When Operation Warp Speed was launched, the US government handpicked the most promising COVID-19 vaccine programs and offered them funding—an offer that was welcomed by all those selected except for one: Pfizer (PFE).

While COVID-19 vaccine frontrunners like Moderna (MRNA), AstraZeneca (AZN), and even Johnson & Johnson (JNJ) accepted financial assistance from the US government, Pfizer insisted on funding its own coronavirus program.

Now, Pfizer has taken another step to make it clear that it does not need any help.

In what could only be described as adding an exclamation point to its “declaration of independence” from the US government, Pfizer announced that it won’t use the country’s chosen distribution partner in delivering its COVID-19 vaccine.

For years, the US government has been using McKesson (MCK) to deliver drugs and other treatments.

In fact, this was the same company used by the Obama administration in 2009, when it distributed the H1N1 vaccine and medications.

This won’t be the case for Pfizer’s COVID-19 vaccine though.

According to the company, it has designed its own delivery system to ensure the proper and safe distribution of its product.

In October, Pfizer disclosed its distribution plans that centered on select sites in Michigan, Belgium, Wisconsin, and Germany.

Other than its goal to operate as independently from the US government as possible, one of the concerns of Pfizer is the sensitive nature of its COVID-19 vaccine.

The vaccine has to be kept at an ultra-cold temperature of minus 94 degrees Fahrenheit, which means that the shipments would require close monitoring.

What we know so far is that Pfizer has designed shipping containers that can maintain the temperature of the vaccine for 10 days.

In terms of monitoring, the company has developed a real-time GPS tracking system that will report any deviations in the set conditions.

All these are implemented to ensure that the COVID-19 vaccine does not lose potency before it reaches patients.

Looking at the other vaccine candidates, Moderna might also resort to this kind of distribution arrangement since its vaccine needs to be stored at negative 4 degrees Fahrenheit.

Outside its COVID-19 efforts, Pfizer has been aggressive in pruning its business divisions.

Since late 2019, Pfizer has been implementing strategies to eliminate its underperforming segments.

In August last year, the company forged a partnership with GlaxoSmithKline (GSK) to combine their consumer healthcare sectors.

This led to the formation of the GSK Consumer Healthcare, where Pfizer holds a 32% stake.

This year, Pfizer has been working on offloading its off-patent drug unit, Upjohn, and merging it with Mylan (MYL).

This deal should be finalized by the fourth quarter of 2020, with the merger offering Pfizer’s shareholders with roughly 57% of the new company, Viatris.

When this is completed, Pfizer would become a smaller and more focused biopharmaceutical company.

This means that the company can leverage its $202.27 billion market capitalization to move the needle more substantially in terms of its long-term prospects.

One of the key areas that Pfizer has been working towards becoming a powerhouse is oncology—a sector that has served as a major growth driver for the company for years.

Pfizer has a deep oncology portfolio comprising over 20 approved drugs marketed to different areas including breast cancer, lung cancer, and blood cancer.

However, none of its cancer drugs have managed to breach the $10 billion annual sales mark in this sector.

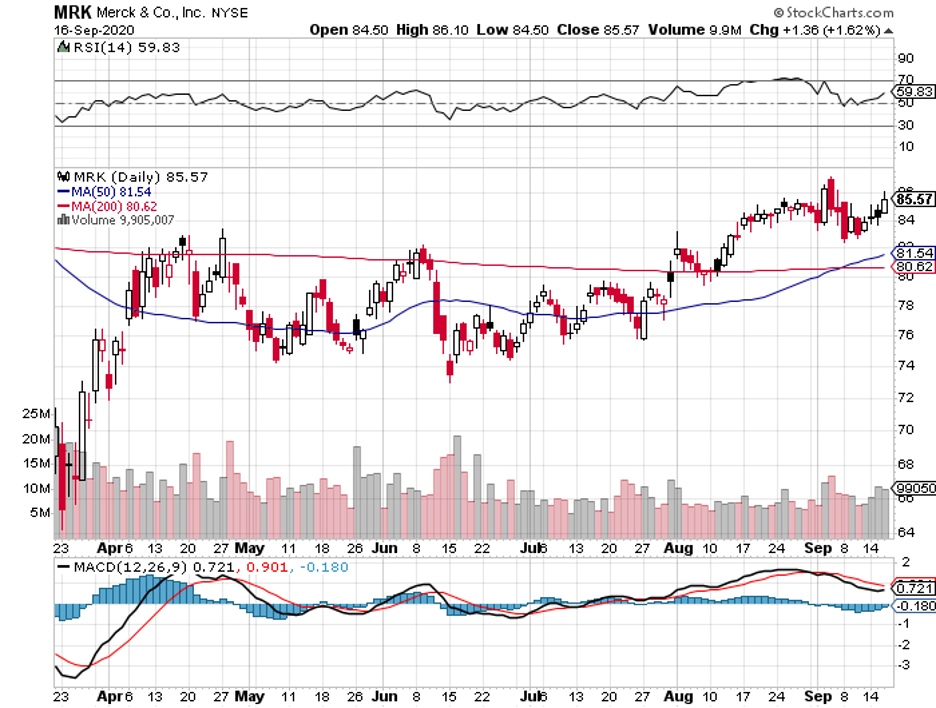

This is because Pfizer has no absolute mega-blockbuster in the oncology space like its competitors Merck (MRK) with Keytruda and Bristol-Myers Squibb (BMY) with Opdivo.

With the growing number of pipeline candidates in its cancer portfolio, Pfizer is expected to come up with a blockbuster by the fourth quarter this year or before the first half of 2021 ends.

Looking at Pfizer’s pipeline, there are 14 approvals anticipated from today through 2025 in the oncology segment alone.

One contender is its prostate cancer drug Xtandi. Another is a non-small cell lung cancer medication called Lorbrena.

In terms of its current product lineup, Pfizer’s biopharmaceutical operations continue to impress investors.

Despite not having a mega-blockbuster, it still has several top-selling drugs like Eliquis and Ibrance. Both showed 9% increase each in sales for the third quarter of 2020.

Taking all these into consideration, Pfizer is estimated to deliver solid growth in the next few years primarily thanks to its fast-developing oncology segment. This market is forecasted to experience an increase of $240 billion every year by 2023.

Overall, a successful COVID-19 program could provide a one-time earnings boost for Pfizer and a substantial earnings accretion in fiscal 2021.

However, this giant biopharmaceutical company’s extensive lineup of commercialized products and promising oncology pipeline mean that its revenue and share performance do not heavily depend on its coronavirus vaccine.

If Pfizer’s COVID-19 vaccine candidate fails, it won’t be a disaster for its shareholders, especially since the company’s shares do not seem to consider this program in its pricing.

In fact, Pfizer shares are looking inexpensive even without a successful COVID-19 vaccine candidate.

If it does turn out to be a success though, then Pfizer investors could enjoy some COVID-19 vaccine call option for free.