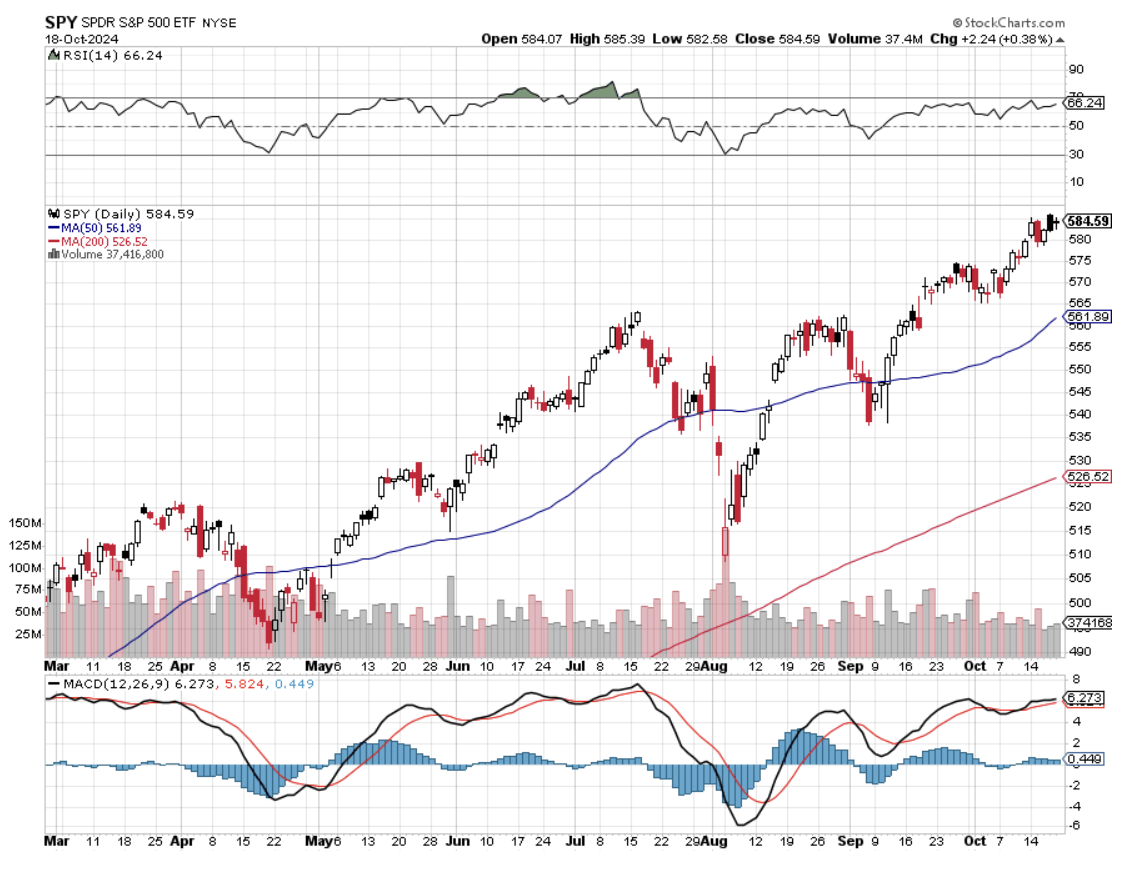

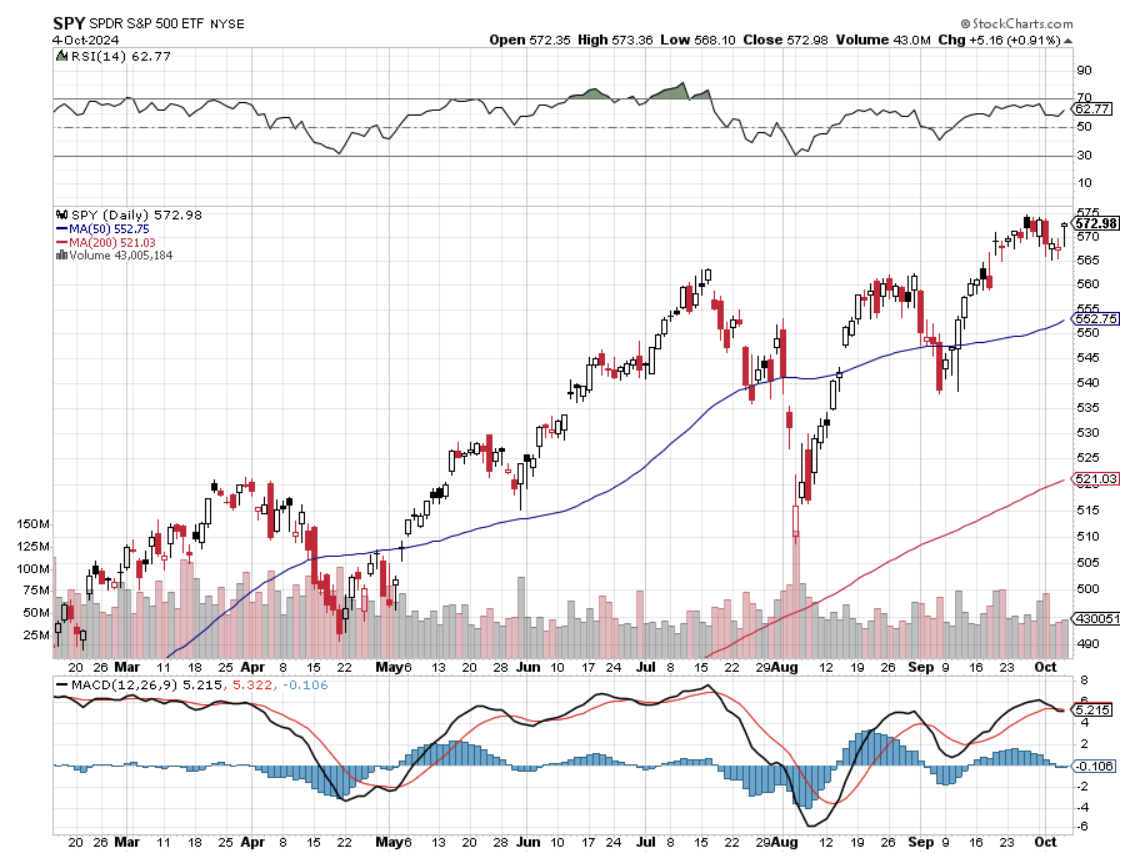

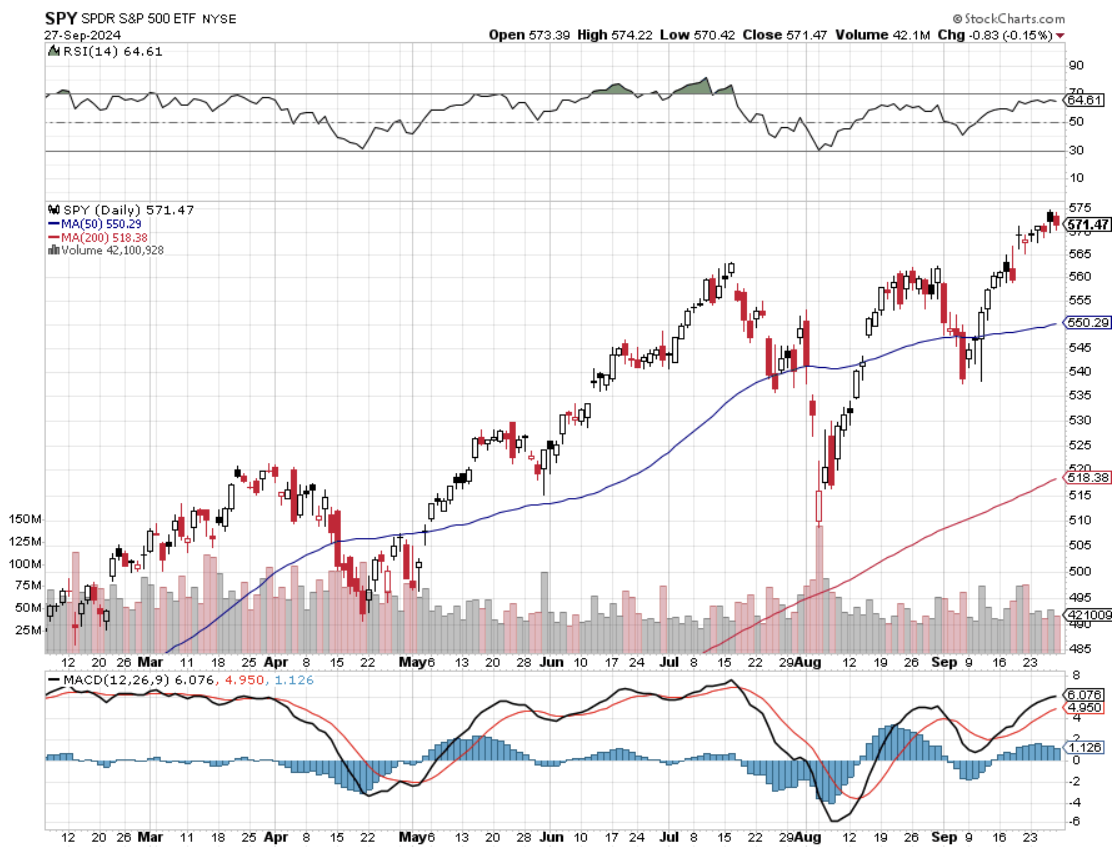

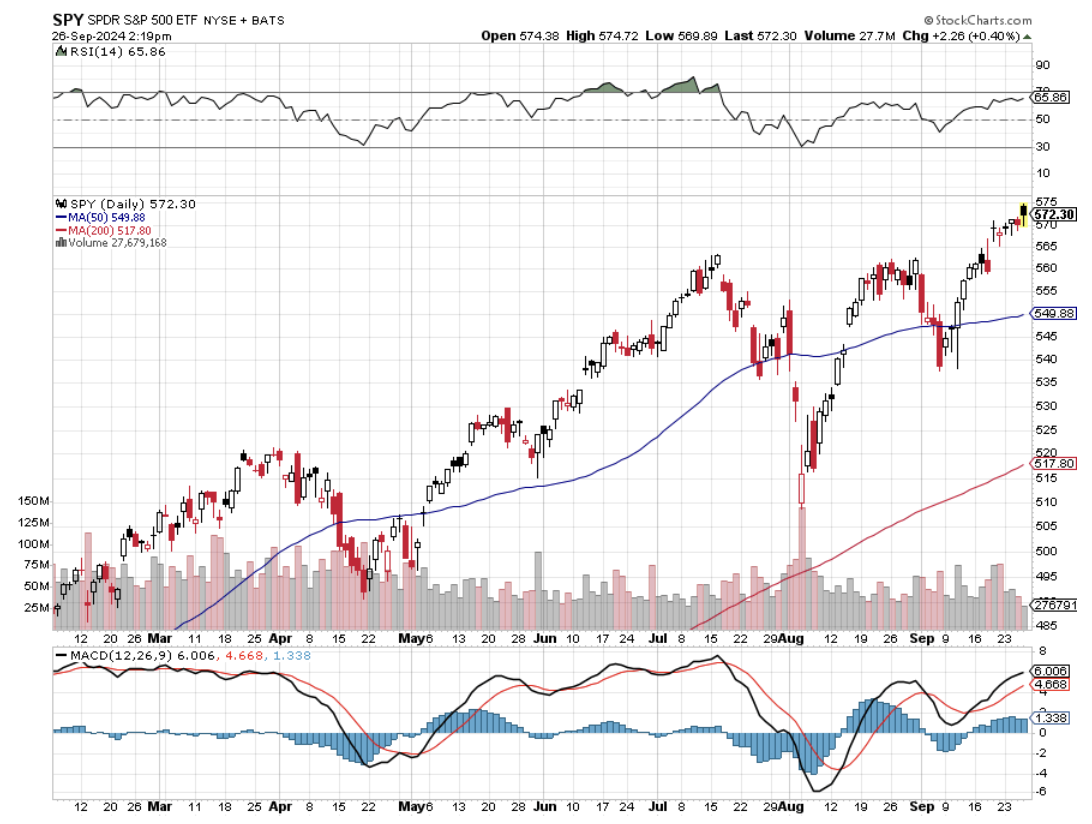

We are now nearly three months into an almost straight-up move in the stock market, and money managers everywhere are scratching their heads. We are now only 136 points or 2.32% from my yearend (SPX) target of 6,000, which is starting to look pretty conservative. The price-earnings multiple for the S&P 500 is now 21X, the Magnificent Seven 28X, and NVIDIA 65X.

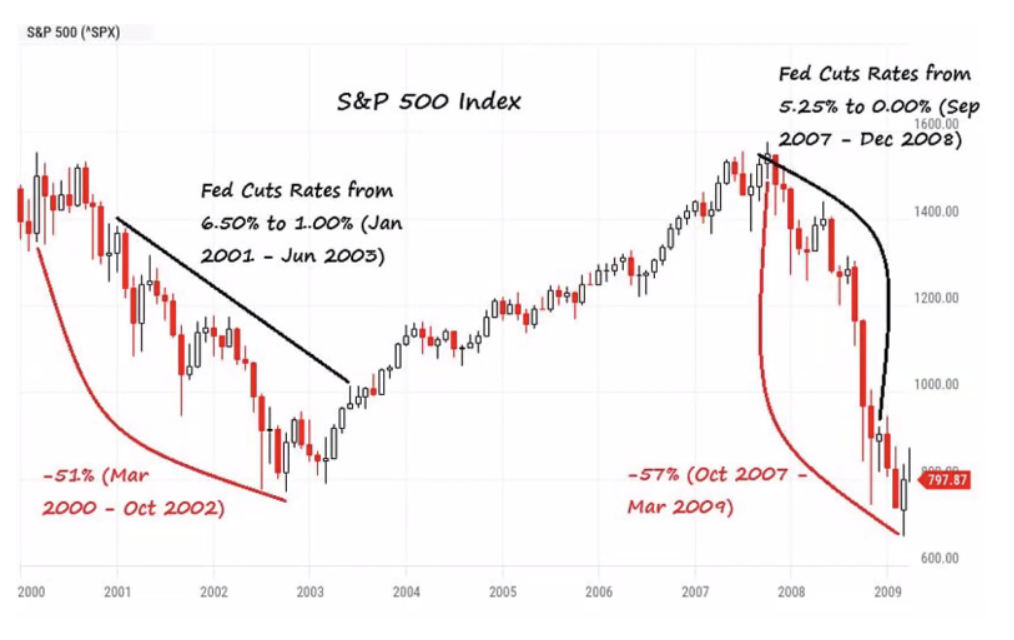

I’ve seen all this before.

