Global Market Comments

March 4, 2022

Fiat Lux

Featured Trade:

(MARCH 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (TSLA), (FCX), (JPM), (BAC), (MS), (TLT),

(TBT),(BA), UPS (UPS), (CAT), (DIS), (DAL),

(GOLD), (VIX), (VXX), (CAT), (BA)

Global Market Comments

March 4, 2022

Fiat Lux

Featured Trade:

(MARCH 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(QQQ), (TSLA), (FCX), (JPM), (BAC), (MS), (TLT),

(TBT),(BA), UPS (UPS), (CAT), (DIS), (DAL),

(GOLD), (VIX), (VXX), (CAT), (BA)

Below please find subscribers’ Q&A for the March 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: Do you think Vladimir Putin will give up?

A: He will either be forced to give up, run out of resources/money, or he will suddenly have an accident. When the people see their standard of living go from a per capita income of $10,000/year today to $1,000—back to where it was during the old Soviet Union—his lifespan will suddenly become very limited.

Q: Would you be buying Invesco Trusts (QQQs) on dips?

A: I think we have a few more horrible days—sudden $500- or $1,000-point declines—but we’re putting in a bottom of sorts here. It may take a month or two to finalize, but the second buying opportunity of the decade is setting up; of course, the other one was two years ago at the pandemic low. So, do your research, make your stock picks now, and once we get another absolute blow-up to the downside, that is your time to go in.

Q: Materials have gone up astronomically, are they still a buy?

A: Yes, on dips. I wouldn't chase 10% or 20% one-week moves up here—there are too many other better trades to do.

Q: Is it time to go long aggressively in Europe?

A: No, because Europe is going to experience a far greater impact economically than the US, which will have virtually none. In fact, all the impacts on the US are positive except for higher energy prices. So, I think Europe will have a much longer recovery in the stock market than the US.

Q: Would you take a flier on a Russian ETF (RSX)?

A: No, most, if not all, of them are about to be delisted because they have been banned or the liquidity has completely disappeared. The (RSX) has just collapsed 85%, from $26 to $4. Virtually all of Russia is for sale, not only stocks, bonds, junk bonds, ETFs, but also joint ventures. ExxonMobil, Shell and BP are all dumping their ownership of Russian subsidiaries as we speak.

Q: Time for a Freeport-McMoRan (FCX) LEAP?

A: No, November was the time for an (FCX) LEAP—we’ve already had a massive run now, up 66% in five months, so wait for the next dip. The next LEAPS are probably going to be in technology stocks in a few months.

Q: My iShares 20 Plus Year Treasury Bond ETF (TLT) call $130 was assigned, What should I do?

A: Call your broker immediately and tell them to exercise your 127 to cover your short in the 130. They usually charge a few extra fees on that because they can get away with it, but you’ve just made the maximum profit on the position. If you haven’t been exercised yet, that 127/130 call spread will expire at max profit in 10 days.

Q: What if I get my short side called away on a position?

A: Use your long side calls to execute immediately to cover your short side. These call spreads are perfectly hedged positions, same name, same maturity, same size, just different strike prices. If your broker doesn’t hear from you at all, they will just exercise the short call and leave you long the long call, and that can lead to a margin call. So the second you get one of these calls, contact your broker immediately and get out of the position.

Q: Is it safe to put 100% of your money in Tesla (TSLA) for the long term?

A: Only if you can handle a 50% loss of your money at any time. Most people can't. It’s better to wait for Tesla to drop 50%, which it has almost done (it’s gotten down to $700), and then put in a large position. But you never bet all your money on one position under any circumstances. For example, what if Elon Musk died? What would Tesla’s stock do then? It would easily drop by half. So, I’ll leave the “bet the ranch trades” for the younger crowd, because they’re young enough to lose all their money, start all over again, and still earn enough for retirement. As for me, that is not the case, so I will pass on that trade. You should pas too.

Q: Do you foresee NASDAQ (QQQ) being up 5-10% or 10-20% by year-end?

A: I do actually, because business is booming across tech land, and the money-making stocks are hardly going down and will just rocket once the rotation goes back into that sector.

Q: We could see an awful earnings sequence in April, which could put in the final bottom on this whole move.

A: That is right. We need one more good capitulation to get a final bottom in, and then we’re in LEAP territory on probably much of the market. We know we’re having a weak quarter from all the anecdotal data; those companies will produce weak earnings and the year-on-year comparisons are going to be terrible. A lot of companies will probably show down turns in earnings or losses for the quarter, that's all the stuff good bottoms are made out of.

Q: What should we make of the Russian threats of WWIII going Nuclear?

A: I think if Putin gave the order, the generals would ignore it and refuse to fire, because they know it would mean suicide for the entire country. Mutual Assured Destruction (MAD) is still in place, and it still works. And by the way, it hasn’t been in the media, but I happen to know that American nuclear submarines with their massive salvos of MIRVed missiles, have moved much closer to Russian waters. So, you're looking at a war that would be over in 15 minutes. I think that would also be another scenario in which they replace Putin: if he gives such an order. This has actually happened in the past; people without top secret clearance don’t know this but Boris Yeltsen actually gave an order to launch nuclear missiles in the early 90s when he got mad at the US about something. The generals ignored it, because he was drunk. And something else you may not know is that 95% of the Russian nuclear missiles don’t work—they don’t have the GDP to maintain 7,000 nuclear weapons at full readiness. Plutonium is one of the world’s most corrosive substances and very expensive to maintain. Only a wealthy country like the US could maintain that many weapons because it’s so expensive. So no, you don’t need to dig bomb shelters yet, I think this stays conventional.

