Below please find subscribers’ Q&A for the June 1 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: What are the 3 best stocks to own for the end of the year?

A: Apple (AAPL), Alphabet Inc. (GOOGL), and Microsoft (MSFT). Those you want to buy on meltdown days, kind of like today. Make sure you scale into these—so maybe buy 20% on every down-500-point Dow day. Eventually, you’ll end up with a pretty decent position at a market low in a stock that will double in 3-5 years.

Q: Why these three stocks?

A: Lots of reasons: They’re huge, they’re safe, two out of three pay dividends, Alphabet is about to split, and they have huge moats so nobody can get into their sectors. They have near monopolies in what they do, and they have immense cash on the balance sheet. These are the kind of stocks that portfolio managers dream about. And watch what rallied the hardest in the last dead cat bounce we had—it was these three names. That tells you that they will lead any long-term bull market in the future. These are the stocks that people want to own.

Q: What will bring your predicted second half-bull market in the stock market?

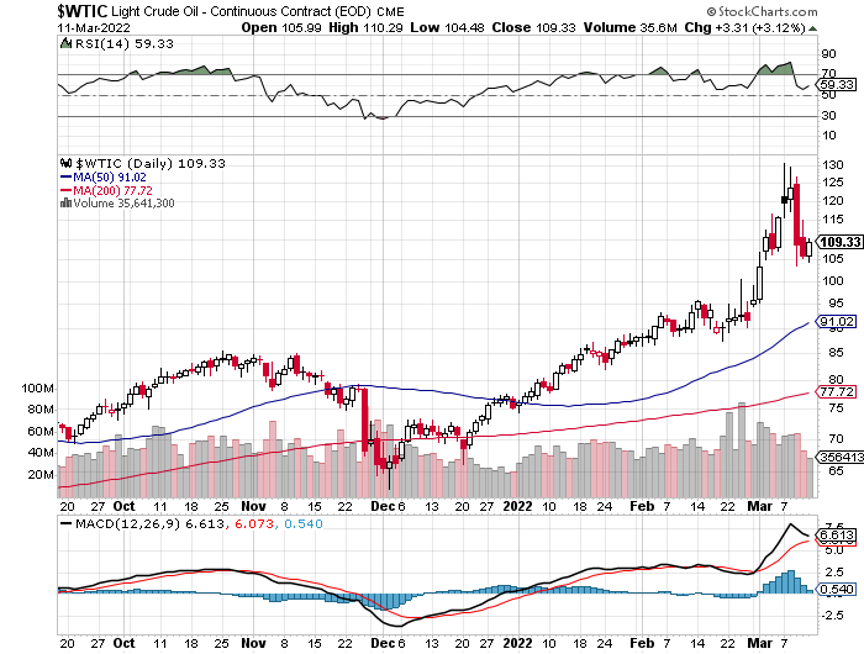

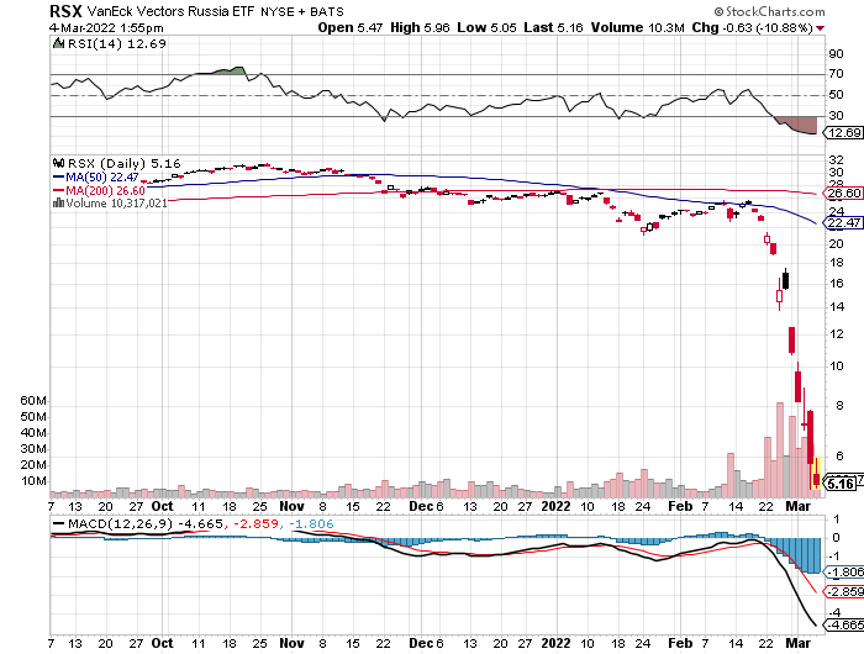

A: Inflation drops from 8% to 4%. That will happen for a couple of reasons. The year-on-year comparisons become highly favorable starting from next month when inflation started to take off a year ago. Inflation numbers are going to be climbing the wall of worry from here on out. That could get us down to 4% by the end of the year. The second reason is the Ukraine War either ends or becomes a stalemate and is no longer a factor in the global markets, and we’ve had time to replace all the Russian oil and Ukrainian wheat.

Q: Are banks positioned to benefit from the coming rally?

A: Absolutely. I think big tech and banks will be the top-performing stock sectors for the next five years because inflation will go away, recession fears will go expire, and credit quality will improve, but interest rates will remain 300 basis points higher than they were during the pandemic. Buy (JPM), (BAC), and (C) on dips.

Q: What will be the worst performing sector?

A: Energy—anything energy-related will get absolutely slaughtered, which is why I don't want to touch it with a ten-foot pole right now. That includes oil companies, exploration companies, E&P companies, and master limited partnerships, as well as coal and other natural gas stocks. So, if you’re long these names don’t forget to sit down when the music stops playing. You could get your head handed to you at the end.

Q: Can we make lower lows?

A: Yes, that’s entirely possible. Market moves are basically random when you get down to these levels— down more than 20%. And on all future downturns, I would be spending your cash going back into the market expecting a second half rally.

Q: What about green energy?

