Global Market Comments

May 12, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR THE MISSILES TO HIT)

(GLD), (SPY), (MSTR), (NVDA), (AAPL),

(TSLA), (QQQ), (TLT), (SH), (MCD), (SVXY)

Global Market Comments

May 12, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR THE MISSILES TO HIT)

(GLD), (SPY), (MSTR), (NVDA), (AAPL),

(TSLA), (QQQ), (TLT), (SH), (MCD), (SVXY)

When I was in Ukraine, the air raid sirens used to go off every night exactly at 2:00 AM.

The Russian goal was to deprive the civilian population of sleep and to make their lives miserable. It was also when the country was least able to defend itself.

You knew the missiles were on the way, it was just a question of whether your number was up. You could only hope to make it to the basement before they hit. It was not safe to go back to sleep until you heard the explosions nearby.

It is not a pleasant feeling.

Here we are in the United States in 2025, and there are missiles on the way, but they are economic ones. Ford Motors (F) has already started raising prices so they can spread them out over a longer period of time. Food and produce prices from Mexico will deliver the first price shocks, as they can go bad in a day. The first hint of this might be visible with the release of the Consumer Price Index at 8:30 AM EST on Tuesday, May 13. That’s when we learn if the inflationary surge is hitting now, or if we have to wait until June. But we know for sure it’s coming.

In fact, there is an onslaught of horrific economic data headed our way. Economic growth is slowing dramatically, prices are rising, international trade is grinding to a halt, and consumer confidence is already at all-time lows. We just don’t know yet if it is going to hit us or blow up the neighbors down the street.

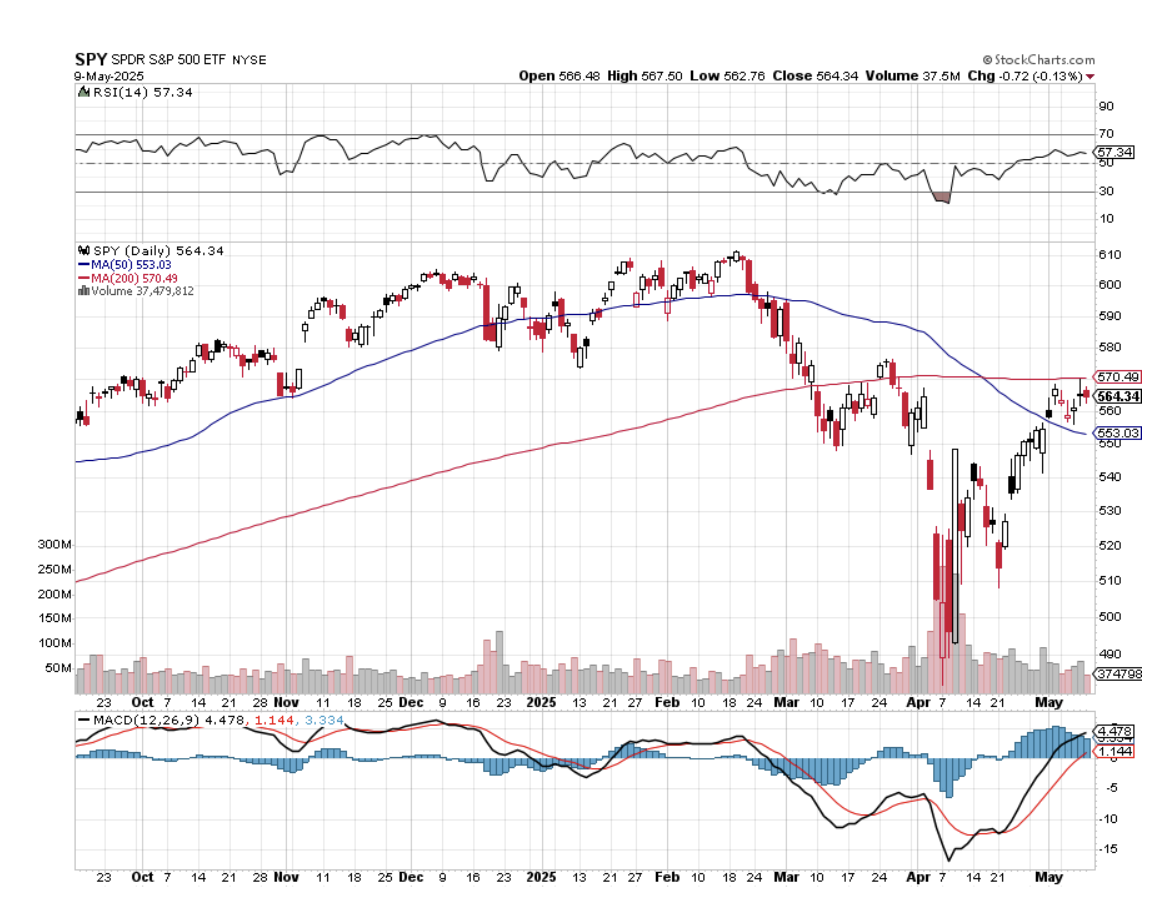

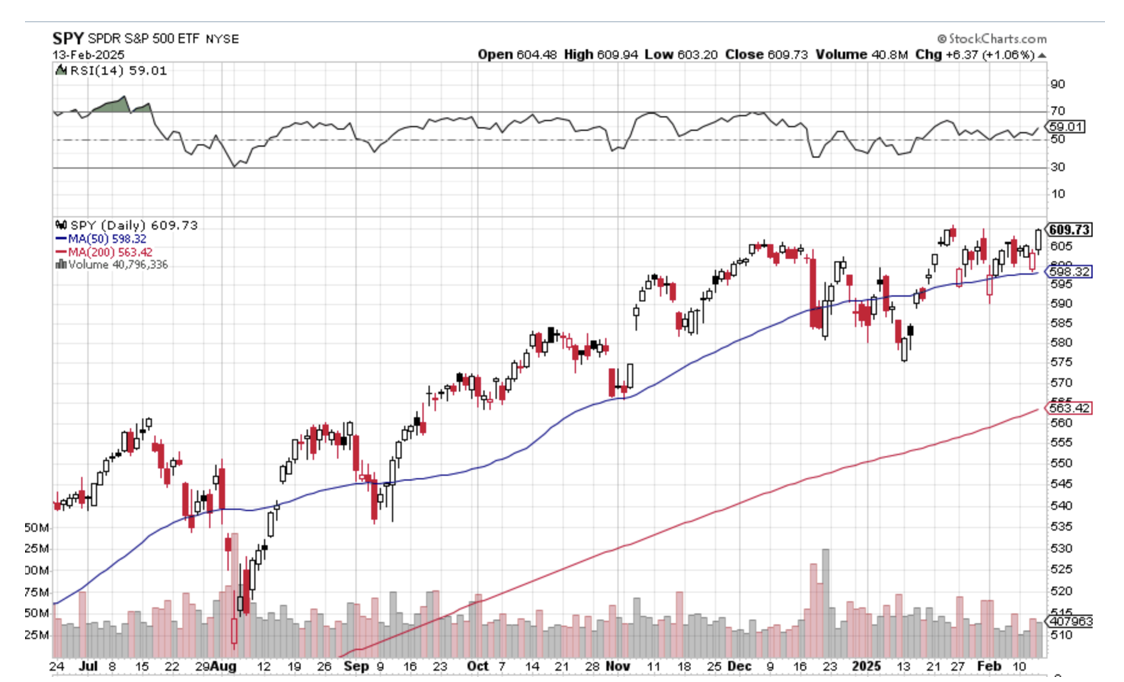

The truly alarming thing about these developments is that the data from hell is going to hit just as the stock market is completing one of its most rapid rises in history, up 19.75% in a month. Stocks are now even more expensive than they were in February, with a price earnings multiple of 22X and earnings falling.

Is anyone ready for a February market crash repeat? You may be about to get it.

I have been through many bear markets since I started trading in 1965, a move down in the indexes of 20% or more. They can last 31 months (2002) and decline as much as 56% (2009). In 1987, we had a bear market in a day!

This one is number nine for me. And while no two bear markets are alike, they all share common characteristics. I have seen them caused by oil shocks, hyperinflation, financial engineering, the Dotcom Crash, the Great Financial Crisis, and the Pandemic. This is the first one caused by a trade war.

Spoiler alert! The monster is about to jump out of a closet at you at the end of the movie.

If you’re praying that the new trade deal with the UK is going to rescue your retirement funds, don’t hold your breath. It’s not a treaty; it is simply an agreement to agree sometime in the distant future. It’s not even a letter of intent. It’s nothing but a bunch of hot air.

In 2024, the U.S. actually ran a trade surplus, not a deficit, with the UK. The surplus was $11.9 billion. The U.S. exported $79.9 billion worth of goods to the U.K. and imported $68.1 billion, resulting in a surplus.

Some $10.5 billion of US aircraft were sold to the UK in 2024, followed by $7 billion in machinery and nuclear reactors and $5.6 billion in pharmaceuticals. The deals announced last week were nothing new, just a reaffirmation of existing trade that has been going on for years.

In the meantime, the punitive 10% tariff against UK imports stands. That is nowhere near enough to move the needle for the $27.7 trillion US GDP. And this was the easy one. Why the US needs to negotiate a trade agreement with a country where it is already running a surplus is beyond me.

All of this has prompted me to run the first 100% short model portfolio in the 17-year history of the Mad Hedge Fund Trader. If the market moves sideways or up small, we will make our maximum profit by the June 20 option expiration in 28 trading days (Memorial Day is a Holiday). If the market crashes, which it can do at any time, we make the maximum profit immediately. That should take us to a 2025 year-to-date profit of over 43%.

Heads I win, tails you lose, I like it.

