I was at a biotech conference in San Francisco, nursing a cup of black coffee and trying not to fall asleep during yet another startup pitch.

Suddenly, I overhear a conversation that makes me perk up faster than if someone had mentioned a 50% off sale on vintage aircraft parts.

"Did you hear about TwoStep Therapeutics?" someone whispered. "They've got Bertozzi, Cochran, and Levy on board."

Now, I've been following the biotech scene longer than I've been flying planes, and those names made my ears perk up faster than an air traffic controller during a thunderstorm. I nearly choked on my coffee trying to catch every word.

As it turns out, TwoStep Therapeutics isn't just another flash-in-the-pan biotech startup. These folks are diving headfirst into the shark-infested waters of immunotherapy and antibody-drug conjugates (ADCs).

And let me tell you, they're not packing pool noodles – they're armed to the teeth with intellectual firepower.

Now, I've seen more biotech startups than there are hedge funds in Connecticut, but this one's got my attention. Why? They're not here to do the same old cancer-fighting waltz.

Instead, they're attempting to solve a Rubik's Cube of cancer treatment – and they might just have the brainpower to do it.

Let's talk about that brainpower for a moment. TwoStep's advisory board reads like a "Who's Who" of biotech brilliance.

We're talking Nobel laureate Carolyn Bertozzi, Stanford's Jennifer Cochran, and Ronald Levy – the wizard behind rituximab. It's as if they raided the faculty lounge at Stanford and offered stock options instead of tenure.

That means TwoStep's not just another me-too biotech. They're cooking up a platform of peptide conjugates that can bind to five different tumor-associated integrins.

In layman's terms? They're building a cancer-fighting multi-tool that makes current treatments look like plastic sporks.

CEO Caitlyn Miller isn't just another lab coat with a PowerPoint presentation either. She's got skin in the game – or rather, genes.

Her stepfather battled oral cancer for 14 years before passing away. I don’t need to tell you, but that's the kind of motivation you just can't buy.

Now, before you start salivating over potential returns faster than Pavlov's dogs at dinnertime, remember: This is early-stage biotech.

We're talking more risk than a game of Russian roulette with five bullets. But for those of you with iron stomachs and a penchant for moonshots, TwoStep might be worth a spot on your watchlist.

Their $6.5 million seed round is chump change in biotech land, but it's not about the size of the boat, it's the motion of the ocean. And with backers like NFX and Alexandria Venture Investments, they've got some serious propulsion.

TwoStep isn't going after the low-hanging fruit either. They're not interested in well-trodden paths like bladder or breast cancer.

No sir, they're setting their sights on tough customers like head and neck and colon cancer. It's a gutsy move, but in biotech, sometimes you've got to swing for the fences.

It's worth noting, though, that TwoStep isn't alone in this high-stakes game.

Big pharma's been falling over themselves to get a piece of this action. Gilead Sciences (GILD) shelled out big bucks for Immunomedics to get their hands on Trodelvy.

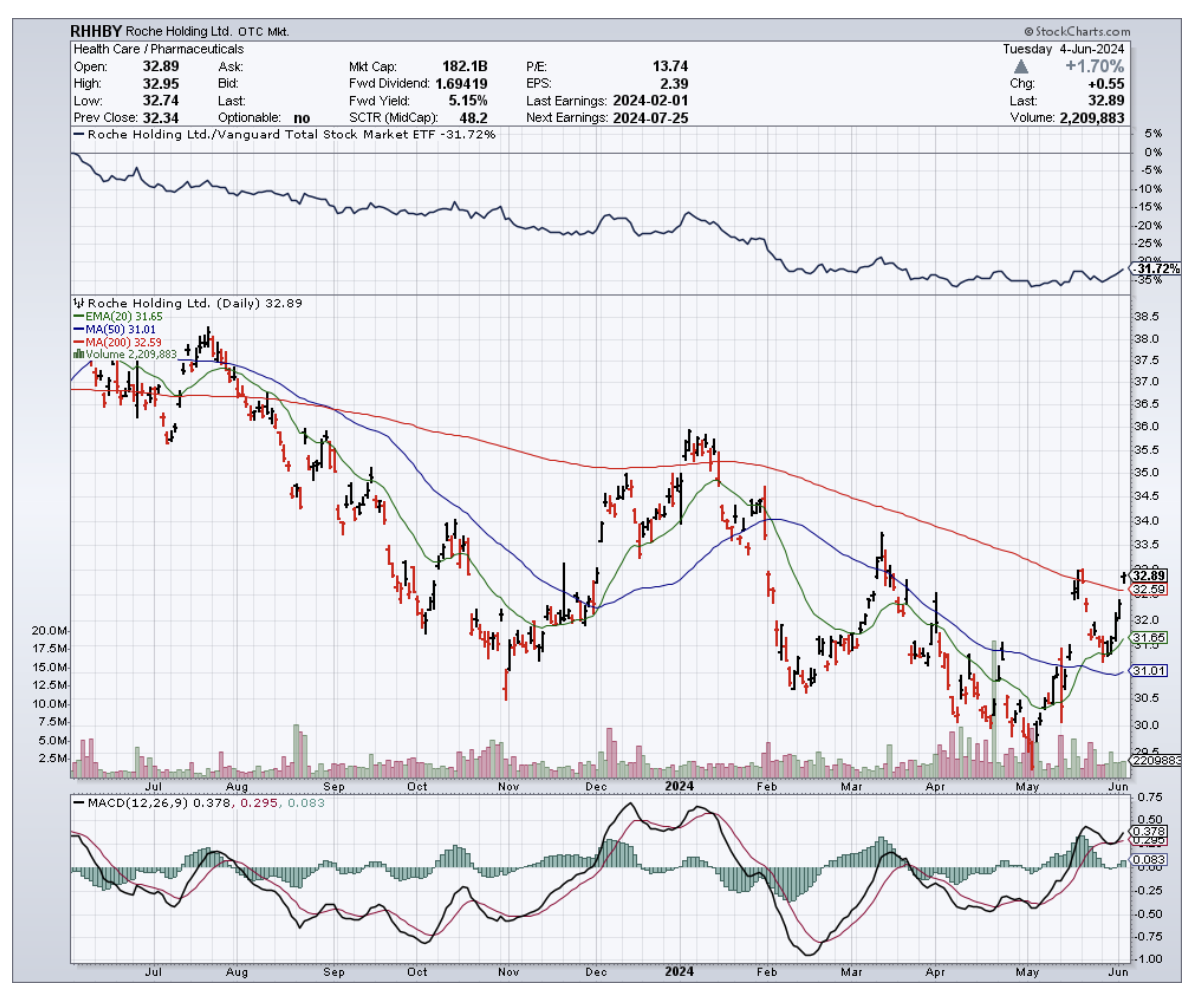

AstraZeneca (AZN) has been playing in this sandbox for a while with Enhertu. Even the Swiss giant Roche (RHHBY) is in on the game, not to mention Pfizer (PFE) and Merck (MRK).

So, there you have it. TwoStep Therapeutics: the new enfant terrible of the biotech world, armed with more brainpower than a MENSA convention and ambitions that could make Elon Musk blush.

Will they revolutionize cancer treatment or become another cautionary tale in biotech textbooks?

The jury's still out, but one thing's for sure – watching this unfold will be more entertaining than a CNBC stock ticker on stimulus check day.