“Buy at the sound of the canon.”

That was the sage advice Nathan Rothschild, ancestor of my former London neighbor Jacob Rothschild, gave to friends about trading stocks during the Napoleonic Wars.

Of course, information moved rather slowly back in 1812, pre-internet. Rothschild relied on carrier pigeons to gain his unfair advantage.

You have me.

Somehow, you have descended into Dante’s seventh level of hell. You have to wake up every morning now, wondering if it will be Jay Powell or Vladimir Putin who is going to eviscerate your wealth, postpone your retirement, and otherwise generally ruin your day.

Every price in the market already knows we’re in a bear market except the major indexes.

The roll call of the dead looks like a WWI casualty report: (NFLX), (ZM), (DOCU), (ROKU), (VMEO). It’s like the bid offer spread has suddenly become 25%. Companies are either reporting great earnings and seeing their shares go through the roof. Or they are sorely disappointing and getting sent to perdition on a rocket ship.

The most fascinating thing to happen last week was a new low in the bond market, since you’re all short up the wazoo, courtesy of a certain newsletter. Ten-year US Treasury yields tickled 2.05%, a two-year high, then retreated to 1.92%. That means bonds have completed their $20 swan dive from their December high, a repeat of the 2021 price action.

Trading has gotten too easy, so I think bonds will stall out here for a while. I even added a small long. And please stop calling me to ask if you should sell short bonds down $20. It’s perfect 20/20 hindsight. You can’t imagine how many such calls I’ve already received.

Our old friend, the barbarous relic, returned from the dead last week too. All it needed was for bitcoin to die a horrible death for gold to recover its bid. A prospective war in the Ukraine helped take it to a one-year high.

However, I think it’s safe to say that has lost its value as an inflation hedge for good. If a move in the CPI from 2% to 7.5% can’t elicit a pulse in the yellow metal now, it never will.

The US dollar was another puzzler last week. While the fixed income markets went from discounting three rate hikes this year to six, the greenback flatlined. It was supposed to go up, as currencies with rapidly rising interest rates usually do.

Maybe the buck just forgot how to go down. Or maybe this is the beginning of the end, when sheer over-issuance destroys the value of the US dollar. Some $30 trillion in the national debt will do that to a currency.

I know you will find this difficult to believe, but there are some outstanding money-making opportunities setting up later in the year. The crappier conditions look now, the better they will become later. But you are going to have to practice some extreme patience to get to the other side.

I hope this helps.

Goldman Sachs Chops 2022 Market Forecast, taking the S&P 500 goal from $5,100 down to $4,900. A tighter interest rate picture is to blame, with the year yields topping 2.05% on Friday. Higher interest rates devalue future corporate earnings and kill the shares of non-earning companies.

Oil Hits Seven-Year High, to $94.44 a barrel, up 3.3% on the day. Putin’s strategy of talking oil prices up with Ukrainian invasion threats is working like a charm. That’s what this is all about. Texas tea accounts for 70% of Russian government revenues.

Fed to Front-Load Rate Rises, says St. Louis Fed president Bullard. The drumbeat for a more hawkish central bank continues. Bonds were knocked for two points.

Wholesale Prices Rocket 1% in January and are up a nosebleed 9.7% YOY. Inflation has clearly not peaked yet. Look for stocks to get punished once the current short-covering rally runs out of gas.

Retail Sales Soar by 3.8%, in January indicating that the economy is stronger than it appears. The rapid shift to an online economy is accelerating. Inflation is the turbocharger. When stocks overshoot on the downside load the boat.

Weekly Jobless Claims Jump, to 248,000. The weird thing is that the economic data says the opposite, that the economy is strengthening. Expect flip-flopping data and markets all year.

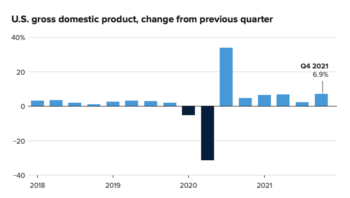

US GDP Jumped by 6.9% in Q4, well above estimates. Consumers are spending like drunken sailors. Eventually, the stock market will notice this, but not before we see lower lows first.

