Superiority is mainly about taking complicated data and finding perfect solutions for it. Trading in technology stocks is no different.

Investing in software-based cloud stocks has been one of the seminal themes I have promulgated since the launch of the Mad Hedge Technology Letter way back in February 2018.

Well, if you thought every tech letter until now has been useless, this is the one that should whet your appetite.

Instead of racking your brain to find the optimal cloud stock to invest in, I have a quick fix for you and your friends.

Invest in The WisdomTree Cloud Computing Fund (WCLD) which aims to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index (EMCLOUD).

What Is Cloud Computing?

The “cloud” refers to the aggregation of information online that can be accessed from anywhere, on any device remotely.

Yes, something like this does exist and we have been chronicling the development of the cloud since this tech letter’s launch.

The cloud is the concept powering the “shelter-at-home” trade which has been hotter than hot in 2020.

Cloud companies provide on-demand services to a centralized pool of information technology (IT) resources via a network connection.

Even though cloud computing already touches a significant portion of our everyday lives, the adoption is on the verge of overwhelming the rest of the business world due to advancements in artificial intelligence and the Internet of Things (IoT) hyper-improving efficiencies.

The Cloud Software Advantage

Cloud computing has particularly transformed the software industry.

Over the last decade, cloud Software-as-a-Service (SaaS) businesses have dominated traditional software companies as the new industry standard for deploying and updating software. Cloud-based SaaS companies provide software applications and services via a network connection from a remote location, whereas traditional software is delivered and supported on-premise and often manually. I will give you a list of differences to several distinct fundamental advantages for cloud versus traditional software.

Product Advantages

Speed, Ease, and Low Cost of Implementation – cloud software is installed via a network connection; it doesn’t require the higher cost of on-premise infrastructure setup and installation.

Efficient Software Updates – upgrades and support are deployed via a network connection, which shifts the burden of software maintenance from the client to the software provider.

Easily Scalable – deploying via a network connection allows cloud SaaS businesses to grow as their units increase, with the ability to expand services to more users or add product enhancements with ease. Client acquisition can happen 24/7 and cloud SaaS companies can more easily expand into international markets.

Business Model Advantages

High Recurring Revenue – cloud SaaS companies enjoy a subscription-based revenue model with smaller and more frequent transactions, while traditional software businesses rely on a single, large, upfront transaction. This model can result in a more predictable, annuity-like revenue streams making it easy for CFOs to solve long-term financial solutions.

High Client Retention with Longer Revenue Periods – cloud software becomes embedded in client workflow, resulting in higher switching costs and client retention. Importantly, many clients prefer the pay-as-you-go transaction model, which can lead to longer periods of recurring revenue as upselling product enhancements does not require an additional sales cycle.

Lower Expenses – cloud SaaS companies can have lower R&D costs because they don’t need to support various types of networking infrastructure at each client location.

