Global Market Comments

July 18, 2025

Fiat Lux

Featured Trade:

(JULY 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(GLD), (SLV), (DHI), (LEN), (CCI), (KRE), (META), (NFLX), (AMZN), (SLB), (PPL), (XOM), (OXY), (AGQ), (WFC), (DXJ), (FXE)

Global Market Comments

July 18, 2025

Fiat Lux

Featured Trade:

(JULY 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(GLD), (SLV), (DHI), (LEN), (CCI), (KRE), (META), (NFLX), (AMZN), (SLB), (PPL), (XOM), (OXY), (AGQ), (WFC), (DXJ), (FXE)

Global Market Comments

July 15, 2025

Fiat Lux

SPECIAL EARLY RETIREMENT ISSUE

Featured Trade:

(HOW TO JOIN THE EARLY RETIREMENT STAMPEDE)

(TESTIMONIAL)

Global Market Comments

July 14, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or DON’T FIGHT THE BUBBLE)

(AAPL), (GOOGL), (META), (NVDA), (MSFT), (XOM), (WFC), (TSLA), (AMG)

Global Market Comments

May 8, 2023

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or THE GOLDEN AGE OF BIG BANKING HAS JUST BEGUN)

(JPM), (FRC), (BAC), (C), (WFC), (AAPL), (GOOGL), (META),

(AMZN), (TSLA), (NVDA), (CRM), ($VIX), (USO), (TLT), (QQQ)

CLICK HERE to download today's position sheet.

The United States is about to change beyond all recognition.

Most investors have missed the true meaning of the JP Morgan takeover of First Republic Bank for sofa change, some $10.6 billion. It in fact heralds the golden age of big banking. The US is about to move from 4,000 banks to four, with all of the profits accruing at the top.

Look at the details of the (JPM)/(FRC) deal and you will become utterly convinced.

(JPM) bought a $90 billion loan portfolio for 87 cents on the dollar, despite the fact that the actual default rate was under 1%. The FDIC agreed to split losses for five years on residential losses and seven years on commercial ones. The deal is accretive to (JPM) book value and earnings. (JPM) gets an entire wealth management business, lock, stock, and barrel. Indeed, CEO Jamie Diamond was almost embarrassed by what a great deal he got.

It was the deal of the century, a true gift for the ages. If this is the model going forward, you want to load the boat with every big bank share out there.

And the amazing thing was that (JPM) made the highest bid among a half dozen contenders.

Along with Health Care, banking is the last unconsolidated US industry. We have five railroads, four airlines, three trucking companies, three telephone companies, two cell phone providers….and 4,000 banks?

Other countries get by with much less. England has five major banks, Australia four, and Germany two, one of which goes bankrupt every decade (I’m not naming names). America’s financial system is an anachronism of its federal system where each of the 50 states is treated like a mini country.

The net net of this will be a massive capital drain from the entire country to New York where the big banks are concentrated. Local economies in the Midwest and the South will collapse for lack of funding. The West Coast will be OK with behemoth technology companies spinning off gigantic cash flows.

The other big story here is the dramatic change in the administration’s antitrust policy. Until now, it has opposed every large merger as an undue concentration of economic power. Then suddenly, the second largest bank merger in history took place on a weekend, and there will be more to come.

All it takes is a Twitter run by depositors. Every weekend has become a waiting game for the foreseeable future.

Needless to say, this makes all the big banks a screaming buy. Hoover up every one of the coming dip, including (JPM), (BAC), (C), and (WFC).

Big is beautiful.

To prove I am not perfect, my position in First Republic Bank (FRC) still sits on my broker statement a week after it filed for bankruptcy, dead, moribund, and worthless as if it is some form of punishment. It’s a very small position but it stings nonetheless.

It’s like they want to punish me for leading them astray. They have been copying my trades for ages without paying for them and I hope they took a big one in (FRC).

