The biotechnology and healthcare industry is fraught with risk. However, it’s also brimming with opportunities.

On the one hand, a new drug takes years of clinical research. On top of that, the average cost to bring each product to the market reached $1 billion between 2009 and 2018.

On the other hand, the chosen few that receive the green light from the FDA more often than not deliver on their promise to become blockbusters, raking in sales of over $1 billion every year.

This arguably justifies the risks that come with the industry.

Amgen (AMGN) has become the recent embodiment of this promise. Despite the volatility of the market in the past months, the company remains a strong player thanks to several factors that could bolster its share price.

In particular, Amgen investors are looking forward to potential gains courtesy of the pipeline of drugs slated for market release over the medium term.

The most exciting among them is its obesity drug AMG 133.

The positive data from AMG 133’s unveiling had experts excited over the drug, with many expecting it to become a multi-billion dollar revenue stream for Amgen.

As expected, Amgen will be facing stiff competition in this market, specifically between 2025 and 2030.

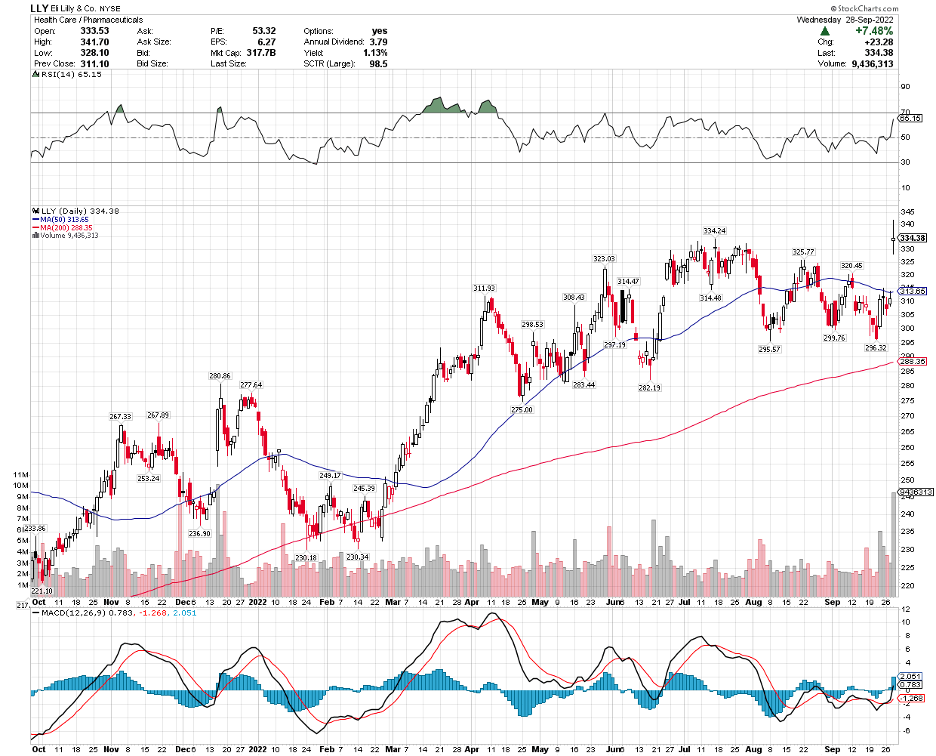

To date, investors have been closely monitoring the obesity segment, with two companies clearly leading the charge: Novo Nordisk (NVO) and Eli Lilly (LLY).

Novo Nordisk markets Wegovy, which is a shot that targets obesity by zeroing in on the glucagon-like peptide receptor, or GLP-1. This is also the same target for many diabetes treatments.

Meanwhile, Eli Lilly is working to integrate obesity as part of the conditions treated by its recently approved diabetes drug Mounjaro. Like Wegovy, this drug also targets GLP-1.

What makes it more potent is that it also targets glucose-dependent insulinotropic polypeptides or GIP. Both GLP-1 and GIP are hormones linked to blood sugar control.

What makes AMG 133 different from other approved and experimental treatments for obesity is that it blocks not only a particular hormone but also a specific protein involved in controlling blood sugar.

While it targets GLP-1, Amgen’s candidate works on a gut protein linked to digestion, called the gastric inhibitory polypeptide receptor, or GIPR.

The obesity market is a lucrative space since the medical world now categorizes obesity as a type of chronic illness instead of a mere consequence of lifestyle choices.

That is, obesity drugs are on the cusp of entering the mainstream primary health care system.

An apparent precedent for this opportunity is the high blood pressure sector, initially a nascent segment in the 1980s and eventually skyrocketed to a $30 billion industry by the 1990s.

In 2022, the obesity market is estimated to be worth $2.4 billion. By 2030, this space is projected to reach $54 billion.

That places all competitors in the same space, Amgen, Eli Lilly, and Novo Nordisk, in excellent positions. In fact, Novo Nordisk has been dealing with shortages of Wegovy due to rising demand.

While any upgrade or downgrade prompted by a single drug’s potential, or even multiple treatments’ potential, is exciting, it should be taken with a grain of salt.

The biotechnology and healthcare industry is continuously in flux, and any company in the sector is one major failed trial or one rival’s success away from facing trouble. Simply put, they tend to be volatile.

Amgen is not an exception to this harsh truth despite the company’s solid obesity prospects and impressive portfolio and pipeline. That means investors expecting an immediate payout following the recent developments might get disappointed.

Nonetheless, it’s also vital to remember that biotechnology and healthcare stocks tend to deliver better results than the broader market even amid the economic turmoil.

These companies seem to operate and function outside typical economic cycles, providing investors with dependable performance when most businesses are struggling.

Amgen is one of the biggest biotechnology companies in the world. It has been one of the pioneers in this segment since the 1980s. It’s also a part of the prestigious Dow 30 list of companies.

Moreover, it has a massive and diversified product portfolio, with nine treatments that individually generate more than $1 billion in sales annually.

These drugs are not only huge sellers, but also offer wide margins because of the existing restrictive and high barriers to entering the biotech world.

Hence, this enables Amgen to enjoy a remarkable pricing power and autonomy over its products while still growing its top line at a steady pace.

If you’re looking for a conservative and attractive long-term investment, then buying Amgen when the price drops wouldn’t be a bad bet.