Q: Banks like (JPM), (BAC), AND (MS) are at a low—are they a buy?

A: Yes, but not yet; wait for more shocks to the system, more panic selling, and then the banks are absolutely going to be a screaming buy because they are on a long-term trend on interest rates, strong economy, lowering defaults—all the reasons we’ve been buying them for the last year.

Q: Should I short bonds or should I buy Freeport up 60%?

A: Short bonds. Next.

Q: Should I buy Europe or should I short bonds?

A: Short bonds. That should be your benchmark for any trade you’re considering right now.

Q: How much and how quickly will we see a collapse in defense stocks?

A: Well, you may not see a collapse in defense stocks, because even if Russia withdraws from Ukraine, they still are a newly heightened threat to the West, and these increases in defense spending are permanent. That’s why the stocks have gone absolutely ballistic. Yeah sure, you may give up some of these monster gains we’ve had in the last week, but this is a dip-buying sector now after being ignored for a long time. So yes, even if Russia gives up, the world is going to be spending a lot more on defense, probably for the rest of our lives.

Q: Just to confirm, LEAP candidates are Boeing (BA), UPS (UPS), Caterpillar (CAT), Disney (DIS), Delta Airlines (DAL)?

A: I would say yes. You may want to hold off, see if there’s one more meltdown to go; or you can buy half now and half on either the next meltdown or the melt-up and get yourself a good average position. And when I say LEAPS, I mean going out at least a year on a call spread in options on all of these things.

Q: Is $143 short safe on the (TLT)?

A: Definitely, probably. In these conditions, you have to allow for one day, out of the blue, supers pikes of $3 like we got last week, or $5 trins week, only to be reversed the next day. The trouble is even if it reverses the next day, you’re still stopped out of your position. So again, the message is, don’t be greedy, don’t over-leverage, don’t go too close to the money. There’s a lot of money to be made here, but not if you blow all your profits on one super aggressive trade. And take it from someone who’s learned the hard way; you want to be semi-conservative in these wild trading conditions. If you do that, you will make some really good money when everyone else is getting their head handed to them.

Q: Would you go in the money or out of the money for Boeing (BA) and Caterpillar (CAT)?

A: It just depends on your risk tolerance. The best thing here is to do several options combinations and then figure out what the worst-case scenario is. If you can handle that worst-case scenario without stopping out, do those strikes. These LEAPS are great, unless you have to stop out, and then they will absolutely kill you. And usually, you only do these with sustained uptrends in place; we don’t have that yet which is why I’m saying, watch these LEAPS. Don’t necessarily execute now, or if you do, just do it in small pieces and leg in. That is the smart answer to that.

Q: What’s the probability that the CBOE Volatility Index (VIX) makes a new high in the next 2 weeks?

A: I give it 50/50.

Q: Call options on the VIX?

A: No, that’s one of the super high-risk trades I have to pass on.

Q: How low can the VIX go down this month?

A: High ten’s is probably a worst-case scenario.

Q: LEAPS on Barrick Gold Corporation (GOLD)?

A: No, that was a 3-month-ago trade. Now it’s too late, never consider a LEAP at an all-time high or close to it.

Q: Time to short oil?

A: Not yet. We have some spike top going on in oil. It’s impossible to find the top on this because, while bottoms are always measurable with PE multiples and such, tops are impossible to measure because then you’re trying to quantify human greed, which can’t be done. So yeah, I would stand by; it’s something you want to sell on the way down. This is the inverse of catching a falling knife.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 4, 2022

Fiat Lux

Featured Trades:

(FEBRUARY 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(PYPL), (PLTR), (BRKB), (MS), (GOOGL), (ROM), (MSFT), (ABNB), (VXX), (X), (FCX), (BHP), (USO), (TSLA), (EDIT), (CRSP)

Below please find subscribers’ Q&A for the February 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, Nevada.

Q: Thoughts on Palantir Technologies Inc. (PLTR)?

A: Well, we got out of this last summer at $28 because the CEO said he didn’t care what the share price does, and when you say that, the market tends to trash your stock. But Palantir is also in a whole sector of small, non-money-making, expensive stocks that have just been absolutely slaughtered. And of course, PayPal (PYPL) takes the prize for that today, down 25% and 60% from the top. So, we’re giving up on that whole sector until proven otherwise. Until then, these things will just keep getting cheaper.

Q: Given the weakness in January, do you think we still have to wait until the second half of the year for a viable bottom?

A: Definitely, maybe. If things are going to happen, they are going to happen fast; we got the January selloff, but that’s nowhere near a major selloff of 20%. And the fact is, the economy is still great so that’s why this is a correction, not a bear market. At some point, you want to buy into this, but definitely not yet; I think we take another run at the lows again sometime this month. We just have to let all the shorts come out and take their profits so they can reestablish again.

Q: Why are bank stocks struggling?