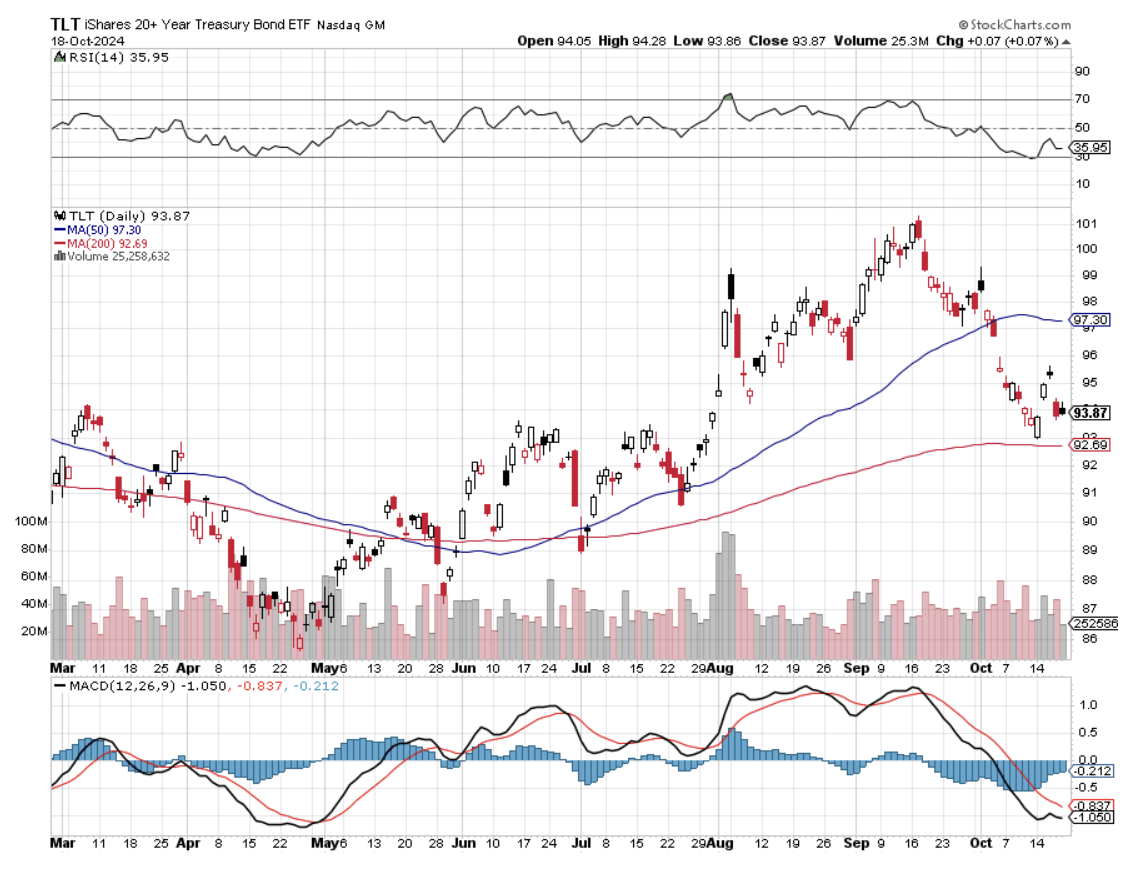

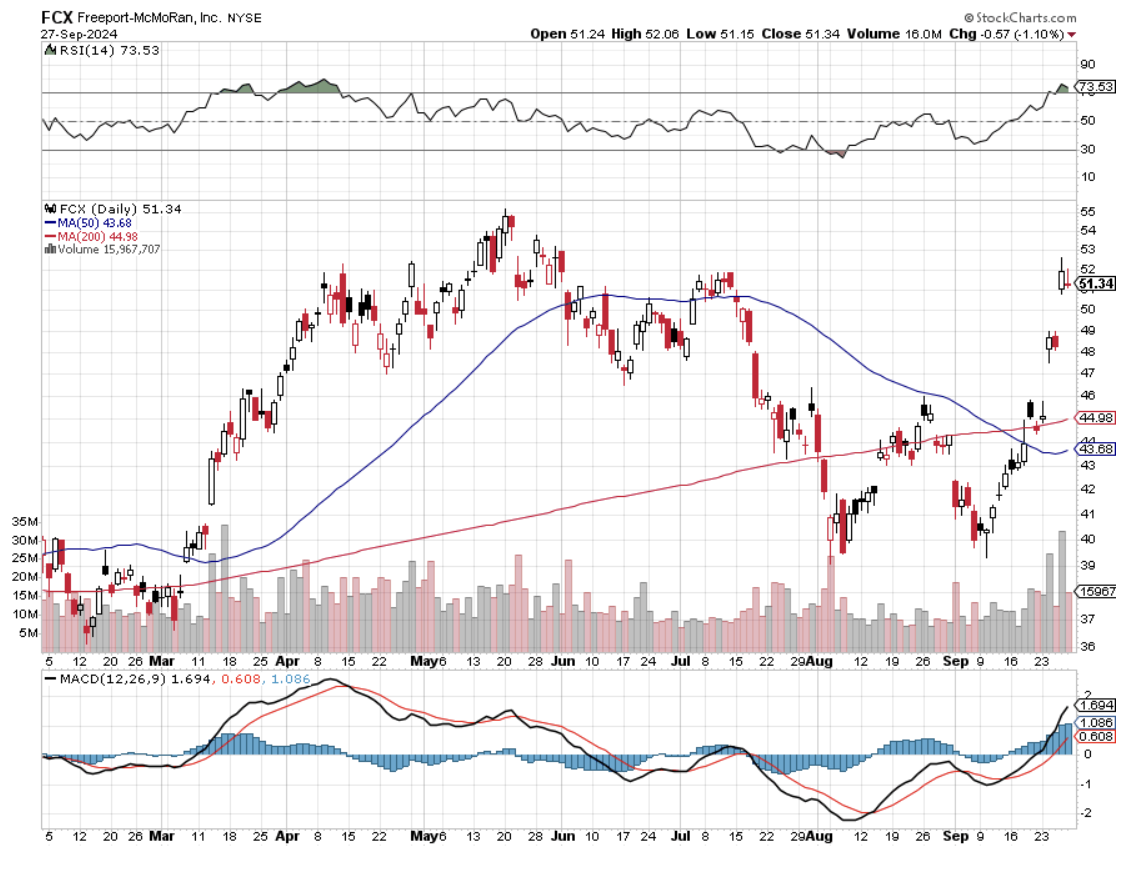

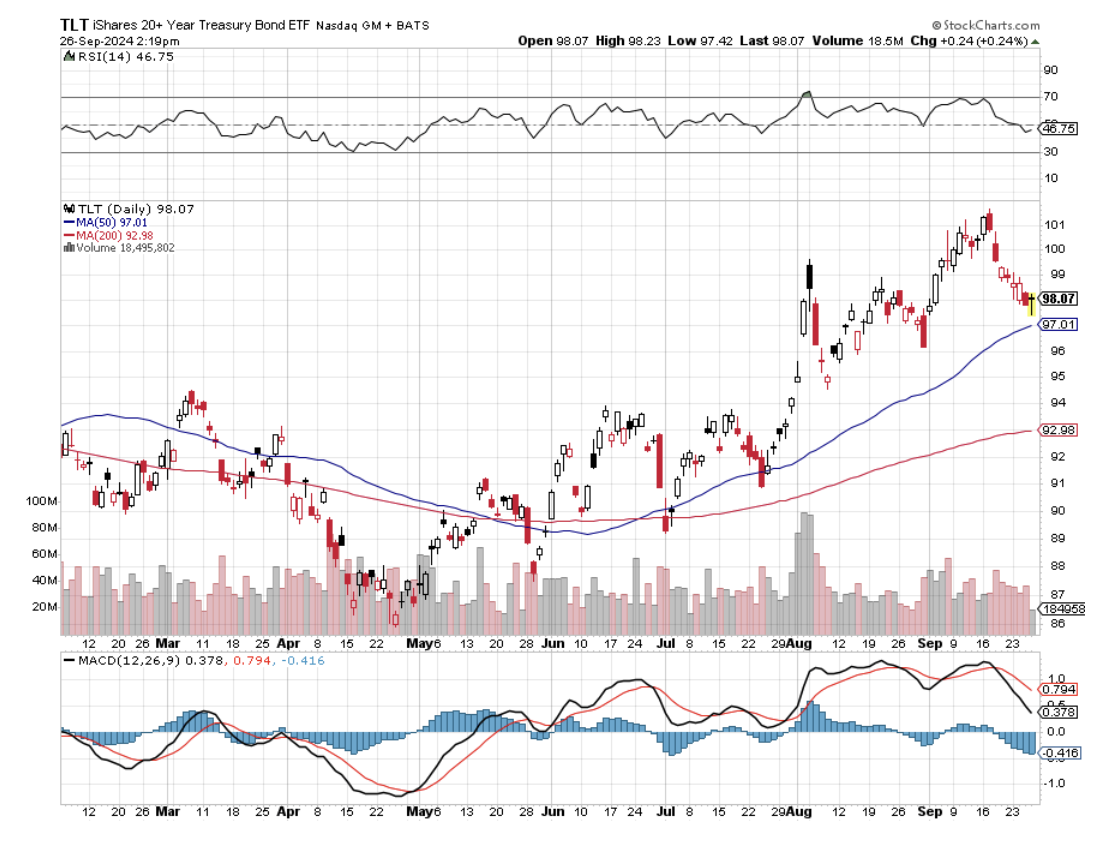

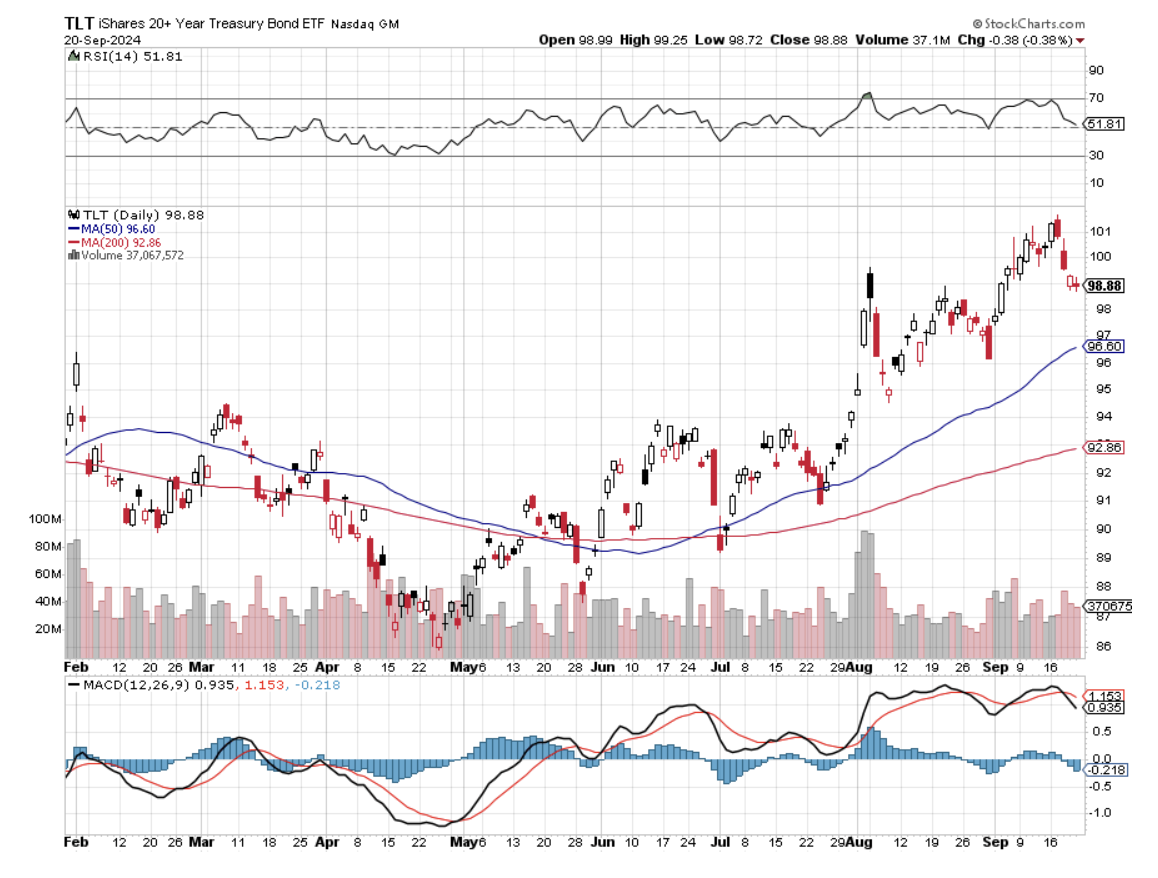

We are about as close to a perfect Goldilocks scenario as we can get. Interest rates and inflation are falling. A 3% GDP growth rate means the US has the strongest major economy and is the envy of the world. We have