Current Capital at Risk

Risk On

NO POSITIONS 0.00%

Risk Off

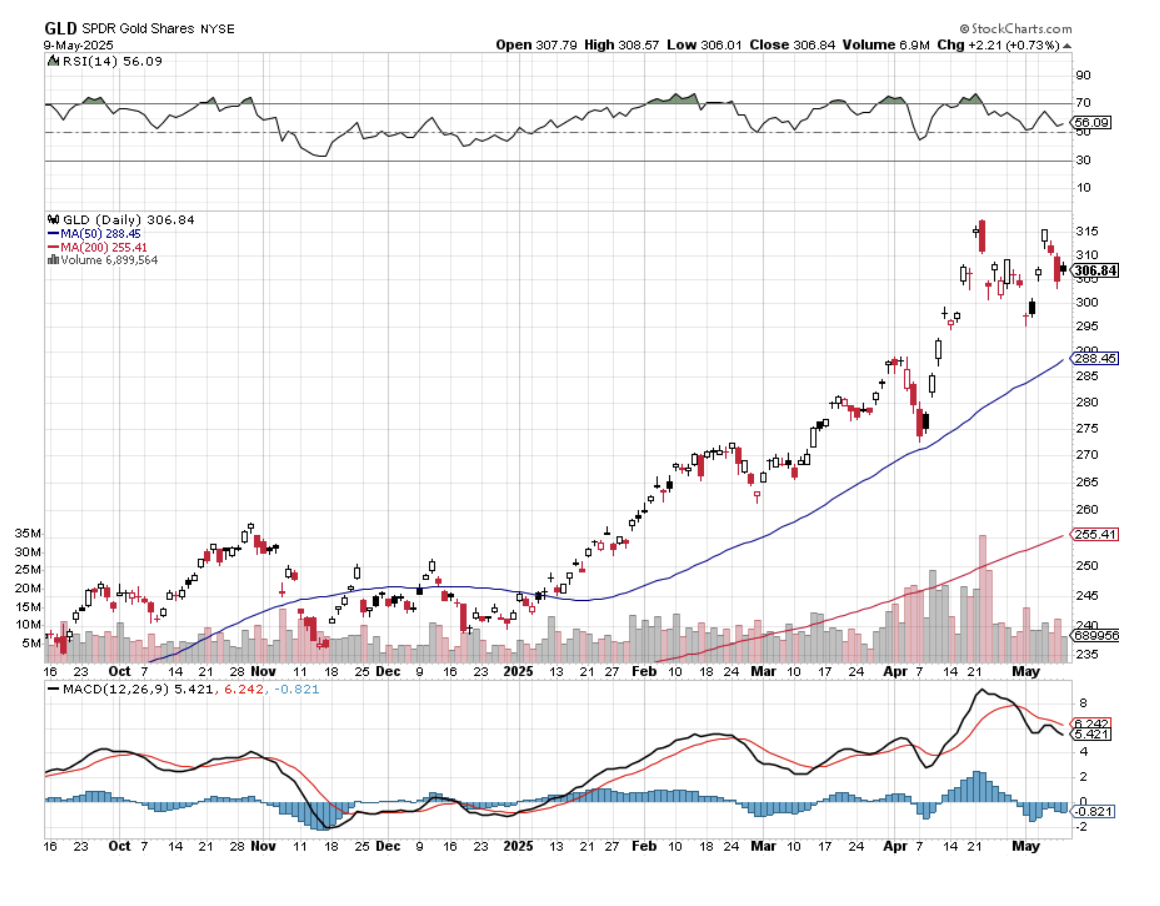

(GLD) 5/$275-$285 call spread -10.00%

(GLD) 6/$275-$285 call spread -10.00%

(SPY) 6/$610-$620 call spread -10.00%

(MSTR) 6/$500-$510 put spread -10.00%

(NVDA) 6/$140-$145 put spread -10.00%

(AAPL) 6/$220-$230 put spread -10.00%

(TSLA) 6/$370-$380 put spread -10.00%

(QQQ) 6/$540-$550 put spread -10.00%

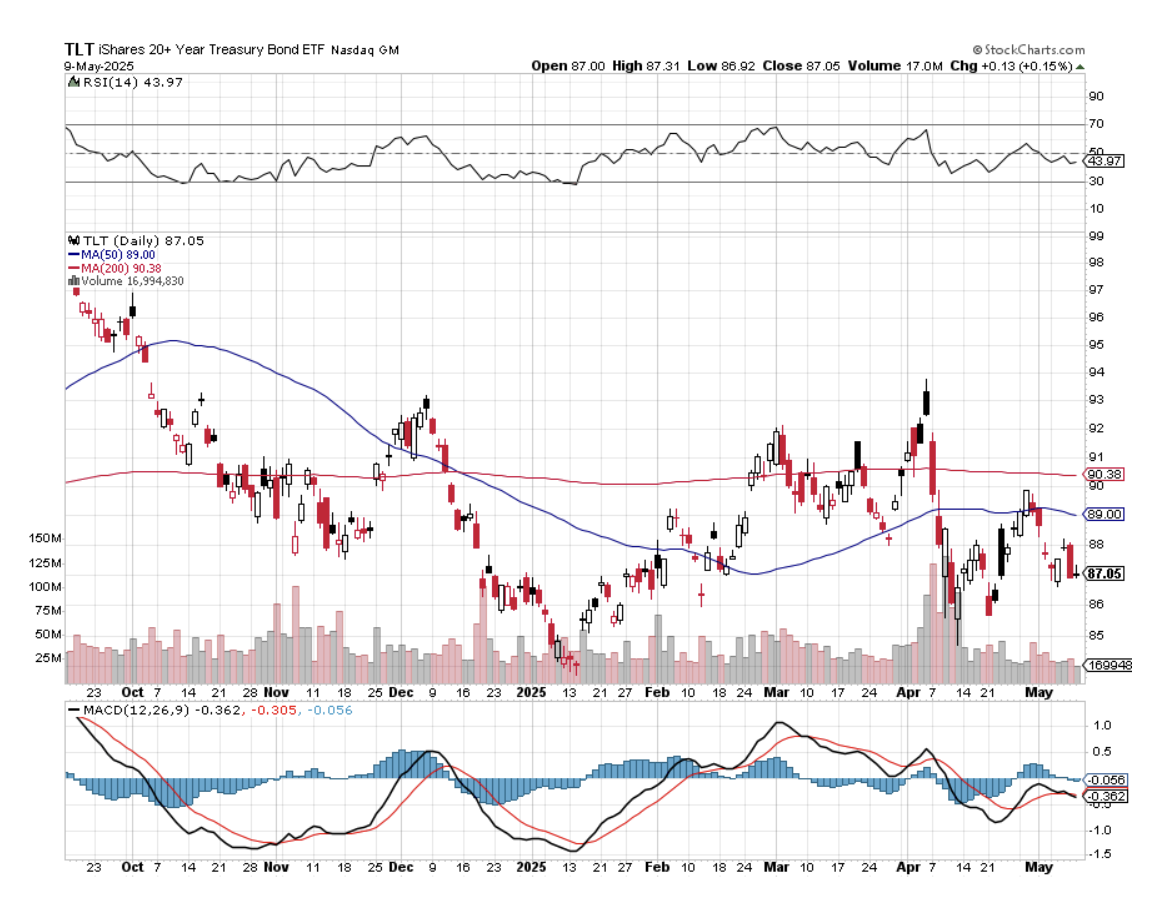

(TLT) 6/$80-$83 call spread -10.00%

(SH) 6/$39-$41 call spread -10.00%

Total Net Position -100.00%

Total Gross Position 100.00%

I love trade wars.

They shine brilliant spotlights on obscure, usually deeply hidden parts of the global economy, revealing almost impossible-to-find data points. And every single new data point enhances your understanding of the big picture.

My first real trade war was the 1973 Oil Shock. Saudi Arabia had cut off America’s oil supply because of our support for Israel in the Yom Kippur War. Huge lines formed at gas stations, and gasoline prices shot up from 25 cents a gallon to $3.00.

Ever the entrepreneur, I started a side business buying beat-up Volkswagen Beetles, the highest mileage car then available in the United States, driving them to Mexico, and getting them repainted and reupholstered in a day for $50. Then I resold them in LA for double the price.

I remember on my last run, I was in a hurry to catch a physics class, so I left a little early. The US customs office learned about the car and asked me if I had any work done while in Mexico. I answered “No.” As he walked away, I saw that his pants were covered with fresh green paint, which had not yet dried.

I drove away as fast as my green Beetle could go.

In the old days, hedge funds reaped huge trading advantages chasing down obscure data points. When satellite data became available to the public in the 1990s, my fund leased satellite time to track the progress of the US wheat crop.

Several successful trades in the commodities markets followed, until others caught on. You already know that I closely track container ship traffic not only in Los Angeles, but ports around the world. This is easy now through many cheap apps available through Apple’s App Store..

In the 2025 stock market, we have all had to become our own mini hedge fund managers. For a start, more money has been made on the short side than the long side, at least the few who participated in instruments like my many vertical bear put debit spreads in (NVDA), (SPY), (TSLA), (MSTR), and the (TLT). There were also nicely profitable plays in the (SH), the (SDS), and the many volatility plays out there, such as the (SVXY).

It's all been enough to help me achieve a welcome 32% profit this year. Those who took my advice to sit out 2025 and bought 90-day US Treasury bills yielding 4.2% are also profitable this year. Any positive return this year is a great accomplishment.

A whole new cottage industry that has gone viral on the internet, offering up more obscure data points about the economy than we could ever consume. We all know that forward-looking soft sentiment data is the worst ever recorded. Credit card balances held by low-income consumers are at all-time highs. But McDonald’s (MCD) and Taco Bell sales have been falling, while those at Domino's Pizza are rising.

What the heck is that supposed to mean?

Although this may sound arcane and deep in the weeds, the 2 year – 10 year spread recently turned positive and is now at 0.47%. That means the yield on two-year Treasury notes is higher than the yield on ten-year Treasury bonds. This has NEVER happened without a following recession. If you were looking for hard data, this is hard data.

Gold is the only asset class absent from volatility this year. That alone says a lot.

There are more than the usual number of binoculars focusing on the Port of Los Angeles these days (click here for the link). Traffic is now down a stunning 25% on the week. That means a supply chain disaster is imminent.

You learn in the Marine Corps that a 50-cent part can ground a $60 million aircraft. How much extra will you pay to get that 50-cent part to get the plane flying? $1.00, $10? $100? Certainly $1 million for a military aircraft in time of war.

This is the basis for some of the exponential inflation forecasts and supply chain disruptions on the scale last seen during the pandemic. Once started, inflation takes off like a rocket with merchants trying to outraise each other and it can take years to get under control, as we saw with the last pandemic.

By the way, I still wake up at 2:00 AM every morning expecting incoming missiles, even though I have been out of Ukraine for 18 months. It turns out that post-traumatic stress gets worse when you get older. Fortunately, my bedroom is now in the basement.

