September 9, 2011 - Why I Covered My Gold Short

Featured Trades: (WHY I COVERED MY GOLD SHORT), (GLD)

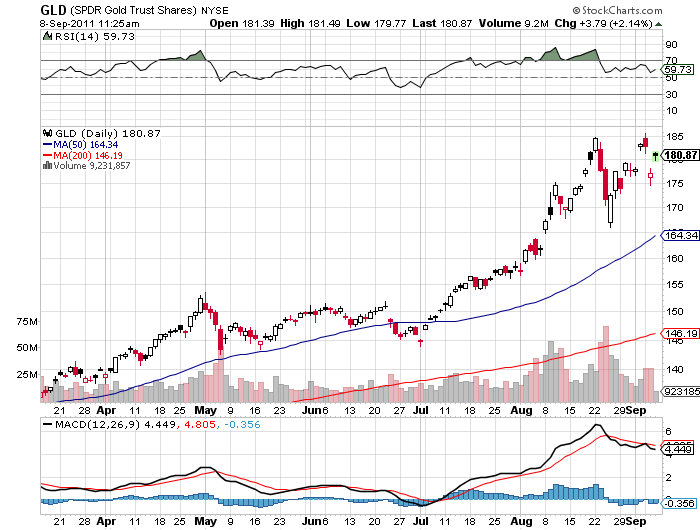

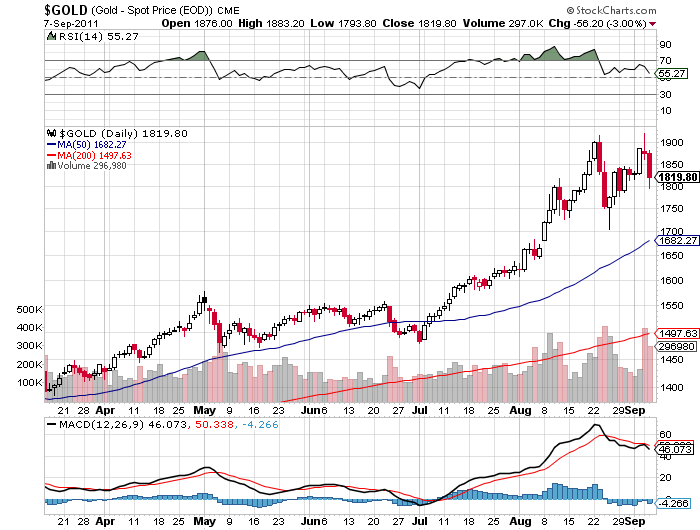

1) Why I Covered My Gold Short. I have to tell you that I was just not feeling the love from my gold short when I came into the office Wednesday morning. You would have thought that, with a double top on the charts in place, there would be a move of the same ferocity we saw two weeks ago, when the barbarous relic cratered $220 in days. But this time, when gold down $132 in 24 hours, the momentum suddenly vaporized.

There are now three possible scenarios for the yellow metal. The double top at $1,920 holds, and we collapse to $1,500-$1,600. We continue to bounce around like a ping pong ball between $1,700-$1,900. We break out to a new high to $2,000. Notice that my October puts, which I strapped on when gold was trading at $1,835, losses money in two out of three of these possibilities. Hence, time to heave-ho the gold short.

Hard earned experience has taught me that you never want to be short the precious metals whenever European Central Bank President Jean Claude Trichet speaks. He never fails to disappoint, befuddle, or outrage traders, giving new life to whatever flight to safety trades are out there.

There also is a risk that traders will reach for their barf bags once they hear Obama's jobs speech, triggering another globalized 'RISK OFF' leg. In any case, he will never get anything through the Tea Party dominated House of Representatives, so what we're likely to get is a round of campaign posturing. Many Republican congressmen have already indicated that they won't even attend. It is all moot.

I have done three gold trades this year, all from the short side, and all profitable. This is despite the fact that my long term belief is that it will eventually hit the old inflation adjusted high of $2,300. The spikes in this market are clearly more visible that the bottoms, which tend to be slow, grinding affairs. The next big call in this market will be what to do if we hit $1,920 again; to sell once more, or go long. When I figure this one out, I'll let you know.

The market gave me a gift on my exit, with gold plunging to $1,790 off the back of some momentary strengthening in the stock market. I whipped out a trade alert that enabled my Macro Millionaire followers to book a quick 28% profit on their puts, boosting their year to date return by 72 basis points. Better not to swing for a home run this time, and settle for a single.

For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put 'Macro Millionaire' in the subject line, as we are getting buried in emails.

-

-