If corporate America were a dinner party (and let's face it, sometimes it absolutely is), Pfizer (PFE) would be that guest who showed up fashionably late with an award-winning bourbon pecan pie during the pandemic, and is now being quietly judged for bringing Trader Joe's crackers to the latest soirée. The pharmaceutical giant, which briefly enjoyed the kind of celebrity usually reserved for Tesla (TSLA) and Apple (AAPL), finds itself in the midst of what we might delicately call a boardroom intervention. With its stock price taking a dive, Pfizer attracted the attention of Starboard Value, a hedge fund with a billion dollars' worth of opinions about how to run things better.

Unfortunately for Starboard, these problems are not that simple to fix. Here's the thing about making breakthrough drugs: 9 out of 10 fail, each costs about $2 billion to develop, and even the most brilliant scientists can't tell you which one will work until the very end. This uncertainty sits at the heart of Pfizer's current predicament. After delivering a ratings blockbuster with its COVID-19 vaccine and Paxlovid treatment, the company now faces the pharmaceutical industry's dreaded sophomore album syndrome.

On top of that, every successful drug faces the same issue: it comes with its own expiration date. Patents run out, generic competitors swoop in, and suddenly everyone's asking, "What's next?"

And here's where it gets more interesting, in the way that all corporate power plays are interesting if you enjoy watching incredibly wealthy people disagree about how to become even wealthier. Take Starboard's critique of Pfizer's performance. It has all the subtlety of a CNN town hall debate, spiced up with the potential involvement of former Pfizer CEO Ian Read and CFO Frank D'Amelio — a plot twist as unsurprising as finding a filibuster in the Senate.

Having previously applied its corporate reconstruction techniques to the restaurant industry (think less Thomas Keller, more Olive Garden optimization), the hedge fund now fancies itself as something of a pharmaceutical expert. This is like suggesting that because someone successfully managed a food truck, that same person is qualified to run a three-Michelin-star restaurant.

Granted, Starboard has an impressive track record in corporate makeovers, much like the HGTV stars of Wall Street. Still, renovating a pharmaceutical company isn't the same as flipping a restaurant chain. There's something uniquely challenging about applying fast-casual dining turnaround principles to the development of life-saving medications. Some processes simply can't be rushed unless you enjoy explaining to the FDA why you thought clinical trials were more of a suggestion than a requirement.

As we try to figure out what's happening with the pharma giant right now, it helps to keep in mind that the key question isn't just whether Pfizer needs a makeover (though that's certainly part of it), but whether Wall Street's "time is money" philosophy can successfully coexist with the "science takes time" reality of drug development. It's the corporate equivalent of trying to teach quantum physics to a day trader - theoretically possible, but likely to result in some interesting misunderstandings along the way.