A: A lot of the interest rate rises that we’re getting now were already discounted last year—banks had a great year last year—so they were front running that move, which is finally happening. To get more moves out of banks, you’re going to have to get more interest rate rises, which we will get eventually. We still like the banks long term, we still like financials of every description, but they are taking a break, especially on the “sell everything” index days. A lot of the recent selling was index selling—banks have a heavy weighting in the index, about 15%. So, they will go down, but they will also be the ones that come back the fastest. We’re seeing that in some of the financials already, like Berkshire Hathaway (BRKB) and Morgan Stanley (MS) which are both close to all-time highs now.

Q: What about the situation with Russia and Ukraine?

A: It’s all for show. This is a situation where both the US and Russia need a war, or threat of a war, because the leaders of both countries have flagging popularity. Wars solve those problems—that’s why we have so many of them by the United States. We’ve been at war essentially for most of the last 40 years, ever since Ronald Reagan came in.

Q: I didn’t exit my big tech positions before the crash, should I just hang onto them at this point?

A: The big ones—yes. The Apples (AAPL), the Googles (GOOGL), the Amazons (AMZN) —they’re only going to drop about 20% at the most, maybe 25%, and then they’ll go to new highs, probably before the end of the year. If you’re good enough to get out and get back in again on a 20% move, go for it. But most people can’t do that unless they’re glued to their screens all day long. So, if you have stock, keep the stock; if you have options, get out of the options, because there the time decay will wipe you out before a turnaround can happen. This is not an options environment, unless you’re playing on the short side in the front month, which is what we’re doing.

Q: When you send out the trade alerts, I have a hard time getting them executed. How do you advise?

A: Move the strike price, go out in maturity, and you can get our prices at slightly higher risk. Or, just leave it and, quite often, people’s limit orders get done at the end of the day when the algorithms have to dump their positions at the close because they’re not allowed to carry overnight positions. Also, even if you get half of my trade alerts, you’re doing pretty good—we’re running at a 23% rate in 6 weeks, or 200% annualized. And remember, when I send out a trade alert, you’re not the only one trying to get in there, so you can even go onto a similar security. If I recommend Alphabet (GOOGL), consider going over to Microsoft (MSFT), because they all tend to move together as a group.

Q: I am sitting on a 16% profit in the ProShares Ultra Technology (ROM), which you recommended. Should I take the money and run, and get back in at a lower price?

A: Yes, this is just a short covering rally in a longer-term correction, and you make the money on the volume. You win games by hitting lots of signals, not hanging on to a few home runs where people usually strike out.

Q: You said inflation will be short lived, so why would there be 9 interest rates after the initial 4?

A: It’s going to take us 8 interest rates just to get us back to the long-term average interest rate. Remember the last 2% is totally artificial and only happened because there was a financial crisis 13 years ago. So, to normalize rates you really need to get overnight rates back up to about 3.0%. And that means 12 interest rate hikes. If you don’t do that, you risk inflation going from controllable to uncontrollable, and that is the death of the Fed. So, that’s why I expect a lot more interest rate rises.

Q: Will the tension between Russia and the Ukraine affect the market?

A: No, it hasn’t so far and I don’t expect it to. Although, it’s hard to imagine going through all of this and not seeing a shot fired. When that one shot gets fired, then maybe you get a down-500-point day, which it then makes back the next day.

Q: Anything to do with Alphabet (GOOGL) announcing its 20 to one split?

A: No, it’s too late. We had a trade alert out on a Google 20 call spread which we actually took profits on this morning. So, nice win for the Mad Hedge Technology Letter there. There’s nothing to do with these splits, it’s not like they’re going to un-announce it, this isn’t a risk-arbitrage situation where there’s always an antitrust risk hovering over the deal that may crash it. This is pretty much a done deal and doesn’t even happen until July 1. People think bringing the share price from $3,000 down to $150 makes it available for a lot more potential retail buyers, which it does. It also makes call spreads on the options a lot cheaper too. When we put out these alerts, we can only do one or two contracts, even tying up $10,000—divide that by 20 and all of a sudden your cheapest Google call spread cost $500 instead of $10,000.

Q: Can you speak about the liquidity on your strikes? Sometimes we’re trading against strikes that have no open interest.

A: Whenever you put in an order for one strike, even if there’s nothing outstanding on that strike, algorithms will arbitrage against that strike—where your order is—against all the other strikes on the whole options chain. So, don’t worry if you have limited open interest or no open interest on our trade alerts. They will get done, and it may get done by some algorithm or some market maker taking more of another strike, that’s how these things get done. It’s all thanks to the magic of computers.

Q: Do you have thoughts about Freeport-McMoRan (FCX)? I have some profitable LEAP positions open.

A: It’ll go higher, keep them. And I like the whole commodity space, which means iron ore (BHP), copper, steel (X), etc.

Q: Would you trade Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) at this point?

A: No, because we’re dead in the middle of the recent range. That’s a horrible place to enter—you only enter (VXX) on extremes on the upsides and the downside.

Q: What should I do about Airbnb (ABNB) at this price? They’ve been profitable for 2-3 years, with revenues rising.