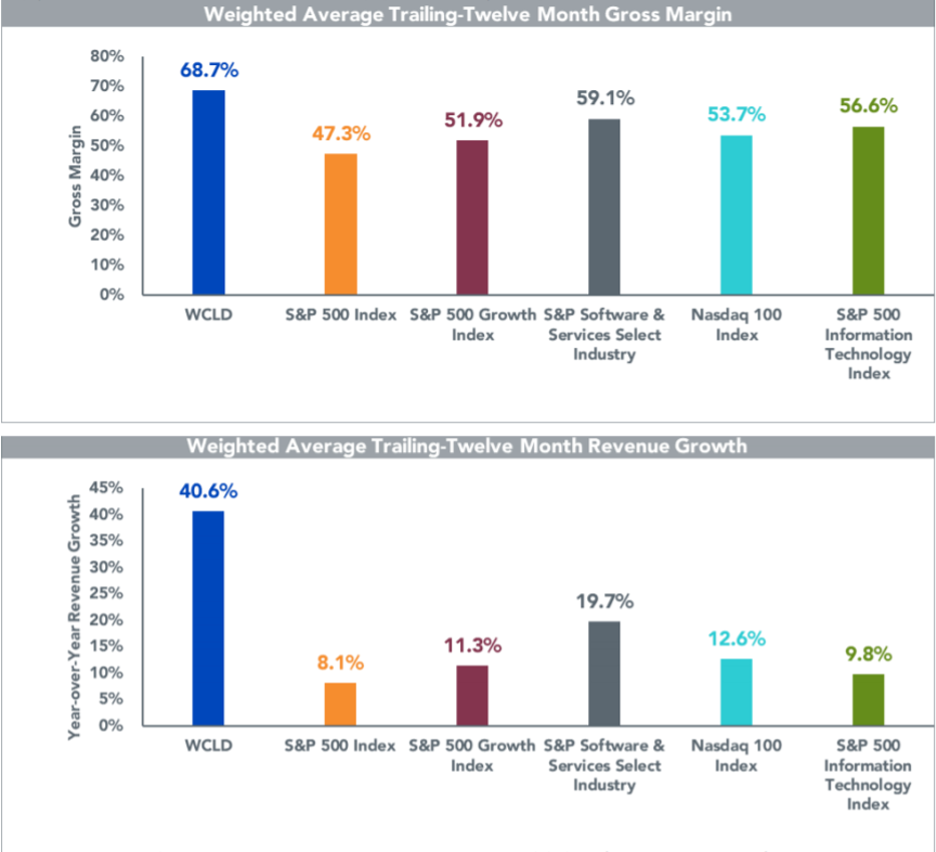

I believe the product and business model advantages of cloud SaaS companies have historically led to better margins, growth, higher free cash flow, and efficiency characteristics as compared to non-cloud software companies.

How does the WCLD ETF select its indexed cloud companies?

Each company must satisfy critical criteria such as they must derive the majority of revenue from business-oriented software products, as determined by the following checklist.

+ Provided to customers through a cloud delivery model – e.g., hosted on remote and multi-tenant server architecture, accessed through a web browser or mobile device, or consumed as an application programming interface (API).

+ Provided to customers through a cloud economic model – e.g., as a subscription-based, volume-based, or transaction-based offering Annual revenue growth, of at least:

+ 15% in each of the last two years for new additions

+ 7% for current securities in at least one of the last two years

Some of the stocks that would epitomize the characteristics of a WCLD stock are Salesforce, Microsoft, Amazon-- I mean, they are all up, you know, well over 100% from the nadir we saw in March and contain the emerging growth traits that make this ETF so robust.

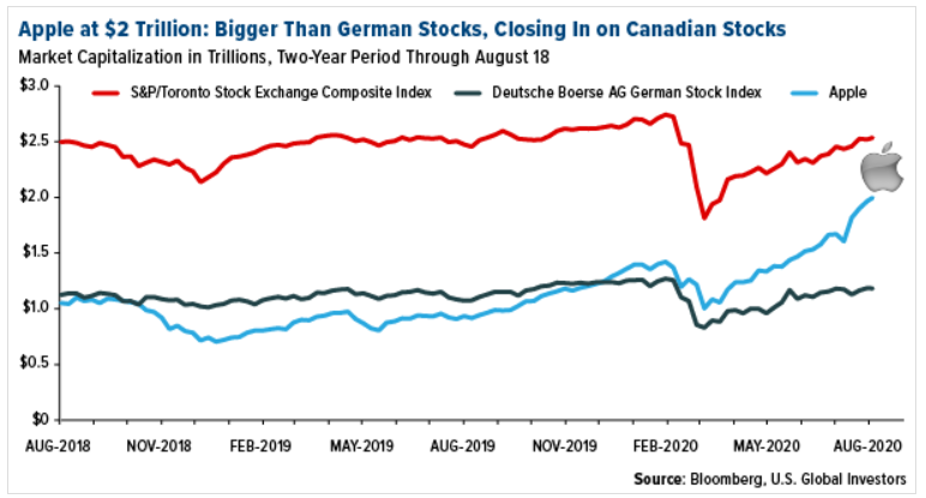

If you peel back the label and you look at the contents of many tech portfolios, they tend to favor some of the large-cap names like Amazon, not because they are “big” but because the numbers behave like emerging growth companies even when the law of large numbers indicate that to push the needle that far in the short-term is a gravity-defying endeavor.