entered the euphoria stage of the current market move in almost all asset glasses. Gold (GLD) has gone up almost every day. Some big tech remains on fire. Energy prices are in free fall. Even bonds (TLT) are trying to put in a bottom.

Complacence is running rampant.

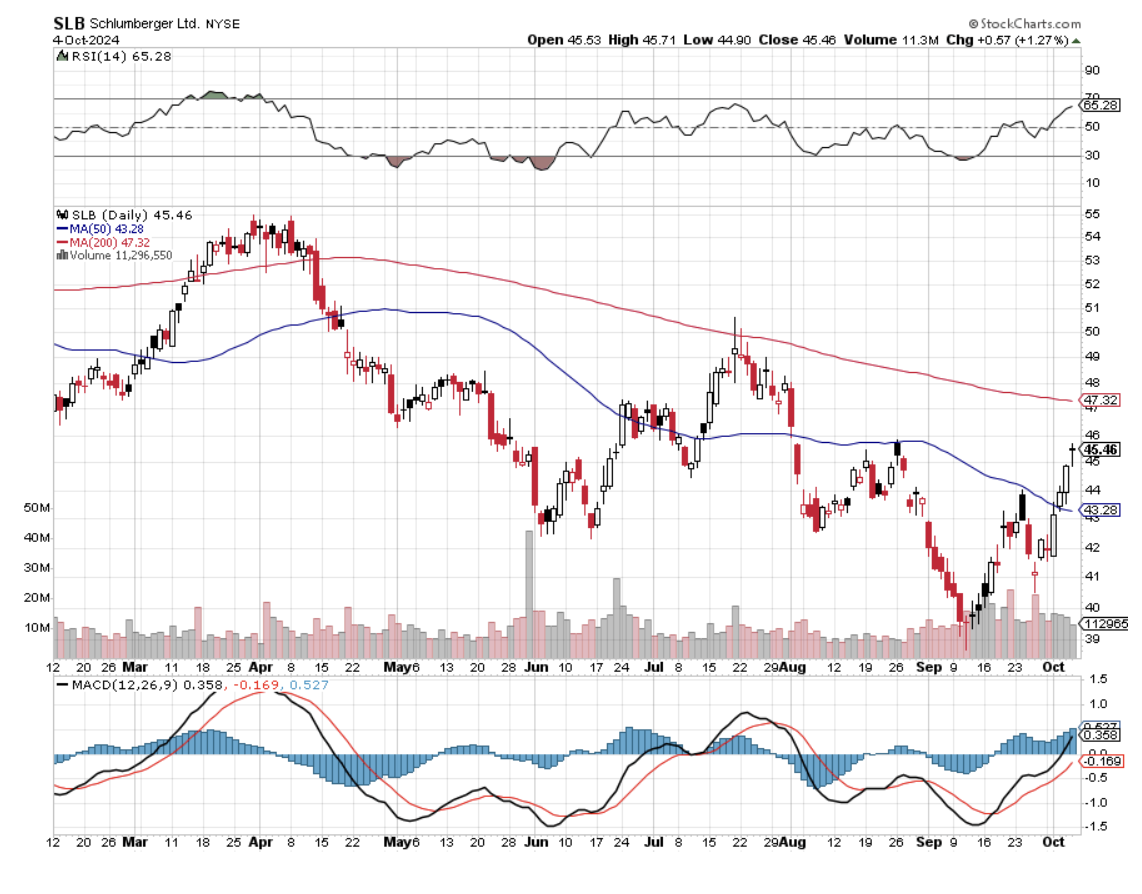

So, how the heck do we trade a market like this? You play the laggard trade.

