In a world where the longing for personalized cancer treatments echoes the craving of superheroes for justice, Thermo Fisher Scientific (PFE) and Pfizer (PFE) have forged an alliance to expand the global reach of next-generation sequencing technologies.

Their ambitious mission? To bring a ray of hope to patients by advancing a more accurate technology that can be used against cancer.

Cancer treatment is evolving at lightning speed, shaking up the status quo and dazzling experts worldwide. In the past, most treatment options revolved around traditional approaches like radiation. But now, a new kid on the block is changing the landscape: genomics.

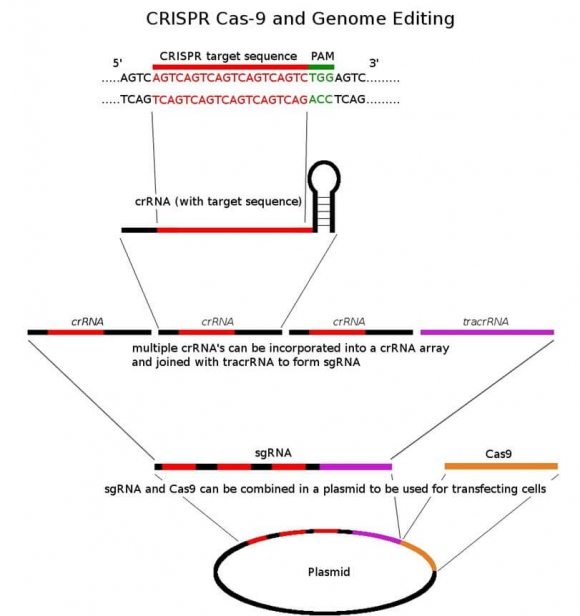

Genomics might sound like a fancy scientific term, but it's a captivating branch of molecular biology that holds the key to unlocking the secrets deep within our genes. By studying our genetic profile, we can diagnose cancer more precisely than ever.

One breakthrough advancement that's causing quite a stir is genomic sequencing.

This technique allows doctors to analyze an individual's genetic sequence and pinpoint their unique genetic makeup. With this information, they can devise treatments finely tuned to each person's needs.

In fact, studies have shown that genomic sequencing can help match cancer patients to the most effective treatments based on their unique genetic makeup, significantly improving survival rates and treatment outcomes.

A recent study even showcased that patients who underwent genomic-guided therapy experienced an astonishing 35% higher overall response rate than those receiving conventional treatments.

Imagine a world where there are no more blanket treatments, only personalized care that targets the source of individual cancers.

In terms of the target market, the projected size of the global genomics market is a staggering $29.1 billion by 2025, and the profound impact on cancer, as the primary target for genomic analysis, is nothing short of colossal.

Here is the next question: Is this technology truly available, accessible, and sustainable in the long run? The resounding answer is yes.

The rise of next-generation sequencing as the gold standard in selecting cancer treatments has put the spotlight on access and affordability. Sequencing technology, once the sluggish tortoise in the race, has transformed into a lightning-fast hare.

Remember the mythical "$1,000 genome?" Well, it's no longer a myth.

Thanks to the groundbreaking unveiling of the $100 genome by Ultima Genomics in 2022, the cost of whole-genome sequencing has plummeted to a fraction of its former self. As costs continue to nosedive and swiftness skyrockets, the stage is unequivocally set for a genomic revolution, with cancer patients emerging as the ultimate beneficiaries of this scientific triumph.

Consequently, the biotechnology and healthcare market stands on the precipice of a seismic shift as Thermo Fisher and Pfizer join forces to democratize genomic sequencing.

With an initial focus on lung and breast cancer patients across more than 30 countries in Latin America, Africa, the Middle East, and Asia, this duo aims to shatter the barriers that have limited access to cutting-edge testing resources.

That is, more lives are about to be touched by the power of precision medicine.

This collaboration also unveils a compelling investment opportunity. As the demand for next-generation sequencing technologies skyrockets, Thermo Fisher Scientific, the vanguard of sequencing equipment and reagents, stands poised to ride this wave of progress.

Envision sales figures soaring as they equip local laboratories, guaranteeing the possession of indispensable technology, robust infrastructure, and expertly trained personnel to orchestrate these genomic symphonies.

Meanwhile, Pfizer, not content with just making blockbuster drugs, seeks to make DNA tests more affordable for patients and enlighten healthcare providers about the tremendous benefits of genomic screening.

As the costs of sequencing continue to decrease, even enabling the elusive $1,000 genome to become a reality, the accessibility and adoption of genomic sequencing are poised to expand, paving the way for personalized cancer therapies and transforming the landscape of oncology. Can you hear the sound of stock prices ascending?

So hold onto your lab coats and stethoscopes; Thermo Fisher and Pfizer's collaboration is about to reshape the landscape of cancer treatment.

As investors, consider the potential windfall of increased demand for sequencing technologies and expansion into emerging markets.

As humanity, marvel at the possibilities that arise when genomic superheroes unite. The era of personalized medicine is dawning, and these two trailblazers may just be your ticket to ride the genomic wave of the future.