The Lucky One (it was a dud)

The Not So Lucky Ones

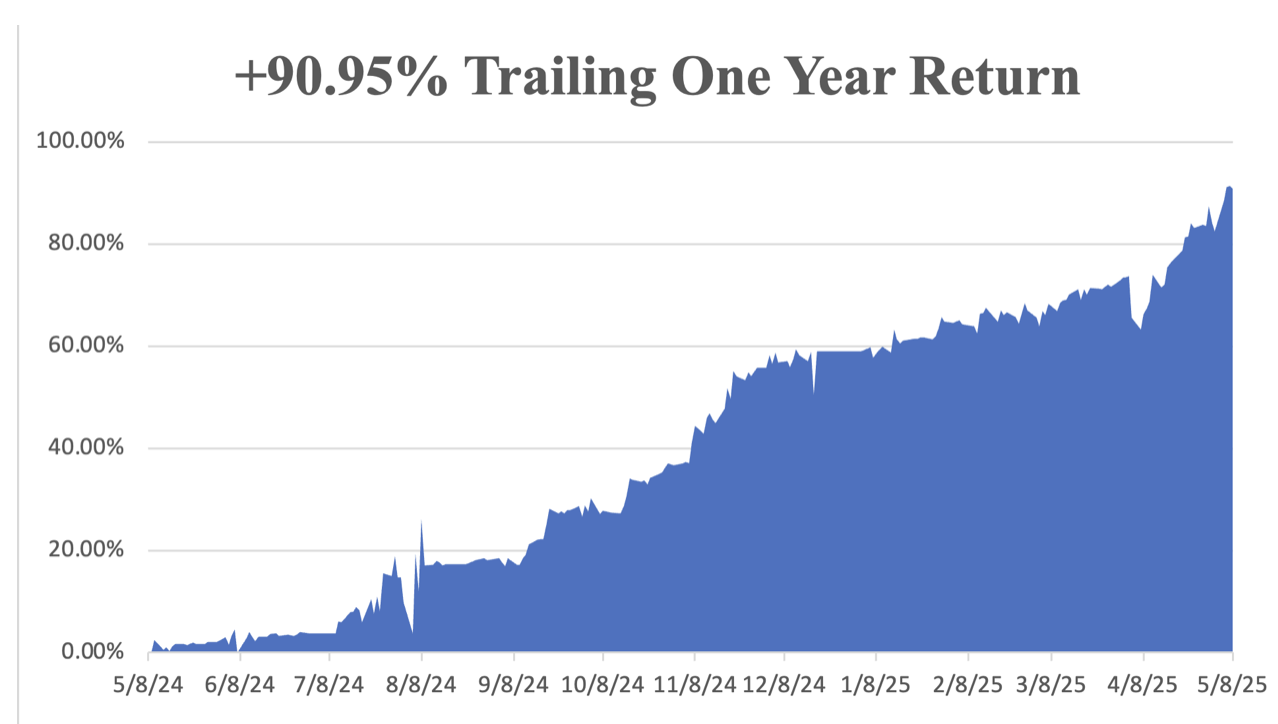

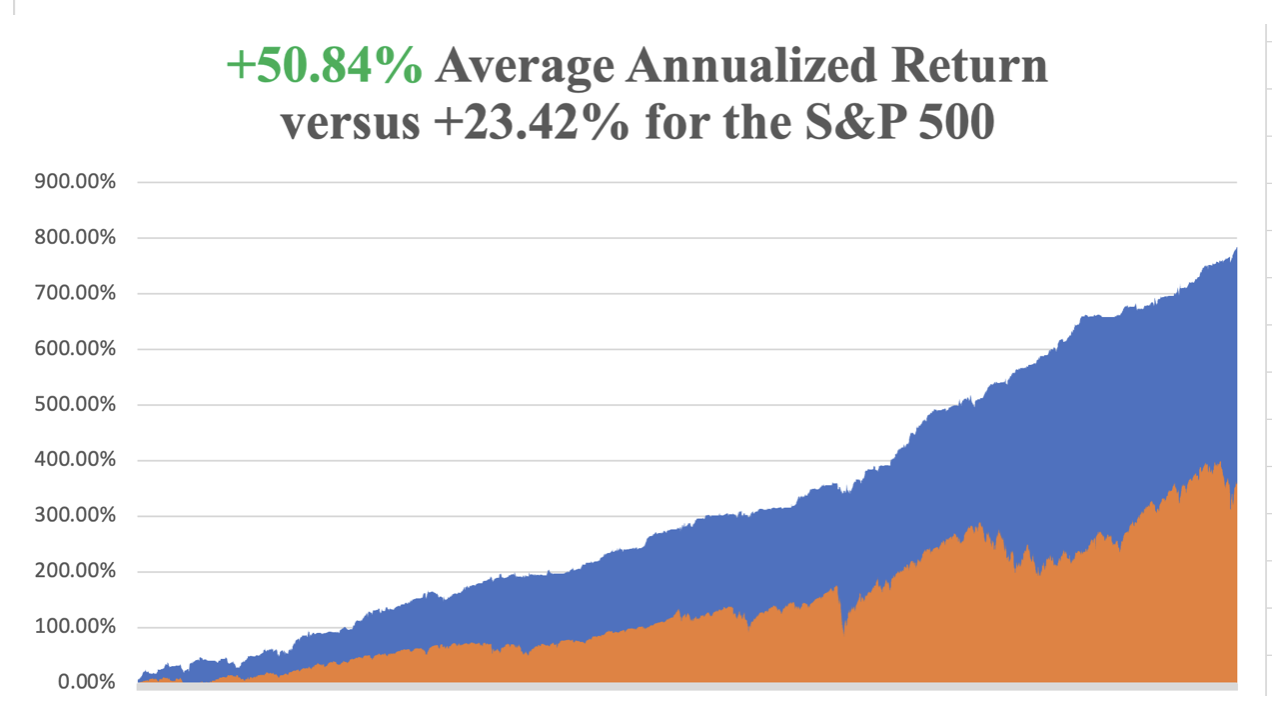

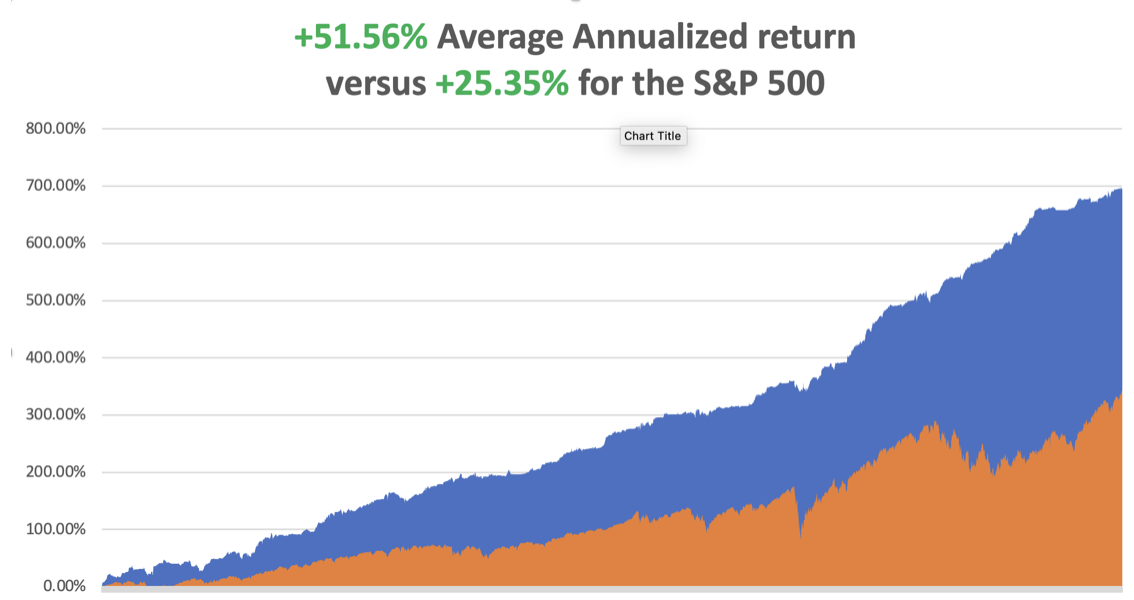

My May performance has reached +3.08%. That takes us to a year-to-date profit of +31.48% so far in 2025. My trailing one-year return stands at a record +90.95%. That takes my average annualized return to +50.84% and my performance since inception to +783.37%, a new all-time high.

It has been another wild week in the market. I took profits in longs in (MSTR) and (NVDA). I stopped out of a short in (SPY) for a small loss. I added a new long in (GLD) and (TLT), new shorts in (QQQ), (AAPL), and (TSLA). After the tremendous run we have just seen, I am moving towards a 100% short portfolio.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

The Stock Market is Headed for New Lows, even if the China tariffs drop from 145% to only 50%, says hedge fund guru and old friend Paul Tudor Jones. Trump’s rollout of the highest levies on imports in a century shocked the world last month, triggering extreme volatility on Wall Street. You have Trump, who’s locked in on tariffs. You have the Fed, which is locked in on not cutting rates. That’s not good for the stock market. We are the losers.

Fed Leaves Interest Rates Unchanged, at 4.25%-4.50%, supported by a consistently rising inflation rate. Stocks tanked and bonds rallied. In case you were wondering, the Fed ALWAYS prioritizes fighting inflation over unemployment because its mandate is to protect the value of the US dollar. It’s written into the 1913 law creating the Federal Reserve System. Don’t expect ANY rate cuts until year-end.

Apple Tanks on Falling Search Revenues. I bet you don’t get many short recommendations for Apple, but here’s a nice one. The implications for Apple were disastrous when a senior officer testified that artificial intelligence was demolishing their traditional search business. Of course, Alphabet (GOOGL) shares were trashed, down 7%. But Apple took a 5% hit as well because it earns an eye-popping $50 billion a year from its IOS operating system, referring all searches to Google. Apple shares have been trading rather feebly this month. While the S&P 500 rocketed 15%, (AAPL) managed to eak out an unimpressive 20% gain, while shares like Palantir (PLTR) doubled.

Bitcoin Recovers $100,000, for the first time since early February, bolstered by a dial down of the trade war in a sign that perhaps Trump is backing off his trade war. Overbought for now, sell Bitcoin rallies.

Nearly All US Exports are in Free Fall, reaching most ports across the U.S. and nearly all export market products as the trade impact of Trump’s tariffs worsens. Agriculture exports to China have been the hardest hit.

Oil Production has Peaked, thanks to the collapse in prices triggered by recession fears. Saudi Arabia is playing a market share game, and increasing production is another factor. Avoid all energy plays like the plague. We’re headed for $30 a barrel.

Warren Buffett Retires, handing over day-to-day management of Berkshire Hathaway (BRK/B) to Greg Abel. It’s a personal blow as Warren was one of the first subscribers to Mad Hedge Fund Trader. No one could ever match his investment performance, not even Warren himself, as stocks are so much more expensive now. Even if (BRK/B) shares dropped 99% from today, it would still be the top-performing S&P 500 stock since 1965. Listening to his annual shareholder summit, he’s still all there at age 94. I want to be Warren Buffett when I grow up.

