Should I Invest In AI Chips Or AI Servers?

The AI server market is booming and so are the AI chip markets.

I’ll talk about 2 prestigious companies right in the mix of things.

For long-term portfolios, it’s essential to not miss out on these supercharge growth companies.

I just don’t think that average investors will be able to make up the performance if they miss the boat of these 2 companies. The law of large numbers will just put you too far behind.

All the hot new money is going into AI which adds to the momentum of the share price trajectories.

Even the old money, after not being convinced by Bitcoin, is starting to come around to AI partly because most of the companies involved in AI are publicly listed companies on the New York Stock Exchange.

It makes it a lot easier when the source of exponential growth isn’t on some alternative exchange in some alternate currency in some backwater jurisdiction.

With a few clicks and moving a few dollars here and there, investors can be part of the AI future whether it be in AI chips or AI servers like the companies I am about to talk about.

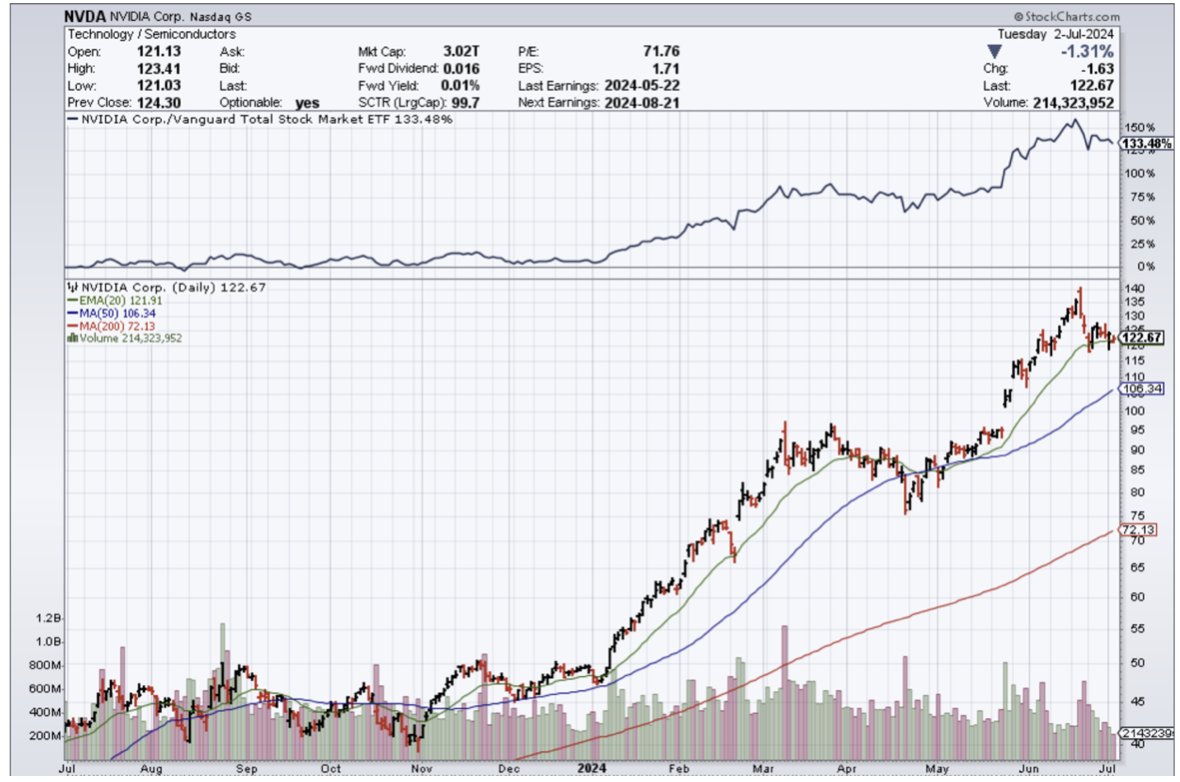

What up with Nvidia?

Nvidia (NVDA) dominates an impressive 94% of the AI chip market. It’s basically a monopoly or close to it.

Revenue is rising a stunning 262% year over year.

Even more interesting, emerging growth avenues in the nascent AI market indicate that Nvidia could end up doing even better than that.

For instance, governments are also betting the ranch on AI and this stable source of revenue will highly likely grow substantially for the foreseeable future.

Nvidia's customer base is diversifying beyond the major cloud infrastructure providers that have been deploying its chips in large numbers to train and deploy AI models.

Spending on AI chips is expected to grow more than 10-fold over the next decade, generating $341 billion in revenue in 2033 compared to $23 billion last year.