A: Unfortunately, green energy is very tied to old energy because $120 oil makes green companies much more competitive from a cost point of view. So, I’m not going to go piling into green companies right here, especially if I think oil is topping out in the near future. Buying green energy companies here is the same as buying oil at $120 a barrel.

Q: What is the best way to play the declining US dollar?

A: Buy the iShares MSCI Emerging Markets ETF (EEM). Also, the Aussie dollar (FXA) and the Canadian Dollar (FXC), which benefit tremendously from commodity prices, which will rise for another decade in a global economic recovery.

Q: Why will energy be the worst sector?

A: If you end the war in the Ukraine or you replace Russian oil, either by finding new sources of oil, getting other producers to increase production which they can do (including the US), or by accelerating the move to alternatives, then you move oil back to pre-invasion prices which were about $70 a barrel or $50 lower than they are here.

Q: Best way to hedge a falling market?

A: Do what I'm doing: keep a balanced portfolio of longs and shorts, that way you always have something that’s going up. And if you do it through the options, you have time decay working for you on both sides of the equation. If you want to go outright, buy outright puts on individual stocks because they had double the moves of the indexes. And go to my short selling school which you can find by going to my website at https://www.madhedgefundtrader.com. There’s actually 12 different ways to benefit from falling markets.

Q: How deep in the money can we go on our call spreads?

A: Wait for the Volatility Index (VIX) to go over $30, and then go 15-20% in the money. And yes, you only make 10, 15, or 20% on those positions in a month but then you put together ten of them and that adds up to quite a lot of money. You want to find the position that has the greatest probability of happening—i.e. something that’s 20% in the money. Do that when the market has just dropped 20%, which it already has, and then you have a position that has a minuscule chance of losing money.

Q: How much longer do you see this current bear market bounce lasting?

A: Until yesterday.

Q: What's your favorite commodity ETF?

A: My favorite commodity stock is Freeport McMoRan (FCX), the world’s largest copper producer. Rather than pay the extra management fees for an ETF, I prefer just to go straight to the source and buy (FCX).

Q: When do you think the Fed will pivot to dovish or neutral?

A: This summer. It’s just a question of whether it’s the July or the September meeting.

Q: When you say “buy on dips”, what does that mean? 1%, 3%, 5%?

A: Well in this market, a dip would be a retest of the previous lows which is going to be down 10% or 15% on the major positions in your portfolio. If you’re day trading, a dip is only 1%, so it really depends on your timeframe and your risk tolerance. That’s why I always tell people to scale by doing everything in incremental pieces—20%, 25%, and so on. You never know what the market’s actually going to do on a short-term basis. Randomness can’t be predicted.

Q: If you plan to enter a LEAPS on Apple, what strikes would you do?