Is Tesla the Next Boeing? By cutting production costs by 17% last year, has Musk also made the cars unsafe? That’s what happened to Boeing (BA), which prioritized raising dividends and share buybacks over quality and safety to the point where its aircraft started falling out of the sky. This year, (TSLA) shares have been matching (BA) downside one for one.

Jeff Bezos to Sell $4.7 Billion of Amazon Stock by May 2026. Time to free up some spending money. Jeff sold $13.4 billion worth of shares in 2024. Some of the money will go to finance his Blue Origin rocket hobby. Bezos still owns 9.56% of the $2 trillion company.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, May 12, at 8:30 AM EST, the WASDE Report is announced, the World Agriculture Supply and Demand Estimate.

On Tuesday, May 13, at 7:30 AM, the Consumer Price Index, a key inflation read, is released.

On Wednesday, May 14, at 9:30 AM, EIA Oil Stocks are disclosed. No move is expected in the face of a rising inflation rate. A press conference follows at 1:30.

On Thursday, May 15, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Producer Price Index and Retail Sales.

On Friday, May 16, at 7:30 AM, we get Housing Starts and Building Permits. At 1:00 PM, the Baker Hughes Rig Count is published.

As for me, one of the many benefits of being married to a British Airways senior stewardess is that you get to visit some pretty obscure parts of the world. In the 1970s, that meant going first class for free with an open bar, and sometimes in the cockpit jump seat.

To extend out 1977 honeymoon, Kyoko agreed to an extra round trip for BA from Hong Kong to Colombo in Sri Lanka. That left me on my own for a week in the former British crown colony of Ceylon.

I rented an antiquated left-hand drive stick shift Vauxhall and drove around the island nation counterclockwise. I only drove during the day in army convoys to avoid terrorist attacks from the Tamil Tigers. The scenery included endless verdant tea fields, pristine beaches, and wild elephants and monkeys.

My eventual destination was the 1,500-year-old Sigiriya Rock Fort in the middle of the island, which stood 600 feet above the surrounding jungle. I was nearly at the top when I thought I found a shortcut. I jumped over a wall and suddenly found myself up to my armpits in fresh bat shit.

That cut my visit short, and I headed for a nearby river to wash off. But the smell stayed with me for weeks.

Before Kyoko took off for Hong Kong in her Vickers Viscount, she asked me if she should bring anything back. I heard that McDonald’s has just opened a stand there, so I asked her to bring back two Big Macs.

She dutifully showed up in the hotel restaurant the following week with the telltale paper back in hand. I gave them to the waiter and asked him to heat them up. He returned shortly with the burgers on plates surrounded by some elaborate garnish. It was a real work of art.

Suddenly, every hand in the restaurant shot up. They all wanted to order the same this, even though the nearest stand was 2,494 miles away.

We continued our round-the-world honeymoon to a beach vacation in the Seychelles, where we just missed a coup d’état, a safari in Kenya, apartheid South Africa, London, San Francisco, and finally back to Tokyo. It was the honeymoon of a lifetime.

Kyoko passed away in 2020 from breast cancer at the age of 50, well before her time.

Sigiriya Rock Fort

Kyoko

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader|

Global Market Comments

February 14, 2025

Fiat Lux

Featured Trade:

(FEBRUARY 12 BIWEEKLY STRATEGY WEBINAR Q&A),

(MCD), (FSLR), (META), (GOOG), (AMZN), (JNK), (HYG), (F), (GM), (NVDA), (PLTR), (INTC)

Below, please find subscribers’ Q&A for the February 12 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

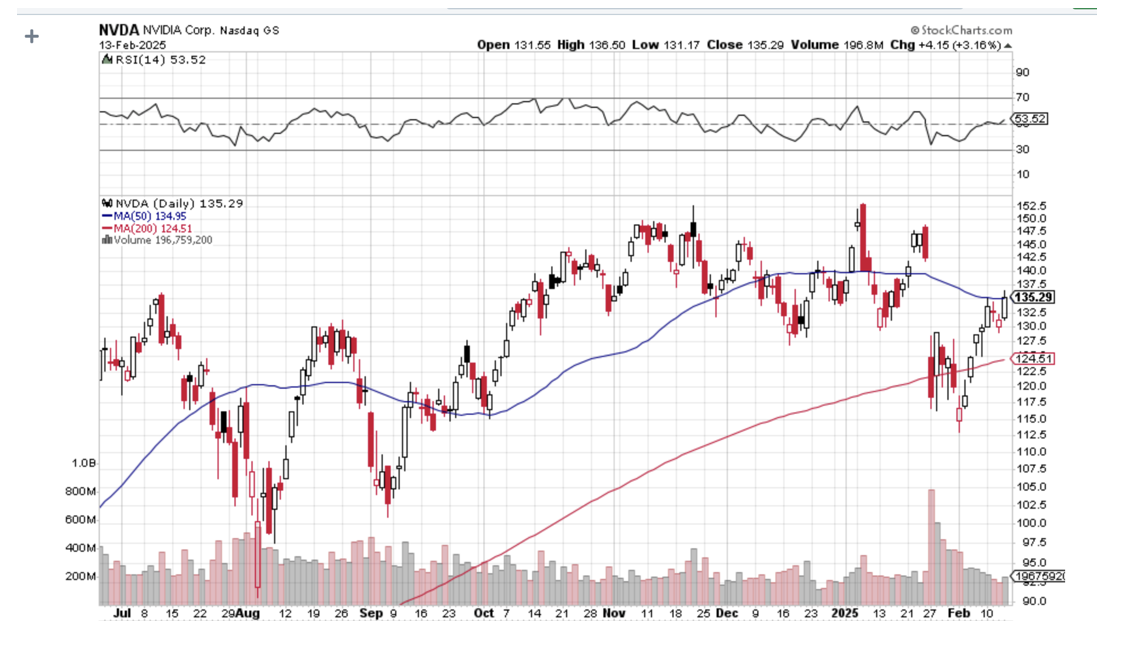

Q: Can Nvidia (NVDA) go to $200 in the next three years?

A: I would imagine probably, yes. They still have a fabulous business—enormous orders and record profits. But it's not going to happen in the next six months. You need to get us out of the current stock market malaise before anything moves dramatically one way or the other, except for META, which is at an all-time high. Their basic business is still great, and the threat posed by DeepSeek is wildly overblown.

Q: Why is McDonald's (MCD) seeing declining sales?

A: Partly, it's because they have been cutting prices. So, of course, that automatically feeds into declining sales. Also, I think the weight loss drugs Mounjaro or Ozempic are having an impact. People just don't go in and eat three Big Macs for lunch anymore. They may not need any Big Macs at all. And forget about the fries and the super-size high fructose corn syrup drink. When these drugs first came out, it was speculated that fast food companies would be the number one victim of these drugs, and that is turning out to be true. Some 15.5 million people in the United States suddenly aren't hungry anymore; they just take one bite of a meal and then push their food around the plate with their fork. That’s better than taking amphetamines, which people like Judy Garland used to take to lose weight. I think that will affect not only McDonald's, but all fast-food companies which I avoid like the plague anyway because my doctor says I shouldn't eat that food.

Q: Should I buy First Solar (FSLR) based on the revised higher sales outlook?

A: I don't want to touch alternative energy anything right now. I think the government will eliminate all subsidies for all alternative energy—be it solar, windmills, hydrogen, nuclear, whatever—and turn us back into an all-oil and coal economy. That is the announced goal of the new administration. So that eliminates the subsidies for sure. It certainly will be a blow to the earnings of all solar-type companies. If you are going to do an energy form, I would do nuclear, which benefits from deregulation, if that ever happens.

Q: Do price caps fix supply problems? Because Europe is thinking about capping energy prices in the short term.

A: Price caps never work, nor does any other attempt to artificially control prices, because all it does is dry up supply. If you cap the prices, and therefore the profits that energy companies can make, they'll quit. They'll abandon the energy business, or they'll pare it down, or they won't expand. One way or the other, you reduce the return on capital. Capital is like water; it will go where it gets the highest return, and price caps certainly are not part of that formula. But what do I know? I only drilled for natural gas for six years.

Q: What's your top AI choice?

A: Well, I would say it's Nvidia (NVDA) still, and the big AI users which include Meta (META), Google (GOOG), and Amazon (AMZN). Nothing has changed here.

Q: Is there any chance that Ford Motors (F) will be bought out anytime soon or never?

A: My view of all of the legacy car companies, including Stellantis, which is the old Chrysler, Ford (F), and General Motors (GM), is that they are basically giant mountains of scrap metal and only have a scrap metal value, which is about 5 cents on the dollar. That's what they fell to in the 2008 financial crisis, and all of them except for Ford went bankrupt. So I am not a big fan of the legacy auto industry now. And now, they have a trade war. They happen to be one of the biggest victims of trade wars because to stay competitive with Tesla, they moved a lot of their production to Canada and Mexico, and now those plans are going up in flames. So it seems like they're damned if they do and they're damned if they don't. I'm happy driving my Tesla, but I'm wondering if my next car is a BYD. Prices are so low, it might even be worth paying 100% duty just to get a cheaper car that has better self-driving capability. But the future is unknown, to say the least.

Q: Is the next big rotation out of Silicon Valley and into Chinese tech stocks?

A: Over the long term, that may happen, but with the current administration and China (the number one target in restraint of trade and trade wars), I don't want to touch anything Chinese. There are too many better things to do in the U.S. Imagine you buy a Chinese stock, and then the administration announces a total cutoff of trade with China the next day. Not good. Chinese stocks are incredibly cheap. Most of the big ones are now single-digit multiples compared to multiples in the 20s, 30s, and 40s for our stocks. But they come with a very high political risk, and that has been true for several years now. There are better fish to fry than in China. I'd rather buy Europe than China right now if you really do want to go international. But I have no idea why they're going up unless they're discounting an end to the Ukraine War.