A: I think Airbnb is one of the best run companies in the world, and I expect their earnings to keep growing like crazy, especially once we get out of the pandemic. I am also a very frequent Airbnb user, having stayed in Airbnb’s in at least 10 countries, so I’m a big fan of them. The stock just got dragged down by the small tech bust but it will come back. This is a “throwing the baby out with the bathwater” situation.

Q: Are there any good LEAPS candidates now?

A: I’m not doing any LEAPS until we reach the final cataclysmic selloff of the correction. Otherwise, the time value will run against you enormously; I’d rather wait for better prices.

Q: Do you see a cataclysmic selloff?

A: Yes, I do. Maybe in a few more weeks, and maybe next week if we get a really hot 8%+ inflation rate—that would really kill the market.

Q: What will tell you if inflation is ending or slowing labor?

A: Labor is 70% of the inflation calculation. So, when these huge pay awards slow down, that's when inflation slows down. By the way, a lot of pay increases that are happening now are catch-up from the last 40 years of no pay increases for American workers in real inflation adjusted terms. So, a lot of this is catch-up—once that’s done, you can forget about inflation. Also, the long-term pressure of technology on prices is downwards, so allow that to reignite deflation, and that will be your bigger issue over the long term.

Q: What should I do about Editas Medicine Inc (EDIT) or CRSPR Therapeutics AG (CRSP)?

A: Don’t touch the sector, it’s out of favor. Let this thing die a slow death. When they come up with profitable products, that’s when the sector recovers. So far, everything they have works in labs but there are no mass-produced Crispr products, they’re trying for mass production on sickle cell anemia and a couple of other things, but still very early days in CRSPR technology.

Q: When will this recording be posted?

A: In two hours, it will be posted on the website. Go to “My Account” and you’ll find the last 13 years of recorded webinars.

Q: What do you mean by “stand aside from Foreign Exchange”?

A: The volatility in the foreign exchange market is just so low compared to equities and bonds, it’s not worth trading right now. When you can trade everything in the world—foreign exchange is at the bottom of the list. If I see a good entry point, I’ll do a trade; but do I trade Tesla (TSLA) with a volatility of 100%, or foreign exchange with a volatility of 5%? Those are the choices.

Q: Should I do any short plays in oil (USO)?

A: Generally, you don’t want to short any commodity unless you're a professional; I say that having been short beef futures when Mad Cow Disease hit in 2003 and you had three limit-up days in a row in the futures market. That happens in the commodity areas—liquidity is so poor compared to stocks and bonds that if you get caught in one of these one-way moves, you can’t get out. So that is the risk; and I’ve known people who have gone bust trading oil both long and short, so this is for professionals only. With stocks you get vastly more data and information than you do in the commodity markets where industry insiders have a much bigger advantage.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy!

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Aga Sophia Mosque in Istanbul

Global Market Comments

November 19, 2021

Fiat Lux

Featured Trade:

(NOVEMBER 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(RIVN), (WMT), (BAC), (MS), (GS), (GLD), (SLV), (CRSP), (NVDA),

(BAC), (CAT), (DE), (PTON), (FXI), (TSLA), (CPER), (Z)

Below please find subscribers’ Q&A for the November 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from the safety of Silicon Valley.

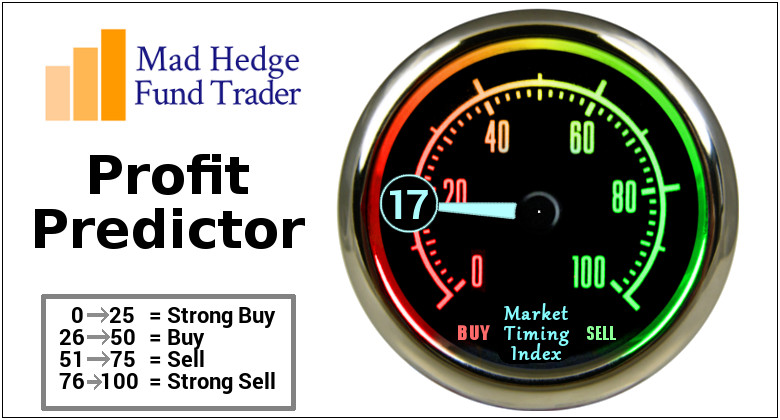

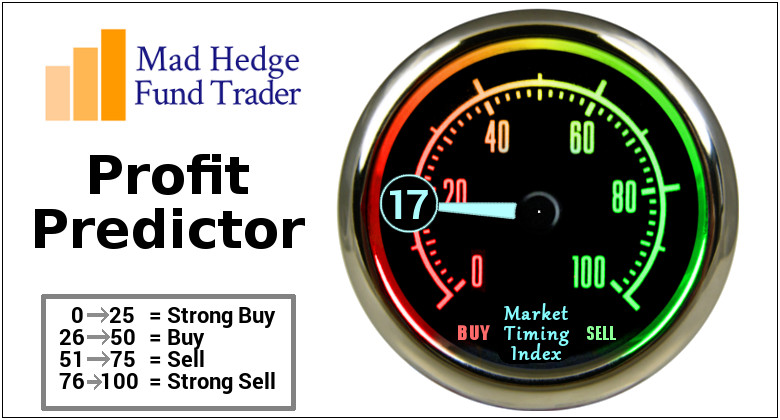

Q: Even though your trading indicator is over 80, do you think that investors should be 100% long stocks using the barbell names?