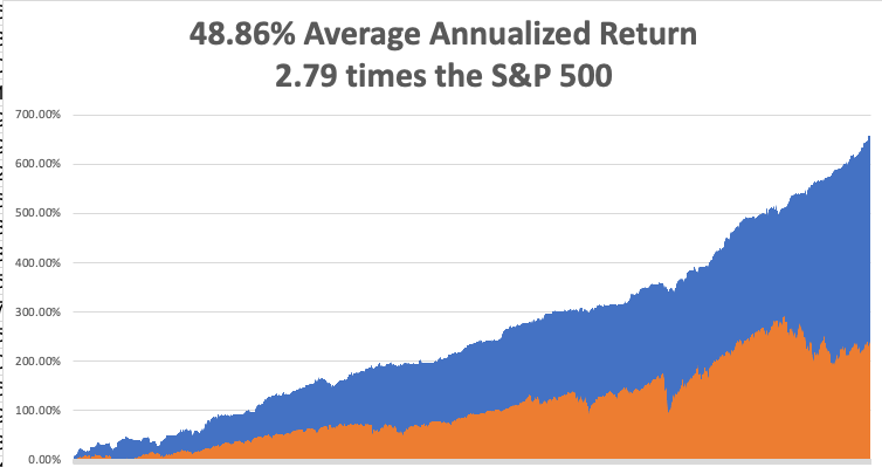

So far in May, I have managed a modest +0.55% profit. My 2023 year-to-date performance is now at an eye-popping +62.30%. The S&P 500 (SPY) is up only a miniscule +8.40% so far in 2023. My trailing one-year return reached a 15-year high at +120.45% versus -3.67% for the S&P 500.

That brings my 15-year total return to +659.49%. My average annualized return has blasted up to +48.86%, another new high, some 2.79 times the S&P 500 over the same period.

Some 40 of my 43 trades this year have been profitable. My last 20 consecutive trade alerts have been profitable.

I initiated no new trades last week, content to run off existing profitable ones. With the Volatility Index at a two-year low at 15.78%, opportunities are few and far between. Those include both longs and shorts in Tesla (TSLA), a long in the bond market (TLT), and a short in the (QQQ).

That leaves me with only one remaining position, a short-dated long in the bond market. I now have a very rare 90% cash position due to the lack of high-return, low-risk trades.

The Fed Raises Rates 0.25%, likely the last such move in this cycle. Futures markets are now discounting a 25-basis point CUT by September, the beginning of a new decade-long falling rate cycle. The problem is that AI is creating more jobs than it is destroying, keeping the Fed fixated on the wrong data.

Nonfarm Payroll Jumps by 253,000, another hot number. The headline Unemployment Rate dropped to a half-century low of 3.4%. These figures suggest for rate hikes to come.

The JP Morgan Buys First Republic Bank from the FDIC, for $10.6 billion, thus wiping out the shareholders. It’s a huge win for (JPM), which picked up 87 branches and $90 billion in loans in the wealthiest part of the country, taking the share up $5. What you lost on (FRC) you made pack on (JPM) LEAPS. Live and learn. On to the next trade! The FDIC got out for nearly free, a big win for the government.

Government Default Date Moved Up to June 1, by US Treasury Secretary Janet Yellen, smacking the bond market for three points. The House remains an albatross around the bond market’s debt.

Europe Ekes Out 0.1% Growth in Q1, versus a 1.1% rate for the US. This is despite the drag of the Ukraine War, energy shortages, high inflation, and Brexit. What’s the difference between the US and Europe? We allow immigrants who become customers, while the continent doesn’t.

You Only Need to Buy Seven Stocks This Year, as the rest are going nowhere. That include (AAPL), (GOOGL), (META), (AMZN), (TSLA), (NVDA), (CRM). Watch out when the next rotation broadens out to the rest of the market.

Is Volatility Bottoming Now? The Fed announcement of a 25 basis point hike on Wednesday could end the move up in stocks. After that, shares will only have an imminent debt default and US government downgrade to focus on. ($VIX) seven-week fade will end that revisit the old highs in the high $20’s. Great shorting opportunities are setting up.

Oil (USO) Crashes 5% on US debt default fears in the biggest drop since January. This is the worst asset class to own going into a recession. EV competition is also starting to take a bite. No gas needed here. $66 a barrel here we come.

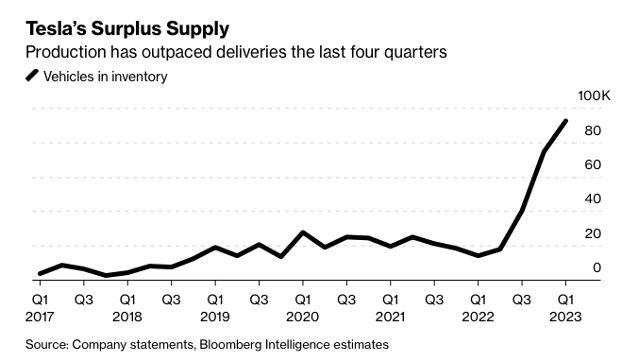

More Tesla Price Cuts to Come, with swelling inventories forcing Musk’s hand. The only consolation is that Detroit will suffer more. Musk is cutting profits while the big three are accelerating losses. Tesla has excess inventory for the first time in its 20-year history.