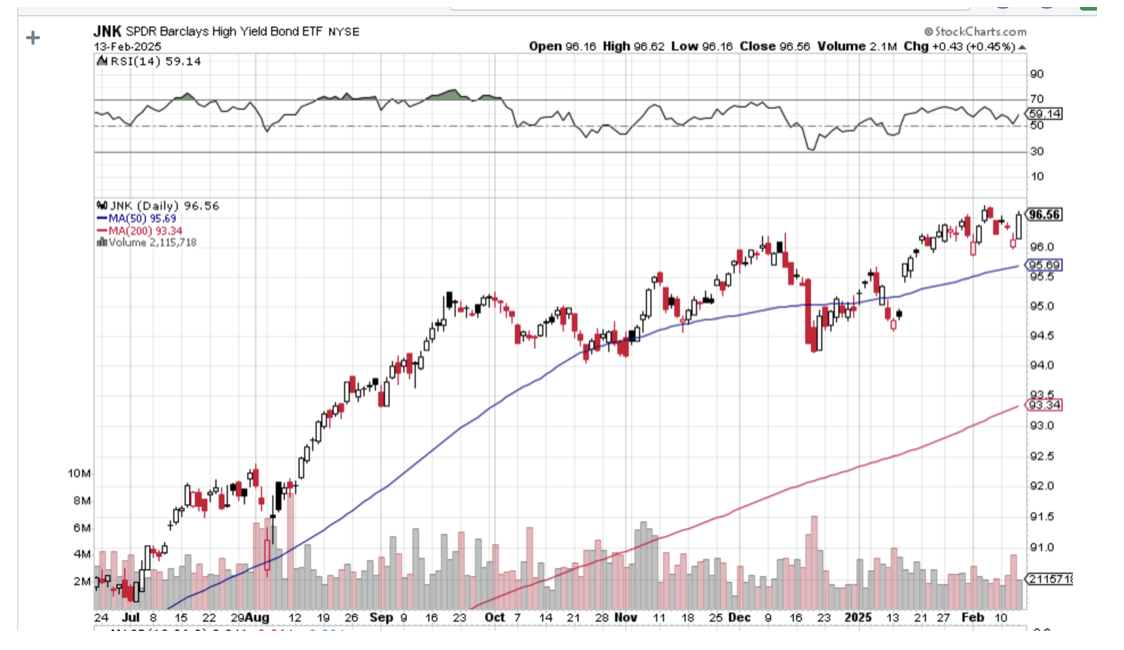

Q: Are junk bonds (JNK) and (HYG) a good play?

A: I would say yes. Their default risk has always been over-exaggerated thanks to their unfortunate name. They're yielding 6.54% and change, but it's a very slow mover. If we do get any improvement, any economy without inflation junk will go to $100. It's currently around $96. And you know, yield is a nice thing to have these days since the capital gain side seems to have dried up and turned into dust on almost any asset class.

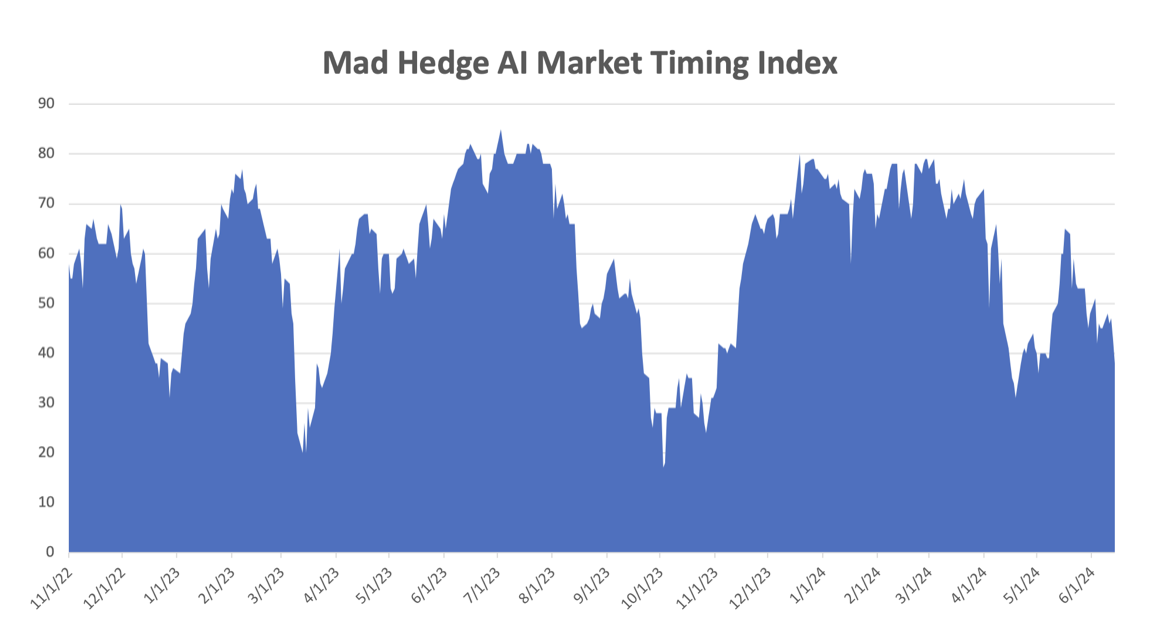

Q: How can I decide when to sell the stocks that we bought on your recommendations?

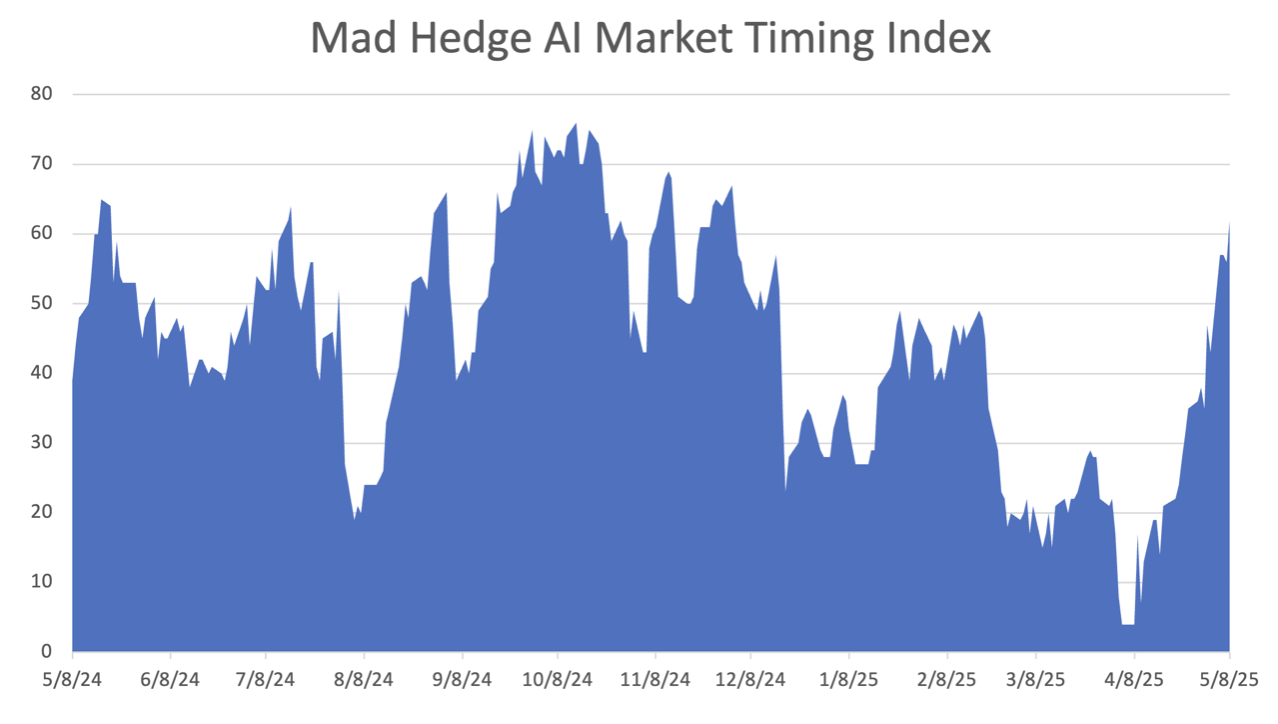

A: Well, our trade alerts always have a buy recommendation and a sell recommendation or an expiration date. If you bought the stocks and kept it, just read Global Trading Dispatch for an updated market view. Watch our Mad Hedge Market Timing Index. When we get up into the 70s and 80s, that is definitely sell territory. It's hard for individuals to have an economic view going out to the rest of the year, but even the people who are economists have no idea what's going to happen right now. As I said, uncertainty is at an 8-year high, and that is being reflected in the market. So nothing beats cash, especially when you can earn 4.2% on 90-day US treasury bills. No one ever got fired for taking a profit.

Q: Can Intel (INTC) make a comeback this year?

A: No. I'm sorry, but they won’t. They had a horrible manager. They dumped him after a couple of disastrous years. I knew he was a horrible manager. I fought off all the pressure to buy Intel. So far, that's working. I mean, the stock has been terrible, so it is very cheap, but there is no guarantee that they will ever recover and, in fact, may get taken over by somebody else. So—too many better things to do. I'd rather be buying more Nvidia right now at these prices than sticking my neck out and praying for a miracle at Intel.

Q: A couple of years ago, I bought a bunch of Palantir (PLTR) on your recommendation for the next 10 bagger. I now have a 10 bagger. What should I do?

A: You know, we did recommend Palantir about 10 years ago, and it did nothing for the longest time. And then last year, it just took off like a rocket—I think it's up 400% last year. Price-earnings multiples are insanely high now. So what I would do is sell half your position. That way, the remaining half is all profit. You're playing with the house's money, and you're reducing your risk in a high-risk environment. Sell half, keep the other half. If it looks like it's starting to roll over and die, then you sell your remaining half.

Q: What's your favorite currency this year, and what should we do about it?

A: My favorite currency is the US dollar. If we're not going to get any interest rate cuts this year, the dollar will remain the highest-yielding currency in the world, and then everybody wants to buy it. It's really that simple. It’s all about interest rate differentials. Everybody else in the world has low interest rates, so stick with the dollar and don't touch the foreign currencies yet.

Q: Inflation expectations have exploded higher in view of today's number. Do you expect it to get worse?

A: If the trade war continues, it will absolutely get worse. 25% price increases are inflationary—period. End of story. A price increase is the definition of inflation, and right now, we are increasing the number of countries subject to high punitive tariffs, not decreasing them. You can expect markets to worry about that. And even if they put a temporary hold on these, people are raising prices now. They are not waiting for the actual tariff to hit; they are front-running that right now. So if you don't believe me, go to the grocery store where prices are through the roof. I actually went to a grocery store the other day, and I couldn't believe what things cost.

Q: I'd like to hedge my Nvidia (NVDA) position with a covered call. Which one should I do?