A: Yes, in a hyper-liquidity type market like we have now, we can spend months in sell territory before the indexes finally rollover. That happened last year and it’s happening now. So, we can chop in this sort of 50-85 range probably well into next year before we get any sell signals. Selling apparently is something you just do anymore; if things go down, you just buy more. It’s basically the Bitcoin strategy these days.

Q: What do you think about Rivian's (RIVN) future?

A: Well, with Amazon behind them, it was guaranteed to be a success. However, we mere mortals won't be able to buy any cars until 2024, and they have yet to prove themselves on mass production. Moreover, the stock is ridiculously expensive—even more than Tesla was in its most expensive days. And it’s not offering any great value, just momentum so I don’t want to chase it right here. I knew it was going to blow up to the upside when the IPO hit because the EV sector is just so hot and EVs are taking over the global economy. I will watch from a distance unless we get a sudden 40% drawdown which used to happen with Tesla all the time in the early days.

Q: Are you worried about another COVID wave?

A: No, because any new virus that appears on the scene is now attacking a population that is 80-90% immune. Most people got immunity through shots, and the last 10% got immunity by getting the disease. So, it’s a much more difficult population for a new virus to infect, which means no more stock market problems resulting from the pandemic.

Q: Is investing in retail or Walmart (WMT) the best way to protect myself from inflation?

A: It’s actually quite a good way because Walmart has unlimited ability to raise prices, which goes straight through to the share price and increases profit margins. Their core blue-collar customers are now getting the biggest wage hikes in their lives, so disposable income is rocketing. And really, overall, the best way to protect yourself from inflation is to own your own home, which 62% of you do, and to own stocks, which 100% of the people in this webinar do. So, you are inflation-protected up the wazoo coming to Mad Hedge Fund Trader. Not to mention we buy inflation plays like banks here.

Q: Why are financials great, like Bank of America (BAC)?

A: Because the more their assets increase in value, the greater the management fees they get to collect. So, it’s a perfect double hockey stick increase in profits.

*Interest rates are rising

*Rising interest rates increase bank profit margins

*A recovering economy means default rates are collapsing

*Thanks to Dodd-Frank, banks are overcapitalized

*Banks shares are cheap relative to other stocks

*The bank sector has underperformed for a decade

*With rates rising value stocks like banks make the perfect rotation play out of technology stocks.

*Cryptocurrencies will create opportunities for the best-run banks.

Q: Do you think the market is in a state of irrational exuberance?

A: Yes. Warning: irrational exuberance could last for 5 years. That’s what happened when Alan Greenspan, the Fed governor in 1996, coined that phrase and tech stocks went straight up all the way up until 2000. We made fortunes off of it because what happens with irrational exuberance is that it becomes more irrational, and we’re seeing that today with a lot of these overdone stock prices.

Q: Should I hold cash or bonds if you had to choose one?

A: Cash. Bonds have a terrible risk/reward right now. You’re getting like a 1% coupon in the face of inflation that's at 6.2%. It’s like the worst mismatch in history. In fact, we made $8 points on our bond shorts just in the last week. So just keep selling those rallies, never own any bonds at all—I don’t care what your financial advisor tells you, these are worthless pieces of paper that are about to become certificates of confiscation like they did back in the 80s when we had high inflation.

Q: What’s your yearend target for Nvidia (NVDA)?

A: Up. It’s one of the best companies in the world. It’s the next trillion dollar company, but as for the exact day and time of when it hits these upside targets, I have no idea. We’ve been recommending Nvidia since it was $50, and it’s now approaching $400. So that’s another mad hedge 20 bagger setting up.

Q: What about CRISPR Therapeutics (CRSP)?

A: The call spread is looking like a complete write-off; we missed the chance to sell it at $170, it’s now at $88. So, I’m just going to write that one-off. Next time a biotech of mine has a giant one-day spike, I am selling. What you might do though with Crisper is convert your call spread to straight outright calls; that increases your delta on the position from 10% to 40% so that way you only need to get a $20 move up in the stock price and you’ll get a break-even point on your long position. So, convert the spreads to longs—that’s a good way of getting out of failed spreads. You do not need a downside hedge anymore, and you’ll find those deep out of the money calls for pennies on the dollar. That is the smart thing to do, however, you have to put money into the position if you’re going to do that.

Q: Would you buy a LEAP in Tesla (TSLA) at this time?

A: No, it’s starting a multi-month topping out process, then it goes to sleep for 5 months. After it’s been asleep for 5 months then I go back and look at LEAPS. Remember, we had a 45% drawdown last year. I bet we get that again next year.

Q: Will inflation subside?

A: Probably in a year or so. A lot depends on how quickly we can break up the log jam at the ports, and how this infrastructure spending plays out. But if we do end the pandemic, a lot of people who were afraid of working because of the virus (that’s 5 or 10 million people) will come back and that will end at least wage inflation.

Q: When is the next Mad Hedge Fund Trader Summit?

A: December 7, 8, and 9; and we have 27 speakers lined up for you. We’ll start emailing probably next week about that.

Q: Are gold (GLD) and silver (SLV) getting close to a buy?

