Let's face it. Cancer is still kicking our collective butts.

Despite all the fancy lab coats and high-tech gadgets, cancer remains the second-leading cause of death in the U.S. It's like that annoying party guest who just won't leave, no matter how many hints you drop.

This year alone, more than 2 million Americans are expected to hear those dreaded words: "You have cancer." And sadly, over 600,000 of our fellow citizens will lose their battle with this relentless foe in 2024.

Before you start thinking I'm all doom and gloom, let me flip the script for you. Where there's a problem, there's opportunity. And in this case, we're talking about a massive opportunity to put your investment dollars to work.

Back in 2020, America shelled out a whopping $200 billion on cancer treatments. By 2030, that number is projected to skyrocket to over $245 billion. That's a growth trajectory that’s worth our attention, don’t you think?

So, let's dive into the world of cancer-fighting stocks. There are some heavy hitters in this space that deserve your attention.

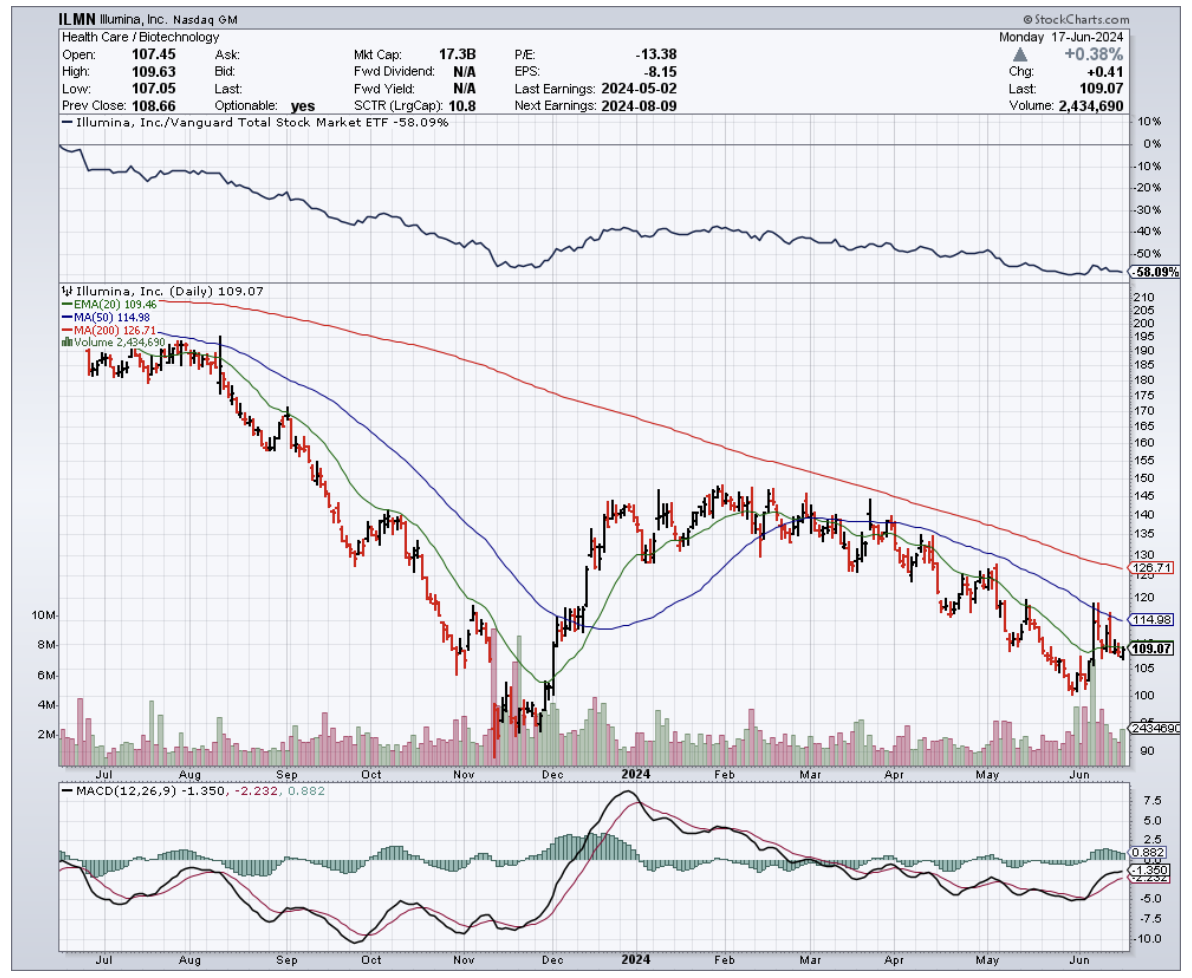

First up, we've got Illumina (ILMN), the gene-sequencing giant. These folks are like the Sherlock Holmes of the genetic world, helping researchers crack the cancer code.

With over 21,600 of their systems installed worldwide, Illumina is the go-to company for anyone looking to dive deep into our genetic makeup.

But here's the thing - Illumina isn't just about cancer. Their tech is used in everything from studying infectious diseases to figuring out if your unborn baby is likely to be the next Einstein.

And while they're tight-lipped about their exact market share, word on the street is they're still the big fish in the gene-sequencing pond.

In fact, let me throw some numbers at you. Illumina holds a whopping 80% market share among the seven main pure-play next-generation sequencing companies.

Even if we toss in some non-pure-play heavyweights like Thermo Fisher Scientific (TMO), Agilent Technologies (A), and Qiagen (QGEN), Illumina's still sitting pretty with roughly two-thirds of the global market.

And get this - despite the industry facing some macro headwinds, Illumina's market share has held steady over the past couple of years. Talk about staying power.

Speaking of big fish, Illumina recently spun off Grail (GRAL), but they've still got their fingers in that pie with a 14.5% stake.

Grail is all about liquid biopsy products – fancy talk for finding cancer through a simple blood test. It's a promising field, but Illumina's not the only player in town.

Enter the new kids on the block: Element Biosciences and Ultima Genomics. Backed by venture capital and hungry for a piece of the action, these upstarts are shaking things up. Element's focusing on accuracy, while Ultima's all about high-volume, low-cost sequencing.