A: Well, it's not actually a hedge. What a covered call does is reduce your cost price and increase income. Right now, we have NVDA at $135. If you shorted something like the February $145 calls, you might get a dollar for that. That reduces your average price by a dollar. If you shorted the March $145 calls, that'll bring in probably $5, reduce your costs by $5, or bring in an extra $5 in income. And if you keep doing this every month and Nvidia stays stuck in a range, you can end up taking $10, $20, or even $30 in premium income over the next six months. And I have a feeling that will be the winning strategy for the first half of this year, using rallies to sell covered calls. You really could get your average cost down quite a lot; that way, if we have a massive sell-off, a lot of that loss will already be covered. If we get a massive rally, your stock just gets called away, and you buy it back on the next dip. The only negative here is the tax consequences of taking capital gains on the call-aways.

Q: You mentioned that the US has a demographic problem coming up; how will that affect the market in the short term?

A: It doesn't affect the market in the short term. Demographics are a long-term game. You have to think in terms of a generation being the round lot, which is about 20 years. Suffice it to say, when demographics go against you, like they did in Japan for 30 years, markets are horrible. Demographics are going against China now, and you're getting horrible markets. Demographics are good now in the US because we have millennials just entering their peak spending years, and that's when economies boom, and that should continue up to 2030. That is how to play demographics, and we keep updated here, although the government has suddenly ceased making available all demographic data to the public—I don't know why, but it's going to make the science of demographics much more difficult to follow without the government data. I don't know why they did that. I don't know what they hope to gain by clouding the demographic picture. Maybe it has to do with the allocation of congressional seats to the states or something like that.

Q: Do you have information on how to place a LEAPS order?

A: Just go to www.madhedgefundtrader.com, go to the search box, put in LEAPS in all caps, and you will find an encyclopedia of information on how to do LEAPS or Long Term Equity Anticipation Securities.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or JACQUIE'S POST, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 17, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE THREE HORSE RACE) plus

(HITCHIKING TO ALASKA)

(AAPL), (MSFT), (NVDA), (TLT), (MCD), (VZ), (GLD), (NLY)

We have a three-horse race underway in the stock market right now between Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA). One day, one is the largest company in the world, another day a different company noses ahead.

And here’s the really good news: this race has no end. Sure, (NVDA) has far and away the most momentum and it should hit my long-term target of $1,400 this year, giving it a market capitalization of $3.44 trillion. (MSFT) and (AAPL) will have to stretch to make another 20% gain by year-end.

Who will really end this three-year race? You will, as the benefits of AI, hyper-accelerating technology, and deflation rains down upon you and your retirement portfolio.

Here is the reality of the situation. The Magnificent Seven has really shrunk to the Magnificent One: NVIDIA. (NVDA) alone has accounted for 32% of S&P 500 gains this year. There are now 400 ETFs where (NVDA) is the biggest holding, largely through share price appreciation. These dislocations in the market are grand. This will end in tears….but not yet.

Dow 240,000 here we come!

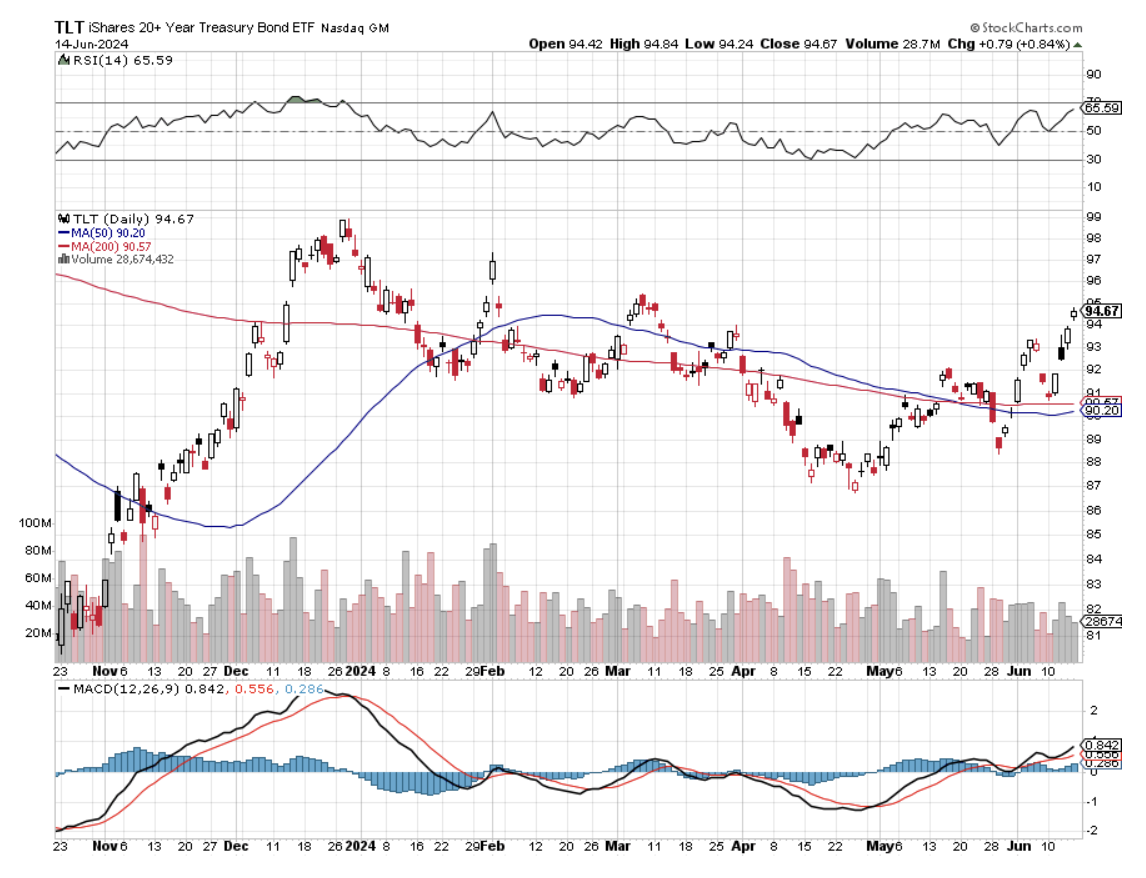

After six months of grief, pain, and suffering last week, my (TLT) LEAPS finally went into the money last week.

Remember the (TLT)?

On January 18, I bought the United States Treasury Bond Fund (TLT) January 17, 2025, $95-98 at-the-money vertical Bull Call spread LEAPS at $1.25 or best. On Friday, they nudged up to $1.35. But I kept averaging down with the $93-$96’s and the $90-$93’s which are now at a max profit.

We lost six months on this trade thanks to a hyper-conservative which is eternally fighting the last battle. A 9.2% peak certainly put the fear of God in them and they persist in thinking a return to higher inflation rates is just around the corner.

Markets, however, have a different view. They are now discounting a 25-basis point cut in September followed by another in December. That will easily take the (TLT) up to $100. This is why we go long-dated on LEAPS. There is plenty of room for error….lots of room, even room for the Fed’s error. If you wait long enough, everything goes up.

With THIS Fed fighting it seems to pay off. That is what happened when Jay Powell waited a full year until raising rates for a super-heated economy. He now risks tipping the US into recession by lowering rates too slowly, when virtually all data points are softening. I guess that’s what happens when you have a Political Science major as Fed governor.

And here is what the Fed is missing. AI is destroying jobs at a staggering rate, not just minimum wage ones but low-end programming ones as well. That’s what the 300,000 job losses over the last two years in Silicon Valley have been all about.

It’s unbelievable the rate at which AI is replacing real people in jobs. If you want a good example of that, I had to call Verizon (VZ) yesterday to buy an international plan, and I never even talked to a human once. They listed three international plans in a calm, even, convincing male voice, and I picked one.

Or go to McDonalds (MCD) where $500 machines are replacing $40,000 a year workers. This is going on everywhere at the same time at the fastest speed I have ever seen any new technology adopted. So buy stocks, that’s all I can say.

It is not just the (TLT) that is having a great month. The entire interest rate-sensitive sector has been on fire as well. My favorite cell phone tower REIT, Crown Castle International with its generous 6.28% dividend yield, has jumped 15%. Distressed lender Annaly Capital Management (NLY) with its spectacular 13.08% dividend, has appreciated by 11%.

