We are closing in on $27,000 and that’s quite the performance for the digital gold Bitcoin (BTC).

It just was last year when Bitcoin was down in the dumps.

I am not here flogging crypto but tech investors should take heed of what is happening in the riskier parts of the asset markets.

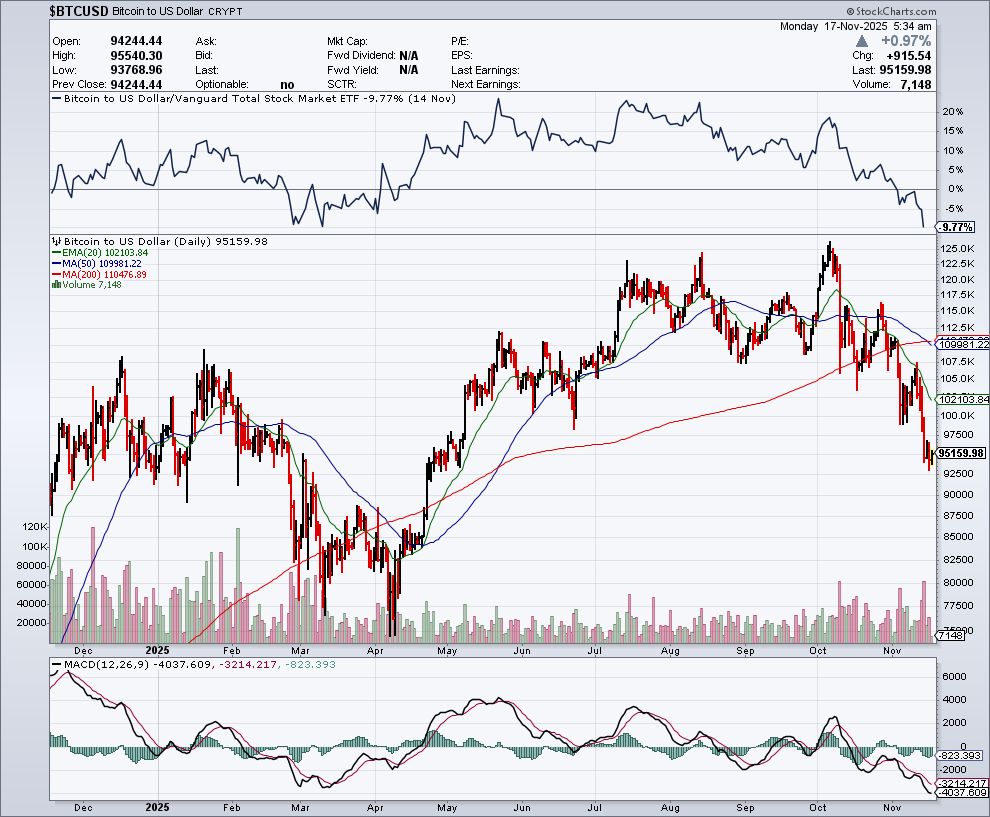

Yes, tech growth is quite volatile, but bitcoin even more so.

The price of Bitcoin is already up 72% this year and that will beat most tech growth stocks including the Teledocs and DocuSigns of the world.

This last strong surge is correlated with global banking contagion with even very liberal-based CNBC stating that Switzerland has become a financial “banana republic.”

Bitcoin is often advertised as the alternative asset class to fiat banking precisely because fiat banking has a history of going to zero.

The blowups at Silicon Valley Bank, First Republic, and Credit Suisse offer credible evidence that the strength of the fiat money banking system is trending down rather than up.

Hence the monster rally and this will just make banking more expensive for the unbanked and give the big banks more power and more “too big to fail” status.

