Tech in 2021

The tech sector has been through a whirlwind in 2020, and if investors didn’t lose their shirt in March and sell at the bottom, many of them should have ended the year in the green.

My prediction at the end of 2019 that cybersecurity and health cloud companies would outperform came true.

What I didn’t get right was that almost every other tech company would double as well.

Saying that video conferencing Zoom (ZM) is the Tech Company of 2020 is not a revelation at this point, but it shows how quickly a hot software tool can come to the forefront of the tech ecosystem.

M&A was as hot as can be as many cash-heavy cloud firms try to keep pace with the Apples and Googles of the tech world like Salesforce’s purchase of workforce collaboration app Slack (WORK).

Not only has the cloud felt the huge tailwinds from the pandemic, but hardware companies like HP and Dell have been helped by the massive demand for devices since the whole world moved online in March.

What can we expect in 2021?

Although I don’t foresee many tech firms making 100% returns like in 2020, they are still the star QB on the team and are carrying the rest of the market on their back.

That won’t change and in fact, tech will need smaller companies to do more heavy lifting come 2021.

The only other sector to get through completely unscathed from the pandemic is housing, and unsurprisingly, it goes hand in hand with converted remote offices that wield the software that I talk about.

The world has essentially become silos of remote offices and we plug into the central system to do business with each other with this thing called the internet.

In 2021, this concept accelerates, and cloud companies could easily check in with 20%-30% return by 2022. The true “growth” cloud firms will see 40% returns if external factors stay favorable.

This year was the beginning of the end for many non-tech businesses and just because vaccines are rolling out across the U.S. doesn’t mean that everyone will ditch the masks and congregate in tight, indoor places.

There is nothing stopping tech from snatching more turf from the other sectors and the coast couldn’t be clearer minus the few dealing with anti-trust issues.

I can tell you with conviction that Facebook, Google, Apple, and Amazon have run out of time and meaningful regulation will rear its ugly head in 2021.

We are already seeing the EU try to ratchet up the tax coffers and lawsuits up the wazoo on Facebook are starting to mount.

Eventually, they will all be broken up which will spawn even more shareholder value.

Even Fed Chair Jerome Powell told us that he thinks stocks aren’t expensive based on how low rates have become.

That is the green light to throw new money at growth stocks unless the Fed signal otherwise.

As we head into the 5G world, I would not bet against the semiconductor trade and the likes of Nvidia (NVDA), AMD (AMD), Qualcomm (QCOM) should overperform in 2021.

Communication is the glue of society and communications-as-a-platform app Twilio (TWLO) will improve on its 2020 form along with cloud apps that make the internet more efficient and robust like Akamai (AKAM).

Workflow cloud app ServiceNow (NOW) is another one that will continue its success.

The uninterrupted shift to the cloud will not stop in 2021 and will be a strong growth driver for numerous tech companies next year.

I will not say this is a digital revolution, but as corporate executives realize they haven’t spent enough on the cloud in the lead-up to the pandemic and must now play catch-up in order to satisfy new demands in the business.

The most recent CIO survey was the thesis that cloud and digital adoption at 10% of enterprise and 15% of consumer spend entering 2020 would continue to accelerate post-pandemic and into 2021-2022.

A key dynamic playing out in the tech world over the next 12 to 18 months is the secular growth areas around cloud and cybersecurity that are seeing eye-popping demand trends.

Consumers will still be stuck at home, meaning e-commerce will still be big winners in 2021 such as Shopify (SHOP), Etsy (ETSY), and MercadoLibre (MELI).

The reliance on e-commerce will open the door for more tech companies to participate in the digital flow of transactions and the U.S. will finally catch up to the Chinese idea of paying through contactless instruments and not cards.

This highly benefits U.S. fintech companies like Square (SQ) and PayPal (PYPL). Intuit (INTU) and its accounting software is another niche player that will dominate.

Intuit most recently bought Credit Karma for $8.1 billion signaling deeper penetration into fintech.

Since we are all splurging online, we need cybersecurity to protect us and the likes of Palo Alto Networks (PANW), Okta (OKTA), and CrowdStrike Holdings, Inc. (CRWD).

The side effect of the accelerating shift to digital and cloud are troves of data that need to be stored, thus anything related to big data will also outperform.

Most of the information created (97%) has historically been stored, processed, or archived.

As new mountains of digital gold are created, we expect AI will have an increasingly critical role.

I believe that 2021 will finally see the integration of 5G technology ushering in another wave of digital migration and data generation that the world has never seen before and above are some of the tech companies that will make out well.

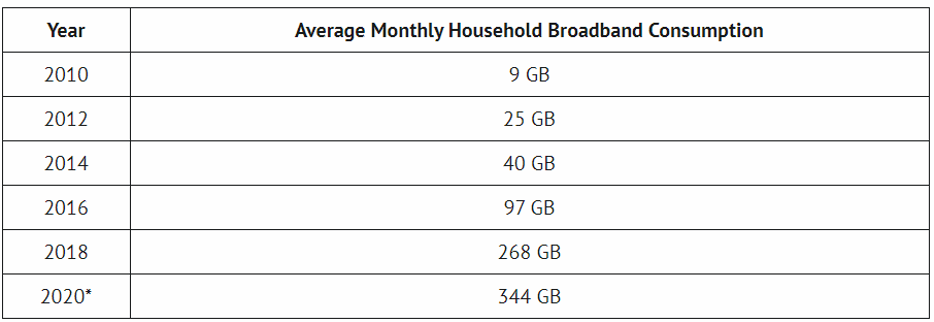

The average household is using 38x the amount of internet data they were using ten years ago and this is just the beginning.