A: Maybe, unless Bitcoin comes and steals their thunder again. It has been the worst-performing asset this year. The only gold I have now is in my teeth.

Q: Morgan Stanley (MS) is tanking today, should I dump the call spread?

A: I’m going to see if we hold here and can close above our maximum strike price of $98 on Friday. But all of the financials are weak today, it’s nothing specific to Morgan Stanley. Let’s see if we get another bounce back to expiration.

Q: Where can I view all the current positions?

A: We have all of our positions in the trade alert service in your account file, and you should find a spreadsheet with all the current positions marked to market every day.

Q: What is the barbell strategy?

A: Half your money is in big tech and the other half is in financials and other domestic recovery plays. That way you always have something that’s going up.

Q: Is Elon Musk selling everything to avoid taxes from Nancy Pelosi?

A: Actually, he’s selling everything to avoid taxes from California governor Gavin Newsom—it’s the California taxes that he has to pay the bill on, and that’s why he has moved to Texas. As far as I know, you have to pay taxes no matter who is president.

Q: Will the price of oil hit $100?

A: I doubt it. How high can it go before it returns to zero?

Q: Is it time to buy a Caterpillar (CAT) LEAP?

A: We’re getting very close because guess what? We just got another $1.2 billion to spend on infrastructure. Not a single job happens here without a Caterpillar tractor or a tractor from Komatsu for John Deere (DE).

Q: Will small caps do well in 2022?

A: Yes, this is the point in the economic cycle where small caps start to outperform big caps. So, I'd be buying the iShares Russell 2000 ETF (IWM) on dips. That's because smaller, more leveraged companies do better in healthy economies than large ones.

Q: Is it too late to buy coal?

A: Yes, it’s up 10 times. The next big move for coal is going to be down.

Q: Peloton (PTON) is down 300%; should I buy here?

A: Turns out it’s just a clothes rack, after all, it isn't a software company. I didn’t like the Peloton story from the start—of course, I go outside and hike on real mountains rather than on machines, so I’m biased—but it has “busted story” written all over it, so don’t touch Peloton.

Q: Will spiking gasoline prices cause US local governments to finally invest in Subways and Trams like European cities, or is this something that will never happen?

A: This will never happen, except in green states like New York and California. A lot of the big transit systems were built when labor was 10 cents a day by poor Irish and Italian immigrants—those could never be built again, these massive 100-mile subway systems through solid rock. So if you want to ride decent public transportation, go to Europe. Unfortunately, that’s the path the United States never took, and to change that now would be incredibly expensive and time-consuming. They’re talking about building a second BART tunnel under the bay bridge; that’s a $20 billion, 20-year job, these are huge projects. And for the last five years, we’ve had no infrastructure spending at all, just lots of talk.

Q: Would Tesla (TSLA) remains stable if something happened to Elon Musk?

A: Probably not; that would be a nice opportunity for another 45% correction. But if that happened, it would also be a great opportunity for another Tesla LEAPS. My long-term target for the stock is $10,000. Elon actually spends almost no time with Tesla now, it’s basically on autopilot. All his time is going into SpaceX now, which he has a lot more fun with, and which is actually still a private company, so he isn’t restricted with comments about space like he is with comments about Tesla. When you're the richest man in the world you pretty much get to do anything you want as long as you're not subject to regulation by the SEC.

Q: How realistic is it that holiday gatherings will trigger a huge wave of COVID in the United States forcing another lockdown and the Fed to delay a rise in interest rates?

A: I would say there’s a 0% chance of that happening. As I explained earlier, with 90% immunity in much of the country, viruses have a much harder time attacking the population with a new variant. The pandemic is in the process of leaving the stock market, and all I can say is good riddance.

Q: What about the Biden meeting with President Xi and Chinese stocks (FXI)?

A: It’s actually a very positive development; this could be the beginning of the end of the cold war with China and China’s war on capitalism. If that’s true, Chinese stocks are the bargain of the century. However, we’ve had several false green lights already this year, and with stuff like Microsoft (MSFT) rocketing the way it is, I’d rather go for the low-risk high-return trades over the high-risk, high return trades.

Q: What’s your opinion of Zillow (Z)?

A: I actually kind of like it long term, despite their recent disaster and exit from the home-flipping business.

Q: Do you like copper (CPER) for the long term?

A: Yes, because every electric car needs 200 lbs. of copper, and if you’re going from a million units a year to 25 million units a year, that’s a heck of a lot of copper—like three times the total world production right now.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

An Old Fashioned Peloton (a Mountain)

Global Market Comments

November 17, 2021

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, NOVEMBER 19 OPTIONS EXPIRATION),

(GS), (MS), (BAC), (TLT), (ROM), (BRKB)

Happy and newly enriched followers of the Mad Hedge Fund Trader Alert Service have the good fortune to own a record ten deep-in-the-money options positions that expire on Friday, November 19 at the stock market close in two days.

I have to admit that I traded like a Wildman this month, pedal to the metal, and 100% invested. This will take our 2021 year-to-date performance to over 100% for the first time in our 14-year history. I like to think that is the end result of my 53 years of investment in researching trading strategies.

Sometimes, overconfidence works.

It is therefore time to explain to the newbies how to best maximize their profits.

