Spend Until Revenue Comes

Spend, spend, and spend some more.

That is the current zeitgeist in the tech community about the direction of generative artificial intelligence.

Companies are trying to outdo each other to see how much cash they can splurge to build out the AI infrastructure.

This is no joke.

Remember that there have been no meaningful explanations about how much revenue will directly come from AI, but my belief is that we are still in the “honeymoon phase” of the AI movement.

Eventually, and gradually, real questions will be asked and results will need to be provided instead of “building” nonstop with no accountability.

We are still in the phase of giving AI a pass which is why many have suggested stocks like Nvidia are turning into a bubble similar to 2001.

How do I know that AI is back?

Look at the chips stocks who were leading the tech rally for most of the year.

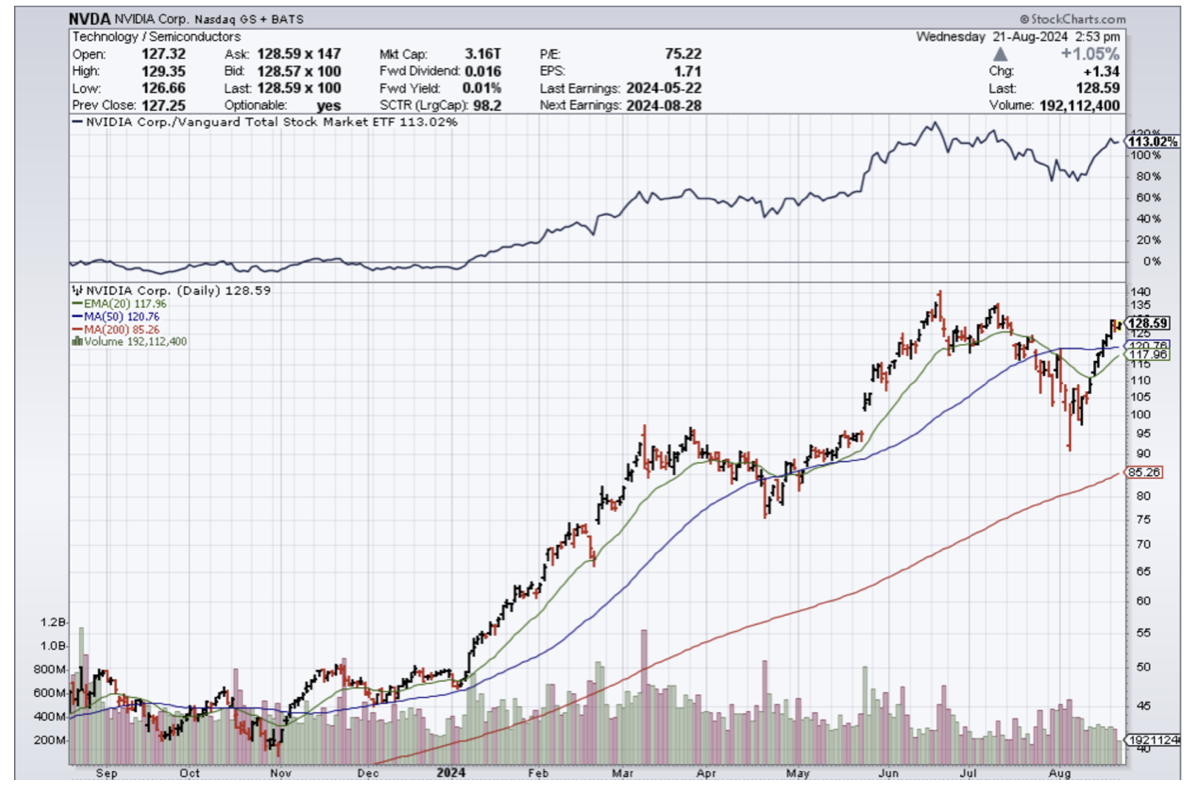

They sold off violently because of the unwinding of the Japanese yen carry trade, but the dip was bought because the discounts were too good to pass up for investors and because the AI trade isn’t over yet.

The snapback in chip stocks was v-shaped and set the stage for the rest of the year to power into the close.

I do believe the tech sector will receive better-than-expected news from the wider economy that shows the consumer is in better shape than initially thought.

The bar is extremely low for tech stocks to jump over and I do believe the ones with great balance sheets will use shareholder returns to convince shareholders to stick with their stocks.

AI hardware and chip companies have led the bounce in the Nasdaq from its August low, with Nvidia the index’s top performer, up almost 30% and just 6.1% short of the all-time high, as of its last close. Similar stocks like Micron, Marvell Technology, Super Micro Computer, and Broadcom have all participated in the snapback.

Strong monthly sales from Taiwan Semiconductor Manufacturing similarly pointed to robust AI demand.

The build-out of AI infrastructure is expected to be both enormous and long-lasting and investment in data center infrastructure needed to support GenAI could reach $6 trillion.

Capex from big tech could potentially increase by as much as 25% in 2025, well above the consensus expectation for 10-15% growth. This is especially positive for AI enablers in the semiconductors field.

Nvidia’s expensive valuation is completely justified when you understand that they carry the entire tech sector which is carrying the entire market on their back.

Shorting NVDA has probably been one of the worst trades you could have made in the past few years.