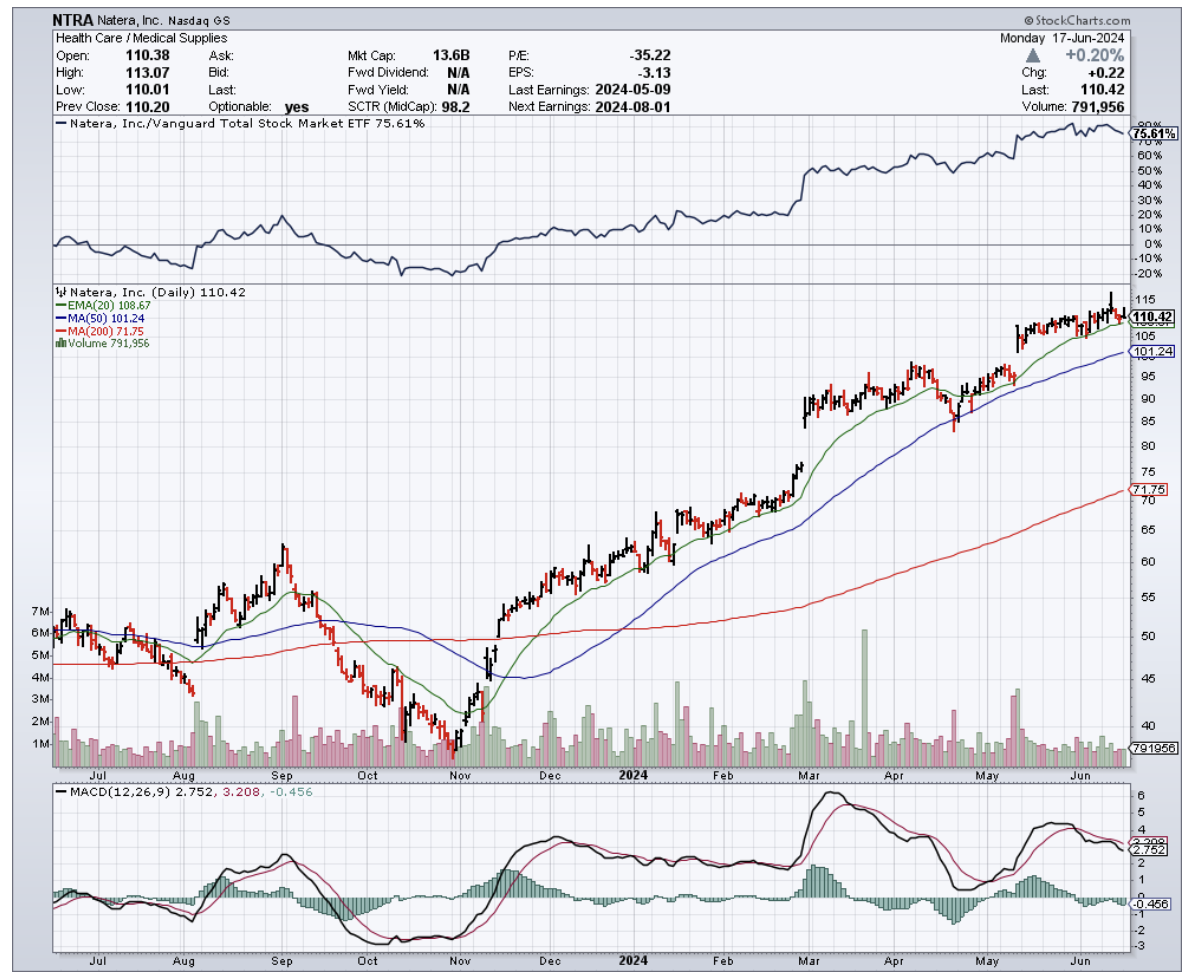

While we're on the topic of liquid biopsies, let's talk about Guardant Health (GH). These folks are the pioneers in finding tiny bits of tumor DNA floating around in your blood. Their Guardant360 product was the first FDA-approved liquid biopsy for all advanced solid tumors. That's like hitting a home run in your first major league at-bat.

But Guardant Health isn't resting on its laurels. They've got a whole suite of products, from tissue biopsies to tests that can tell if your cancer treatment is working. And get this – they're looking at a $30 billion annual market just in cancer treatment selection and recurrence monitoring.

But it doesn't end there. Early-stage cancer detection could add another $50 billion to that pot in the U.S. alone.

As if that wasn't enough, Guardant Health just got FDA approval for their Shield blood test for colorectal cancer screening in July 2024. Next stop? Lung cancer. These folks are aiming to create a test that can catch multiple cancers early.

And let's not forget the big boys. Pfizer (PFE), the pharmaceutical giant, is throwing its considerable weight into the cancer fight.

They've already got three blockbuster cancer drugs – Ibrance, Xtandi, and Inlyta – each raking in over a billion dollars a year. And that's just the tip of the iceberg. Pfizer's got about 40 more cancer programs in clinical testing.

Still, Pfizer isn't just relying on its own lab coats. They're not afraid to open up their wallet either. In 2021, they snatched up Trillium Therapeutics to beef up their blood cancer portfolio. And in 2023, they added Seagen to their collection, giving them a leg up in antibody-drug conjugates for cancer treatment.

Now, I know what you're thinking. "But what if the cancer market dries up?" (As if!) Well, Pfizer's got that covered too. They're big players in the vaccine market, with their new respiratory syncytial virus vaccine, Abrysvo, looking set to bring in some serious cash.

So there you have it. The war on cancer is far from over, but these companies are leading the charge. And while they're fighting to save lives, they might just help fatten up your portfolio too. I suggest you add these names to your watchlist and buy the dip.