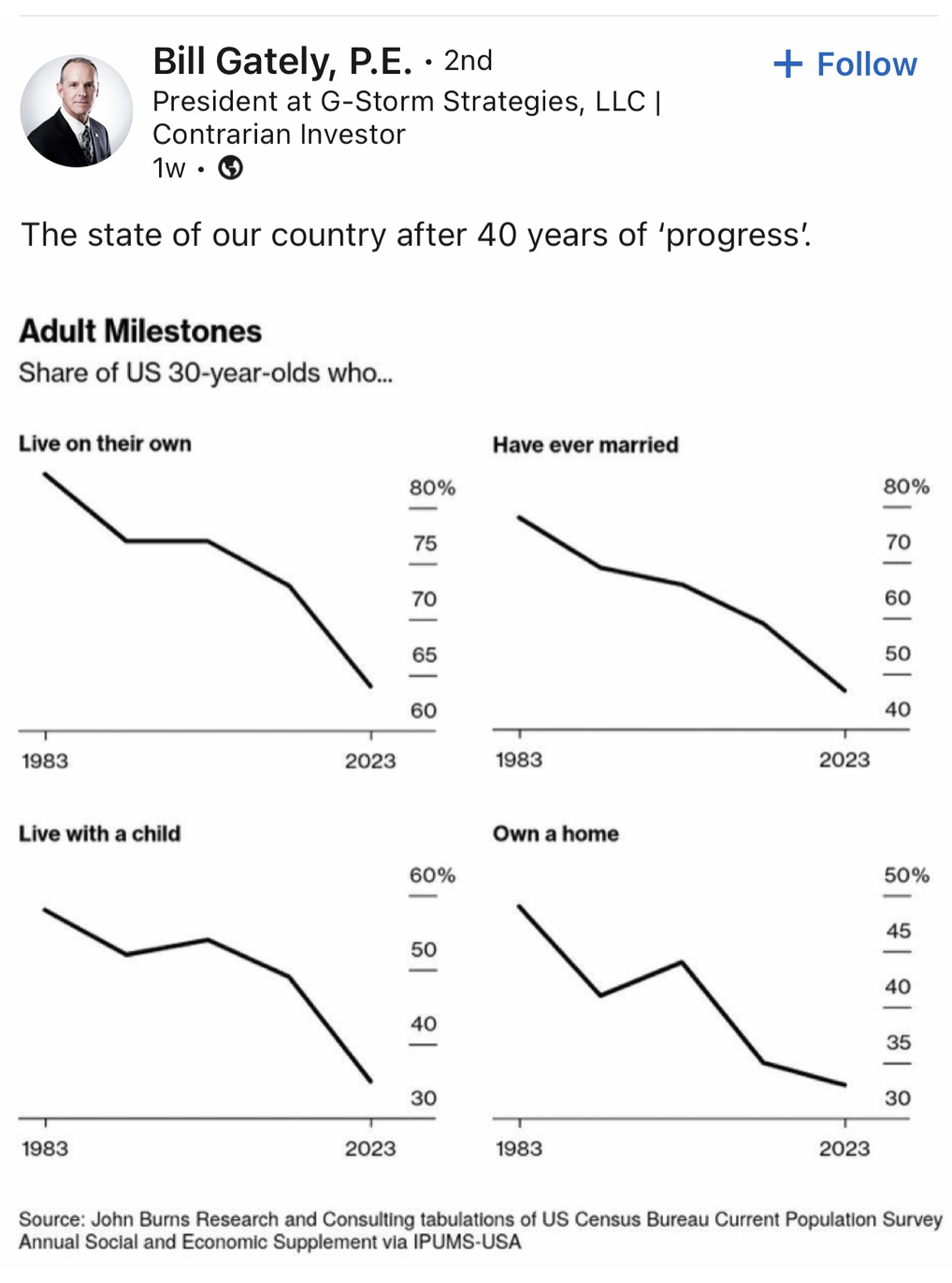

SOMETHING TO THINK ABOUT

Cheers

Jacquie