Tea With Economist David Hale

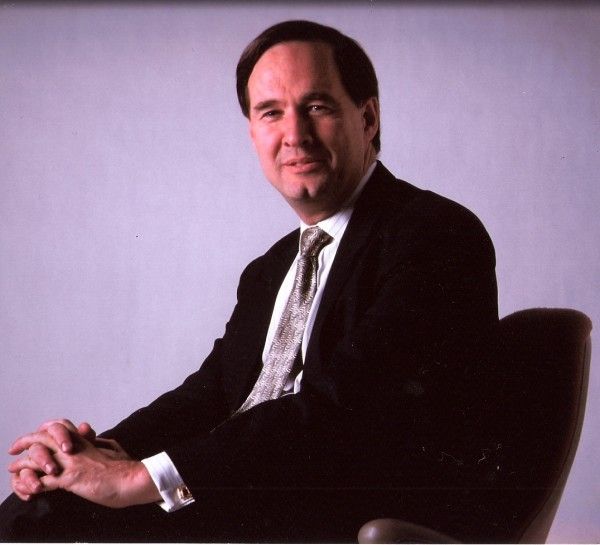

Before I left Chicago, I managed to catch up with my old friend, David Hale, for a cup of tea at the city?s prestigious University Club. I have been using David as my de facto global macro economist for decades, and I never miss an opportunity to get his updated views. The challenge is in writing down David?s eye popping, out of consensus ideas fast enough, because he spits them out in a rapid fire succession.

Hale believes that Q4 will come in much hotter than expected, delivering US growth possibly as high as 3.5% to 4%. If the payroll tax cuts and unemployment benefits are renewed once again, these alone could be worth 1% in GDP this year. The streak could spill into Q1, 2012, staying as firm as 2%-2.5%.

After that, the sushi hits the fan, and the numbers will threaten another dip. Europe will become a major drag, which accounts for 14% of US exports. A slowing by emerging markets, led by China and India, will also take its toll. This will lead to falling private demand and weak commodity prices. But David is not predicting a crash by any means.

To keep up with trends in the Middle Kingdom, Hale confesses to reading The People?s Daily News online edition each morning. He formerly worked as chief economist for Kemper Financial Services from 1977 to 1995, and Zurich Financial Services, which he joined as chief economist in 1995. He advised the group?s fund management and insurance operations on both the economic outlook and a wide range of public policy issues until 2002, when he founded David Hale Global Economics. To visit David?s website, please click here.

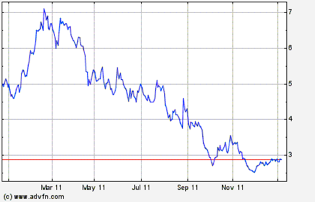

Does Hale see any outstanding investment opportunities out there? He sure does. Greece, of all countries, is presenting a generational opportunity. Big, state owned monopolies are being broken up. The unions are being tamed. Banks are trading at 10% of book value. The Hellenic Stock Exchange, which has cratered 65% since March, is about to end taxes on trading. Major structural reforms are being pushed through at a breakneck pace. Tourism, its biggest industry, is ready to rocket. A plunging Euro is giving it an important cost advantage.? After a long series of violent strikes and recent horrific economic performance, the country could return to positive growth as early as 2014. We could all be dining on moussaka, gyros, and Metaxa sooner than we think.

Is This in Your Future?