The biggest risk to the gold trade is that it has gone up 40% in a year. So, what do you do? The response by traders has been to move into lagging silver (SLV) (AGQ), which has been on a tear since September.

Had enough with the Mag Seven? Then, rotate in the sub $1 trillion part of the market with Broadcom (AVGO), ASML Holdings NV (ASML), Micron Technology (MU), and Lam Research (LRCX).

Tired of watching your DH Horton (DHI) go up every day? Then, flip into smaller homebuilders like Pulte Homes (PHM) and Lennar (LEN).

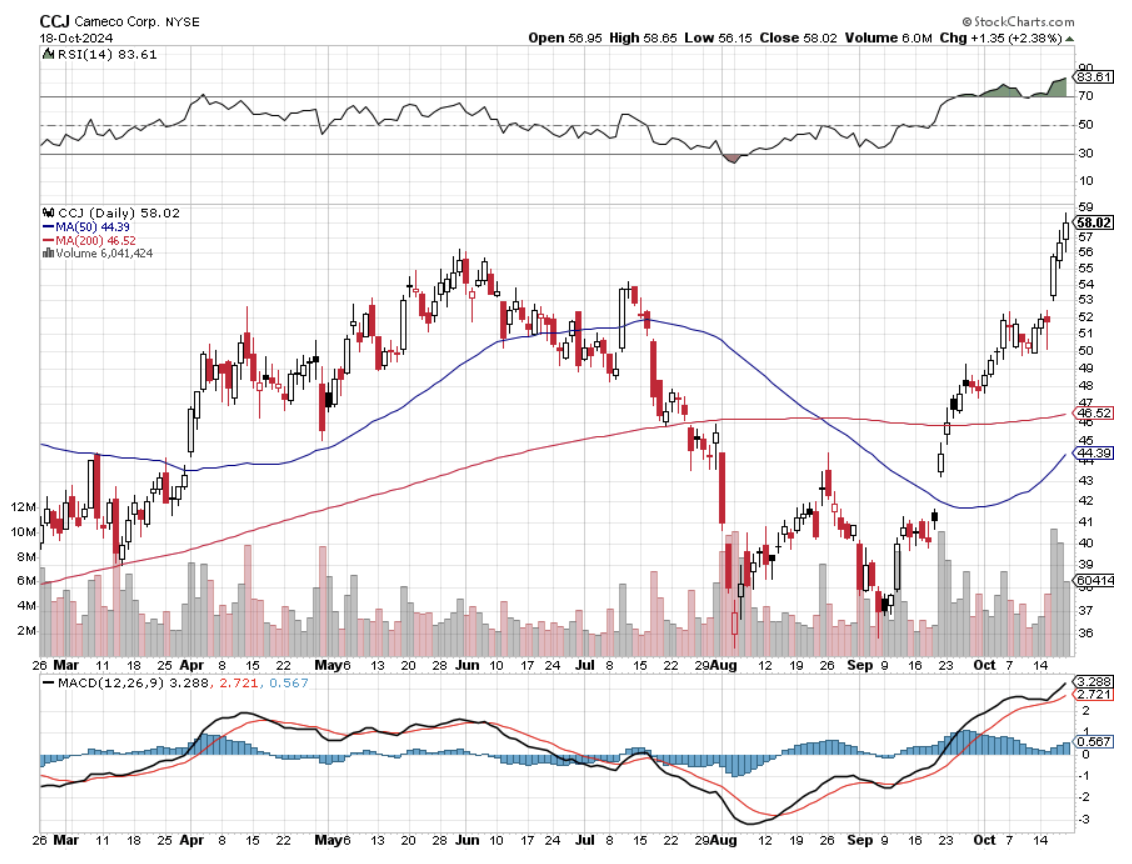

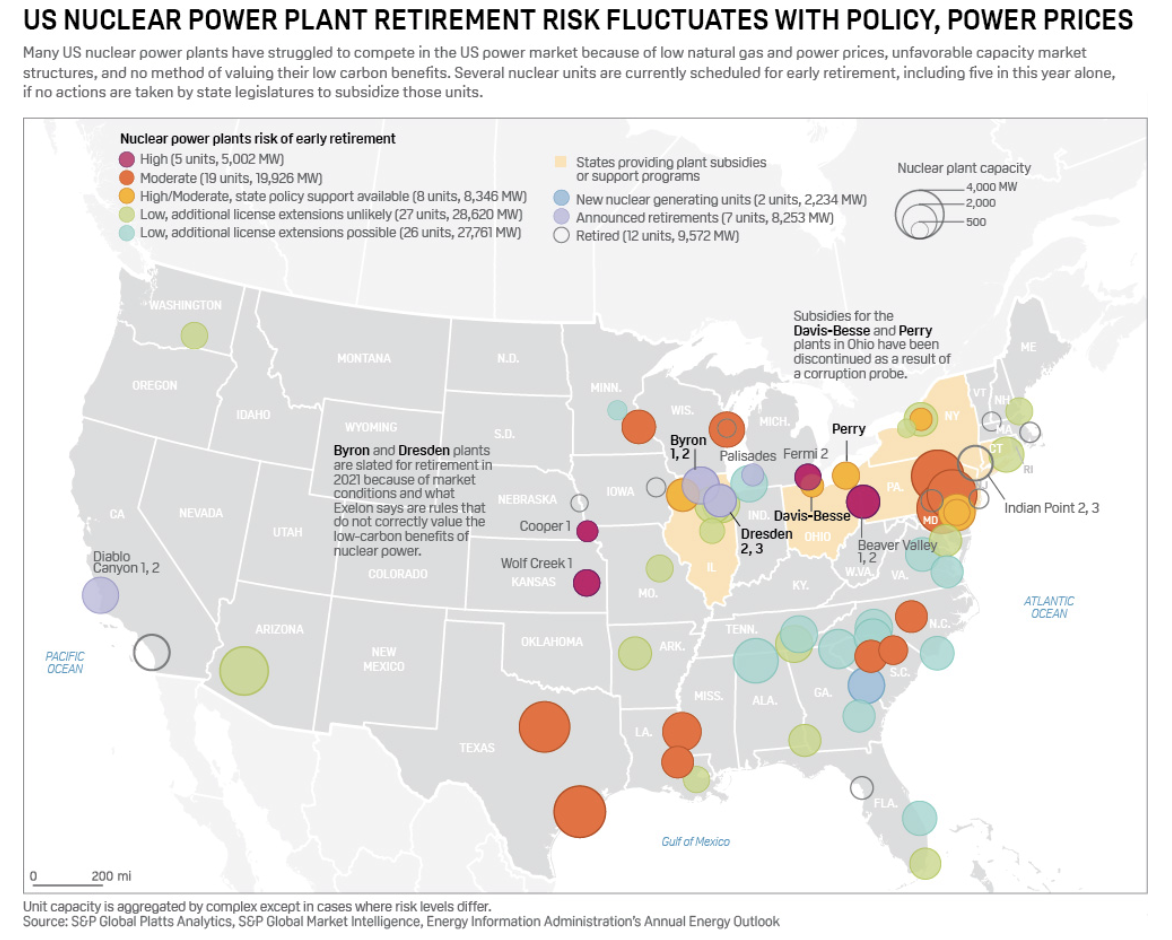

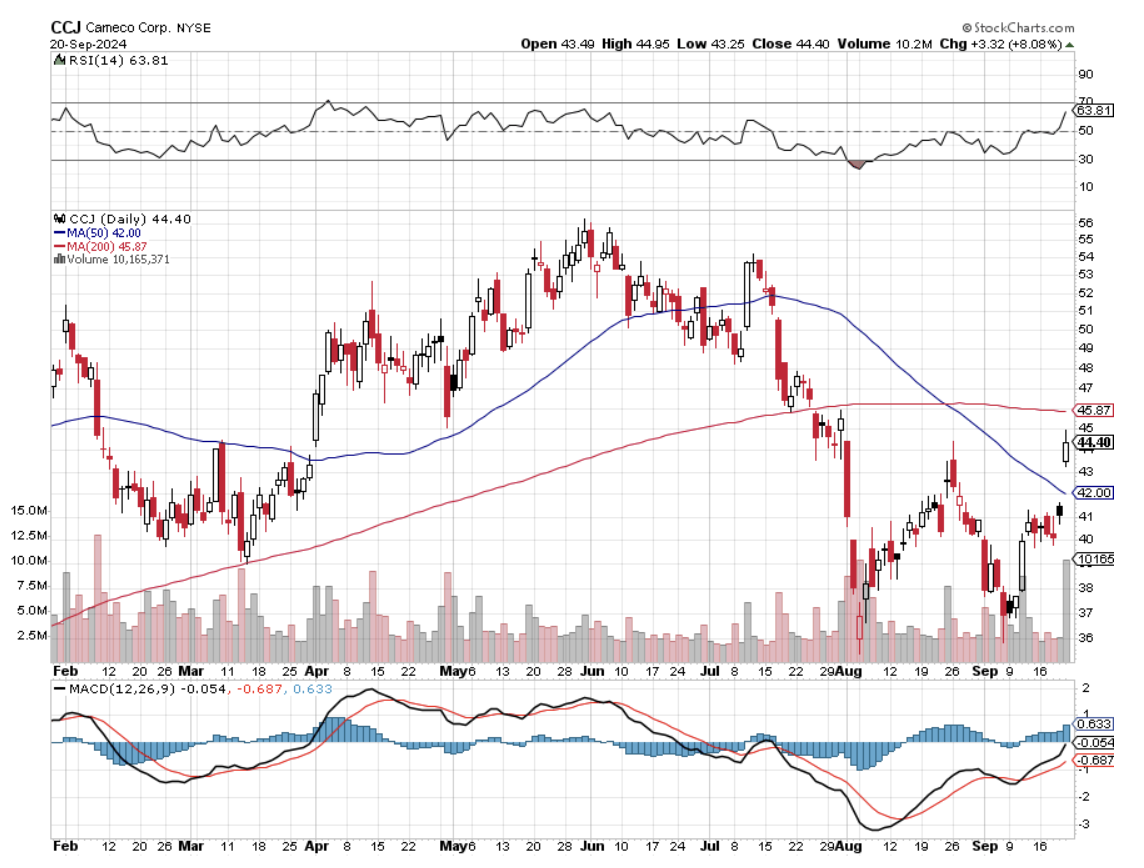

And then there is the biggest laggard of all, the nuclear trade, which is just crawling out of a 40-year penalty box. With news that Amazon (AMZN) was planning to order up to eight Small Modular Reactors to power its AI efforts, all uranium plays continue to go ballistic. The proliferation of power-hungry data centers is driving the greatest growth of power needs since WWII and the Manhattan Project.

Fortunately, I got in early. This is a trend that could become the next NVIDIA, as the public stocks involved are coming off such a low base. I have personally interviewed the founders and examined Nuscale’s plans with a fine tooth come and consider them genius. The company is, far and away, the overwhelming leader in the sector. The puzzle for the pros who understand the technology is why it took so long. Buy (CCJ), (VST), (CEG), (BWXT), and (OKLO) on dips.

It's like everything is racing towards a key, even with an unknown outcome. There happens to be a big one coming up: the US presidential elections on November 6.

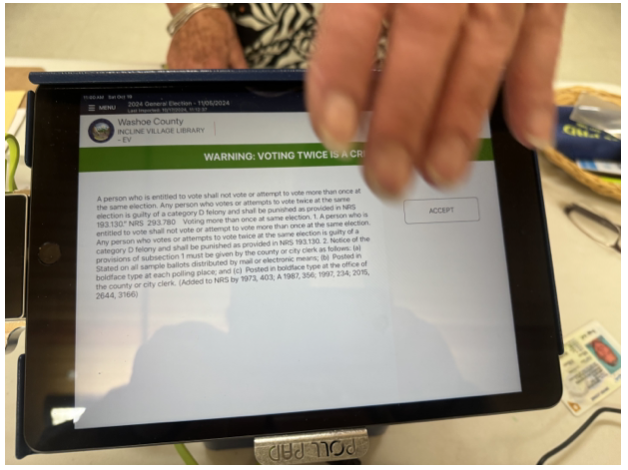

Speaking of elections, I took the time to participate in the first day of voting in Nevada on Saturday, October 19, at the Incline Village Public Library. I waited in line for two hours in a brisk and breezy 40 degrees. I wore my Marine Corps cap and Ukraine Army ID just to confuse people. Some got so tired of waiting in the cold that they went home, retrieved their mail-in ballots, and returned to the polls to drop them off.

I looked back on the line, and women outnumbered the men by three to one. Where did all these women come from? There used to be such a shortage of women at Lake Tahoe that it was impossible to get a date. Hunting, fishing, long-distance backpacking, and skiing weren’t used to attract such large numbers of the female gender. Maybe now they do? But now they’re driving up in Mercedes AMG’s and Range Rovers.

When I finally arrived at the front of the line, I was asked to sign an agreement with my finger, acknowledging that I knew it was illegal to vote twice. The poll worker noticed my ID. When I explained what it was in the Cyrillic alphabet, she burst into tears, apologized, and said she had goosebumps all over.