Apple (AAPL) Earnings Beat, led by stronger than expected Q1 iPhone sales at $53.1 billion. EPS came in at $1.53 versus $1.42 expected, revenues at $94.84 billion versus $92.96. Mac and iPad sales are down YOY. Services rose 5.3%. Apple bought back a stunning $90 billion of its own shares and paid dividends. The shares popped $3. The long-term growth play here is low prices phone in India where second hand phone sales have been burgeoning. That's why Apple is now offering to buy your old phone. Next stop: New Delhi.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 8 at 7:30 AM EST, the Consumer Inflation Expectations are out.

On Tuesday, May 9 at 6:00 AM, the NFIB Business Optimism Index is announced.

On Wednesday, May 10 at 11:00 AM, the US Inflation rate is printed.

On Thursday, May 11 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Producer Price Index.

On Friday, May 12 at 8:30, the University of Michigan Consumer Sentiment Index for April is released.

As for me, I have been going down memory lane looking at my old travel photos looking for new story ideas and I hit the jackpot.

Most people collect postcards from their foreign travels. I collect lifetime bans from whole countries.

During the 1970s, The Economist magazine of London sent me to investigate the remote country of Nauru, one half degree south of the equator in the middle of the Pacific Ocean.

At the time, they had the world’s highest per capita income due to the fact that the island was entirely composed of valuable bird guano essential for agriculture. Before the Haber-Bosch Process to convert nitrogen into ammonia was discovered, guano was the world’s sole source of high grade fertilizer.

So I packed my camera, extra sunglasses, and a couple of pairs of shorts and headed for the most obscure part of the world. That involved catching Japan Airlines from Tokyo to Hawaii, Air Micronesia to Majuro in the Marshall Islands, and Air Nauru to the island nation in question.

There was a problem in Nauru. Calculating the market value of the bird crap leaving the island, I realized it in no way matched the national budget. It should have since the government owned the guano mines.

Whenever numbers don’t match up, I get interested.

I managed to wrangle an interview with the president of the country in the capital city of Demigomodu. It turns out that was no big deal as visitors were so rare in the least visited country in the world that he met with everyone!

When the president ducked out to take a call, I managed to steal a top-secret copy of the national budget. I took it back to my hotel and read it with great interest.

I discovered that the president’s wife had been commandeering Boeing 727s from Air Nauru to go on lavish shopping expeditions to Sydney, Australia where she was blowing $200,000 a day on jewelry, designer clothes, and purses, all at government expense. Just when I finished reading, there was a heavy knock on the door. The police had come to arrest me.

It didn’t take long for missing budget to be found. I was put on trial, sentenced to death for espionage, and locked up to await my fate. The trial took 20 minutes.

Then one morning I was awoken by the rattling of keys. My editor at The Economist, the late Peter Martin, had made a call and threatened the intervention of the British government. Visions of Her Majesty’s Navy loomed on the horizon.

I was put in handcuffs and placed on the next plane out of the country, a non-stop for Brisbane Australia. When I was seated next to an Australian passenger, he asked “Jees, what did you do mate, kill someone?” On arrival, I sent the story to the Australian papers.

I dined out on that story for years.

Alas, things have not gone well for Nauru in the intervening 50 years. The guano is all gone, mined to exhaustion. It is often cited as an environmental disaster. The population has rocketed from 4,000 to 10,000. Per capita incomes have plunged from $60,000 a year to $10,000. The country is now a ward of the Australian government to keep the Chinese from taking it over.

If you want to learn more about Nauru, which many believe to be a fictitious country, please click here.

As for me, I think I’ll pass. I don’t ever plan to visit Nauru again. Once lucky, twice forewarned.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 13, 2023

Fiat Lux

Featured Trade:

(THE MAD HEDGE SUMMIT VIDEOS ARE UP),

(THE BULL CASE FOR BANKS),

(JPM), (BAC), (C), (WFC), (GS), (MS)

CLICK HERE to download today's position sheet.

Banks have become the call option on a US economic recovery.

When the economic data runs hot, banks rally. When it’s cold, they sell off. So, in recent months bank share prices have been melting up.

If we are falling into a recession, then unloading banks here is the right thing to do. If we’re not, and this is really a fake out, then you are looking at the buying opportunity of the decade for banks.

I fall in the latter camp.

There also is a huge sector rotation issue staring you in the face. Where would you rather put new money, stocks at all-time highs trading at ridiculous multiples, like energy stocks, or a quality sector in the bargain basement?

Big institutions have already decided what to do and are buying every dip in financials.

Banks certainly took it on the nose in 2022. Loan default rates soared, demanding a massive increase in loan loss provisions.