Gold Catches a Bid, off the back of the unrelenting Ukraine crisis. This may continue as a drip for months. Watch it collapse when peace is declared.

Existing Home Sales Jump 6.7%, to 6.5 million units, far better than expected. Inventory is down to yet another record low of 16.5%, an incredibly short 1.6-month supply. The Median Home Price has risen to $350,300, with the bulk of sales on the high end. Million-dollar plus homes are up 39% YOY.

Bond Yields Dive to a 1.93% Yield after failing at 2.05%. There is another nice (TLT) put spread setting up here. Let’s see if war breaks out over the weekend. The threats continue.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

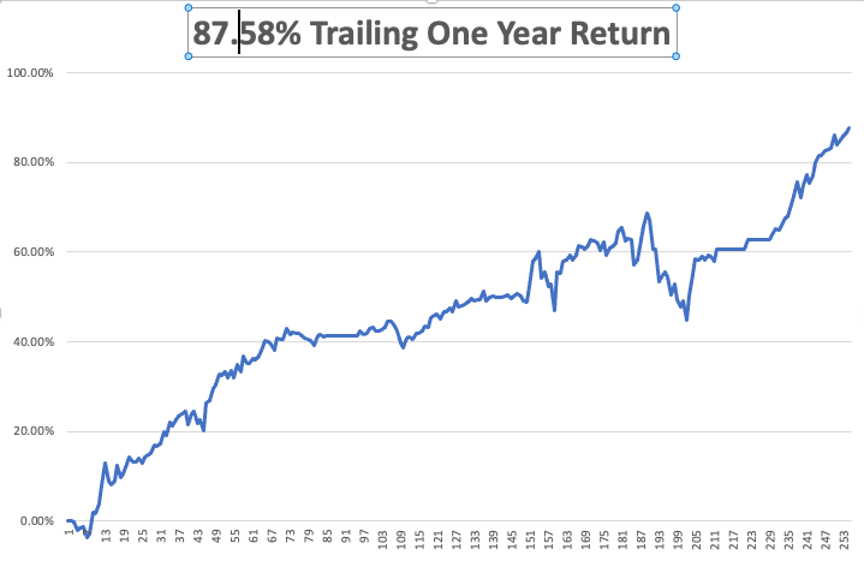

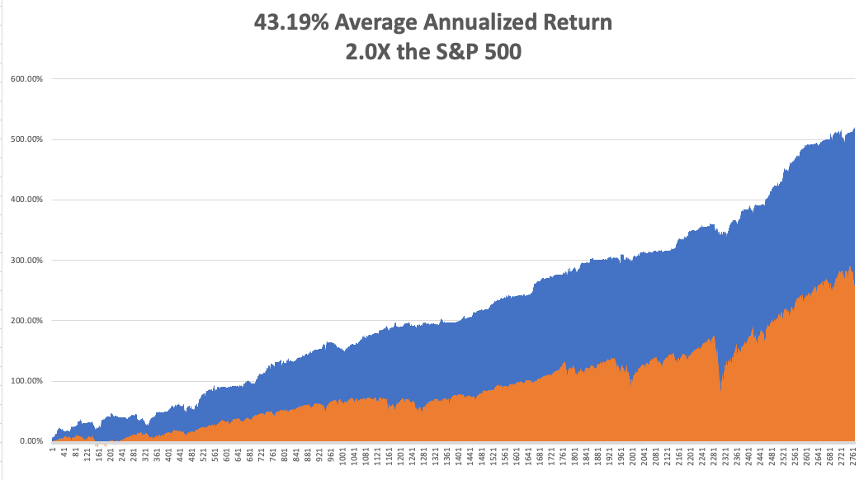

With seven options positions expiring at max profit on Friday, my February month-to-date performance rocketed to a blistering 10.37%. My 2022 year-to-date performance has exploded to an unbelievable 24.90%. The Dow Average is down -7.9% so far in 2022. It is the great outperformance on an index since Mad Hedge Fund Trader started 14 years ago.

With 30 trade alerts issued so far in 2022, there was too much going on to describe here. Check your inboxes.

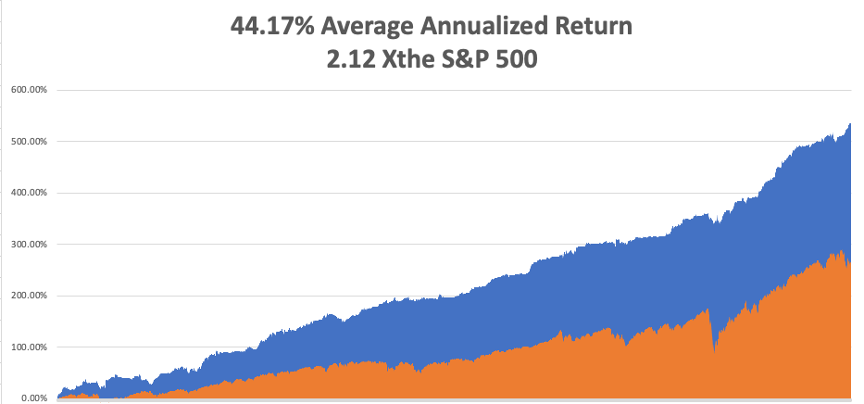

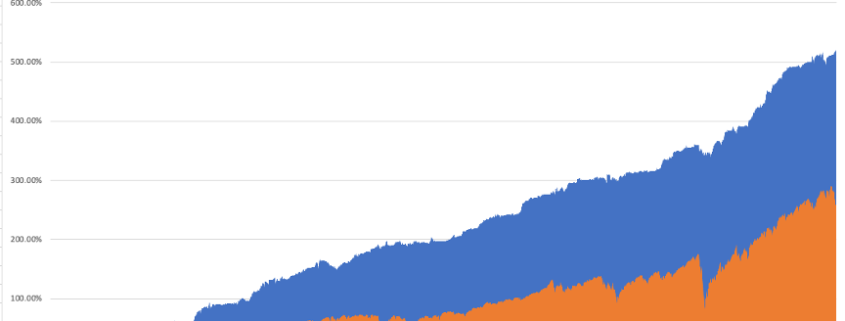

That brings my 13-year total return to 537.46%, some 2.00 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.17% for the first time. How long it will keep rising I have no idea, but as long as it is, I’m not complaining. When you’re hot, you have to be maximum aggressive. That’s me to a tee.

We need to keep an eye on the number of US Coronavirus cases at 78.5 million, down 67% from the January peak, and deaths close to 936,000, off 20% in two weeks, which you can find here.

On Monday, February 21 markets are closed for Presidents Day.

On Tuesday, February 22 at 8:30 AM, the S&P Case Shiller National Home Price Index for December is announced.

On Wednesday, February 23 at 1:30 PM, API Crude Oil Stocks are released.

On Thursday, February 24 at 8:30 AM, Weekly Jobless Claims are published. The second estimate for Q4 GDP is also disclosed.

On Friday, February 25 at 7:00 AM, Personal Income & Spending for January is printed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, in the seventies, Air America was not too choosy about who flew their airplanes at the end of the Vietnam War. If you were willing to get behind the stick and didn’t ask too many questions, you were hired.

They didn’t bother with niceties like pilot licenses, medicals, or passports. On some of their missions, the survival rate was less than 50% and there was no retirement plan. The only way to ignore the ratatatat of bullets stitching your aluminum airframe was to turn the volume up on your headphones.

Felix (no last name) taught me to fly straight and level so he could find out where we were on the map. We went out and got drunk on cheap Mekong Whiskey after every mission just to settle our nerves. I still remember the hangovers.

When I moved to London to set up Morgan Stanley’s international trading desk in the eighties, the English had other ideas about who was allowed to fly airplanes. Julie Fisher at the London School of Flying got me my basic British pilot’s license.

If my radio went out, I learned to land by flare gun and navigate by sextant. She also taught me to land at night on a grass field guided by a single red lensed flashlight. For fun, we used to fly across the channel and land at Le Touquet, taxiing over the rails for the old V-1 launching pads.

A retired Battle of Britain Spitfire pilot named Captain John Schooling taught me advanced flying techniques and aerobatics in an old 1949 RAF Chipmunk. I learned barrel rolls, loops, chandelles, whip stalls, wingovers, and Immelmann turns, everything a WWII fighter pilot needed to know.

John was a famed RAF fighter ace. Once he got shot down by a Messerschmitt 109, parachuted to safety, took a taxi back to his field, jumped into his friend’s Spit, and shot down another German. Every lesson ended with a pint of beer at the pub at the end of the runway. John paid me the ultimate compliment, calling me “a natural stick and rudder man,” no pun intended.

John believed in tirelessly practicing engine-off landings. His favorite trick was to reach down and shut off the fuel, telling me that a Messerschmitt had just shot out my engine and to land the plane. When we got within 200 feet of a good landing, he turned the fuel back on and the engine coughed back to life. We practiced this more than 200 times.

When I moved back to the US in the early nineties, it was time to go full instrument in order to get my commercial and military certifications. Emmy Michaelson nursed me through that ordeal. After 50 hours flying blindfolded in a cockpit, you get very close with someone.

Then came flight test day. Emmy gave me the grim news that I had been assigned to “One Engine Larry” the most notorious FAA examiner in Northern California. Like many military flight instructors, Larry believed that no one should be allowed to fly unless they were perfect.

We headed out to the Marin County coast in an old twin-engine Beechcraft Duchess, me under my hood. Suddenly, Larry shut the fuel off, told me my engines failed, and that I had to land the plane. I found a cow pasture aligned with the wind and made a perfect approach. Then he asked, “How did you do that?” I told him. He said, “Do it again” and I did. Then he ordered me back to base. He signed me off on my multi-engine and instrument ratings as soon as we landed. Emmy was thrilled.

I now have to keep my many licenses valid by completing three takeoffs and landings every three months. I usually take my kids and make a day of it, letting them take turns flying the plane straight and level.

On my fourth landing, I warn my girls that I’m shutting the engine off at 2,000 feet. They cry “No dad, don’t.” I do it anyway, coasting in bang on the numbers every time.

A lifetime of flight instruction teaches you not only how to fly, but how to live as well. It makes you who you are. Thus, my insistence on absolute accuracy, precision, risk management, and probability analysis. I live my life by endless checklists, both short and long term. I am the ultimate planner and I have a never-ending obsession with the weather.

It passes down to your kids as well.

Julie became one of the first female British Airways pilots, got married, and had kids. John passed on to his greater reward many years ago. I don’t think there are any surviving Battle of Britain pilots left. Emmy was an early female hire as United pilot. She married another United pilot and was eventually promoted to full captain. I know because I ran into them in an elevator at San Francisco airport ten years ago, four captain’s bars adorning her uniform.

Flying is in my blood now and I’ll keep flying for life. I can now fly anything anywhere and am the backup pilot on several WWII aircraft including the B-17, B-24, and B-25 bombers and the P-51 Mustang fighter.

Over the years, I have also contributed to the restoration of a true Battle of Britain Spitfire, and this summer I’ll be taking the controls at the Red Hill Aerodrome for the first time.

Captain John Schooling would be proud.

Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Captain John Schooling and His RAF 1949 Chipmunk

A Mitchell B-25 Bomber

A 1932 De Havilland Tiger Moth

Flying a P-51 Mustang

The Next Generation