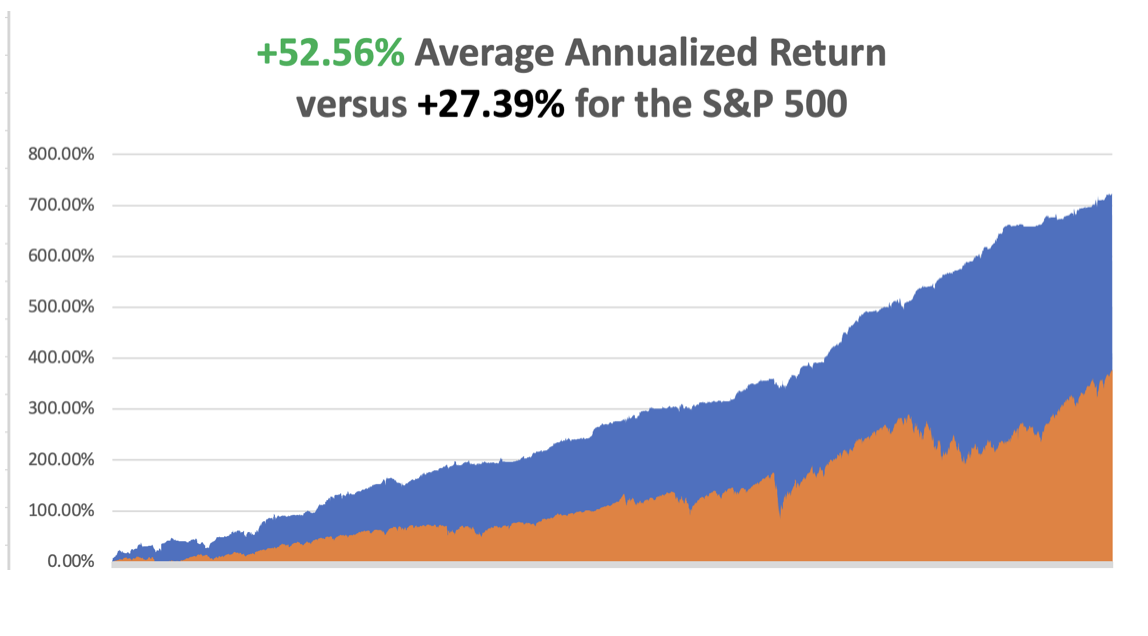

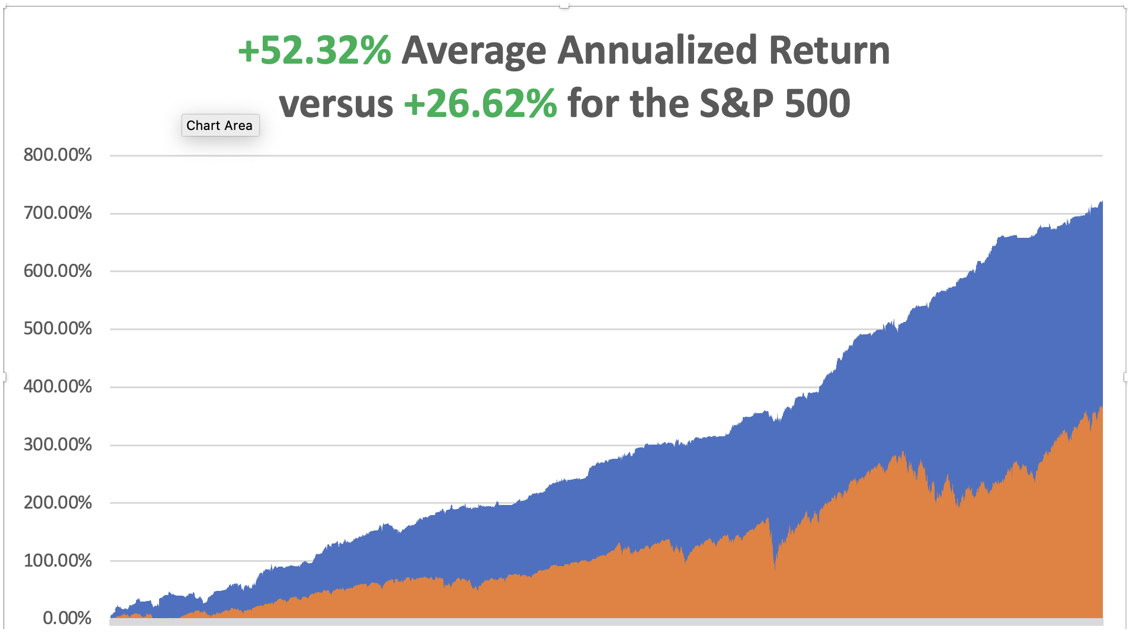

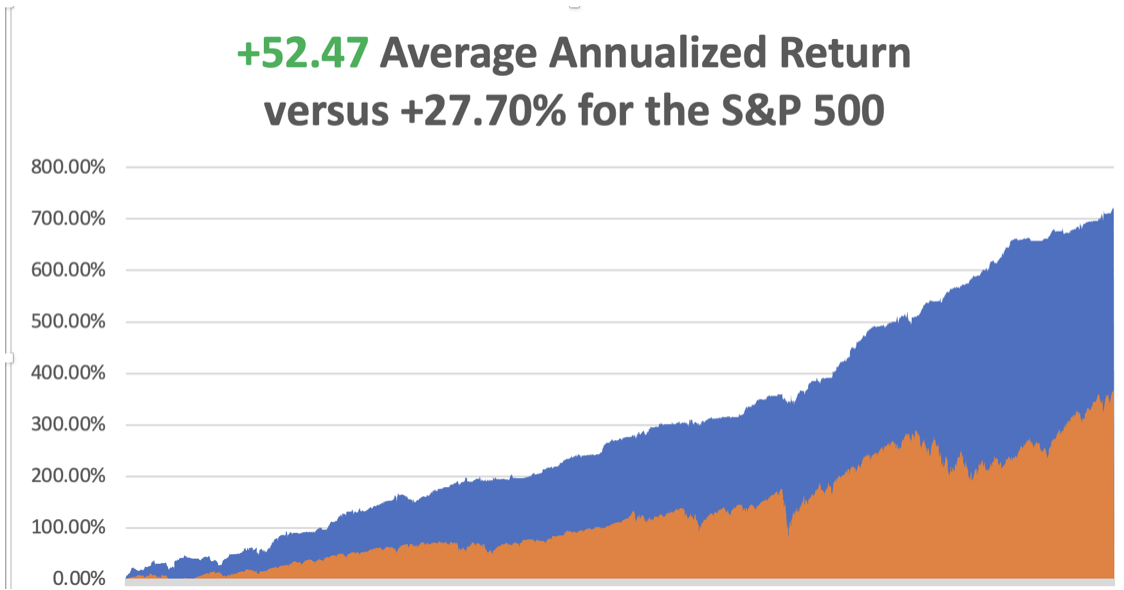

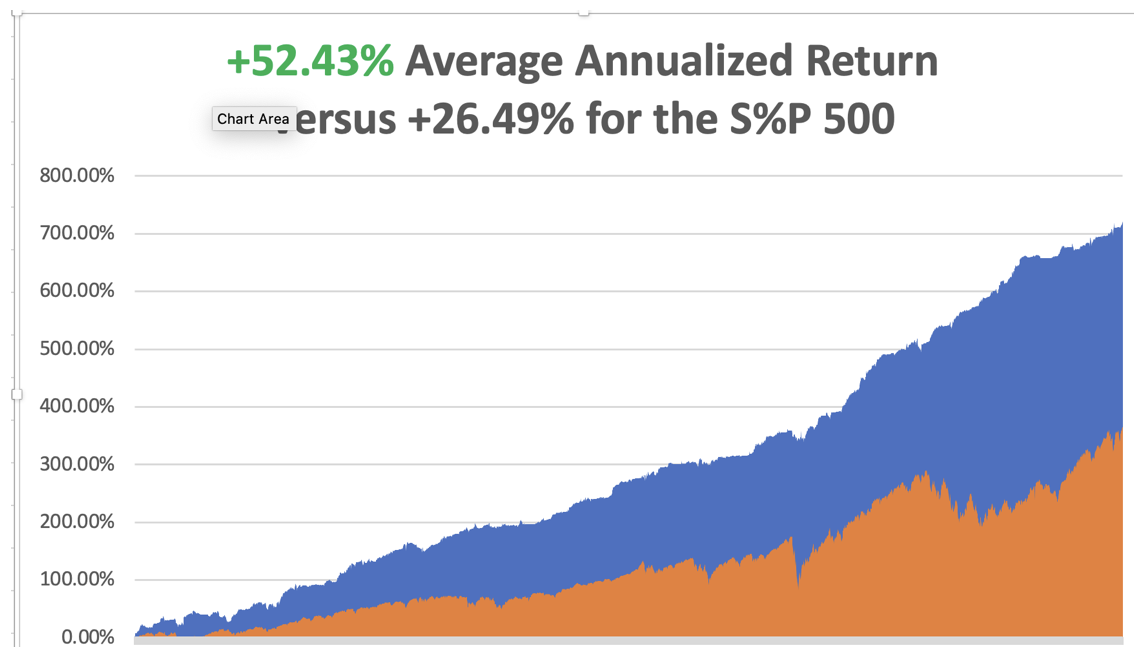

It was another blockbuster week, up over 6%. So far in October, we have gained +4.89%. My 2024 year-to-date performance is at +50.13%. The S&P 500 (SPY) is up +22.43% so far in 2024. My trailing one-year return reached a nosebleed +65.90. That brings my 16-year total return to +726.76%. My average annualized return has recovered to +52.56%.

