Tackling the Low Inflation Myth

I have long told my listeners at conferences, webinars, and strategy luncheons my definition of the “new inflation”: the price for whatever you have to buy is rising, as with your home, health care, and a college education.

The price of the things you need to sell, such as your labor and services, is falling.

So while official government numbers show that the overall rate of inflation is muted at multigenerational highs, the reality is that the standard of living of most Americans is being squeezed at an alarming rate by both startling price increases and real wage cuts.

I finally found someone who agrees with me.

David Stockman was president Ronald Reagan’s director of the Office of Management and Budget from 1981-1985. I regularly jousted with David at White House press conferences, pointing out that the budgets he was proposing would not produce a balanced budget, as he claimed.

Instead, I argued that they would lead to an enormous expansion of the federal deficit. In the end, I was right, with the national debt growing 400% during the Reagan years.

To his credit, David later admitted to running two sets of books for the national accounts, one for external consumption for people like me, and a second internal one for the president with much more dire consequences.

When David finally made the second set of books public, there was hell to pay. It was a fiery departure. I knew Ronald Reagan really well, and when the cameras weren’t rolling, he could get really angry.

After a falling out with Reagan over exactly the issues I brought up, Stockman disappeared for three decades.

He is now back with a vengeance.

He is running a blog named David Stockman’s Contra Corner (click here for the link at http://davidstockmanscontracorner.com ), a site he says “where mainstream delusions and cant about the Welfare State, the Bailout State, Bubble Finance, and Beltway Banditry are ripped, refuted and rebuked.” (Good writing was never his thing).

Despite this rant, there is no place I won’t go to discover some valid arguments and useful statistics, and Stockman is no exception.