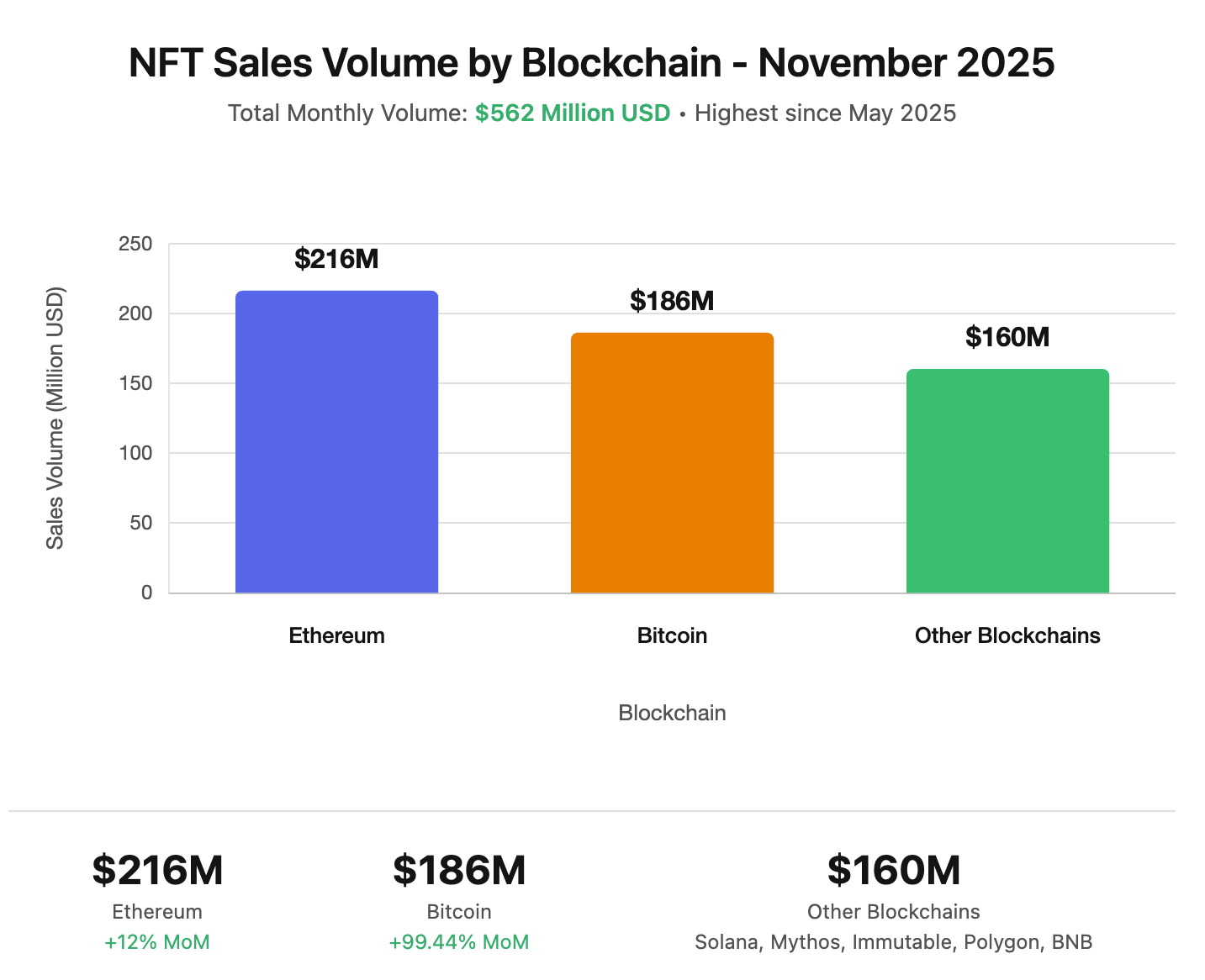

Narratives are more powerful in crypto in generating real price movements than any other asset class and no matter what your thoughts on how powerful that narrative is, people actually believe this.

Cryptocurrency initially attracted interest from a niche group of investors following bank failures and government rescues.

While its popularity has grown among speculative investors in the roughly decade-and-a-half since, it has retained a status among some as being an asset more removed from the banking system than stocks and government bonds.

If the Fed decides to slow down the pace of interest rate hikes this is highly bullish for the crypto and tech growth sector.

Crypto investors have been particularly sensitive to regulatory and interest-rate developments.

They tend to pull money from long-bitcoin funds while adding to short-bitcoin products after the Federal Reserve announces interest-rate increases and regulators take action against crypto companies.

Since regulators started to crack down on some of the biggest crypto players, investors have pulled about $424 million from global exchange-traded products.

It’s been a terrible year to short bitcoin as that trade was last year’s rich uncle.

An important part of investing is to avoid searching for that boat that has left the dock.

Investors betting against crypto exchange, Coinbase (COIN), and bitcoin-buying software intelligence firm, MicroStrategy (MSTR), were down 76% and 62%, respectively, this year.

Some investors remain cautiously optimistic about the trajectory of bitcoin’s price, especially as it has surged against the backdrop of a banking crisis.

Although there could be a vicious pullback from the epic surge so far this year, Bitcoin will likely do well along with tech growth stocks in a paused or lower rate interest environment.

Throw in the bank contagion as a supercharger and 2023 is shaping up to be a great year to buy bitcoin and growth tech on the dips.