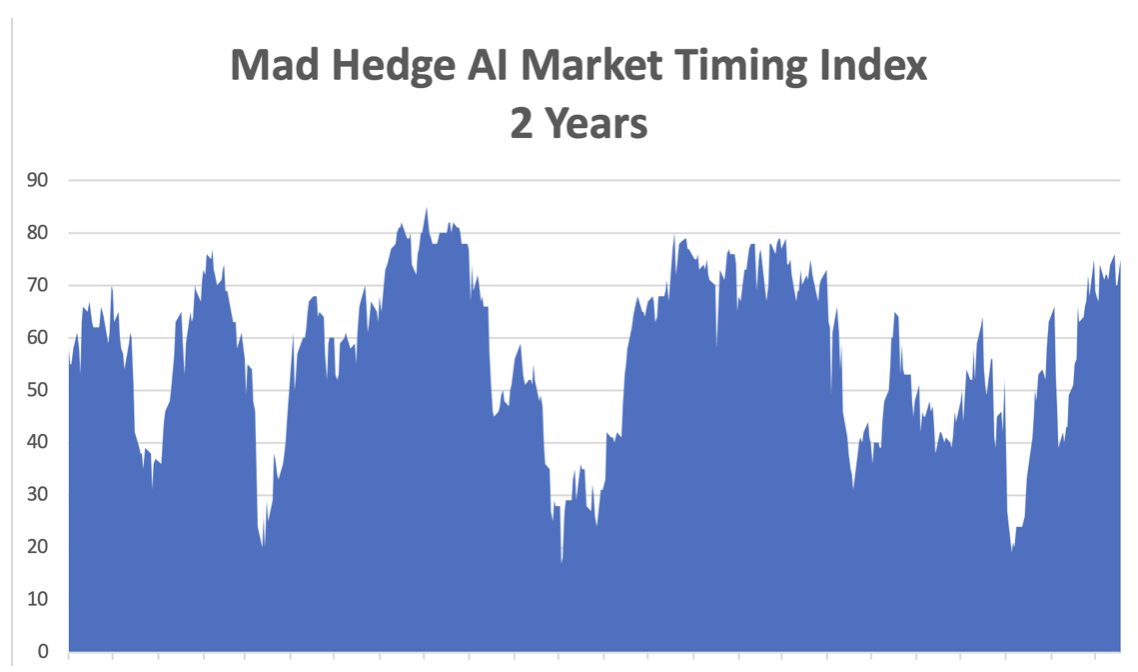

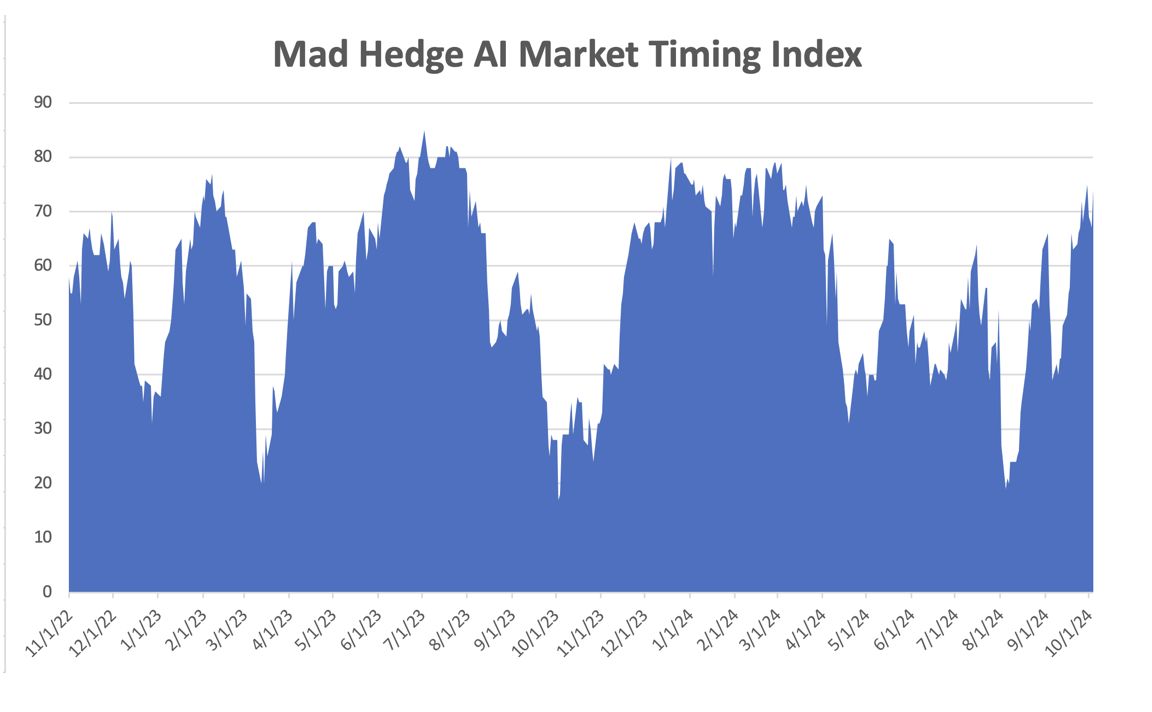

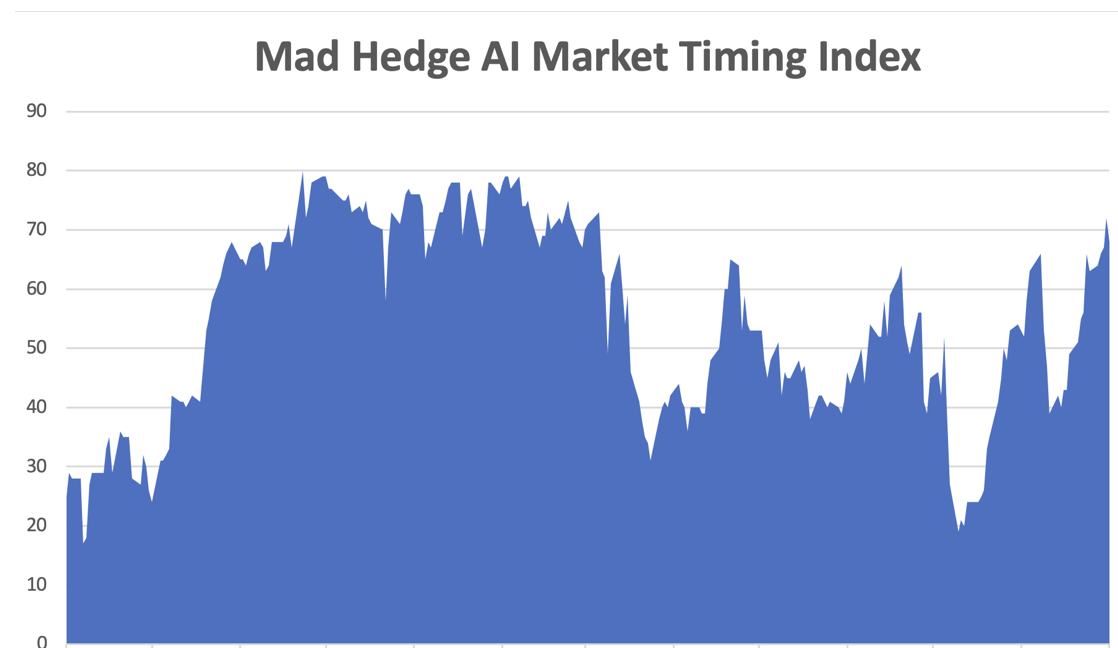

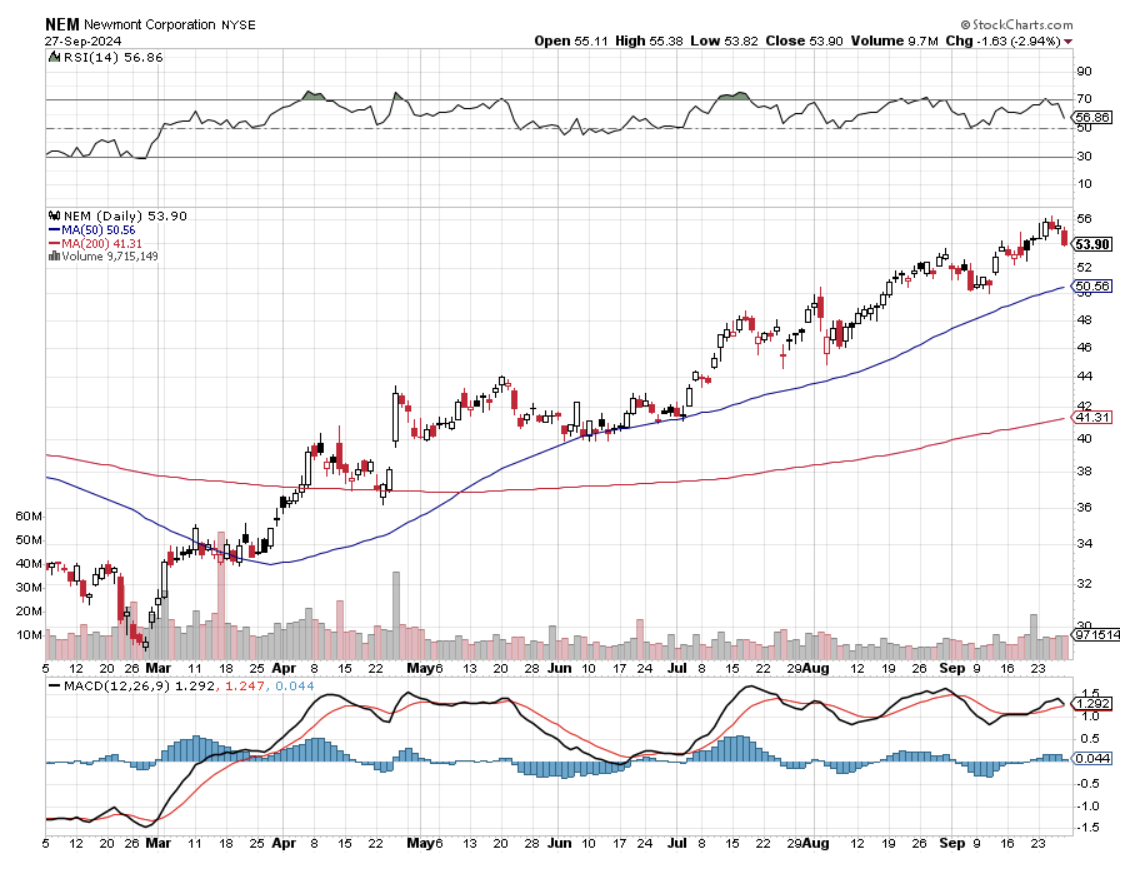

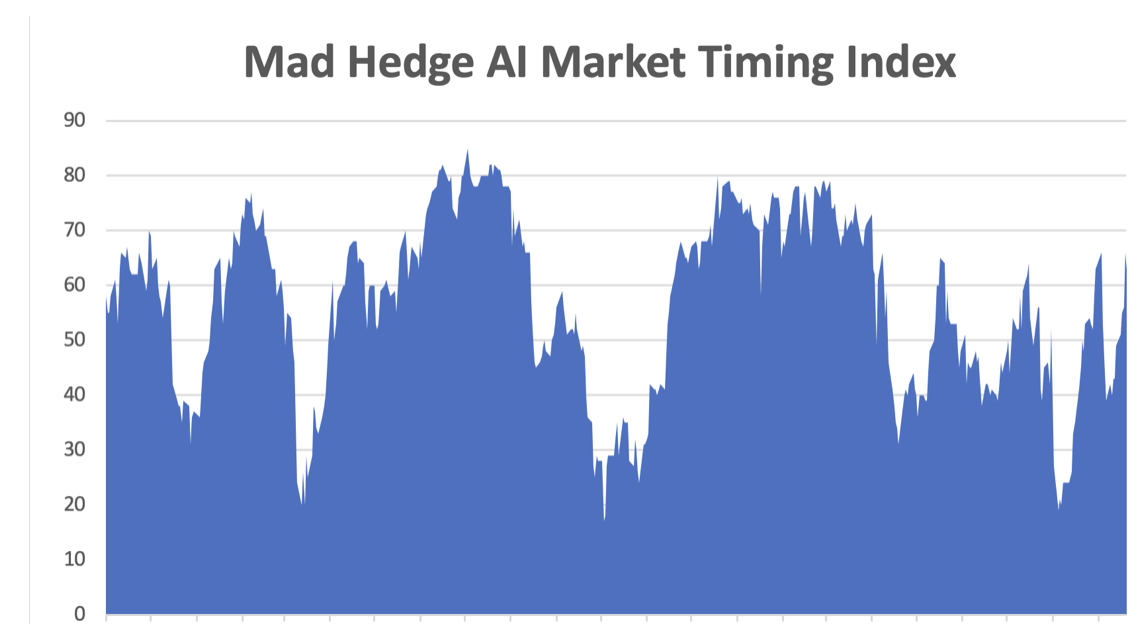

With my Mad Hedge Market Timing Index at the 70 handles for the first time in five months, I am remaining cautious with a 70% cash and 30% long. I look for a small profit in (TSLA) to reduce risk. Two of my positions expired at their maximum profit point for (NEM) and (DHI) on Friday, October 18 options expiration.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 60 of 80 trades have been profitable so far in 2024, and several of those losses were really break-even. Some 16 out of the last 19 trade alerts were profitable. That is a success rate of +75.00%.

Try beating that anywhere.

Risk Adjusted Basis

Current Capital at Risk

Risk On

(TSLA) 11/$165-$175 call spread 10.00%

(JPM) 11/$195-$205 call spread 10.00%

(GLD) 11/230-$235 call spread 10.00%

Risk Off

NO POSITIONS 0.00%

Total Net Position 30.00%