We all know quite well that Amazon isn't necessarily a direct play on cloud computing, but the elements of its cloud business are nothing short of brilliant.

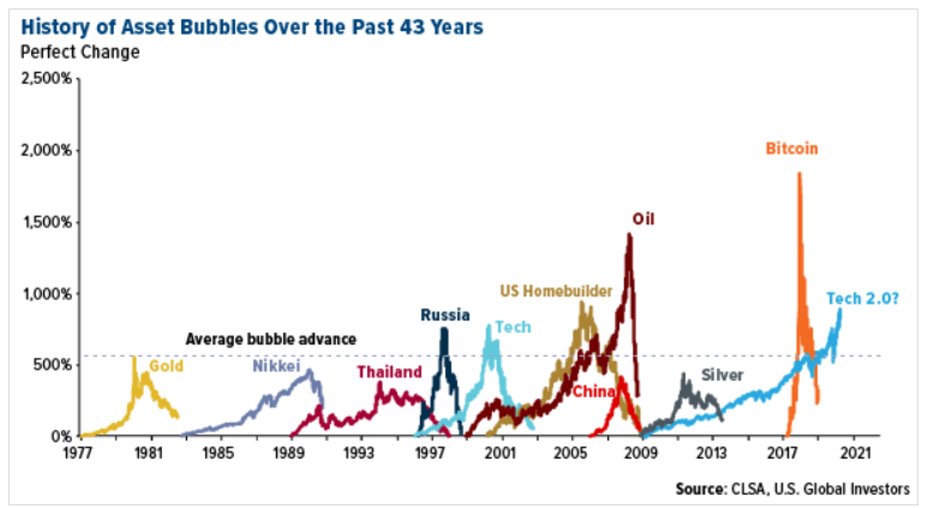

But ETF funds like WCLD, what they look to do is to cue off of pure plays and include pure plays that are growing faster than the broader tech market at large. So you're not going to necessarily see the vanilla tech of the world in that portfolio. You're going to see a portfolio that's going to have a little bit more sort of explosive nature to it, names with a little more mojo, a little bit more risk because you're focusing on smaller names that have the possibility to go parabolic and gift you a 10-bagger.

One stock that has the chance of a 10-bagger is my call on Palantir (PLTR).

Palantir is a tech firm that builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations, and my call was to buy them at $10 after it’s IPO, it's up to $26 and has an easy pathway to $50.

This is one of the no-brainers that procure revenue from Democrat and Republican administrations even though its CEO Alex Karp has been caught on video making fun of the current administration’s leaders.

In a global market where the search for yield couldn’t be tougher right now, right-sizing a tech portfolio to target those extraordinary, extra-salacious tech growth companies is one of the few ways to produce alpha without overleveraging.

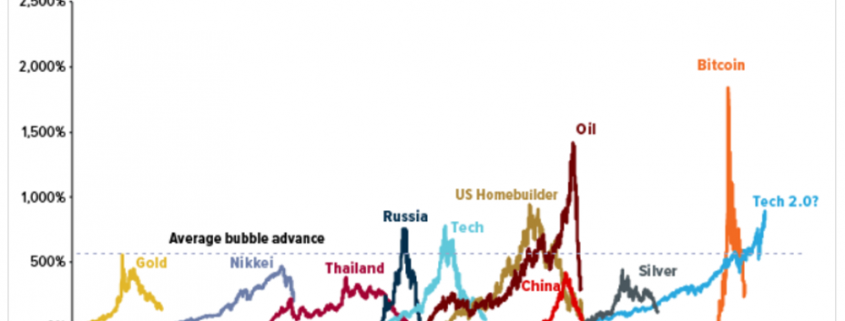

No doubt there will be periods of volatility, but if a long-term horizon is something suited for you, this super-growth strategy is a winner and don’t forget about PLTR while you’re at it.