My barber Charlie has this uncanny ability to diagnose which of his clients are making money in the market just by watching how they tip.

Last Thursday, while he was working his magic on what's left of my hairline, he mentioned how his pharmaceutical rep clients have been tipping like oil sheiks lately.

"Something big is brewing in biotech," he said. That conversation got me thinking about Incyte Corporation (INCY).

You see, Charlie's pharmaceutical reps understand something most Wall Street analysts miss most of the time, and that’s the difference between flashy breakthrough drugs that grab headlines and the workhorses that generate consistent cash flow quarter after quarter.

Incyte falls squarely into that second category, except their "workhorse" just delivered Q2 2025 numbers that would make a racehorse jealous.

Digging deeper, I found where things get exciting, and why my neighbor's dermatologist probably drives a Porsche.

Incyte's Opzelura cream isn't just another skincare product - it's the first and only FDA-approved treatment for vitiligo in the United States. Think about that for a moment.

When you own the sole solution to a visible medical condition that affects millions, you've essentially discovered a legal monopoly that patients will pay for without batting an eye.

Revenue from this little tube of magic hit $164.5 million in Q2, climbing 38.6% quarter-over-quarter and 35.2% year-over-year.

But the real treasure lies in their emerging drug Niktimvo, which just posted sales of $36.2 million with a staggering 166% quarterly growth.

Meanwhile, the clinical data backing this drug shows 86% of patients with essential thrombocythemia achieving normalized blood counts.

For a condition affecting roughly 60,000 Americans, those efficacy rates suggest Incyte has another blockbuster hiding behind the boring medical terminology.

More impressively, the financial architecture of this company reads like a masterclass in pharmaceutical economics.

Their gross margin expanded to 55.9% while operating income margin hit 25.6%, a three-year high. On top of that, their total debt sits at just $42.4 million against EBITDA of $334.5 million.

That debt-to-EBITDA ratio of 0.04x is like having a mortgage payment of fifty bucks on a million-dollar mansion.

Now here's where Wall Street's myopia creates opportunity.

Everyone obsesses over Jakafi's patent cliff coming in 2028, treating it like some inevitable catastrophe. What they're missing is the patent protection story that extends well beyond that timeline.

Opzelura's patents don't expire until 2040, essentially giving Incyte a guaranteed revenue stream for the next 15 years.

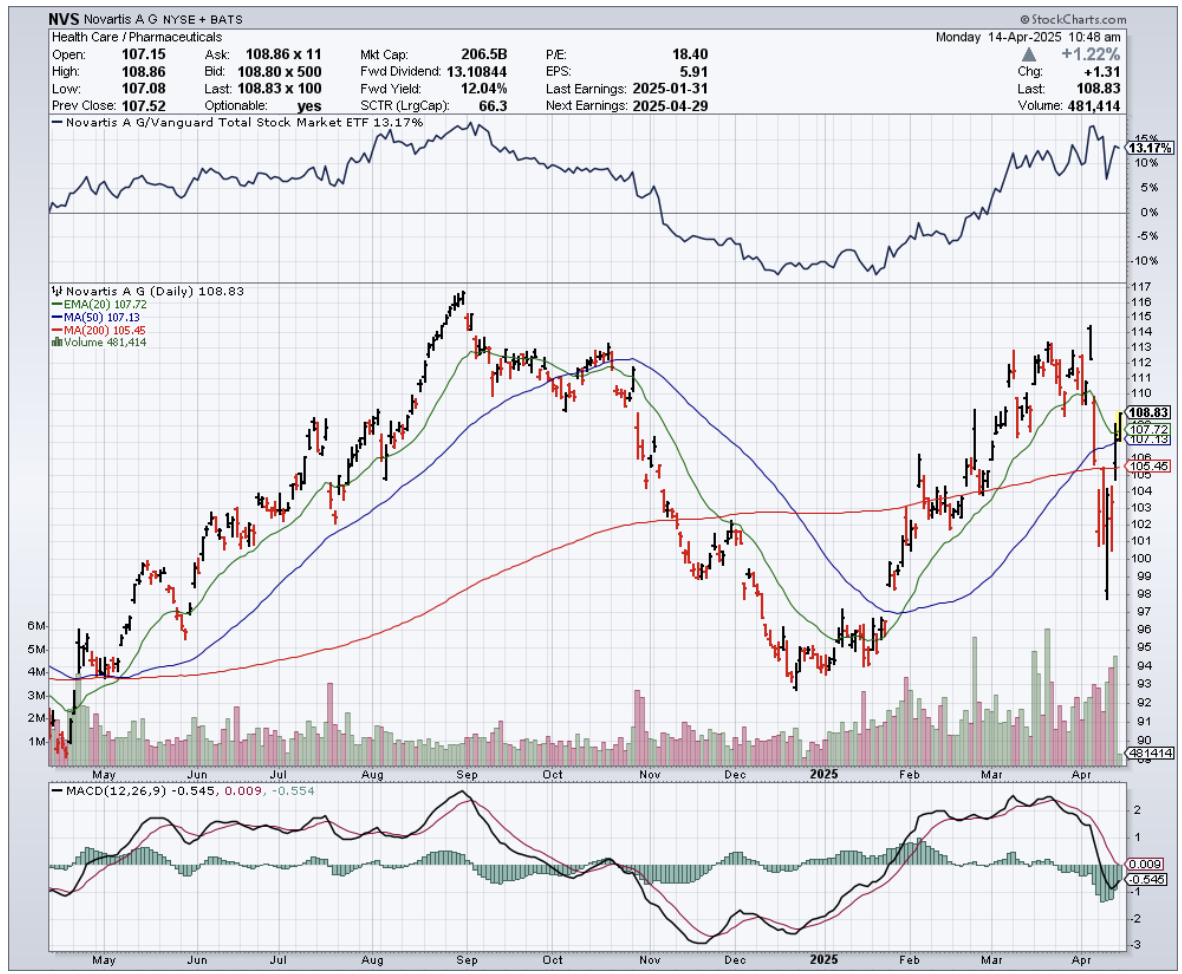

The May settlement with Novartis (NVS) also cut their royalty payments in half, dropping cost of goods sold guidance to just 8-9% of revenues.

Every percentage point of margin expansion in a billion-dollar revenue company translates to serious money hitting shareholders' pockets.

The acquisition angle makes this story even more compelling.

Remember when Sanofi (SNY) swooped in and bought Blueprint Medicines for $9.5 billion in June?

Incyte trades at 13.8x forward earnings, roughly 24% below the sector median, with minimal debt, growing cash flows, and a diversified pipeline that includes povorcitinib and INCB123667.

They're essentially gift-wrapped for a strategic buyer. Those November 2024 rumors about Merck (MRK) sniffing around weren't idle gossip - they were reconnaissance missions.

What really seals this investment thesis is the momentum building behind their numbers.

Non-GAAP earnings per share hit $1.57, beating expectations by a nickel, while management raised Jakafi guidance from $2.95-3 billion to $3-3.05 billion for 2025.

The beauty of Incyte's transformation reminds me of watching a small-town hardware store evolve into a regional empire. They're systematically building a franchise that compounds value over time.

Trading at $84.61 with multiple growth catalysts, patent protection extending into the 2040s, and a strong balance sheet, this represents exactly the kind of overlooked opportunity that creates generational wealth.

My barber may think he's just cutting hair and making conversation, but his pharmaceutical rep theory just validated what decades of investing has taught me: find companies that solve real problems for real people, then hold on tight.

My next visit to Charlie's chair just might coincide with a very good mood and an even better tip.