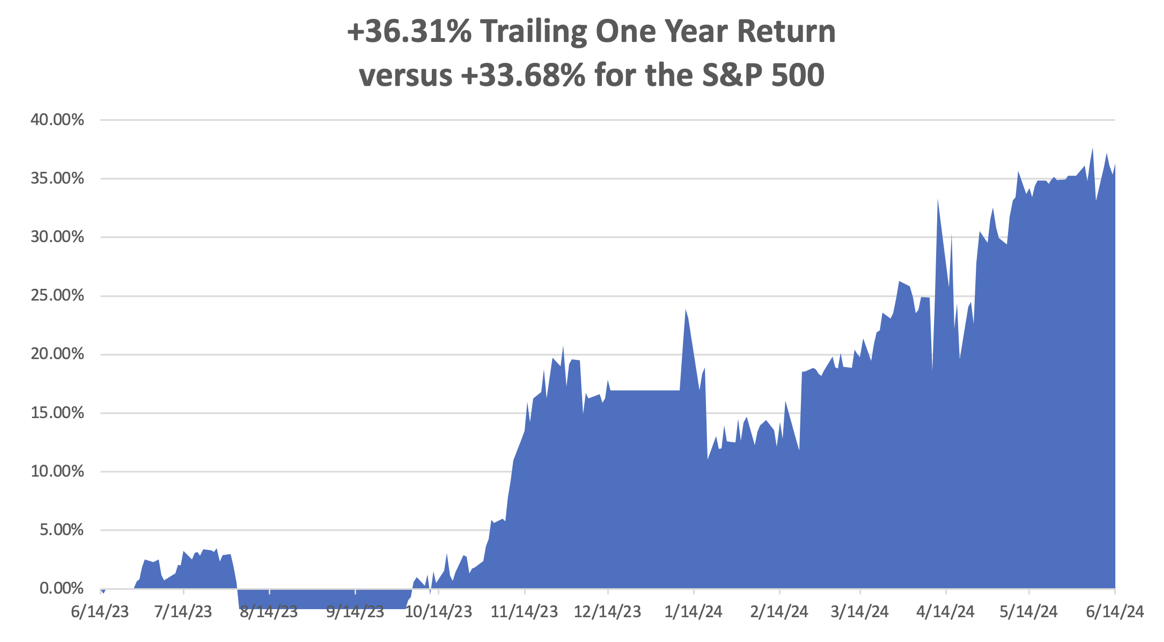

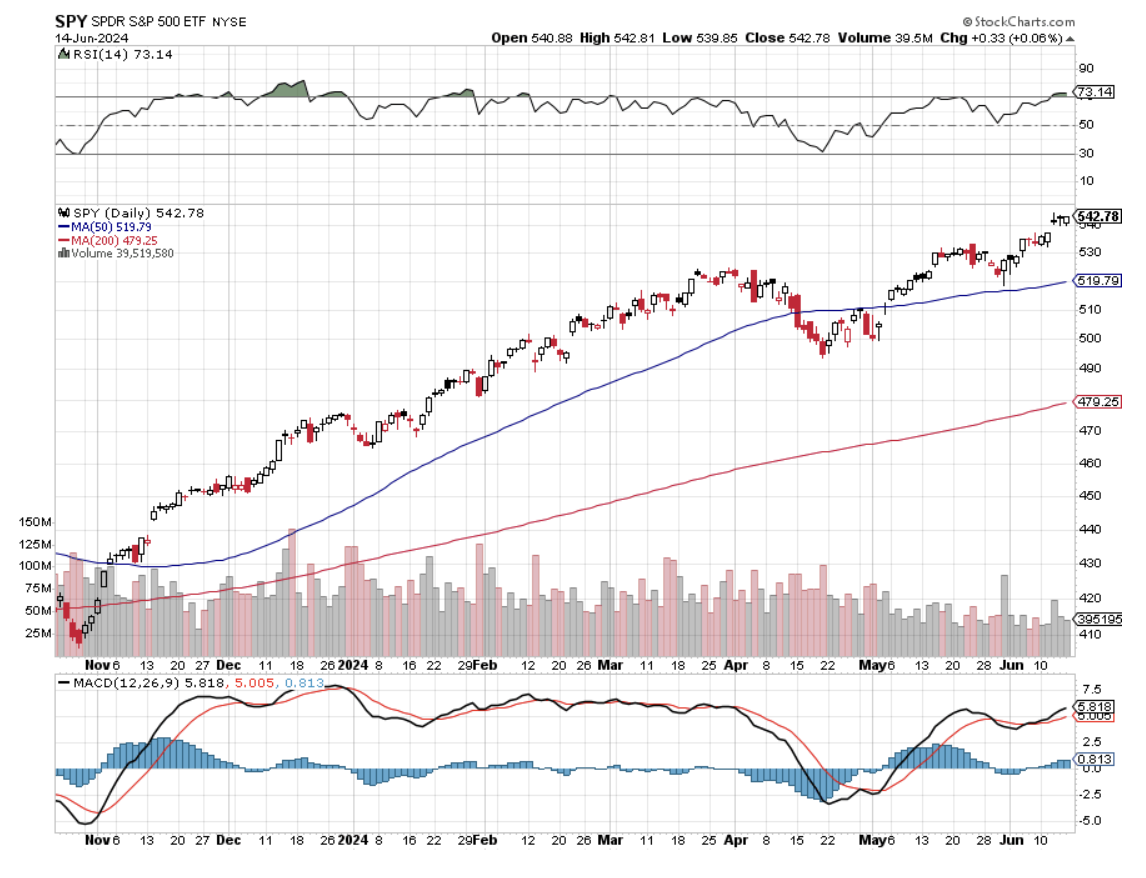

So far in June, we are up +1.04%. My 2024 year-to-date performance is at +19.39%. The S&P 500 (SPY) is up +13.83% so far in 2024. My trailing one-year return reached +36.31%.

That brings my 16-year total return to +696.02%. My average annualized return has recovered to +51.56%.

As the market reaches higher and higher, I continue to pare back risk in my portfolio. I stopped out of my near-money gold position (GLD) at close to breakeven because we were getting too close to the nearest strike price.

Some 63 of my 70 round trips were profitable in 2023. Some 29 of 38 trades have been profitable so far in 2024, and several of those losses were really break-even.

Fed Leaves Rates Unchanged at 5.25%-5.5% but reduces the cuts by March from three to one, citing an inflation rate that remains elevated. The projections were very hawkish, and the markets sold off on the news.

CPI Comes in Cool, unchanged MOM and 3.4% YOY. The May Nonfarm Payroll Report out Friday was an anomaly. It’s game on once again.

Europe Imposes Stiff Tariff on Chinese EVs, up to 38.1%. Daimler Benz, BMW, and Fiat have to be protected or they will go out of business.

The Gold Rush Will Continue through 2024, as much of Asia is still accumulating the yellow metal. Asia lacks the stock market we here in the US enjoy. A global monetary easing is at hand.

Broadcom (AVGO) Announces a 10:1 Split, and the shares explode to the upside. Earnings were also great. I actually predicted this in my newsletter last week and again at my Wednesday morning biweekly strategy webinar. The split takes place on July 15. Split fever continues. Buy (AVGO) on dips.

Apple (AAPL) Soars to New All-Time High, over $200 a share for the first time. However, it is now only the third largest company in the world, losing first place to (NVDA) and (MSFT). Analysts piled up the benefits of pitching AI to one billion preexisting customers. Just don’t tell Elon Musk.

Dollar Hits One Month High, on soaring interest rates spinning out from the super-hot May Nonfarm Payroll Report. This may be your last chance to sell at the highs. Never own a currency with falling interest rates. Just look at the Japanese yen.

Stock Buybacks Hit $242 Billion in Q1, but a new 1% tax may slow down the activity. The tax was passed as part of the Inflation Reduction Act in 2022 and is retroactive to January 1, 2023. (AAPL), (DIS), (CVX), (META), (GS), (WFC), and (NVDA) were the big buyers.

Home Equity Hits All-Time High at $17 Trillion according to CoreLogic. About 60% of homeowners have a mortgage. Their equity equals the home’s value minus outstanding debt. Total home equity for U.S. homeowners with and without a mortgage is $34 trillion. That is a lot of cash that could potentially end up in the stock market.

Home Prices to Keep Rising says Redfin CEO. While experts are forecasting more homes will be available, they said the boost in supply is not enough to solve affordability issues for buyers. Interest rates are expected to come down, but not by enough to counteract high prices.

Elon Musk Wins his $56 Billion Pay Package after a shareholder vote where retail investors came to his rescue. Institutional investors like CalPERS were overwhelmingly against it. It didn’t help that Elon moved Tesla to Texas. State pension funds always show a heavy bias in favor of local companies. Luck for California teachers includes (NVDA), (AAPL), (GOOGL), and (SMCI). (TSLA) rose 4% on the news.

The Gold Rush Will Continue through 2024, as much of Asia is still accumulating the yellow metal. Asia lacks the stock market we here in the US enjoy. A global monetary easing is at hand.

US Homes Sales Fall, down 1.7% month-over-month in May on a seasonally adjusted basis and dropped 2.9% from a year earlier. Median home sale price rose to a record high of $439,716, up 1.6% month-over-month and 5.1% year-over-year.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, June 17, the New York Empire State Manufacturing Index is released.

On Tuesday, June 18 at 7:00 AM EST, Retail Sales are published.

On Wednesday, June 19, the first-ever Juneteenth holiday where the stock market is closed. Juneteenth celebrates the date when the slaves in Texas were freed in 1866, the last to do so.

On Thursday, June 20 at 8:30 AM, the Weekly Jobless Claims are announced. We also get Building Permits.

On Friday, June 21 at 8:30 AM, the Existing Home Sales are announced.

At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, as I am about to embark on Cunard’s Queen Elisabeth from Vancouver Canada on the Mad Hedge Seminar at Sea, I thought I’d recall some memories from when I first visited there 54 years ago.

Upon graduation from high school in 1970, I received a plethora of scholarships, one of which was for the then astronomical sum of $300 in cash from the Arc Foundation, whoever they were.

By age 18, I had hitchhiked in every country in Europe and North Africa, more than 50. The frozen wasteland of the North and the Land of Jack London and the northern lights beckoned.

After all, it was only 4,000 miles away. How hard could it be? Besides, oil had just been discovered on the North Slope and there were stories of abundant high-paying jobs.

I started hitching to the Northwest, using my grandfather’s 1892 30-40 Krag & Jorgenson rifle to prop up my pack and keeping a Smith & Wesson .38 revolver in my coat pocket. Hitchhikers with firearms were common in those days and they always got rides. Drivers wanted the extra protection.

No trouble crossing the Canadian border either. I was just another hunter.

The Alcan Highway started in Dawson Creek, British Columbia, and was built by an all-black construction crew during the summer of 1942 to prevent the Japanese from invading Alaska. It had not yet been paved and was considered the great driving challenge in North America.

One 20-mile section of road was made out of coal, the only building material then available, and drivers turned black after transiting on a dusty day. I’ll never forget the scenery, vast mountains rising out of endless green forests, the color of the vegetation changing at every altitude.

The rain started almost immediately. The legendary size of the mosquitoes turned out to be true. Sometimes, it took a day to catch a ride. But the scenery was magnificent and pristine.

At one point a Grizzley bear approached me. I let loose a shot over his head at 100 yards and he just turned around and lumbered away. It was too beautiful to kill.

I passed through historic Dawson City in the Yukon, the terminus of the 1898 Gold Rush. There, abandoned steamboats lie rotting away on the banks, being reclaimed by nature. The movie theater was closed but years later was found to have hundreds of rare turn-of-the-century nitrate movie prints frozen in the basement, a true gold mine. Steven Spielberg paid for their restoration.

Eventually, I got a ride with a family returning to Anchorage hauling a big RV. I started out in the back of the truck in the rain, but when I came down with pneumonia, they were kind enough to let me move inside. Their kids sang “Raindrops keep falling on my head” the entire way, driving me nuts. In Anchorage they allowed me to camp out in their garage.

Once in Alaska, there were no jobs. The permits required to start the big pipeline project wouldn’t be granted for four more years. There were 10,000 unemployed.

The big event that year was the opening of the first McDonald’s in Alaska. To promote the event, the company said they would drop dollar bills from a helicopter. Thousands of homesick showed up and a riot broke out, causing the stand to burn down. It was rumored their burgers were made of much cheaper moose meat anyway.

I made it all the way to Fairbanks to catch my first sighting of the wispy green contrails of the northern lights, impressive indeed. Then began the long trip back.

I lucked out by catching an Alaska Airlines promotional truck headed for Seattle. That got me free ferry rides through the inside passage. The driver wanted the extra protection as well. The gaudy, polished cruise destinations of today were back then pretty rough ports inhabited by tough, deeply tanned commercial fishermen and loggers who were heavy drinkers and always short of money. Alcohol features large in the history of Alaska.