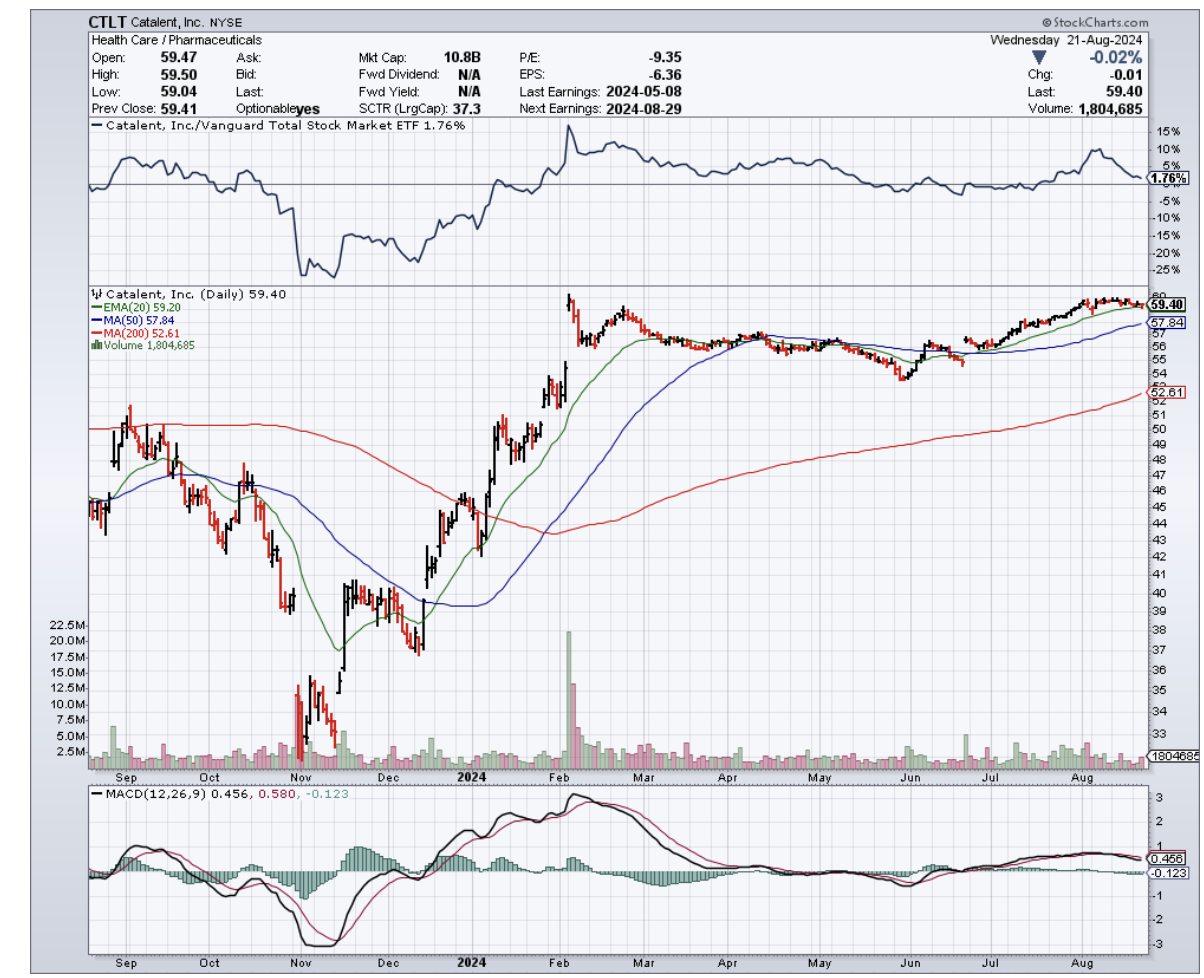

So, what's the play here? Looking at Pfizer's current stock price of around $28.45 (down 2.47%), the chart looks about as exciting as a waiting room magazine collection.

While the stock hovers below its 50-day moving average and sits near the lower end of its $25.20 - $31.54 yearly range, there are a few bright spots: a healthy 5.91% dividend yield and several promising projects in the pipeline - an RSV vaccine and an obesity treatment that could have customers lining up around the block again.

But here's my recommendation: Keep this one on your watchlist, but hold off on placing your order just yet.

Think of Pfizer as that once-trendy restaurant that's neither closing its doors nor winning any new Michelin stars - it's simply simmering on medium heat while the new chef (courtesy of Starboard) debates menu changes with the original kitchen staff.

Will Starboard's intervention prove to be the corporate equivalent of a breakthrough drug, or more like one of those miracle cures you see advertised at 3 AM?

The answer, like most things in the pharma world, will take time to develop. And in this battle of wits within corporate America, sometimes the hardest pill to swallow is patience - though I suspect Starboard would prefer it in fast-dissolving form.

After all, when Wall Street meets Pharma, it's less about whether the patient needs the medicine and more about timing the market's appetite.

For now, let's keep this one in the "worth watching" category until we see some signs of the stock's vital signs improving.