A: Well, first of all, I want to see if Apple drops all the way to $125, which is a lot of people’s downside target. If it did, then I would do the $125/$135 call spread two years out, and that will probably double. And if it starts a long term up trend, then I’ll keep rolling up the strike prices. If, say, Apple goes to $125, you put your LEAPS on. If the stock rises to 150, then take profits on the $125/$135 and roll into the $150/$160. That’s how you can get like 1,000% returns like we got on Tesla (TESLA) a few years ago. You just keep rolling up your strike prices on every weak day and maintain your leverage.

Q: When do we bet the farms on Editas Medicine Inc. (EDIT) and Crispr (CRSP) Therapeutics?

A: Never. These are small, highly speculative companies which will make money someday, but if the someday is in five years and you’re betting the farm with a LEAPS, you lose the farm. It's going to take a long time for these smaller biotech stocks to come back. If you want to play biotech, go with the big ones like Amgen. It takes a long time to convert cutting-edge technology into profits. The big companies already have a stable of reliable money-making drugs on hand.

Q: Salesforce Inc. (CRM) is up big on earnings—what should I do with the stock?

A: Buy the dips. It’s still way, way below its all-time highs, so use the weekdays to accumulate Salesforce for the long term. It’s one of the best cloud plays out there.

Q: What do you think about NVIDIA Corporation (NVDA)?

A: I absolutely love it. It rallied 20% off the bottom. Use any other additional weak days like today to increase your position. This stock someday is worth $1,000, up from today’s $195.

Q: Do you like SPACS?

A: No, I hate them and think they’re a rip-off. And a lot of them have become totally illiquid and untradable, so you have no choice but for them to shut down and return their money if they have any left. I’ve hated SPACS from day one and people are now getting their comeuppance on these.

Q: What do you think about the weakness in Coinbase Global Inc. (COIN) down here?

A: It’s just going down with all the other high-risk, speculative, meme stock type plays, which include all of the crypto plays like Bitcoin. I would avoid all of those. You want to buy quality at the discount now, and you want to buy the Cadillacs at Volkswagen prices and leave the speculative plays for the next generation, Gen Z, who are already highly interested in stocks.

Q: What is your favorite non-US country to invest in?

A: Australia, because you get a double play there on the currency, which should go up 30% from here, and they will benefit from a global commodity boom which continues for another ten years. They pretty much sell a lot of the major commodities like iron ore, wheat, sheep, and so on. It’s also a really nice country to visit. The only negative with Australia are the sharks.

Q: Biotech takeover targets?

A: Well (EDIT) and (CRSP) would be two of them. Things in the sector are so cheap that they are all potential takeover targets. M&A (Mergers and Acquisitions) will be a major play in the biotech sector for the foreseeable future.

Q: Should we sell short the defense industry here?

A: No, even if the war ends tomorrow, you might get some profit-taking, but the fact is that long term military spending is increasing permanently. The peace dividend now has to be paid back, and that is great for all the defense companies, so I would not be shorting them. If anything, I’d be buying on dips. Buy Lockheed Martin (LMT), Raytheon (RTX), who make the Javelin antitank missile for which there is now a two-year order backlog. You can also throw in General Dynamics (GD) for good measure which builds nuclear submarines and the Stryker armored vehicle.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

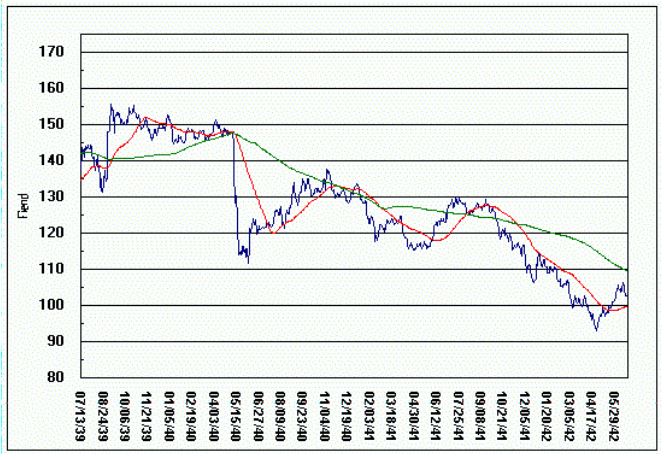

Keep Those Defense Plays

Dow Average 1939-1942

Dow Average 1939-1942