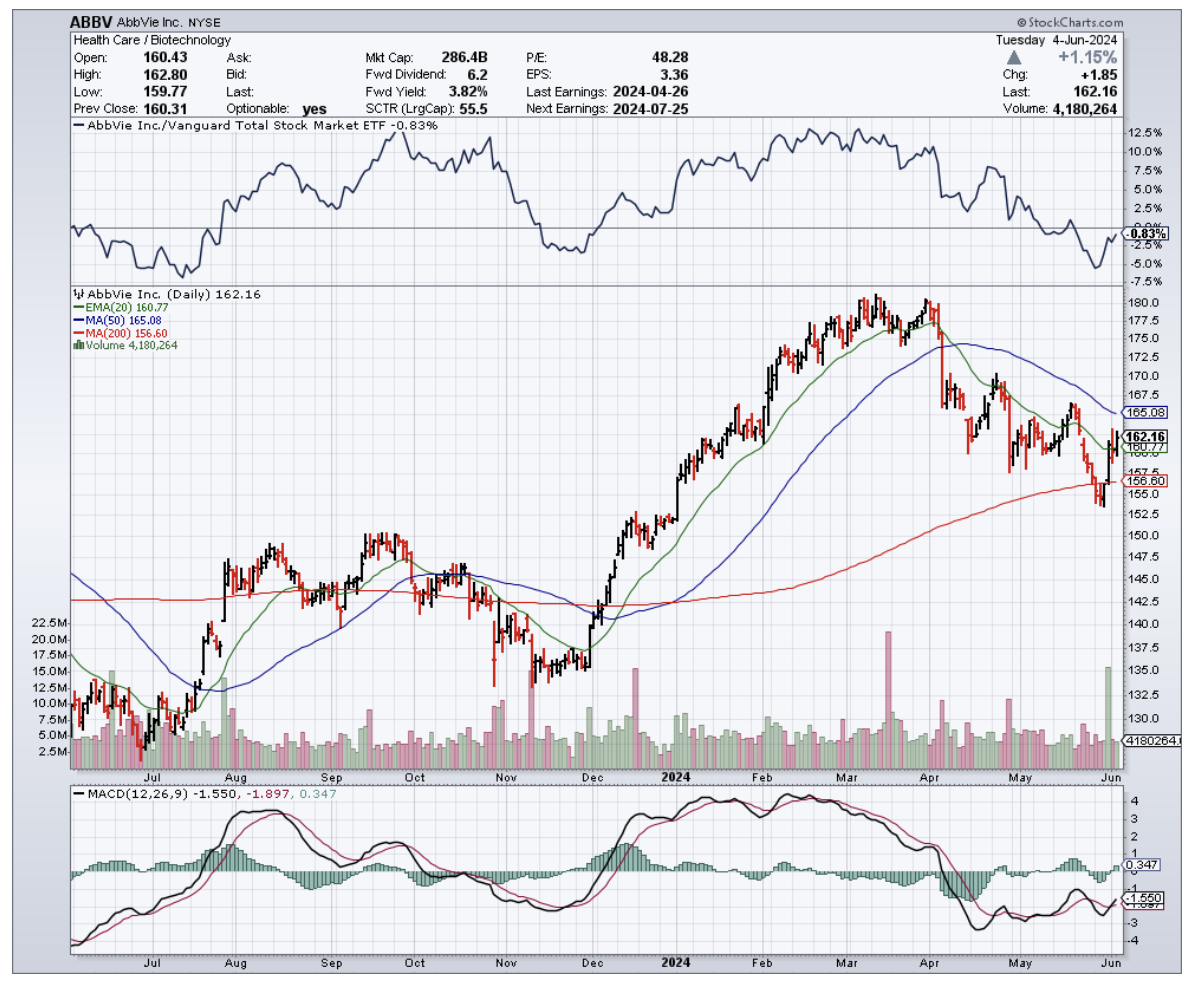

AbbVie (ABBV): A biotech stock that's been on my radar longer than most. If I could travel back to my UCLA biochem days, I'd tell young John to ditch the petri dishes and buy shares in this pharma giant. Why?

Because AbbVie isn't just another pharma play – it's a masterclass in diversification, innovation, and market-beating performance.

This is the stock that could turn a bright-eyed student into a savvy investor faster than you can say "immunology franchise."

In fact, if you've been paying attention to the market, you might have noticed that AbbVie's stock has been outperforming the broader U.S. market since mid-April, and for good reason.