Much more stringent accounting rules also kicked in known as “Current Expected Credit Losses.” That requires banks to write off 100% of their losses immediately, rather than spread them out over a period of years.

So what happens next?

For a start, fall down on your knees and thank that Dodd-Frank, the Obama-era financial regulation bill, was passed.

Banks carped for years that it unnecessarily and unfairly tied their hands by limiting leverage ratios to only 10:1. Morgan Stanley reached 40:1 going into the Great Recession and barely made it out alive, while ill-fated Lehman Brothers reached a suicidal 100:1 and didn’t.

That meant the banks went into the pandemic with the strongest balance sheets in decades. No financial crisis here.

Thanks to government efforts to bring the pandemic hit to the economy to a quick end, generous fees have been raining down on the banks from the numerous loan programs they helped to implement, such as PPP.

And trading profits? You may have noticed that options trading volume is up a monster 100% so far in 2023. That falls straight to the banks’ bottom lines. If you’re wondering why your online trading platform keeps crashing that’s why.

I list below my favorite bank investments using the logic that during depressions you want to buy Rolls Royces, Teslas, and Cadillacs at deep discounts, not Volkswagens, Fiats, or Trabants.

JP Morgan (JPM) – is the crown jewel of the sector, with the best balance sheet and the strongest customers. It has over reserved for losses that are probably never going to happen, stowing away some $25 billion in the last quarter alone.

Morgan Stanley (MS) - Brokerage-oriented ones like Morgan Stanley (MS) and Goldman Sachs (GS) are benefiting the most from the explosion in stock and options trading. Morgan’s focus on asset management has made it the first pick among investors demanding a high multiple. I’ll pick my former employer (MS), where I once accounted for 80% of equity division profits.

Bank of America (BAC) - is another quality play with a fortress balance sheet.

Citigroup (C) – is the leveraged play in the sector with a slightly weaker balance sheet and a more aggressive marketing strategy. It seems like they’re always trying to catch up with (JPM). This is the high volatility play in the sector.

And what about Wells Fargo (WFC) you may ask, the cheapest bank of all? This year, it has shaken off hair suit because of its many regulatory transgressions, before, during, and after the financial crisis so I’ll give it a miss.

Here's My Pick

Global Market Comments

February 9, 2023

Fiat Lux

Featured Trade:

(THE BULL CASE FOR BANKS),

(JPM), (BAC), (C), (WFC), (GS), (MS)

CLICK HERE to download today's position sheet.

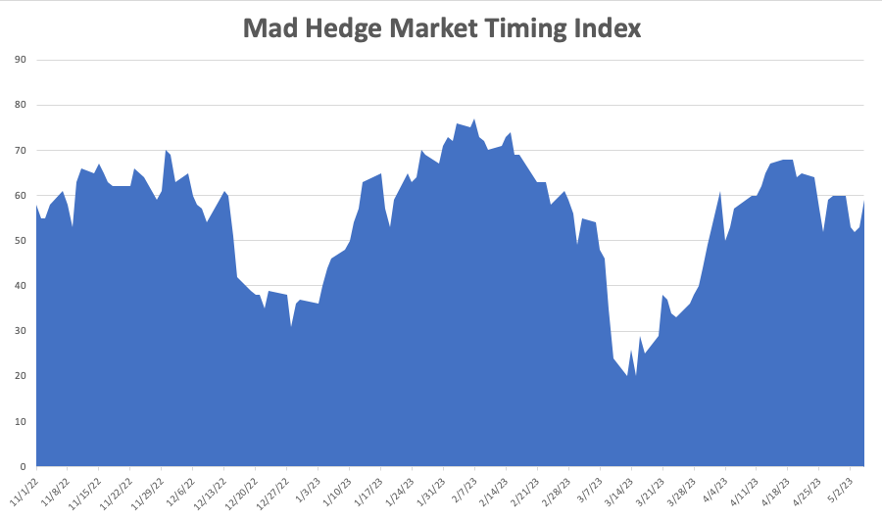

Urgent Trader Warning: The Mad Hedge Market Timing Index moved to a one-year high yesterday and is in “STRONG SELL” territory. Any long stock positions you have for the short-term should be hedged. For more details, please visit my Refresher Course at Short Selling School by clicking here.

Caveat Emptor!

Global Market Comments

January 26, 2023

Fiat Lux

Featured Trade:

(WHY I AM GOING TO LIVE FOREVER)

CLICK HERE to download today's position sheet.

Global Market Comments

January 25, 2023

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(THE BULL CASE FOR BANKS),

(JPM), (BAC), (C), (WFC), (GS), (MS)

CLICK HERE to download today's position sheet.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.