Short Term Momentum Breathes Life Into Tech Stocks

The post-election trade is absolute fire now, and readers need to pay attention.

Silicon Valley has delivered what could amount to the mother of tech rallies into the end of 2024.

Look at the examples that have turned heads.

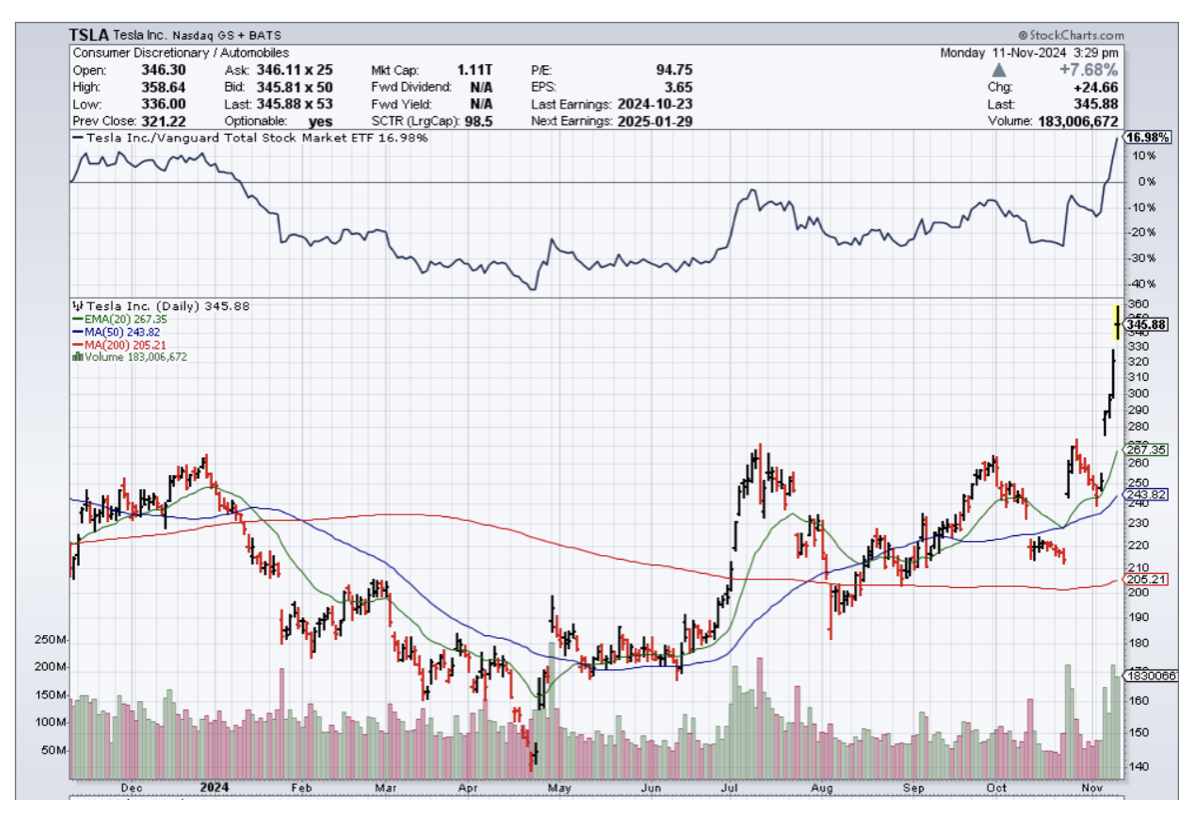

Electric vehicle (EV) company Tesla stock has gone absolutely parabolic with Elon Musk securing deep influence in the U.S. government for the next 4 years.

Part of the rally is also due to the increase in scarcity value from his social media platform X, which body-slammed traditional media avenues and convinced 75 million U.S. citizens to vote.

Musk could be tasked with “making recommendations for drastic reforms” aimed at the efficiency and performance of “the entire federal government”, Trump has said. This could grant Musk huge power over the agencies that regulate his and other tech companies.

Musk could be in charge with regulating – Apple, Google, Meta, Microsoft, and Amazon – which wield the data and processing power that shapes the social and economic lives of billions of people.

It was under Trump’s first presidency that the Justice Department began an investigation into Google, resulting in a case against the firm for suppressing competition.

Trump will probably take office with cases under way challenging the market power of several big tech firms, spearheaded by the anti-monopoly chair of the Federal Trade Commission, Lina Khan.

Many expect she will be fired. Yet Trump’s vice-president pick, JD Vance, has voiced support for aspects of her monopoly-busting approach.

Trump also thinks the tech giants give the US global clout at a time when AI is becoming a matter of national security.

“China is afraid of Google,” Trump said last month when he questioned whether a corporate split of Google could “destroy the company”.

Trump said he would “save TikTok” after a ruling that its Chinese owners must sell it if it is to continue in the US, but the trade-offs are everywhere.

In other areas, any Trump plan to cut incentives for EV manufacturers would be “an overall negative for the EV industry.

This would probably help Musk’s Tesla because its existing competitive advantage would be exaggerated if its rivals were hobbled. There are reports Trump may only tweak the subsidies rather than scrap them. If Trump’s trade tariffs limit imports of cheaper Chinese EVs, that would further help Musk.

Crypto-linked stocks in Coinbase, MicroStrategy, Riot Platforms, and MARA Holdings have jumped between 11% and 21%, participating in what is known as the post-election Trump trade.

I certainly expect a follow-through on the post-election trade, with money from the sidelines opting into the rally.

Not only that, retail traders have signaled they are participating in this broad rally as well.

The paradigm shift cannot be understated, and many changes will start to be visible as the new administration comes closer to taking over.

The high inflation of the last few years was painful for the bottom segment of the American population, and it will be interesting to see if the new government will discount them or start to redirect policy to them.

Either way, the more important policy decisions as it relates to big tech are regulation, corporate tax policy, tariffs, and the ease of doing business in the U.S.

Clearly, Trump has made it known he does value strong American tech companies, but I don’t believe they will be left untouched to do whatever they want.

In the short term, ride the rally to higher highs. Since the summer dip, I had a hunch that we would reverse to all-time high’s, and that is exactly where we find ourselves in the Nasdaq index.