These involve the:

(GS) 11/$330-$350 call spread 10.00%

(GS) 11/$385-$395 call spread 10.00%

(MS) 11/$85-$90 call spread 10.00%

(MS) 11/$95-$98 call spread 10.00%

(BAC) 11/$37-$40 call spread 10.00%

(BAC) 11/$43-$46 call spread 10.00%

(TLT) 11/$150-$153 put spread 10.00%

(ROM) 11/$105-$110 call spread 10.00%

(BRKB) 11/$275-$280 call spread 10.00%

(BRKB) 11/$277.50-$282.50 call spread 10.00%

Provided that we don’t have another 2,000-point move down in the market in the next two days, these positions should expire at their maximum profit points.

So far, so good.

I’ll do the math for you on our deepest in-the-money position, the Goldman Sachs (GS) November 19 $330-$350 vertical bull call spread, which I almost certainly will run into expiration. Your profit can be calculated as follows:

Profit: $20.00 expiration value - $16.50 cost = $3.50 net profit

(6 contracts X 100 contracts per option X $3.50 profit per options)

= $2,100 or 17.65% in 24 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning November 22 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and make your broker find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday, November 19. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next month end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

You Can’t Do Enough Research

Global Market Comments

November 15, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or PROFITING FROM INFLATION),

($INDU), (TLT), (TBT), (MS), (GS), (BAC), (BRKB), (TSLA)

Worried about inflation?

I’m not. That’s because I know how to trade inflation, which we had in spades during the 1970s when it reached a horrific 18% rate. Those who figured out the game early made fortunes. Those who didn’t got killed.

And what is the best protection against inflation? You own stocks and homes, as much as you can get your hands on.

That’s because in an inflationary environment, companies can raise their prices faster than the inflation rate, which they have been doing since the summer. That’s why we have just seen the best earnings quarter in recent memory and all-time high stock indexes.

Homes do well because there are still 85 million millennials chasing a housing stock that is easily short ten million homes and are given free money to chase prices upward.

I asked a local real estate agent when home prices would slow down and she answered, “it might slow down on Christmas eve and Christmas day, and after that, it will take off again.”

I think home prices will continue to rise for another decade, but not at this year’s ballistic rate.

What about impending rising interest rate, you may ask? They will rise but not enough to hurt either stocks or homes. The pandemic vastly accelerated technology, which we all know is the greatest price destroyer of all time. So, inflation will go up, but from zero to 3%-4%, not the 18% of yore.

And yes, prices are rising for the working classes, those least able to pay them. But the same minimum wage workers are getting the biggest pay hikes in history, up to 100% in some cases, more than offsetting inflation.

And while stocks and homes see rising inflation, bonds don’t. My feeling is that the bond market will stumble across it in the dark some nights and prices will crash. Bonds will keep ignoring inflation until they can’t. The bond vigilantes will then return with a vengeance and are doing their stretching exercises as we speak.

One of the odder things about the past week is that each of the three announcements heralding sharply higher inflation trigger sharp moves up in bonds when they were supposed to go down. That worked until Thursday when the worst 30-year Treasury bond auction since 1990 prompted a $5.00 selloff.

Another bizarre development is that call options are trading at greater premiums than put options, an exceedingly rare event. That means that the consensus for stocks is now almost universally up.

It also means that the at-the-money long-dated LEAPS call option spreads I have been pelting my Concierge members with have become massively profitable. Six months out you can earn eye-popping 100% returns, and 200% in some of the more volatile names, like (ROM) and (MSTR).

The bottom line is that goldilocks is moving in for the long term and might advance to senior citizenship on this watch.

That works for me, so I’m going on a long hike.

The $1.2 Trillion Infrastructure Budget Passes, adding another 6% in GDP growth for the next two years. Construction detours are about to break out all over the country, and the domestic recovery play is on fire. Lost along the way was $550 million in social spending. No increase in corporate taxes sets up a perfect storm for stocks the next several months. Stay fully invested as I begged you to do weeks ago.

The US Reopens, provided you have two Covid shots and a test within the last three days. Got to keep those pesky diseased foreigners out! Hotels, airlines, casinos, and cruise lines took off like a scalded chimp, taking the indexes to new all-time highs. Buy (ALK) and (LUV) on dips.

The Bitcoin Rally Continues, with new all-time highs for both (BITO) and (ETHE). Concerns about the monetary health of the US are rising ahead of a major debt ceiling fight in Congress in December.

Inflation Soars with a Red Hot 6.2% CPI Print in October, the highest in 31 years. Energy, rent, and car costs led the gains. Bitcoin (BITO) and Ethereum (ETHE) jumped to new all-time highs in response. This is only going to get better. You can now count on a Fed interest rate hike in June.

The Disappearing Worker Trend Continues, with a record 4.4 million quitting in September. Workers are taking advantage of the labor shortage to switch jobs for higher wages. This will get worse before it gets better. Good luck trying to hire anyone.

US Consumer Sentiment Hits Ten-Year Low, down from 71.7 to 68.6 in October, according to the University of Michigan. Inflation at a 30-year high 6.2% is starting to hit consumers hard.

