The Secular Tailwinds are Intact

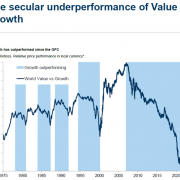

As we zoom out from tech, energy and industrials stocks have muddled through lately relatively well, while growth tech has been lethargic.

I cannot argue that we are in the middle of a rotation away from growth with capital migrating into value stocks.

Issuing low-interest rate corporate debt and spinning around to unload it to the debt market is advantageous because growth projects can be initiated without worrying about a crushing amount of future interest payments.

There is an expectation of three rate hikes by the end of 2023 which the market must absorb.

Then a mid-term expectation that the domestic economy will come roaring back is now penalizing expensive cloud services and digital communications stocks.

So now, here we are at a rock and hard place with growth with the broader market attempting to digest these roadblocks before the Nasdaq turns higher.

Just take a look at the ultimate growth stock Amazon (AMZN) or even Facebook (FB) to see a frustrating sideways consolidation from last September.

As much of this is quite disheartening for the tech investor, the tech sector remains one of the best places to look for companies creating innovative products and services that transcend industries.

I view this more as a buy the dip opportunity with the dip being elongated with numerous external events working against tech stocks.

So what are tech’s secular drivers?

According to IDC, investments in digital transformation will nearly double by 2023 to $2.3 trillion, representing more than 50% of total IT spending worldwide.

Deloitte recently released a report revealing that during the next 18 months, they expect to witness global companies embrace the bespoke-for-billions trend by exploring ways to use human-centered design and digital technology to create personalized, digitally enriched interactions at scale.

The study found that digital engagement was essential in 2020, with 96% of business leaders reporting companies who did not digitize customer engagement would experience severe negative repercussions.

These problems include a reduction in competitiveness and an inability to meet customer demands.

The companies who chose to embrace software agility meant empowering their developers to prepare tech firms for the unknown and meeting these customer expectations.

Whether it's a meteor hitting the earth, or anything else that is threatening to disrupt an industry or a business, the companies who do best can change on a dime to suit themselves for conditions in the current marketplace.

The health crisis accelerated transformation overnight.

Healthcare had to accelerate the adoption of telemedicine, and commerce companies accelerated their e-commerce plans.

The funnel that led to the consumer wallet has forever changed and in 2021, we will see further strength and momentum where we left off from last year.

Given the increased importance of digital engagement to the company's success moving forward, nearly all business leaders surveyed, 95%, expect to increase investment in digital tools after the pandemic.

Firms are now hyper-targeting a model revolving around customer engagement platforms that truly serve the end-to-end life cycle of all customer engagement in the enterprise.

Why? Because companies need to understand who their customers are, what products they're looking for, what products they bought, and where customers are interacting with their brand across multiple touchpoints.

Platforms allow the developers of the world to build, to take all of those bits of data that are siloed throughout the company to build a cohesive picture of the customer, build a world-class customer service experience and deliver the right communication over the right channel at the right time.

The endgame is to meaningfully improve every interaction every business has with every customer.

That's incredibly valuable to enterprises because it allows them to create differentiated customer experiences and all of the successful tech companies have participated in this trend.

I think that the infrastructure to build great digital products and great digital experiences spans many categories.

This rich area of opportunity will unlock developer influence and developers' ability in tech companies to build the future of these companies.

Now that every other company and industry needs tech to reach the end-user and to even initiate the selling cycle, tech is entrenched as the long-term winner.

Global business will cease to exist without software and no company will reach full potential without being powered by the best tech tools in the world, period.

And as the digital transformation is suppressed momentarily by external factors out of the control of the tech companies themselves, tech investors wait for signals for when the consolidation is over.

Tech already comprises 40% of the S&P, and by 2030, that number will be close to 75%.

This is still an industry that nobody should bet against in the long term.