Nvidia should remain the Tom Brady of AI stocks as the race to develop AI applications by companies and governments alike has created a secular growth opportunity.

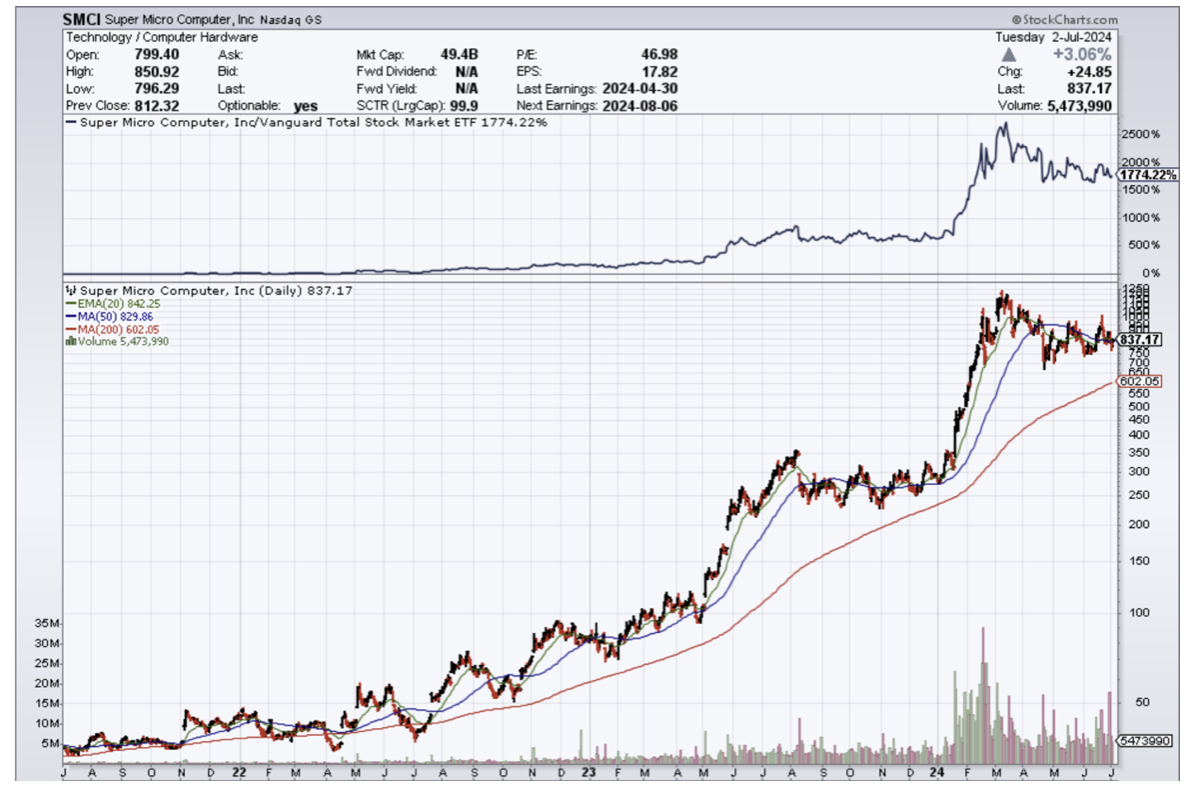

What about Super Micro Computer?

Supermicro's future prospects are attached to some extent with that of Nvidia’s.

Data center operators require server rack solutions of the type that Supermicro sells to mount the processors sold by Nvidia and other chipmakers.

Revenue jumped 200% year over year and Supermicro isn't all that far behind Nvidia when it comes to how AI has supercharged its fortunes.

I expect its top line to nearly double over the next couple of years.

Demand for AI servers is expected to expand at a compound annual rate of 25% through 2029.

Supermicro is growing at a faster pace than the AI server market right now. As it turns out, its growth is faster than that of more established companies such as Dell.

How to invest?

Supermicro is cheaper than Nvidia and Nvidia’s run-up to a more than $3 trillion market valuation has got to scare some people with sticker shock.

People with a time advantage of more than a few years should invest in Super Micro, whereas investors looking for that quick sugar high should buy the dips in Nvidia.

In short, anyone under the age of 40 and many years in front of them should invest long-term in Super Micro at a market cap of $50 billion. With Nvidia, I could easily see its market cap climbing to $4 trillion soon, but a wicked pullback would mean its market cap going from $4 to $3 trillion.

Either way, these are two tech firms with great prospects in the current and future.