This is a company that's been running at full throttle, posting some seriously impressive numbers in Q2 2024. We're talking $14.46 billion in revenue, a whopping 17.5% increase from the previous quarter and beating consensus estimates by a cool $430 million.

Earnings per share may have fallen just short of analysts' expectations, but they still climbed by a respectable 34 cents to $2.65.

But here's the thing: AbbVie's success isn't just a flash in the pan. This is a company with a diversified portfolio that's driving growth across multiple fronts.

I'm talking about their immunology, oncology, and neuroscience franchises, which together account for a staggering 75% of the company's total revenue.

Let's start with immunology. Now, I know what you're thinking - isn't that just Humira, AbbVie's blockbuster drug for Crohn's disease and ulcerative colitis? Well, yes and no.

While Humira has been facing some generic competition from the likes of Teva Pharmaceutical (TEVA), Pfizer (PFE), and Amgen (AMGN), resulting in a 30% year-over-year decline in global sales, AbbVie's got a couple of other tricks up its sleeve.

Enter Skyrizi and Rinvoq, two immunology drugs that are picking up the slack in a big way. Sales of these bad boys climbed 45% and 56%, respectively, in Q2 2024.

Skyrizi, in particular, has been an absolute beast, raking in $2.73 billion and growing 44.8% year-over-year. And with the FDA giving it the green light for moderate-to-severe ulcerative colitis in June 2024, the sky's the limit for this game-changer.

But AbbVie's not content to rest on its laurels. They're pushing the envelope with Rinvoq, a JAK inhibitor that's been approved for a wide range of indications and is showing some serious promise.

In Q2 2024, Rinvoq brought in $1.43 billion, a 30.8% quarter-over-quarter increase, thanks to strong demand in the U.S., excellent clinical trial results, and FDA approval for treating children with psoriatic arthritis and juvenile idiopathic arthritis.

And let's not forget about giant cell arteritis, a condition that AbbVie's been targeting with Rinvoq.

Recent trials have shown some impressive results, with 46% of adult patients taking Rinvoq 15 mg experiencing sustained remission, compared to just 29% of those on placebo.

No wonder AbbVie's been submitting applications left and right to get this drug approved for even more indications.

But it's not just immunology where AbbVie's making waves. Their oncology portfolio, bolstered by the acquisition of ImmunoGen in mid-February 2024, is also delivering the goods.

Sure, demand for Imbruvica may be declining due to newer BTK inhibitors from AstraZeneca (AZN), BeiGene (BGNE), and Eli Lilly (LLY), but Elahere, an antibody-drug conjugate for ovarian cancer, is quickly becoming a rising star.

In Q2 2024, Elahere sales jumped 65.4% quarter-over-quarter to $128 million, driven by increased marketing, growing awareness among physicians, and promising data from clinical trials.

Finally, let's not overlook AbbVie's neuroscience franchise, which generated a cool $2.16 billion in Q2 2024, a 14.7% year-over-year increase.

Headlining this portfolio are Qulipta and Ubrelvy for migraine treatment, and Vraylar for a range of psychiatric conditions.

Qulipta, specifically, has been a standout, with sales surging 56.3% year-over-year to $150 million, thanks to its convenient oral administration and long-term efficacy data.

Looking ahead, AbbVie's got even more irons in the fire. Their $8.7 billion acquisition of Cerevel Therapeutics (CERE) is set to close soon, bringing promising neuroscience candidates like emraclidine for schizophrenia and davapidon for Parkinson's into the fold.

With all these positive developments, it's no wonder AbbVie's feeling confident enough to raise its full-year adjusted EPS guidance to $10.71-$10.91, up from the previous range of $10.61-$10.81. Talk about a biochemistry experiment gone right!

So, there you have it. AbbVie: a healthcare powerhouse that's firing on all cylinders and poised for even greater success in the years to come. If only I could've shown this to my younger self back in those UCLA labs – he might've traded his test tubes for trading terminals a lot sooner.

Now, if you're ready to take a ride on this rocket ship, I suggest you buckle up and hang on tight. Because let me tell you, dissecting AbbVie's financial DNA has been more thrilling than any fracking adventure or hedge fund rodeo I've ever been on.

And if there's one thing I've learned in my years hopscotching from biochem labs to Wall Street, it's that the view from the top of a well-diversified, innovative pharma giant is always worth the climb. I suggest you buy the dip.