From Seattle, it was just a quick 24-hour hop down to LA. I still treasure this trip. The Alaska of 1970 no longer exists, as it is now overrun with summer tourists. It now has 27 McDonald’s stands.

And with runaway global warming the climate is starting to resemble that of California than the polar experience it once was. Permafrost frozen for thousands of years is melting, causing the buildings among them to sink back into the earth.

It was all part of life’s rich tapestry.

The Alcan Highway Midpoint

The Alaska-Yukon Border in 1970

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 22, 2024

Fiat Lux

Featured Trade:

(MARCH 20 BIWEEKLY STRATEGY WEBINAR Q&A),

(DIS), (GLD), (BITB), (UUP), (FXY), (F), (TSLA), (NVDA), (FCX), (UNG), (TLT), (MCD)

Global Market Comments

August 26, 2022

Fiat Lux

Featured Trade:

(AUGUST 24 BIWEEKLY STRATEGY WEBINAR Q&A),

(UNG), (AAPL), (MU), (AMD), (NVDA),

(META), (VIX), (MCD), (UBER)

Below please find subscribers’ Q&A for the August 24 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: I’ve heard another speaker say that we are not heading for a Roaring Twenties; instead, we are heading for a Great Depression. Who is right?

A: There are many different possible comments to this. Number one, in the newsletter business, the easiest way to make money is to predict the Great Depression and panic people. Stock market Gurus have been predicting the next Great Depression for all of the 54 years that I have been in the financial markets. We’ve gone through a whole series of Dr. Doom's over this time. We had Nouriel Roubini, we had Henry Kaufman, and before that, there was Joe Granville who predicted Dow 300 when the Dow was at 600 and never gave up. The reason is very simple: the people making these dire forecasts are based in depressionary places. If you live in Puerto Rico, or Ukraine, or Europe, it’s easier to be depressed right now, because the economy is falling to pieces. If you live in Silicon Valley, like I do, and you see these incredible technologies delivering every day, it’s easy to be bullish about the future. So, that is another part of it. On top of that, we’ve just had a recession. And even during this last recession, earnings continued to grow at 5% for the main market, and 20-30% for individual technology companies. The market goes up 80% of the time so if you’re bullish, you’re right 80% of the time. In fact, that may increase going into the future because we just had six months of down days behind us.

Q: How do you know when to buy?

A: Well, I have about 100 different market indicators that I look at, but my favorite one is the Volatility Index (VIX). The (VIX) is the perfect contrary indicator because when fear is high the payoff for taking on risk is huge. The risk/reward swings overwhelmingly in your favor. The simplest indicators are usually the best ones. When (VIX) gets to $30—I don’t think I’ve ever lost money in my life adding on a new trade with (VIX) at $30. If I add positions with the (VIX) at under $30, the loss rate goes up; so, I’m inclined to only do trades when the (VIX) gets close to $30. If that means doing nothing for a month, that’s fine with me. If telling you to stay out of the market makes more money than getting you into the market, I’ll keep you out of the market. I’m not a broker so, I don’t get paid commission; I get paid to give you the highest annual returns so you’ll renew because I only get paid if you renew. Our renewal rate is about 80% these days, and the other 20% either die or retire.

Q: What about the Tesla (TSLA) 3:1 split?

A: In the short term I would stand back and do nothing because you often get a “buy the rumor sell the news” selloff in stocks after splits. Long term, Tesla is a strong buy; short term, we are up close to 60% in a couple of months. Betting that Tesla would rise going into this split was one of the most successful trades that I’ve ever done.

Q: Did you know Julian Robertson?

A: Yes, I did. Julian was one of the first investors in my hedge fund, and then he was one of the first buyers of my Mad Hedge newsletter. He was also my first concierge client. He had one heck of a temper; if you didn’t know your stuff cold, he would just absolutely blow up at you. But he did tend to surround himself with geniuses. He drew on Morgan Stanley people a lot, so I knew a lot of the tiger cubs. But he certainly knew stocks, and he knew markets.

Q: What do we do on the SPDR S&P 500 ETF (SPY) position?

A: Just run it into expiration. As it is my only position, I don’t really have anything else to do and I don’t really see any explosive upside moves in markets this month. And then after that, we will be 10 days to expiration; so there may be enough profit there at that time.

Q: As a long-term investor, should I take Tesla profits now?

A: If you're really a long-term investor and sell now, you’ll miss the move to $10,000. However, if you’re a trader, you should take some profits now and look to buy and scale in down $50 and more down $100, and so on, depending on what the market does.

Q: What are your thoughts on Nvidia Corporation (NVDA) and semis?

A: When recession fears exist, you will have sharp downturns in the semis, because this is the most volatile sector in the market. However, in the long term in Nvidia you might be looking at a 20% of downside, and 200% of upside on a three-year view. It just depends on how much pain you want to take while keeping your long-term position.

Q: Why is September typically the worst month of the year for stocks?

A: You need to go back 120 years when farmers accounted for 50% of the US population. In the farming business, September/October is your maximum stress point, because you’ve put out all your money for seed, for water, for fertilizer, but you don’t get paid until you sell your crop in September/October. That creates a point of maximum stress—when farmers have to max out the loans from the banks, and that creates cascading stresses in the financial system. That’s why almost every stock market crash happened in October. And of course, since that cycle started, it has become a self-fulfilling prophecy to this day. Even though only 2% of the population is in farming now, that selloff in September/October is still there. There’s no real current reason behind it.

Q: How do you find good spreads?

A: You find a good stock first, then a good chart, and then wait for the market to come to you with a high Volatility Index (VIX) with a good micro and macro tailwind. It’s that simple.

Q: Do you think healthcare will sell off once the recession fear is gone?

A: It may not because it had a massive selloff across the entire industry when COVID went away. They've taken that COVID hit. That's a recession if you’re a healthcare company. Now COVID is essentially gone, so they haven’t got it left to lose. In the meantime, technology continues to hyper-accelerate in the healthcare area, just in time for old people like me.

Q: How would you invest $1 million in a retirement portfolio today?

A: Call me—that’s a longer conversation. Or better yet, sign up for the concierge service, and we can talk as long as you want.

Q: Any hope for Facebook (META)?

A: No, when you’re advertising that you’re going to lose money and that you’re not going to make money for five years, that’s bad for the stock. I’m sorry Mr. Zuckerberg, but you should have taken those financial markets classes instead of just doing the programming ones.

Q: Will Powell be dovish or hawkish in his speech?

A: I think he has to go hawkish because he needs to justify the next interest rate hike in September. That’s why I’m 90% cash. The market is set up here not to take disappointments on top of a 4,000-point rally in two months. It’s very sensitive to disappointment, so it’s a good time to be in cash.

Q: What stocks go down the most if we get a 5-10% correction?

A: Semiconductors. Nvidia (NVDA), Advanced Micro Devices (AMD), Micron Technology (MU) are your high beta stocks. Having said that, those are the ones you want to buy at market bottoms. I’ve caught many doubles on Nvidia over the years just using that strategy. When you’ve had a horrible market, you want to go for the highest beta stocks out there, and those are the semis. Plus, semis have a long-term undercurrent of always making more money, always improving their products, always increasing market shares. So, you want to invest with tailwinds behind you all the time. 30 years ago, a new car needed ten chips. Now they need 100. That accelerates exponentially as the entire auto industry goes EV.

Q: What’s your opinion on Lithium companies?

A: You know, I haven’t really done much in this area because it is a basic commodity. The profit margins are minimal, there is no Lithium shortage in the world like there is an oil shortage. Plus, no one has a secret method of mining Lithium that is more profitable than another. No one has an advantage.

Q: Is there a logical maximum number of stocks to have in a share portfolio?

A: I keep mine at ten. You should be able to cover every good sector in the market with ten. When I talk to new concierge customers and review their portfolios, one of the most common mistakes is they own too many stocks – there can be 50, 100, 200 stocks, even several gold stocks. And you never want to own more than you can follow on a daily basis. It’s better to follow ten stocks very closely than 100 stocks just occasionally.

Q: How low do you think Apple (APPL) will go on this dip?

A: Minimum 10%, maybe 20%. Just depends on how weak the market will go in this correction.

Q: What was your defensive plan when you sold short Tesla puts?

A: If they got exercised against me and the Tesla shares were sold to me at my strike price, I was going to take the stock, then let the stock rally. If my long-term view for Tesla is $10,000, it’s not such a problem having a $500 put exercise against you—you just take the stock and run the stock. That was always the strategy. Never sell short more puts than you can take delivery of in the stock. Your broker won’t let you do it anyway to protect themselves.

Q: Do you think we could get a strong rally on the next CPI report?

A: Yes. The report is due out on September 13. But some of a sharp drop in the CPI in the next report is already in the market, so don’t expect another 2,000-point stock market rally like we got last time. It’ll be a much lesser move and after that, we’ll need to see more data. We may get 1,000 points out of it, probably not much more. After that, the November midterm election becomes the dominant factor in the market.

Q: When is natural gas (UNG) going to roll over?

A: When the Ukraine War ends, and that day is getting closer and closer. I think it’ll be sometime in 2023. And if you get an end to the war (and the resumption of Russian supplies is not necessarily a sure thing) you’d get a move in natgas from $9 down to $2. So, that’s why I’m very cautiously avoiding energy plays right now. The big money has been made; next to happen is that the big money gets lost.

Q: What are your thoughts on Florida’s pension fund now banning ESG stocks? I live on Florida state pension fund payments.

A: You might start checking out other income opportunities, like becoming an Uber (UBER) driver or working at MacDonalds (MCD). What the Florida governor has done is ban the pension fund from the sector that is most likely to go up over the next ten years and restricted them to the sector (oil) which is most likely to go down. That is very bad for Florida’s pension fund and any other pension funds that follow them. And I’ve seen this happen before, where a pension fund gets politicized, and it’s 100% of the time a disaster. Governors aren't great market timers; politicians are terrible at making market calls. There are too many examples to name. ESG stocks were one of the top performing sectors of the market for 5 years until we got the pandemic crash. So, that is an awful idea (and one of the many reasons I don’t live in Florida besides hurricanes, humidity, alligators, and the Bermuda Triangle).

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, or BITCOIN LETTER, whichever applies to you, then select WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

June 2, 2022

Fiat Lux

Featured Trade:

(WHY WATER WILL SOON BE WORTH MORE THAN OIL),

(CGW), (PHO), (FIW), (VE), (TTEK), (PNR), (BYND), (MCD)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.