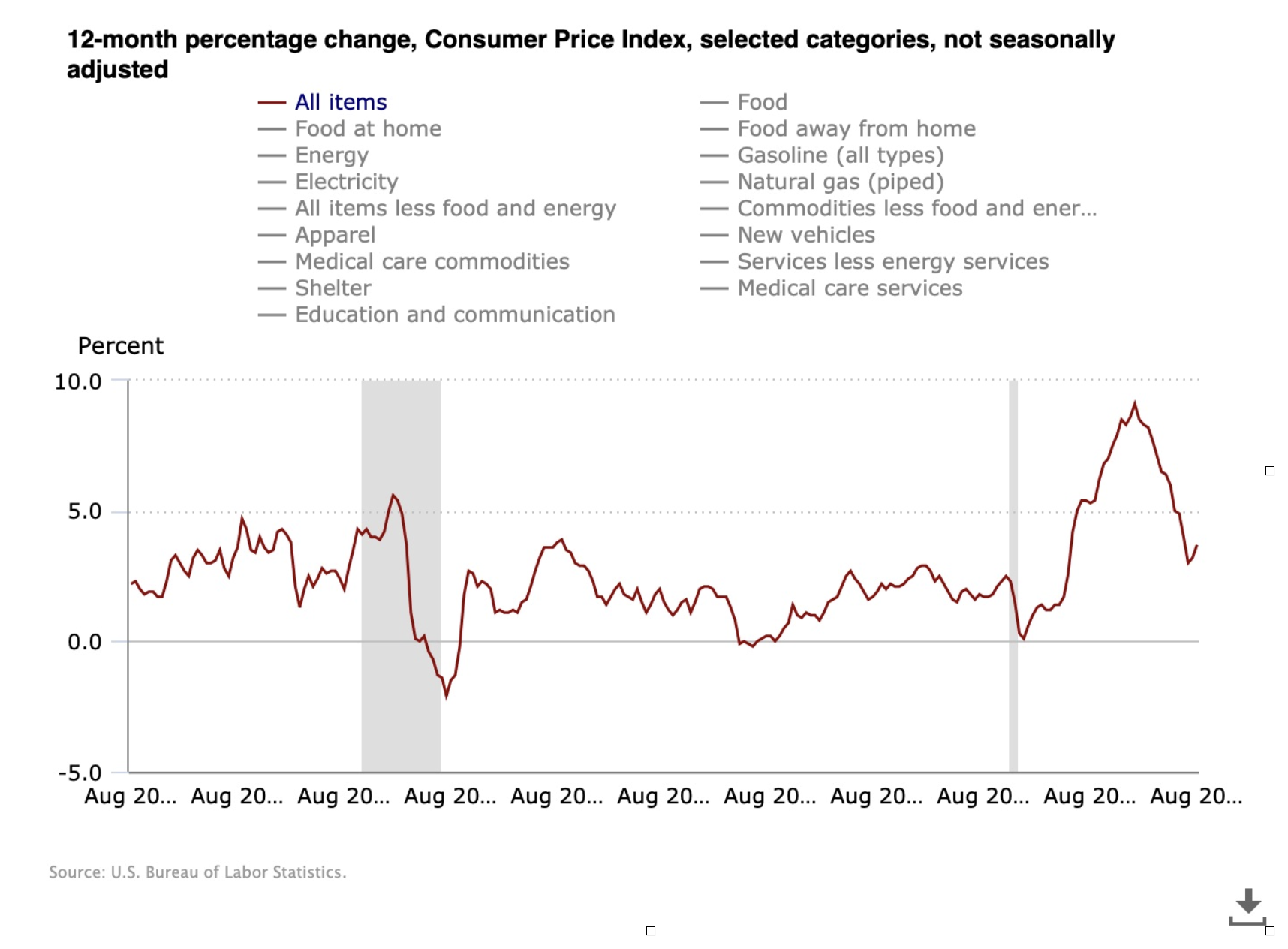

For a start, home utility prices have been skyrocketing for the past decade, nearly doubling. Over the last 12 months alone, it has jumped by 5.3%, while natural gas is up more than 10%, compared to an annual Consumer Price Index rise of only 3.3%.

But utilities have such a low 5% weighting in the Fed’s inflation calculation it barely moves the needle.

Wait, it gets better.

Gasoline costs have also been on a relentless uptrend since the nineties. Crude oil is up from a $10 low to today’s print of $95. Retail gasoline has popped from $1 a gallon to $5.50 in California, and that’s off from the year’s high at $3.50.

That works out to an annualized increase of 57%, or more than triple the official inflation rate.

The nation’s 40 million renting households have been similarly punished with price increases. They have averaged a 5.0% annual rate, nearly double the inflation rate.

The country’s 75 million homeowners are getting hit in the pocketbook as well. They have seen the cost of water, sewer, and trash collection balloon at a 4.8% annualized rate. And this has been an almost entirely straight-line move, with no pullbacks. And home insurance? It is absolutely through the roof.

David recites a dirty laundry list of Fed omissions and understatements on the inflation front, including gold, silver, and commodities prices.

All of these nickels and dimes add up to quite a lot for a family of four who is trying to scrape by on a median household income of $69,000 a year. And Heaven help you if you try to live on that in California.

The cost of a few items has declined, but not by much. They are largely composed of cheap import substitutes from Asia, including apparel, shoes, household furniture, consumer electronics, toys, and appliances.

One area the Fed data doesn’t remotely come close to measuring is the plunging cost of technology. How do you measure the savings from products that didn’t exist 20 years ago, like smart phones, iPods, iPads, and solid-state hard drives? How do you measure the cost of services that are handed out for free as Google, Facebook, and X do?

I can personally tell the cost of my own business is probably 90% cheaper to run than it would have three decades ago. I remember shelling out $5,000 for a COMPAQ PC that costs $300 today but has 1,000 times the performance.

David finishes with his usual tirade against the Fed, accusing them of obsessing over the noise of the daily data releases and missing the long-term trend.

Anyone like myself who watched in horror how long it took our central bank to recognize the seriousness of the 2008 financial crisis pr the pandemic would agree.

This all reminds me of what a college Economics professor once told me during the late 1960’s. “Statistics are like a bikini bathing suit. What they reveal is fascinating, but what they conceal is essential.”

What They Reveal is Fascinating....