Forget your classic biotech launch story. One of 2024's most lavishly funded biotech upstarts is taking a massively ambitious swing at reinventing the entire drug development process.

I'm talking AI, venture billions, and some serious star power all rolled into one wild capital extravaganza.

The company behind this cash-flushed disruption bid is Xaira Therapeutics. And they've snagged a bona fide heavy hitter as CEO — Marc Tessier-Lavigne, the ex-president of Stanford and former chief science officer at Genentech (DNA).

His mandate is simple: turn Xaira's billion-dollar AI vision into cold, hard, realized potential.

Tessier-Lavigne is a true believer when it comes to AI's potential for transforming every clunky, painfully inefficient step of conventional drug R&D. We're not just talking incremental improvements here.

The man thinks smart deployment of generative AI could legitimately deliver "two- or three-fold" increases in both speed AND success rates across the entire confounding slog of getting new medicines approved.

That's one heckuva rallying cry.

But Tessier-Lavigne has legitimate grievances with the antiquated status quo. We all know the drug development game is brutal.

By most credible estimates, only about 1 in 10 drug candidates that make it to human trials ever get approved for use. Attrition rates are staggering, even before reaching those do-or-die clinical trials – that's money, research hours, and hope down the drain.

Xaira plans to flip that script. Their pitch: AI is their ace in the hole.

We're talking about designing entirely new drugs from scratch, pinpointing disease targets faster than ever, and finally cutting those mammoth clinical trials down to size. Think of it as the entire process of getting a machine learning upgrade.

And they're not starting from zero. Xaira tapped into the brains behind groundbreaking protein science: biochemist and computational biologist David Baker's team at the University of Washington. These are the geniuses who revolutionized protein structure prediction, and several of their top scientists are now on Xaira's payroll.

For the key task of AI-driven lead design, Xaira is leaning heavily on the advanced protein modeling systems developed in David Baker's acclaimed lab at the University of Washington.

To actually design the new candidate drug molecules, Xaira is deploying advanced AI systems developed in Baker's lab. We're talking cutting-edge tech like RFdiffusion and RFantibody.

These use similar "diffusion" AI architectures that power viral image generators like DALL-E, except instead of churning out weird digital art, they generate brand-new protein structures from scratch.

On the biology side, Xaira has assembled specialist teams from genomics titan Illumina (ILMN) and proteomics upstart Interline Therapeutics. The goal is to use AI to decipher complex disease mechanisms on a molecular level at an unprecedented scale and quality.

As for the money side, Xaira's co-founders are a duo of biopharma's biggest VC shot-callers: Bob Nelsen from ARCH Venture Partners and Vik Bajaj, who leads the investment crew over at Foresite Capital's in-house incubator.

The rest of Xaira's bulging investor list reads like a who's who of the VC world's heaviest hitters from coast to coast.

But let's get one thing straight: deploying AI for drug discovery itself isn't new. Investors have poured hundreds of millions into previous AI-oriented biotech upstarts with remarkably little tangible progress to show for it so far.

That’s why plenty of scientists remain deeply skeptical about the real-world viability of using in silico methods to design brand-new proteins capable of becoming actual medicines.

But Xaira's leaders are taking an unmistakably bullish stance. As Tessier-Lavigne brazenly stated, "We believe the technology is ready for making therapeutics today. And it's only going to get better and better going forward." Shots fired.

And this startup isn't just flexing impressive scientific ambition and bravado, either.

Xaira's boardroom and executive lineup is stacked with certified rockstars spanning the lofty peaks of biopharma's regulatory, academic, and corporate pillars.