Total Aggregate Position 30.00%

Netflix Soars on Blockbuster Earnings, up 11% at the opening on a 5 million gain in subscribers. The company posted earnings per share of $5.40 for the period ended Sept. 30, higher than the $5.12 LSEG consensus estimate.

Crucially, Netflix saw momentum in its ad-supported membership tier, which surged 35% quarter over quarter. The streaming wars are over, and (NFLX) won. Buy (NFLX) on dips.

Silver is Ready to Break Out to the Upside after a year-long-range trade. The white metal is a predictor of a healthy recovery and a solar rebound. It’s a long overdue catch-up with (GLD). Buy (AGQ) on dips.

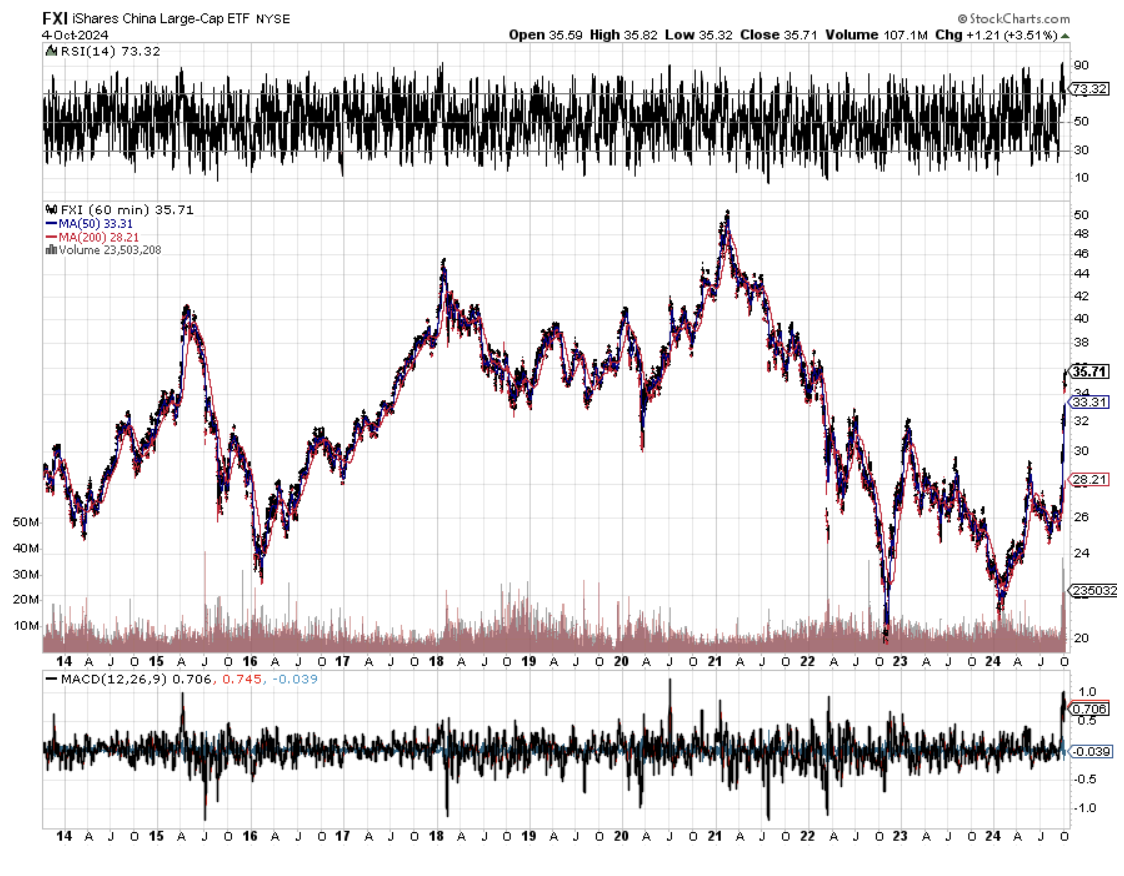

Apple China Sales Jump 20% on the new iPhone 16 launch. Both Apple and Huawei's (HWT.UL) latest smartphones went on sale in China on Sept. 20, underscoring intensifying competition in the world's biggest smartphone market, where the U.S. firm has been losing market share in recent quarters to domestic rivals. Buy (AAPL) on dips.

