Did you know that more Americans are now trying to lose weight than trying to quit smoking? That's a staggering shift, and it has a lot to do with the buzz around those new obesity drugs.

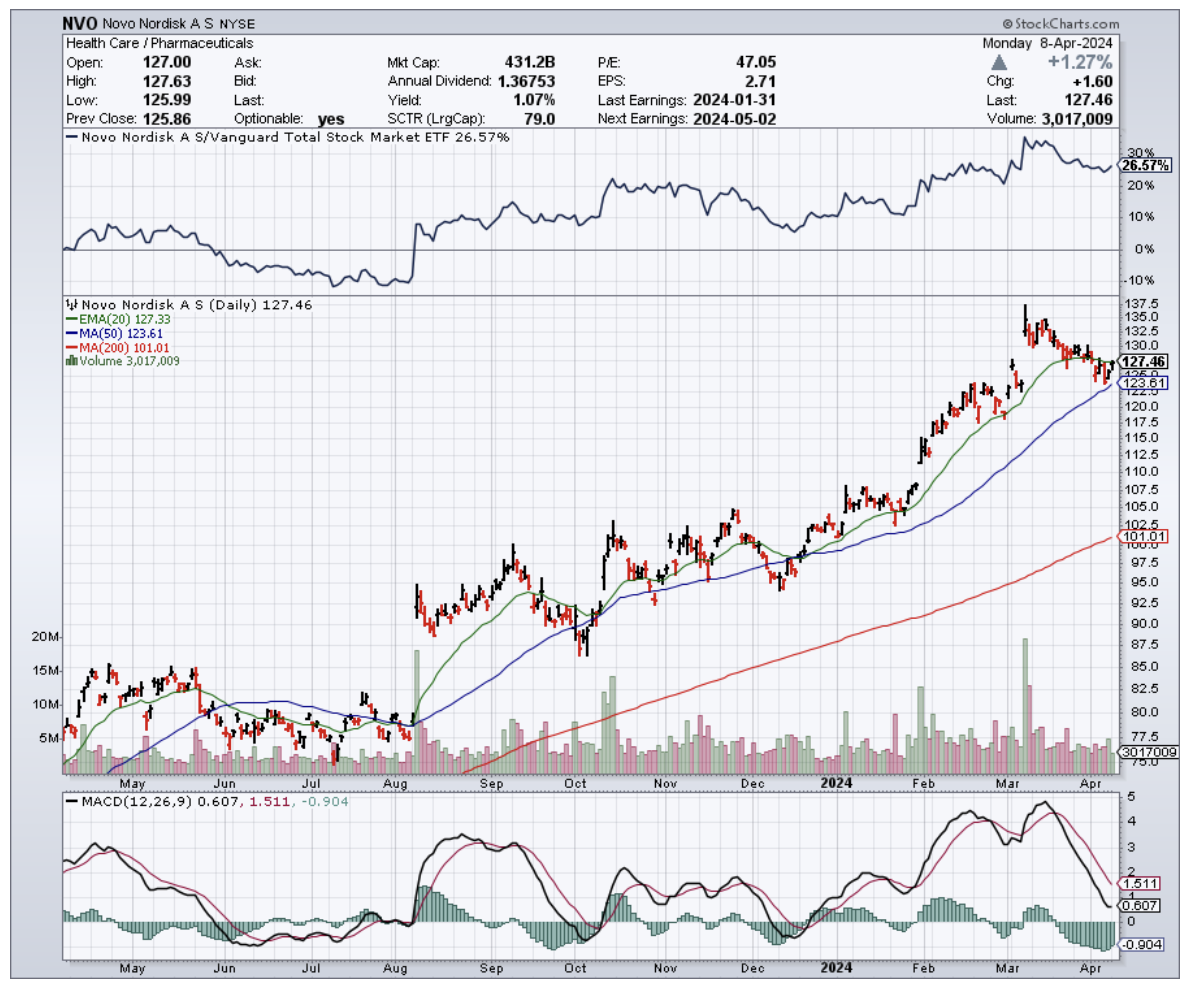

Novo Nordisk (NVO) got the ball rolling in 2021 when they received the green light to market their diabetes drug, Ozempic, as a weight loss miracle called Wegovy.

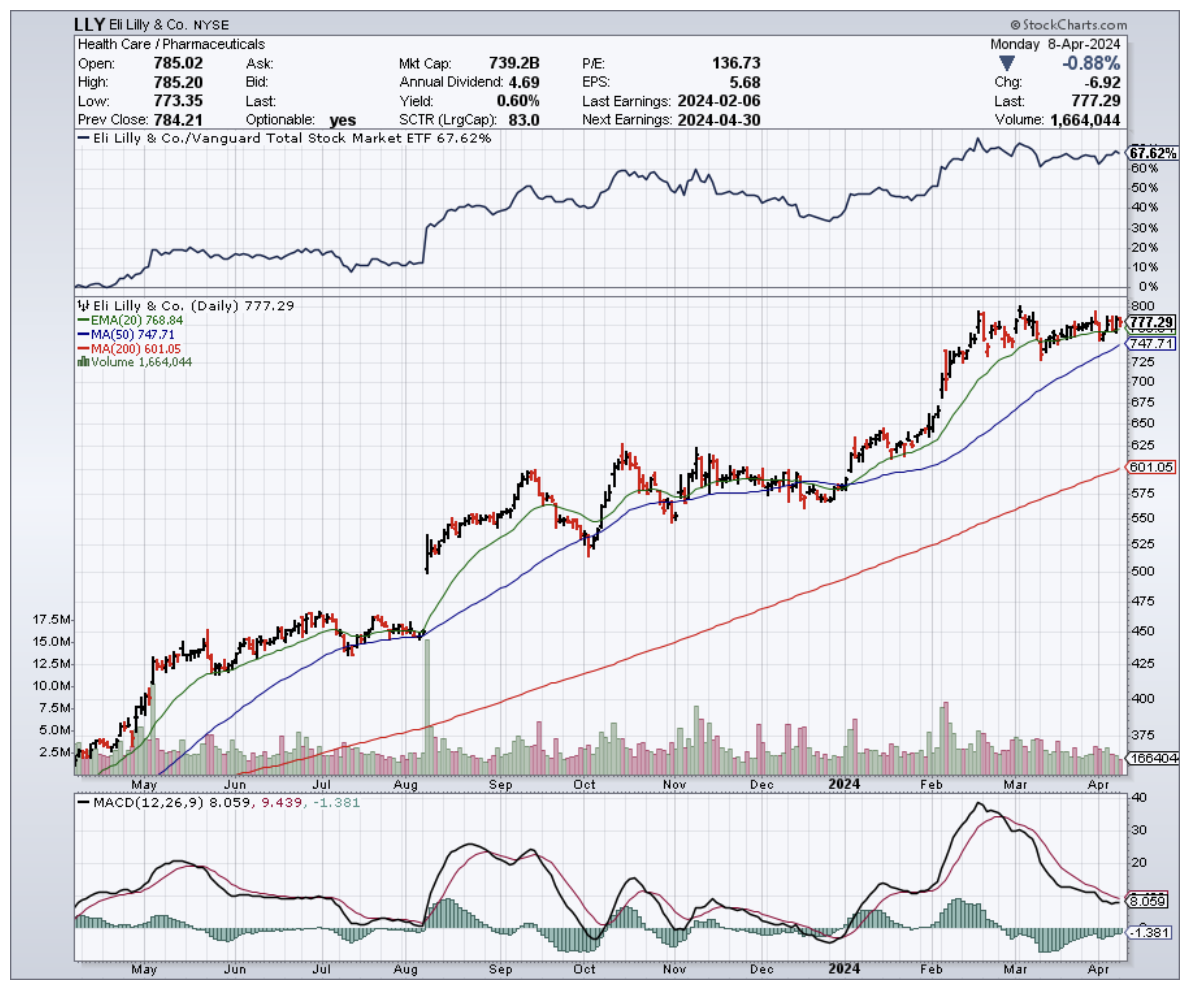

Not to be outdone, Eli Lilly (LLY) swooped in the fall of 2023 with Mounjaro – also a diabetes drug, sold as Zepbound – that got the FDA nod for weight loss, too.

Then, the whole pharma world, it seems, has started to go all-out on obesity, flooding the market with a whole new generation of weight loss drugs.

To date, there are 124 obesity meds in the works – a mix of 61 Phase 1 hopefuls, 47 in Phase 2, eight in Phase 3, and eight already greeting patients.

Remember that whole fen-phen disaster back in the 90s? That left a bad taste in everyone's mouth when it comes to weight loss drugs.

But things are different this time. These new obesity meds, especially those from Novo Nordisk and Lilly, are a game-changer. They're blowing those old weight loss pills out of the water.

It's not about fitting into those skinny jeans anymore (though that's a nice bonus). The focus is on health.

And while Novo Nordisk and Eli Lilly might be the big names in the obesity drug game, they've got competition. There's a whole crew of pharma companies jumping on the bandwagon, like Currax Pharmaceuticals, Roche (RHHBY), GlaxoSmithKline (GSK) – you get the picture.

But here's the really wild part about these drugs like Mounjaro and Wegovy, which use GLP-1 (Glucagon-like peptide-1) compounds to treat diabetes: They kinda stumbled onto their weight loss powers by accident.

Turns out, while they were busy helping diabetes patients, boom, patients started shedding pounds. Talk about a happy side effect.

As expected, this has created excitement in the market. Now, usually in the drug world, it's baby steps forward. A little better here, a bit less nausea there... yawn.

But with eight of these drugs already in the late stages of development (Phase 3), expect even more surprises as potential breakthroughs could bypass traditional drug trial phases for a faster route to market.

Frankly, I'm shocked at the number of new mystery drugs suddenly popping up in early testing. Even those old-school Big Pharma players are jumping in: AstraZeneca (AZN), Novartis (NVS), Amgen (AMGN), and, heck, even Johnson & Johnson (JNJ) – everyone wants a slice of the obesity pie.

Now, this whole obesity meds craze reminds me of what happened with those PD-1 drugs in cancer treatment.

One good result, and suddenly everyone was scrambling to get their version to market. But like in a reality TV show, not everyone makes it to the finale.

But what's the endgame in this obesity market expansion? Not 124 contenders, that's for sure.

Even right now, with everything in its early stages, you can already see which candidates have the potential. The competition's going to get fierce, and only the strongest drugs will survive.

Viking Therapeutics (VKTX), for example, has a dual GLP-1 and GIP agonist showing serious promise. After just 13 weeks, patients lost an average of 14.7% of their weight.

This data, released in February, proves Viking’s not just chasing the big pharma players; they're running right alongside them.

Now, over at Novo and Lilly, the pace hasn’t slowed down one bit either. Wegovy, which is Novo's contender in the ring, just got a nod in March for something a bit bigger than weight loss.

It’s been approved to tackle some serious heavyweights — cardiovascular deaths, heart attacks, and strokes in adults dealing with obesity or who are overweight. It's like getting a one-two punch for health.

As for Eli Lilly? They’ve been making some noise with tirzepatide, especially around metabolic dysfunction-associated steatohepatitis, or MASH for short.

They’ve got results showing that 74% of adults who were either overweight or obese managed to kick MASH to the curb without any increase in liver scarring after sticking with the treatment for 52 weeks.

Sadly, the biggest roadblock isn't the science, it's the money. It’s not just about making these drugs. It’s about getting them into the hands of those who need them most.

The current scene? A bit of a heartbreaker.

Most US insurance companies are drawing the line at covering Wegovy or Zepbound for obesity. This leaves a hefty bill on the table, putting these potentially life-altering treatments out of reach for many.

Think about it – the people who could benefit the most, maybe those on Medicaid or living paycheck to paycheck, are staring at a closed door. And let’s not even get started on Medicare, which, as of now, can’t even touch these drugs.

It’s a strange paradox, isn’t it? The very treatments that could lift the weight of obesity off society’s shoulders are dangling just out of reach for many.

So, now, the burning question isn’t so much about whether these treatments can make shareholders and companies do a happy dance. It’s more about where we’re heading.

Think about cancer treatment – the sickest patients get the cutting-edge drugs first. What would that even look like in obesity?

Will all these 124 experimental options help level the playing field, finally forcing insurers to step up? Only time will tell.

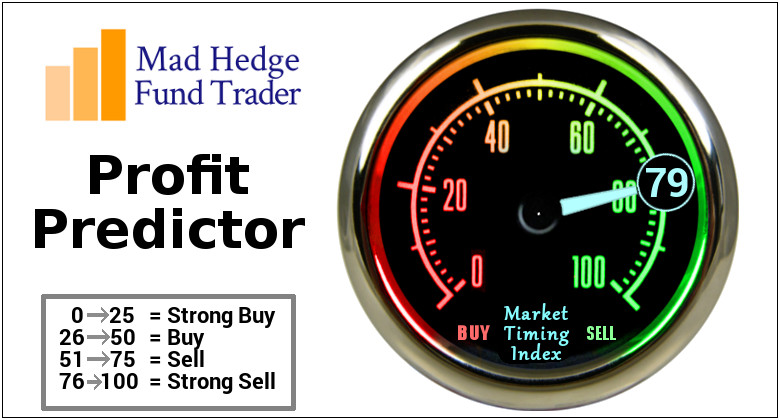

As of now, the obesity treatment field is going through a revolution. While the market faces challenges like accessibility, I suggest you closely monitor the progress of key players like Novo Nordisk and Eli Lilly.

Consider smaller, innovative companies, such as Viking Therapeutics, for potential high-risk, high-reward investments as well.