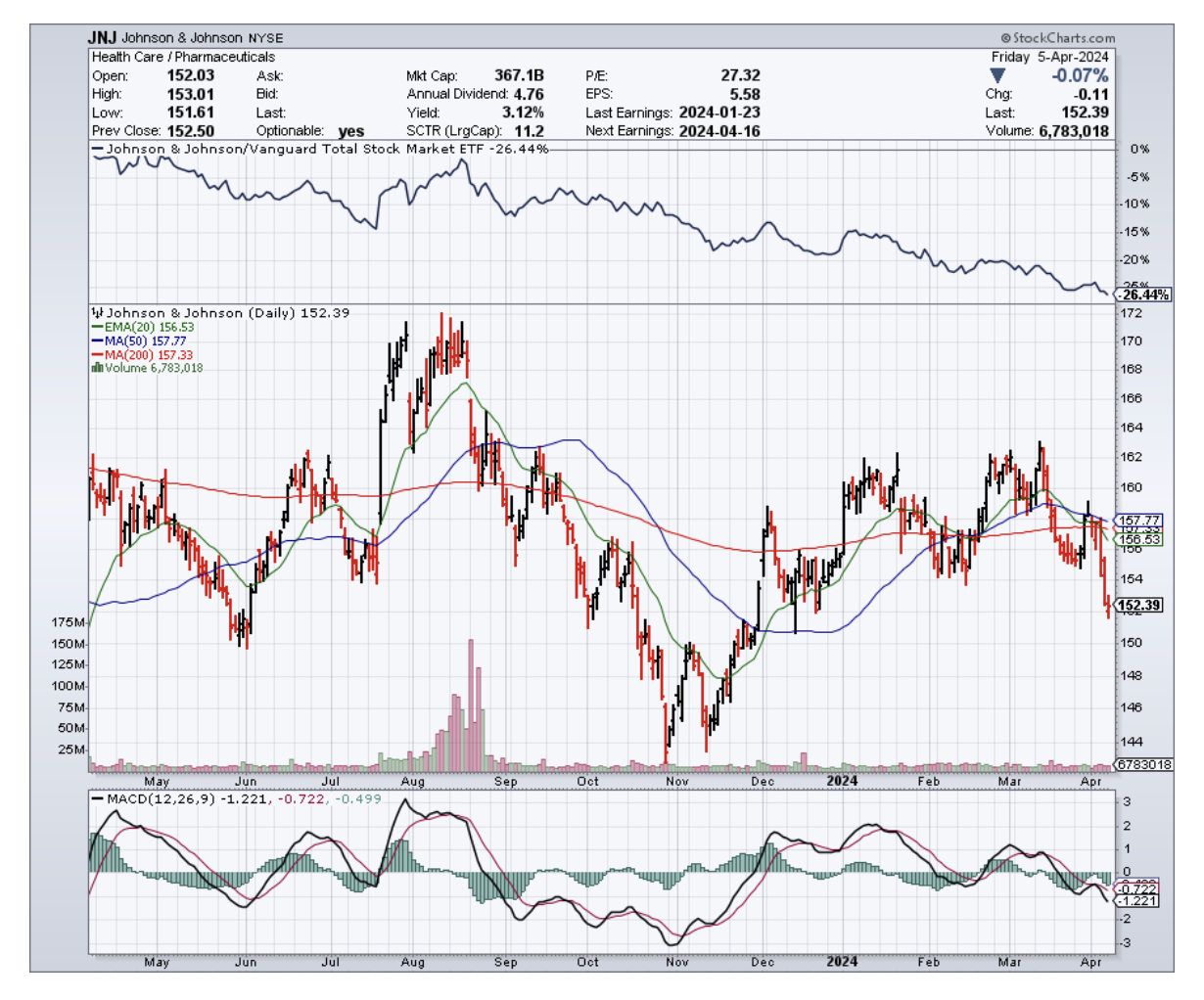

The company's board alone includes former FDA head Scott Gottlieb, Stanford chemist Carolyn Bertozzi (you know, the Nobel laureate), and even ex-Johnson & Johnson (JNJ) CEO Alex Gorsky.

Clearly, this isn't some penny-ante upstart's advisory council.

Speaking of going big, let's talk about Xaira's huge VC funding for a minute. Their over $1 billion haul puts them in a seriously elite company among the top five largest VC-backed biopharma raises of all time.

We're talking the same rarified air as anti-aging disruption play Altos Labs (ALTO) and Roivant Sciences' (ROIV) $1.1 billion mega round from 2017.

That's an outrageously rich launch valuation for an upstart AI biotech without a single disclosed pipeline product. But it reflects the blazing hot enthusiasm and optimism around applying machine learning to overcoming drug development's biggest bottlenecks and inefficiencies.

In that vein, Xaira's most direct competition comes from other prominent AI drug trailblazers like Alphabet's (GOOGL) Isomorphic Labs and Flagship Pioneering's Generate Biomedicines.

All three of these hyper-funded disruptors are in a race to develop superior AI systems for accurately modeling protein structures or generating wholly new proteins from digital representations.

Of course, Xaira's monster ambitions will ultimately live or die based on tangible results and clinical execution over the long haul.

Love it or hate it, though, the great AI-powered biopharma upheaval is officially underway thanks to Xaira's monster VC haul. Whether the company can truly live up to its gargantuan hype and disruption premise, well, that multi-billion dollar enigma should start getting some added clarity in the not-too-distant future.

Let's see if these self-professed drug R&D revolutionaries have the disruptive chops to put their lofty money where their mouths are.