Elon Musk Tesla Sales Top $5.1 billion, to pay off Uncle Sam. That must be one hell of a tax bill. At this rate, the market is rapidly running out of the sole seller. Buy (TSLA) on dips.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a massive +8.95% gain in October, followed by a decent 4.42% so far in November. My 2021 year-to-date performance moved to a new high of 92.97%. The Dow Average is up 18.00% so far in 2021.

After the recent ballistic move in the market, we got a week of consolidation which brought some generalized bitching, moaning, and wining.

I am continuing to run my longs in. Those include (MS), (GS), (BAC), (BRKB), and a short in the (TLT). The (TLT) short brought some hair-raising moments when we got a $3.00 spike up in the wake of the red hot 6.2% CPI release. I knew it was a complete BS move and successfully stared it down, watching it all reverse the next day. I don’t do this very often.

All positions are now approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 4 trading days and capture all the accelerated time decay.

That brings my 12-year total return to 515.52%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 43.26%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 112.08%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 47 million and rising quickly and deaths topping 763,000, which you can find here.

The coming week will be all about the inflation numbers.

On Monday, November 15 at 9:00 AM, the New York Empire State Manufacturing Index for November is released. WeWork reports.

On Tuesday, November 16 at 8:30 AM, US Retail Sales for October are printed. Home Depot (HD) and Walmart (WMT) report.

On Wednesday, November 17 at 8:30 AM, the Housing Starts and Building Permits for October are published. NVIDIA (NVDA) and Cisco Systems (CSCO) report.

On Thursday, November 18 at 8:30 AM, Weekly Jobless Claims are announced. The Philadelphia Fed Manufacturing Index is printed. Macy's (M) and Alibaba (BABA) report.

On Friday, November 19 at 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, I am sitting in the Centurion Lounge in San Francisco Airport waiting for a United flight to Las Vegas where I have to speak at an investment conference. I have time to kill so I will reach back into the deep dark year of 1968 in Sweden.

My trip to Europe was supposed to limit me to staying with a family friend, Pat, in Brighton, England for the summer. His family lived in impoverished council housing.

I remember that you had to put a ten pence coin into the hot water heater for a shower, which inevitably ran out when you were fully soaped up. The trick was to insert another ten pence without getting soap in your eyes.

After a week there, we decided the gravel beach and the games arcade on Brighton Pier were pretty boring, so we decided to hitchhike to Paris.

Once there, Pat met a beautiful English girl named Sandy, and they both took off for some obscure Greek island, the ultimate destination if you lived in a cold, foggy country.

That left me stranded in Paris.

So, I hitchhiked to Sweden to meet up with a girl I had run into while she was studying English in Brighton. It was a long trip north of Stockholm, but I eventually made it.

When I finally arrived, I was met at the front door by her boyfriend, a 6’6” Swedish weightlifter. That night found me bedding down in a birch forest in my sleeping bag to ward off the mosquitoes which hovered in clouds.

I started hitchhiking to Berlin, Germany the next day. I was picked up by Ronny Carlson in a beat-up white Volkswagen bug to make the all-night drive to Goteborg where I could catch the ferry to Denmark.

1968 was the year that Sweden switched from driving English style on the left to the right. There were signs every few miles with a big letter “H”, which stood for “hurger”, or right. The problem was that after 11:00 PM, everyone in the country was drunk and forgot what side of the road to drive on.

Two guys on a motorcycle driving at least 80 pulled out to pass a semi-truck on a curve and slammed head on to us, then were thrown under the wheels of the semi. The driver was killed instantly, and his passenger had both legs cut off at the knees.

As for me, our front left wheel was sheared off and we shot off the mountain road, rolled a few times, and was stopped by this enormous pine tree.

The motorcycle riders got the two spots in the only ambulance. A police car took me to a hospital in Goteborg and whenever we hit a bump in the road, bolts of pain shot across my chest and neck.

I woke up in the hospital the next day, with a compound fracture of my neck, a dislocated collar bone, and paralyzed from the waist down. The hospital called my mom after booking the call 16 hours in advance and told me I might never walk again. She later told me it was the worst day of her life.

Tall blonde Swedish nurses gave me sponge baths and delighted in teaching me to say Swedish swear words and then laughing uproariously when I made the attempt.

Sweden had a National Healthcare system then called Scandia, so it was all free.

Decades later, a Marine Corp post-traumatic stress psychiatrist told me that this is where I obtained my obsession with tall, blond women with foreign accents.

I thought everyone had that problem.

I ended up spending a month there. The TV was only in Swedish, and after an extensive search, they turned up only one book in English, Madame Bovary. I read it four times but still don’t get the ending.

The only problem was sleeping because I had to share my room with the guy who lost his legs in the accident. He screamed all night because they wouldn’t give him any morphine.

When I was released, Ronny picked me up and I ended up spending another week at his home, sailing off the Swedish west coast. Then I took off for Berlin to get a job since I was broke.

I ended up recovering completely. But to this day whenever I buy a new Brioni suit in Milan, they have to measure me twice because the numbers come out so odd. My bones never returned to their pre-accident position and my right arm is an inch longer than my left. The compound fracture still shows upon X-rays.

And I still have this obsession with tall, blond women with foreign accents.

Go figure.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Brighton 1968

Ronny Carlson in Sweden

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.