Stick With Enterprise Tech in 2025

Although, on the surface, tech stocks might be performing quite well, we need to talk about an imminent issue that could affect them.

I would even say that I am quite surprised by how the year is panning out.

There was so much uncertainty going into this year, and the election was a brutal contest that was bitterly fought.

However, the election gave us a clear winner, triggering a short-term tsunami of capital into tech stocks with the likes of Tesla (TSLA) leading the charge.

Even institutional money from heavyweights like Blackrock and others poured into tech stocks like there was no tomorrow.

TSLA is up today again on more stock upgrades.

If one ever needed a skinny variety of reliable tech stocks, then investing capital in Nvidia, Tesla, and perhaps Netflix or a Meta would be a solid foundation.

It is not only the Midas touch in the tech world, with management at HP and Dell saying the computer and laptop business isn’t all too hot.

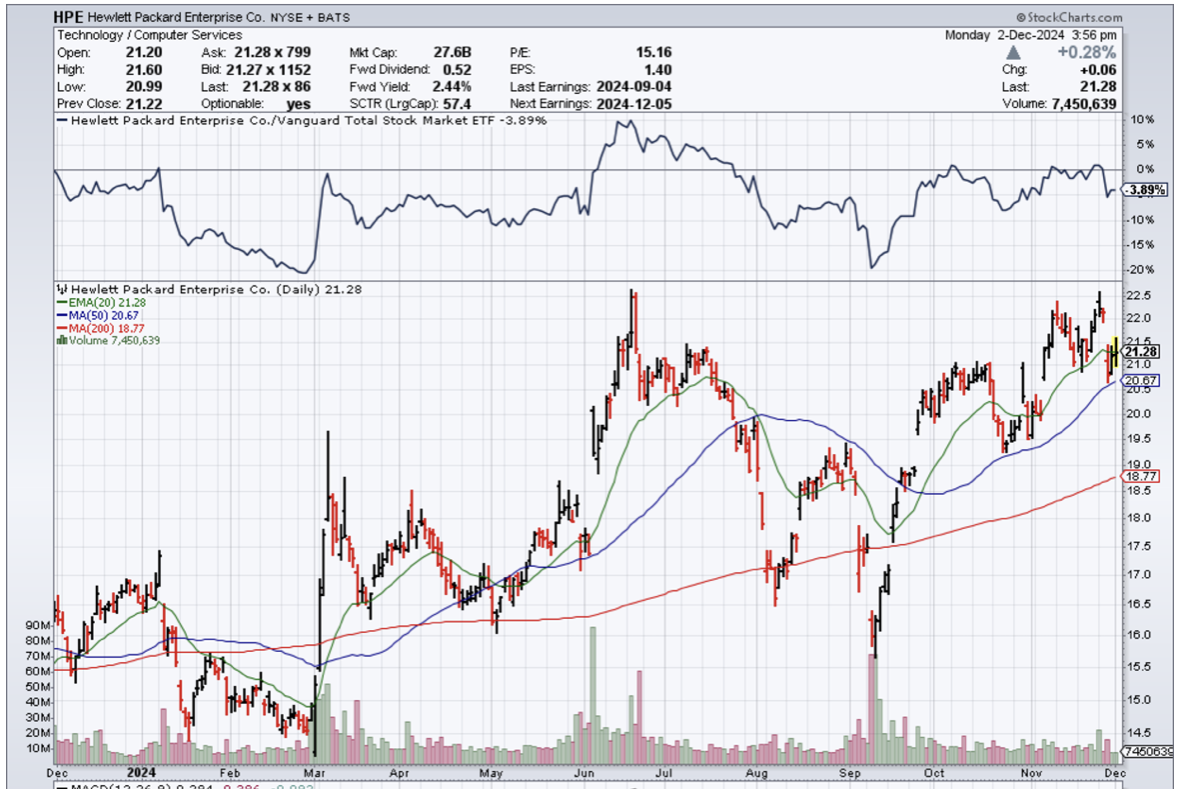

Revenue generated by Dell’s (DELL) PC business declined 1% to $12.1 billion in the fiscal third quarter, falling short of estimates. While sales in HP’s (HPE) PC unit rose 2% to $9.59 billion, missing forecasts.

The PC refresh cycle is pushing into next year (2025), said Dell management.

HP Chief Executive Officer Enrique Lores said in an interview that the release of Microsoft’s new edition of Windows software hasn’t fueled PC sales from corporate clients as quickly as in previous releases.

The market had seen a historic decline in recent years after a burst of demand for new laptops in the early months of the pandemic when students and corporate employees were stuck at home. While signs of a rebound began to materialize this year, shipments again dipped in the third quarter.

This type of narrative has been put in motion by the crowd who think a new administration and their immigration stance will cause rampant inflation in wages.

No doubt, a lot of changes will take place in the next 50 days and after, and that type of uncertainty could deliver us a sharp selloff if short-term pain is sensed by the market.

Comments from Best Buy already set a very low bar even lower, as the recession that was supposed to take place in 2018 could be sneaking up on us.

The unemployment rate is forecasted to peak at 4.4% and has been steadily trending higher, highlighting the weakening of the US consumer.

There is a good chance that in 2025, retail tech will be in a recession before enterprise tech and enterprise tech stocks will be the last bastion of a narrowing market growth.

The key signal to focus on is a big Bitcoin sell-off that could trigger a flight to safety.

As long as market action stays orderly, I expect the pain trade to go higher in tech stocks in an uneven way, and I would avoid any tech stocks directly connected to American retail shoppers.