The Vision Fund Lacking Vision

The most painful place to be in tech these days is where the venture capitalists used to make their name.

Private startups used to be glamorized, and now nobody wants to touch them with even a 10-foot pole.

VCs are the capital-rich guys who used to buy companies privately, hold onto them until they grew 10X, and then dish them off to the public once they went ex-growth.

That playbook was the surefire way to capitalize from companies during their highest growth phase.

Softbank’s Vision Fund was the poster boy for this strategy as the founder of Softbank Masayoshi Son deployed gargantuan resources from his Japanese telecom company (mostly in the form of debt) to pour into private tech firms.

Now, The Vision Fund has basically blown up as ideas like throwing $300 million at a dog walking app haven’t resulted in higher valuations from ludicrous types of aggressive investments.

Markets can behave irrationally for a while, but sooner or later, it regresses back to reality.

In the end, the world’s most brazen tech investor, Softbank, wasted billions helping to artificially lift tech valuations, only to see them plunge and lose their own money along with other adjacent investors.

In some cases like the office sub-let company WeWork (WE), they were the only investors to value assets at such lofty valuations. In WeWork’s case, they valued the company at $48 billion at its peak, and at the time of this writing, WE has a valuation of $920 million after finally going public.

So it’s not a surprise to see WE’s experience highlighting a broader failure of epic underperformance from Softbank with a decline in value for 73% of its 472 investments from an expert boutique firm that apparently is on the pulse of every new tech trend.

They would have done better with a monkey throwing darts at a dart board.

To address the headwinds, they are drastically reducing investment for the time being because they are tired of being wrong.

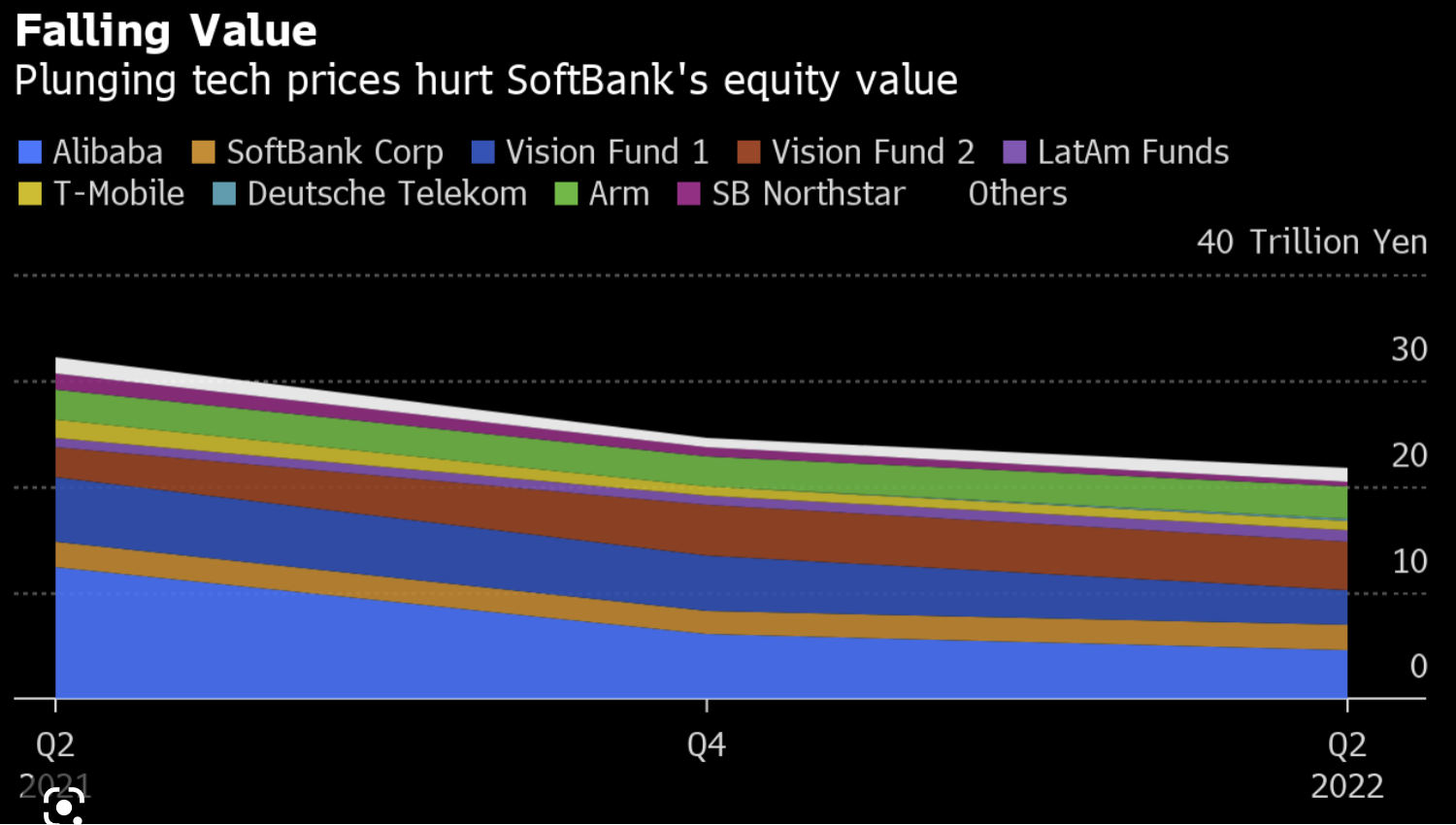

For the October to December quarter, SoftBank reported an investment loss of ¥731.94bn ($5.5bn), compared with a ¥1.38tn loss in the previous quarter for its two Vision Funds and a fund investing in start-ups in Latin America.

As of the end of December, SoftBank said the fair value of the $100bn Vision Fund I was down 4.4% from a year earlier due to markdowns in privately held companies despite gains in some listed holdings, such as ride-hailing groups Didi and Grab. The valuation for investments in Vision Fund II was down 6.2%

Son announced last year that he would step back from day-to-day operations to basically get out of the way of himself.

I applaud him for doing that because many arrogant leaders don’t understand when their time is up.

The private markets aren’t what they used to be and the deal breaker is higher rates.

This part of tech won’t come back until cheap money floods visionary ideas because these ideas are usually risky and most attempts become a zero.

Tech stocks will continue to be choppy in the meantime and continue to represent ideal trader markets for investors to jump in and out of tech stocks.

It’s natural for a reversion to the mean after a blistering January and big moves up and down will be the likely story in this stock pickers market for 2023.

However, the time for those 10Xers from VCs is dead until further notice.