Taiwan Semiconductor Soars on Spectacular Earnings, dragging up the rest of the chip sector with it. The world's largest contract chipmaker raised its expectation for annual revenue growth and said sales from AI chips would account for mid-teen percentage of its full-year revenue. U.S.-listed TSMC shares rose nearly 9%, and if gains hold, the company's market capitalization would cross $1 trillion. Buy (NVDA) on dips.

Weekly Jobless Claims Fall. Initial claims for state unemployment benefits dropped 19,000 last week to a seasonally adjusted 241,000 for the week ended Oct. 12, the Labor Department said on Thursday. Economists polled by Reuters had forecast 260,000 claims for the latest week. Claims jumped to more than a one-year high in the prior week, attributed to Helene, which devastated Florida and large swathes of the U.S. Southeast in late September.

Morgan Stanley Announces Blowout Earnings, fueling a 32% profit jump for the third quarter. Revenue from the trading business rose 13%. That followed gains recorded by its biggest rivals as the market business lifted fortunes across the industry, and a steady rebound in investment banking fees increased dealmaking. The wealth unit generated revenue of $7.27 billion, higher than analysts’ expectations, with $64 billion in net new assets. The unit boosted its pretax margin to 28%, driven by growth in fee-based assets. Buy (MS) on dips.

Global EV Sales Up 30% in September, with the largest gains in China. Gains in the U.S. market have been lagging in anticipation of the Nov. 5 election. Chinese carmakers are seeking to grow their sales in the EU despite import duties of up to 45% and amid cooling global demand for electric cars. Chinese and European automakers were going head-to-head at the Paris Car Show on Monday. Buy (TSLA) on dips.

Dollar Hits Two Month High on rising US interest rates. Ten-year US Treasuries have risen from 3.55% to 4.12% since the September Nonfarm Payroll Report. A string of U.S. data has shown the economy to be resilient and slowing only modestly, while inflation in September rose slightly more than expected, leading traders to trim bets on large rate cuts from the Fed. Buy all foreign currencies on dips (FXA), (FXE), (FXB), (FXY).

S&P 500 Value Gain Hits $50 Trillion, since the 1982 bottom, which I remember well and is up 50X. The index hit a record high Wednesday and is trading Thursday at around 5770, up 21% so far in 2024. The index’s value is up sixfold since it stood at $8 trillion at year-end 2008, near the depth of the bear market during the financial crisis.

JP Morgan Delivers Blowout Earnings. Its stock, trading around $223, was on course for its biggest daily percentage gain in 1-1/2 years.

(JPM)'s investment-banking fees surged 31%, doubling guidance of 15% last month. Equities propelled trading revenue up 8%, exceeding an earlier 2% forecast. These earnings are consistent with the soft-landing narrative of modest U.S. economic growth. Buy (JPM) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy is decarbonizing, and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000, here we come!

On Monday, October 21 at 8:30 AM EST, nothing of note takes place is out.

On Tuesday, October 22 at 6:00 AM, the Richmond Fed Manufacturing Index is out.

On Wednesday, October 23 at 11:00 AM, the Existing Home Sales is printed.

On Thursday, October 24 at 8:30 AM, the Weekly Jobless Claims are announced. We also get New Homes Sales.

On Friday, October 25 at 8:30 AM, the US Durable Goods Orders are announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, I am headed out for early voting in Nevada this morning. It’s been a year since I came back from Ukraine badly wounded, so I thought I would recall my recollections from that time.

You know you’re headed into a war zone the moment you board the train in Krakow, Poland. There are only women and children headed for Kiev, plus a few old men like me. Men of military age have been barred from leaving the country since the Russians Invaded. That leaves about 8 million to travel to Ukraine from Western Europe to visit spouses and loved ones.

After a 15-hour train ride, I arrived at Kiev’s magnificent Art Deco station. I was met by my translator and guide, Alicia, who escorted me to the city’s finest hotel, the Premier Palace on T. Shevchenka Blvd. The hotel, built in 1909, is an important historic site as it was where the Czarist general surrendered Kiev to the Bolsheviks in 1919. No one in the hotel could tell me what happened to the general afterward.

Staying in the best hotel in a city run by Oligarchs does have its distractions. Thanks to the war, occupancy was about 10%. That didn’t keep away four heavily armed bodyguards from the lobby 24/7. Breakfast was well populated by foreign arms merchants. And for some reason, there are always a lot of beautiful women hanging around with nothing to do.

The population is definitely getting war-weary. Nightly air raids across the country and constant bombings take their emotional toll. Kiev’s Metro system is the world’s deepest and, at two cents a ride, the cheapest. It’s where the government hid out during the early days of the war. They perform a dual function as bomb shelters when the missile attacks become particularly heavy.

My Look Out Ukraine has duly announced every incoming Russian missile and its targeted neighborhood. The buzzing app kept me awake at night, so I turned it off. Let the missiles land where they may. For this reason, I reserved a south-facing suite and kept the curtains drawn to protect against flying glass.

The sound of the attacks was unmistakable. The anti-aircraft drones started with a pop, pop, pop until they hit a big 1,000-pound incoming Russian cruise missile, then you heard a big kaboom! Disarmed missiles that were duds are placed all over the city and are amply decorated with colorful comments about Putin.

The extent of the Russian scourge has been breathtaking, with an epic resource grab. The most important resource is people to make up for a Russian population growth that has been plunging for the last century. The Russians depopulated their occupied territory, sending adults to Siberia and children to orphanages to turn them into Russians. If this all sounds medieval, it is. Some 19,000 Ukrainian children have gone missing since the war started.

Everyone has their own atrocity story, almost too gruesome to repeat here. Suffice it to say that every Ukrainian knows these stories and will fight to the death to avoid the unthinkable happening to them. There will be no surrender.

It will be a long war.

Touring the children’s hospital in Kiev is one of the toughest jobs I ever undertook. Kids are there shredded by shrapnel, crushed by falling walls, and newly orphaned. I did what I could to deliver advanced technology and $10,000 in cash, but their medical system is so backward, maybe 30 years behind our own, that it couldn’t be employed. Still, the few smiles I was able to inspire made the trip worth it. This is the children’s hospital that was bombed a few months ago.

The hospital is also taking the overflow of patients from the military hospitals. One foreign volunteer from Sweden was severely banged up, a mortar shell landing yards behind him. He had enough shrapnel in him, some 250 pieces, to light up an ultrasound and had already been undergoing operations for months. It was amazing he was still alive.

To get to the heavy fighting, I had to take another train ride a further 15 hours east. You really get a sense of how far Hitler overreached in Russia in WWII. After traveling by train for 30 hours to get to Kherson, Stalingrad, where the German tide was turned, is another 700 miles east!

I shared a cabin with Oleg, a man of about 50 who ran a car rental business in Kiev with 200 vehicles. When the invasion started, he abandoned the business and fled the country with his family because they had three military-aged sons. He now works at a minimum-wage job in Norway and never expects to do better.

What the West doesn’t understand is that Ukraine is not only fighting the Russians but a Great Depression as well. Some tens of thousands of businesses have gone under because people save during war and also because 20% of their customer base has fled.

I visited several villages where the inhabitants had been completely wiped out. Only their pet dogs remained alive, which roved in feral starving packs. For this reason, my major issued me my own AK47. Seeing me heavily armed also gave the peasants a greater sense of security.

It’s been a long time since I’ve held an AK, which is a marvelous weapon. It’s it’s like riding a bicycle. Once you learned, you never forget.

I’ve covered a lot of wars in my lifetime, but this is the first fought by Millennials. They post their kills on their Facebook pages. Every army unit has a GoFundMe account where doners can buy them drones, mine sweepers, and other equipment.

Everyone is on their smartphones all day long, killing time, and units receive orders this way. But go too close to the front, and the Russians will track your signal and call in an artillery strike. The army had to ban new Facebook postings from the front for exactly this reason.

Ukraine has been rightly criticized for rampant corruption, which dates back to the Soviet era. Several ministers were rightly fired for skimming off government arms contracts to deal with this. When I tried to give $10,000 to the Children’s Hospital, they refused to take it. They insisted I send a wire transfer to a dedicated account to create a paper trail and avoid sticky fingers.

I will recall more memories from my war in Ukraine in future letters, but only if I have the heart to do so. They will also be permanently posted on the home page at www.madhedfefundtrader.com under the tab “War Diary”.

Donating $10,000 to the Children’s Hospital

On the Front at Crimea with a Dud Russian Missile

A Gift or Piroshkis from Local Peasants

One of 2,000 Destroyed Russian Tanks

The Battle of Kherson with my Unit

This Blown Bridge Blocked the Russians from Entering Kiev

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader