Global Market Comments

February 5, 2026

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments

February 5, 2026

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments

May 12, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR THE MISSILES TO HIT)

(GLD), (SPY), (MSTR), (NVDA), (AAPL),

(TSLA), (QQQ), (TLT), (SH), (MCD), (SVXY)

When I was in Ukraine, the air raid sirens used to go off every night exactly at 2:00 AM.

The Russian goal was to deprive the civilian population of sleep and to make their lives miserable. It was also when the country was least able to defend itself.

You knew the missiles were on the way, it was just a question of whether your number was up. You could only hope to make it to the basement before they hit. It was not safe to go back to sleep until you heard the explosions nearby.

It is not a pleasant feeling.

Here we are in the United States in 2025, and there are missiles on the way, but they are economic ones. Ford Motors (F) has already started raising prices so they can spread them out over a longer period of time. Food and produce prices from Mexico will deliver the first price shocks, as they can go bad in a day. The first hint of this might be visible with the release of the Consumer Price Index at 8:30 AM EST on Tuesday, May 13. That’s when we learn if the inflationary surge is hitting now, or if we have to wait until June. But we know for sure it’s coming.

In fact, there is an onslaught of horrific economic data headed our way. Economic growth is slowing dramatically, prices are rising, international trade is grinding to a halt, and consumer confidence is already at all-time lows. We just don’t know yet if it is going to hit us or blow up the neighbors down the street.

The truly alarming thing about these developments is that the data from hell is going to hit just as the stock market is completing one of its most rapid rises in history, up 19.75% in a month. Stocks are now even more expensive than they were in February, with a price earnings multiple of 22X and earnings falling.

Is anyone ready for a February market crash repeat? You may be about to get it.

I have been through many bear markets since I started trading in 1965, a move down in the indexes of 20% or more. They can last 31 months (2002) and decline as much as 56% (2009). In 1987, we had a bear market in a day!

This one is number nine for me. And while no two bear markets are alike, they all share common characteristics. I have seen them caused by oil shocks, hyperinflation, financial engineering, the Dotcom Crash, the Great Financial Crisis, and the Pandemic. This is the first one caused by a trade war.

Spoiler alert! The monster is about to jump out of a closet at you at the end of the movie.

If you’re praying that the new trade deal with the UK is going to rescue your retirement funds, don’t hold your breath. It’s not a treaty; it is simply an agreement to agree sometime in the distant future. It’s not even a letter of intent. It’s nothing but a bunch of hot air.

In 2024, the U.S. actually ran a trade surplus, not a deficit, with the UK. The surplus was $11.9 billion. The U.S. exported $79.9 billion worth of goods to the U.K. and imported $68.1 billion, resulting in a surplus.

Some $10.5 billion of US aircraft were sold to the UK in 2024, followed by $7 billion in machinery and nuclear reactors and $5.6 billion in pharmaceuticals. The deals announced last week were nothing new, just a reaffirmation of existing trade that has been going on for years.

In the meantime, the punitive 10% tariff against UK imports stands. That is nowhere near enough to move the needle for the $27.7 trillion US GDP. And this was the easy one. Why the US needs to negotiate a trade agreement with a country where it is already running a surplus is beyond me.

All of this has prompted me to run the first 100% short model portfolio in the 17-year history of the Mad Hedge Fund Trader. If the market moves sideways or up small, we will make our maximum profit by the June 20 option expiration in 28 trading days (Memorial Day is a Holiday). If the market crashes, which it can do at any time, we make the maximum profit immediately. That should take us to a 2025 year-to-date profit of over 43%.

Heads I win, tails you lose, I like it.

Current Capital at Risk

Risk On

NO POSITIONS 0.00%

Risk Off

(GLD) 5/$275-$285 call spread -10.00%

(GLD) 6/$275-$285 call spread -10.00%

(SPY) 6/$610-$620 call spread -10.00%

(MSTR) 6/$500-$510 put spread -10.00%

(NVDA) 6/$140-$145 put spread -10.00%

(AAPL) 6/$220-$230 put spread -10.00%

(TSLA) 6/$370-$380 put spread -10.00%

(QQQ) 6/$540-$550 put spread -10.00%

(TLT) 6/$80-$83 call spread -10.00%

(SH) 6/$39-$41 call spread -10.00%

Total Net Position -100.00%

Total Gross Position 100.00%

I love trade wars.

They shine brilliant spotlights on obscure, usually deeply hidden parts of the global economy, revealing almost impossible-to-find data points. And every single new data point enhances your understanding of the big picture.

My first real trade war was the 1973 Oil Shock. Saudi Arabia had cut off America’s oil supply because of our support for Israel in the Yom Kippur War. Huge lines formed at gas stations, and gasoline prices shot up from 25 cents a gallon to $3.00.

Ever the entrepreneur, I started a side business buying beat-up Volkswagen Beetles, the highest mileage car then available in the United States, driving them to Mexico, and getting them repainted and reupholstered in a day for $50. Then I resold them in LA for double the price.

I remember on my last run, I was in a hurry to catch a physics class, so I left a little early. The US customs office learned about the car and asked me if I had any work done while in Mexico. I answered “No.” As he walked away, I saw that his pants were covered with fresh green paint, which had not yet dried.

I drove away as fast as my green Beetle could go.

In the old days, hedge funds reaped huge trading advantages chasing down obscure data points. When satellite data became available to the public in the 1990s, my fund leased satellite time to track the progress of the US wheat crop.

Several successful trades in the commodities markets followed, until others caught on. You already know that I closely track container ship traffic not only in Los Angeles, but ports around the world. This is easy now through many cheap apps available through Apple’s App Store..

In the 2025 stock market, we have all had to become our own mini hedge fund managers. For a start, more money has been made on the short side than the long side, at least the few who participated in instruments like my many vertical bear put debit spreads in (NVDA), (SPY), (TSLA), (MSTR), and the (TLT). There were also nicely profitable plays in the (SH), the (SDS), and the many volatility plays out there, such as the (SVXY).

It's all been enough to help me achieve a welcome 32% profit this year. Those who took my advice to sit out 2025 and bought 90-day US Treasury bills yielding 4.2% are also profitable this year. Any positive return this year is a great accomplishment.

A whole new cottage industry that has gone viral on the internet, offering up more obscure data points about the economy than we could ever consume. We all know that forward-looking soft sentiment data is the worst ever recorded. Credit card balances held by low-income consumers are at all-time highs. But McDonald’s (MCD) and Taco Bell sales have been falling, while those at Domino's Pizza are rising.

What the heck is that supposed to mean?

Although this may sound arcane and deep in the weeds, the 2 year – 10 year spread recently turned positive and is now at 0.47%. That means the yield on two-year Treasury notes is higher than the yield on ten-year Treasury bonds. This has NEVER happened without a following recession. If you were looking for hard data, this is hard data.

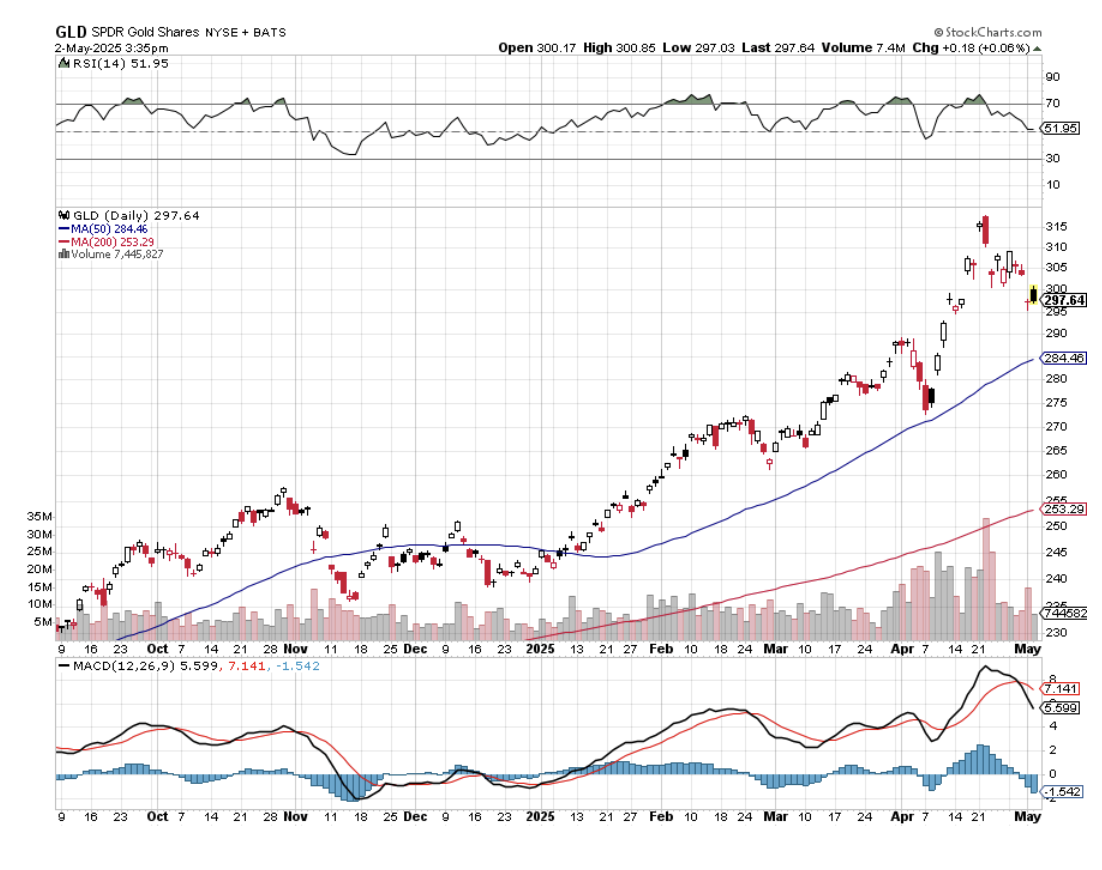

Gold is the only asset class absent from volatility this year. That alone says a lot.

There are more than the usual number of binoculars focusing on the Port of Los Angeles these days (click here for the link). Traffic is now down a stunning 25% on the week. That means a supply chain disaster is imminent.

You learn in the Marine Corps that a 50-cent part can ground a $60 million aircraft. How much extra will you pay to get that 50-cent part to get the plane flying? $1.00, $10? $100? Certainly $1 million for a military aircraft in time of war.

This is the basis for some of the exponential inflation forecasts and supply chain disruptions on the scale last seen during the pandemic. Once started, inflation takes off like a rocket with merchants trying to outraise each other and it can take years to get under control, as we saw with the last pandemic.

By the way, I still wake up at 2:00 AM every morning expecting incoming missiles, even though I have been out of Ukraine for 18 months. It turns out that post-traumatic stress gets worse when you get older. Fortunately, my bedroom is now in the basement.

The Lucky One (it was a dud)

The Not So Lucky Ones

My May performance has reached +3.08%. That takes us to a year-to-date profit of +31.48% so far in 2025. My trailing one-year return stands at a record +90.95%. That takes my average annualized return to +50.84% and my performance since inception to +783.37%, a new all-time high.

It has been another wild week in the market. I took profits in longs in (MSTR) and (NVDA). I stopped out of a short in (SPY) for a small loss. I added a new long in (GLD) and (TLT), new shorts in (QQQ), (AAPL), and (TSLA). After the tremendous run we have just seen, I am moving towards a 100% short portfolio.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

The Stock Market is Headed for New Lows, even if the China tariffs drop from 145% to only 50%, says hedge fund guru and old friend Paul Tudor Jones. Trump’s rollout of the highest levies on imports in a century shocked the world last month, triggering extreme volatility on Wall Street. You have Trump, who’s locked in on tariffs. You have the Fed, which is locked in on not cutting rates. That’s not good for the stock market. We are the losers.

Fed Leaves Interest Rates Unchanged, at 4.25%-4.50%, supported by a consistently rising inflation rate. Stocks tanked and bonds rallied. In case you were wondering, the Fed ALWAYS prioritizes fighting inflation over unemployment because its mandate is to protect the value of the US dollar. It’s written into the 1913 law creating the Federal Reserve System. Don’t expect ANY rate cuts until year-end.

Apple Tanks on Falling Search Revenues. I bet you don’t get many short recommendations for Apple, but here’s a nice one. The implications for Apple were disastrous when a senior officer testified that artificial intelligence was demolishing their traditional search business. Of course, Alphabet (GOOGL) shares were trashed, down 7%. But Apple took a 5% hit as well because it earns an eye-popping $50 billion a year from its IOS operating system, referring all searches to Google. Apple shares have been trading rather feebly this month. While the S&P 500 rocketed 15%, (AAPL) managed to eak out an unimpressive 20% gain, while shares like Palantir (PLTR) doubled.

Bitcoin Recovers $100,000, for the first time since early February, bolstered by a dial down of the trade war in a sign that perhaps Trump is backing off his trade war. Overbought for now, sell Bitcoin rallies.

Nearly All US Exports are in Free Fall, reaching most ports across the U.S. and nearly all export market products as the trade impact of Trump’s tariffs worsens. Agriculture exports to China have been the hardest hit.

Oil Production has Peaked, thanks to the collapse in prices triggered by recession fears. Saudi Arabia is playing a market share game, and increasing production is another factor. Avoid all energy plays like the plague. We’re headed for $30 a barrel.

Warren Buffett Retires, handing over day-to-day management of Berkshire Hathaway (BRK/B) to Greg Abel. It’s a personal blow as Warren was one of the first subscribers to Mad Hedge Fund Trader. No one could ever match his investment performance, not even Warren himself, as stocks are so much more expensive now. Even if (BRK/B) shares dropped 99% from today, it would still be the top-performing S&P 500 stock since 1965. Listening to his annual shareholder summit, he’s still all there at age 94. I want to be Warren Buffett when I grow up.

Is Tesla the Next Boeing? By cutting production costs by 17% last year, has Musk also made the cars unsafe? That’s what happened to Boeing (BA), which prioritized raising dividends and share buybacks over quality and safety to the point where its aircraft started falling out of the sky. This year, (TSLA) shares have been matching (BA) downside one for one.

Jeff Bezos to Sell $4.7 Billion of Amazon Stock by May 2026. Time to free up some spending money. Jeff sold $13.4 billion worth of shares in 2024. Some of the money will go to finance his Blue Origin rocket hobby. Bezos still owns 9.56% of the $2 trillion company.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, May 12, at 8:30 AM EST, the WASDE Report is announced, the World Agriculture Supply and Demand Estimate.

On Tuesday, May 13, at 7:30 AM, the Consumer Price Index, a key inflation read, is released.

On Wednesday, May 14, at 9:30 AM, EIA Oil Stocks are disclosed. No move is expected in the face of a rising inflation rate. A press conference follows at 1:30.

On Thursday, May 15, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Producer Price Index and Retail Sales.

On Friday, May 16, at 7:30 AM, we get Housing Starts and Building Permits. At 1:00 PM, the Baker Hughes Rig Count is published.

As for me, one of the many benefits of being married to a British Airways senior stewardess is that you get to visit some pretty obscure parts of the world. In the 1970s, that meant going first class for free with an open bar, and sometimes in the cockpit jump seat.

To extend out 1977 honeymoon, Kyoko agreed to an extra round trip for BA from Hong Kong to Colombo in Sri Lanka. That left me on my own for a week in the former British crown colony of Ceylon.

I rented an antiquated left-hand drive stick shift Vauxhall and drove around the island nation counterclockwise. I only drove during the day in army convoys to avoid terrorist attacks from the Tamil Tigers. The scenery included endless verdant tea fields, pristine beaches, and wild elephants and monkeys.

My eventual destination was the 1,500-year-old Sigiriya Rock Fort in the middle of the island, which stood 600 feet above the surrounding jungle. I was nearly at the top when I thought I found a shortcut. I jumped over a wall and suddenly found myself up to my armpits in fresh bat shit.

That cut my visit short, and I headed for a nearby river to wash off. But the smell stayed with me for weeks.

Before Kyoko took off for Hong Kong in her Vickers Viscount, she asked me if she should bring anything back. I heard that McDonald’s has just opened a stand there, so I asked her to bring back two Big Macs.

She dutifully showed up in the hotel restaurant the following week with the telltale paper back in hand. I gave them to the waiter and asked him to heat them up. He returned shortly with the burgers on plates surrounded by some elaborate garnish. It was a real work of art.

Suddenly, every hand in the restaurant shot up. They all wanted to order the same this, even though the nearest stand was 2,494 miles away.

We continued our round-the-world honeymoon to a beach vacation in the Seychelles, where we just missed a coup d’état, a safari in Kenya, apartheid South Africa, London, San Francisco, and finally back to Tokyo. It was the honeymoon of a lifetime.

Kyoko passed away in 2020 from breast cancer at the age of 50, well before her time.

Sigiriya Rock Fort

Kyoko

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader|

Global Market Comments

May 2, 2025

Fiat Lux

Featured Trade:

(APRIL 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (AGQ), (NVDA), (SH), (UNG), (USO),

(TSLA), (SPX), (CCJ), (USO), (GLD), (SLV)

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 17, 2025

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT REPLAYS ARE UP)

(APRIL 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SH), (SDS), (TLT), (MSTR), (GLD),

(GOLD), (SLV), (AGQ), (NEM)

Below, please find subscribers’ Q&A for the April 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Is it time to get out of the (SH), which is the short S&P 500 LEAPS?

A: I would say no. We're still very deep in the money for the LEAPS I put out two months ago. I doubt we're going to new highs by August when that LEAPS expires, so I would hang on to it, especially if you have other longs on the stock market. But if you're nervous, you probably have at least a 50% profit in that anyway, so take the money and run.

Q: Could the S&P 500 trade down to 4,500?

A: Absolutely, yes. China is kind of in a good position. They can wait. They can wait a very long time until they get what they want. We can't. Trump needs China to fold immediately, or the trade with China will cause a never-ending recession in the US. Remember, we have elections here—in China, they don't. That puts them in a very strong negotiating position. That's why you're seeing basically all economic data roll over and point to a recession. Even if some settlement is negotiated, there still will be some tariffs left. They just won't be at 145%. You know, it’s not a great investment environment to bet your retirement savings on, and certainly not an environment to engage in very rapid short-term trading unless you have 50 years of experience like I do. That's why I'm up this month, and the rest of the world is getting absolutely crushed.

Q: Are you going to send more LEAPS?

A: LEAPS are something we do at market bottoms, not tops, because we have such enormous leverage in the LEAPS trade—they’re usually 10 - 1 to 100 - 1 leverage. At some point, there'll be a lot of fantastic LEAPS in technology stocks, but I don't think we've hit bottom yet. In fact, at best, they've mounted weak bounces over the last few days. So, the charts still look terrible—not a good time for LEAPS.

Q: When do you see the bottom?

A: I have no idea, nobody has any idea. It's like economic policy is changing hour by the hour. Best thing to do is nothing in that situation—and that's what most of the economy is doing. That's why the economy is shutting down. Nobody knows what the final picture will look like—the uncertainty is the greatest since the uncertainty of the pandemic, or 9/11 before that.

Q: Should I hide in a money market fund?

A: No, with the money market fund, you run credit risk with the issuer of that fund. With 90-day US Treasury bills, there's no risk, so you have a government guarantee to get all your money back on the maturity date. If your custodian goes bankrupt, you can always get the T-bills back. It may take you three years in custodian bankruptcy proceedings to get your money market fund back. That’s what we saw with MF Global in 2011.

Q: What is the end game of the China-US trade dispute? How does it affect the stock market?

A: Well, we can't see an end game. Basically, you have two counterparties who are stubborn as heck, and we could be stuck in no man's land for a very long time. You'd have to think eventually a settlement of some type comes. Is that worth a recession for the U.S? For most people, I doubt it. And what if China just wants to wait out Trump and wait for the tariffs to go away in four years? That is a possible outcome. Stock markets always discount the worst-case scenario first before they discount anything else. I think that's what we saw last week, when we broke 5,000 in the S&P 500.

Q: Are you optimistic about bank stocks now?

A: No. They will lead the downturn along with technology stocks. But when this all ends, they will also lead the upturn, and that's why you're seeing bank stocks have such hard bounces off their bottom. It's another one of two sectors that people will be first to rush into—banks and technology stocks. And while tech is expensive, banks are cheap.

Q: How can interest rates fall when government policies, interest rate policies, are causing them to spike?

A: Well, it's very simple: when foreign investors lose faith in the U.S. Government, they have, they pull their money out. They don't need to be here. It's a situation of, “Well, if you don't need us, we don't need you.” And foreigners own about 25% of all of the $36 trillion in national debt out there, or about $9 trillion. And in stocks they own here and the number goes up to $12 trillion. It doesn't take much selling to cause a panic in the bond market. That is what we have been seeing. Whether that continues, I have no idea—it depends on the next tweet coming out of Washington.

Q: What about Bank of America (BAC)?

A: Yeah, it will also bounce the hardest off the bottom—great buy, and these things are all cheap relative to technology stocks. You know, banks still have PE multiples in the low teens. Tech stocks are all the way down to the low 20s from the 30s and 40s, so they're roughly trading at double the multiples of bank stocks. That's one reason people are rushing back into these.

Q: What's the basis of your prediction on a falling US dollar?

A: Again, it's foreign selling. I don't think I've ever seen a falling dollar and rising interest rates in 60 years of watching. It goes against all economic fundamentals in the currency markets. But when there's a panic, there's a panic. People want out of everything at any price, and that's what's happening now. As long as foreigners are dumping our assets, the dollar will keep going down—dumping our assets means dollar selling after 80 years of dollar buying.

Q: Is gold the only safe haven?

A: Yes. We'll get into this in the gold section, but even gold went down for three days, and then wiser heads prevailed and it actually triggered a panic melt-up in gold assets. The miners were up 25% in days. That is another great weak-dollar play.

Q: How do you protect the US from a dollar fall?

A: Change our economic policies; end the trade war.

Q: Is it a good time to buy a house?

A: No, it is not, unless you can wait out the current downturn. High interest rate mortgage rates shot up from 6.5% to 7.1% in a week, and that basically kills off the housing market for the foreseeable future. And of course, when people are worried about their futures, their savings, and their assets, the last thing they do is go out and buy a house.

Q: Is there enough negative sentiment around now for us to go back into the bond market?

A: No. There is no precedent for the type of market action that's going on now. Will the U.S. government suddenly become reasonable? I doubt it. You can expect tweet bombs to happen at any time. So, people are just hoarding cash and avoiding risk at all costs. It used to be that bonds were the safe place to go. No longer. Not with 10% moves down in a week like we saw last week. Sorry—T-Bills are the only actual safe play out there, and their yield is the same as Treasury bonds without the risk.

Q: Will crypto keep going down?

A: If we continue with a risk-off market, I think you can expect crypto to keep falling. Crypto fell 30% from its top—at least Bitcoin did. It's basically matching the downside with tech stocks one for one, so no protection in crypto, no diversification. The protection aspect that was promised by crypto promoters lever shows. No flight to safety is happening there whatsoever. And that's why I'm looking to add to my short in MicroStrategy Inc. (MSTR)—they're a leveraged long Bitcoin play.

Q: Is the U.S. economy set for a hard landing?

A: I think absolutely, yes, the hard landing is in progress. That's what all of the economic data says. It's hard to find any positive news coming out of the economy—people are running for their lives, essentially.

Q: Do you expect inflation to return and take stocks lower?

A: Absolutely, yes. The highest tariffs in history start hitting retail prices in the next month or two, and the price increases should be dramatic, especially on anything from China. So yeah, we should see that come out in the data in the next few months.

Q: Do you expect silver to follow gold?

A: Yes, I do, but it hasn't been performing as well because there is a recession drag on silver, which you don't have for gold. Silver (SLV), (AGQ) are used in a lot of electronics and solar panels.

Q: When do you get back into gold (GLD)?

A: Whenever we get a dip. So far, any dips have been very brief and short-term. It's kind of reminiscent of the 1970s when gold moved from $32 an ounce to $900. That’s when you found me in a line in Johannesburg, South Africa, waiting to sell all my Krugerrands.

Q: Which countries will benefit from manufacturing moving out of China?

A: The answer is really no countries. As soon as manufacturing moves from China to another one like Vietnam, the US then puts punitive tariffs on that second country. So, there's no place to hide. It's really a war against the world. That's the message that the administration is putting out: if you don't want to build a factory here, we don't want to do business with you. We don't want your products. And most companies will do nothing. They'll wait this out, wait for a future president to eliminate all tariffs. Until then, international trade grinds to a halt. No trade makes sense at 145% tariff. Just to give you some idea on how much that is, if you buy a top end MacBook Pro for $8,000, and you pay the full 145% tariff, that is an $11,600 tariff if you have to pay it, which brings the total cost of a MacBook Pro to nearly $19,600. How many are you going to buy at that price?

Q: Do you think the Fed will cut interest rates?

A: No, we haven't seen the inflation data yet. They are backward-looking, and only after we see a sharp rise in prices will they raise rates. Chances of them cutting now are zero with all the risks in inflation to the upside right now and unemployment still under control. So, no interest rate cuts this year.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 8, 2025

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Global Market Comments

March 24, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE SPECIAL NO CONFIDENCE ISSUE)

(GM), (SH), (TSLA), (NVDA), (GLD), (TLT), (LMT), (BA), (NVDA), (GOOGL), (AAPL), (META), (AMZN), (PANW), (ZS), (CYBR), (FTNT), (COST)

(AMGN), (ABBV), (BMY), (TSLA), GM), (GLD), (BYDDF)

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder.

It has in fact been deleted.

That explains a lot about how markets have been trading this year. It looks like it is going to be a reversion to the mean year. Forecasters, strategists, and gurus alike are rapidly paring down their stock performance targets for 2025 to zero.

When someone calls the fire department, it’s safe to assume that there is a fire out there somewhere. That’s what Fed governor Jay Powell did last week. It raises the question of what Jay Powell really knows that we don’t. Given the opportunity, markets will always assume the worst, that there’s not only a fire, but a major conflagration about to engulf us all. Jay Powell’s judicious comments last week certainly had the flavor of a president breathing down the back of his neck.

It's interesting that a government that ran on deficit reduction pressured the Fed to end quantitative tightening. That’s easing the money supply through the back door.

For those unfamiliar with the ins and outs of monetary policy, let me explain to you how this works.

Since the 2008 financial crisis, the Fed bought $9.1 trillion worth of debt securities from the US Treasury, a policy known as “quantitative easing”. This lowers interest rates and helps stimulate the economy when it needs it the most. “Quantitative easing” continued for 15 years through the 2020 pandemic, reaching a peak of $9.1 trillion by 2022. For beginners who want to know more about “quantitative easing” in simple terms, please watch this very funny video.

The problem is that an astronomically high Fed balance sheet like the one we have now is bad for the economy in the long term. They create bubbles in financial assets, inflation, and malinvestment in risky things like cryptocurrencies. That’s why the Fed has been trying to whittle down its enormous balance sheet since 2022.

By letting ten-year Treasury bonds it holds expire instead of rolling them over with new issues, the Fed is effectively shrinking the money supply. This is how the Fed has managed to reduce its balance sheet from $9.1 trillion three years ago to $6.7 trillion today and to near zero eventually. This is known as “quantitative tightening.” At its peak a year ago, the Fed was executing $120 billion a month quantitative tightening.

By cutting quantitative tightening, from $25 billion a month to only $5 billion a month, or effectively zero, the Fed has suddenly started supporting asset prices like stocks and increasing inflation. At least that is how the markets took it to mean by rallying last week.

Why did the Fed do this?

To head off a coming recession. Oops, there’s that politically incorrect “R” word again! This isn’t me smoking California’s largest export. Powell later provided the forecasts that back up this analysis. The Fed expects GDP growth to drop from 2.8% to 1.7% and inflation to rise from 2.5% to 2.8% by the end of this year. That’s called deflation. Private sector forecasts are much worse.

Just to be ultra clear here, the Fed is currently engaging in neither “quantitative easing nor “quantitative tightening,” it is only giving press conferences.

Bottom line: Keep selling stock rallies and buying bonds and gold on dips.

Another discussion you will hear a lot about is the debate over hard data versus soft data.

I’ll skip all the jokes about senior citizens and cut to the chase. Soft data are opinion polls, which are notoriously unreliable, fickle, and can flip back and forth between positive and negative. A good example is the University of Michigan Consumer Confidence, which last week posted its sharpest drop in its history. Consumers are panicking. The problem is that this is the first data series we get and is the only thing we forecasters can hang our hats on.

Hard data are actual reported numbers after the fact, like GDP growth, Unemployment Rates, and Consumer Price Indexes. The problem with hard data is that they can lag one to three months, and sometimes a whole year. This is why by the time a recession is confirmed by the hard data, it is usually over. Hard data often follows soft data, but not always, which is why both investors and politicians in Washington DC are freaking out now.

Bottom line: Keep selling stock rallies and buying bonds and gold (GLD) on dips.

A question I am getting a lot these days is what to buy at the next market bottom, whether that takes place in 2025 or 2026. It’s very simple. You dance with the guy who brought you to the dance. Those are:

Best Quality Big Tech: (NVDA), (GOOGL), (AAPL), (META), (AMZN)

Big tech is justified by Nvidia CEO Jensen Huang’s comment last week that there will be $1 trillion in Artificial Intelligence capital spending by the end of 2028. While we argue over trade wars, AI technology and earnings are accelerating.

Cybersecurity: (PANW), (ZS), (CYBR), (FTNT)

Never goes out of style, never sees customers cut spending, and is growing as fast as AI.

Best Retailer: (COST)

Costco is a permanent earnings compounder. You should have at least one of those.

Best Big Pharma: (AMGN), (ABBV), (BMY)

Big pharma acts as a safety play, is cheap, and acts as a hedge for the three sectors above.

March is now up +2.92% so far. That takes us to a year-to-date profit of +12.29% in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +82.50%. That takes my average annualized return to +51.12% and my performance since inception to +764.28%.

It has been another busy week for trading. I had four March positions expire at their maximum profit points on the Friday options expiration, shorts in (GM), and longs in (GLD), (SH), and (NVDA). I added new longs in (TSLA) and (NVDA). This is in addition to my existing longs in the (TLT) and shorts in (TSLA), (NVDA), and (GM).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

UCLA Andersen School of Business announced a “Recession Watch,” the first ever issued. UCLA, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract. Recessions occur when multiple sectors of the economy contract at the same time.

Retail Sales Fade, with consumers battening down the hatches for the approaching economic storm. Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021.

This Has Been One of the Most Rapid Corrections in History, leaving no time to readjust portfolios and put on short positions.

The rapid descent in the S&P 500 is unusual, given that it was accomplished in just 22 calendar days, far shorter than the average of 80 days in 38 other examples of declines of 10% or more going back to World War II.

Home Builder Sentiment Craters to a seven-month low in March as tariffs on imported materials raised construction costs, a survey showed on Monday. The National Association of Home Builders/Wells Fargo Housing Market Index dropped three points to 39 this month, the lowest level since August 2024. Economists polled by Reuters had forecast the index at 42, well below the boom/bust level of 50.

BYD Motors (BYDDF) Shares Rocket, up 72% this year, on news of technology that it claims can charge electric vehicles almost as quickly as it takes to fill a gasoline car. BYD on Monday unveiled a new “Super e-Platform” technology, which it says will be capable of peak charging speeds of 1,000 kilowatts/hr. The EV giant and Tesla rival say this will allow cars that use the technology to achieve 400 kilometers (roughly 249 miles) of range with just 5 minutes of charging. Buy BYD on dips. It’s going up faster than Tesla is going down.

Weekly Jobless Claims Rise 2,000, to 223,000. The number of Americans filing new applications for unemployment benefits increased slightly last week, suggesting the labor market remained stable in March, though the outlook is darkening amid rising trade tensions and deep cuts in government spending.

Copper Hits New All-Time High, at $5.02 a pound. The red metal has outperformed gold by 25% to 15% YTD. It’s now a global economic recovery that is doing this, but flight to safety. Chinese savers are stockpiling copper ingots and storing them at home distrusting their own banks, currency, and government. I have been a long-term copper bull for years as you well know. New copper tariffs are also pushing prices up. Buy (FCX) on dips, the world’s largest producer of element 29 on the Periodic Table.

Boeing (BA) Beats Lockheed for Next Gen Fighter Contract for the F-47, beating out rival Lockheed Martin (LMT) for the multibillion-dollar program. Unusually, Trump announced the decision Friday morning at the White House alongside Defense Secretary Pete Hegseth. Boeing shares rose 5.7% while Lockheed erased earlier gains to fall 6.8%. The deal raises more questions than answers, in the wake of (BA) stranding astronauts in space, their 737 MAX crashes, and a new Air Force One that is years late. Was politics involved? You have to ask this question about every deal from now on.

Carnival Cruise Lines (CCL) Raises Forecasts, on burgeoning demand from vacationers, including me. The company’s published cruises are now 80% booked. Cruise lines continue to hammer away at the value travel proposition they are offering. However, the threat of heavy port taxes from the administration looms over the sector.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 24, at 8:30 AM EST, the S&P Global Flash PMI is announced.

On Tuesday, March 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, March 26, at 1:00 PM, the Durable Goods are published.

On Thursday, March 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, March 28, the Core PCE is released, and important inflation indicator. At 2:00 PM, the Baker Hughes Rig Count is printed.

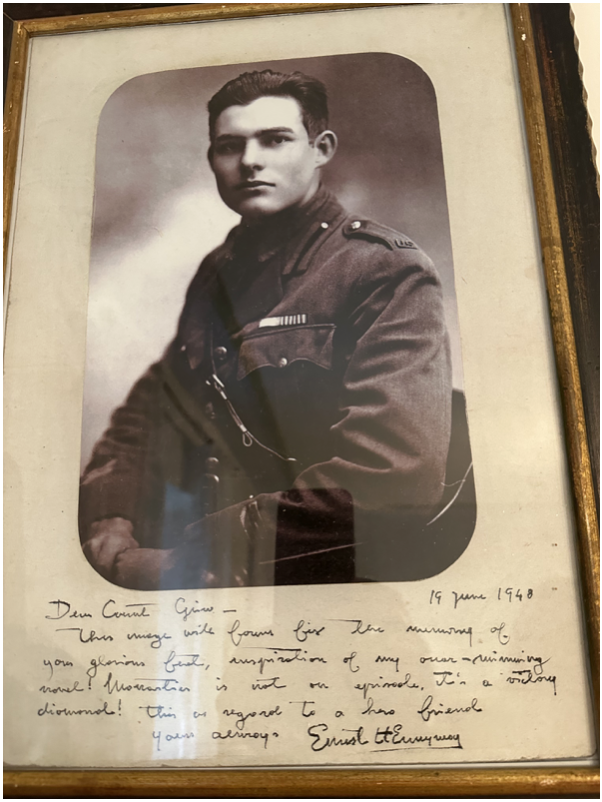

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel Prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West, Cuba, and Ketchum Idaho.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was also being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

As for last summer, I stayed in the Hemingway Suite at the Hotel Post in Cortina d’Ampezzo Italy where he stayed in the late 1940’s to finish a book. Maybe some inspiration will run off on me.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.