Tech Earnings Is The Next Catalyst

It’s been a slap in the face lately in the tech market as the market has realized that rate cuts are not imminent.

The party is over in the short term until a catalyst re-ignites the bull market rally.

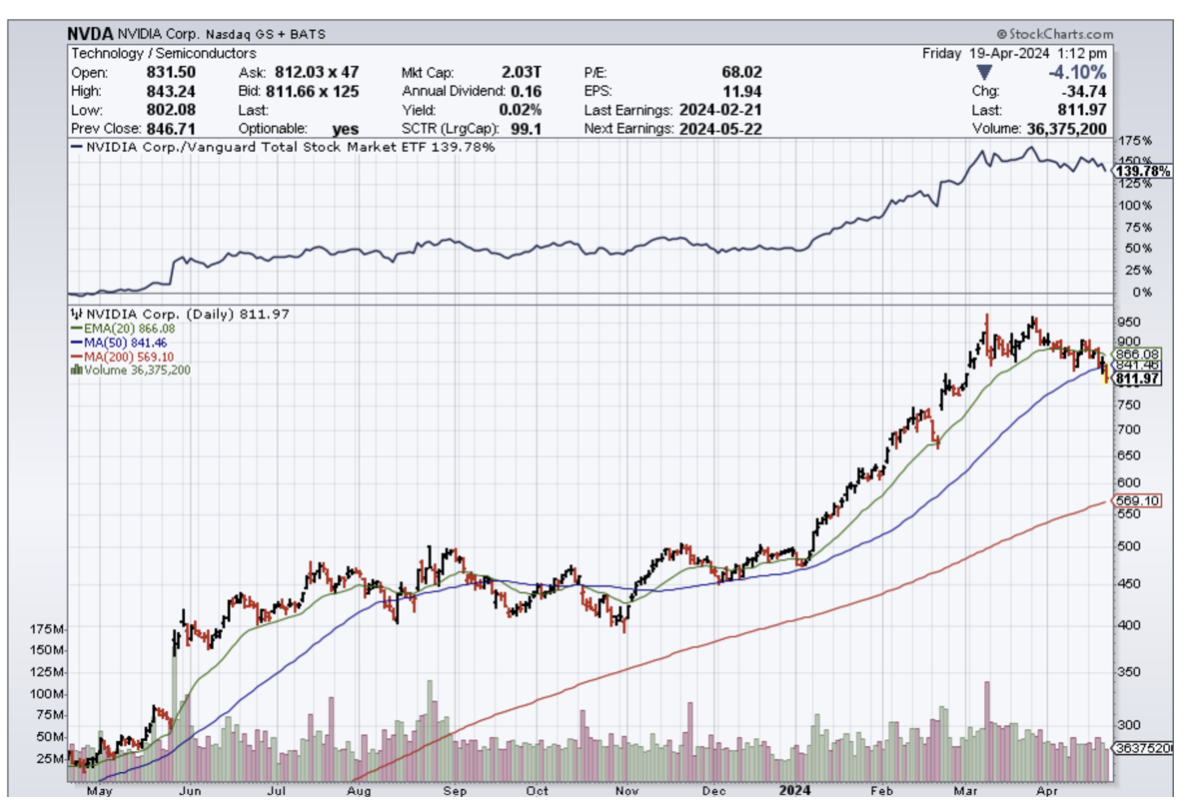

The softness has put a real dent into the momentum and trajectory of tech stocks.

Now we are confronted with the sad reality that inflation is here to stay because hot report after hot report is confirming tech investors' greatest fear, that inflation is not transitory like the Fed once said.

In fact, inflation has been a serious problem now for over 4 years and the same Fed that botched the transitory inflation issue is still in charge.

My bet is that they won’t ease prematurely with all the heat they received from the failed transitory inflation call.

Yet here we are with the tech market selling off in the short-term and healthily pulling back.

Even AI chip stock Super Micro Computer (SMCI) is back around $750 per share after skyrocketing past $1,200 per share.

The froth for now is ebbing.

Readers had to expect that a consolidation of some kind was in the cards and that is what we are going through right now.

In the near term, earnings are our best hope for a positive catalyst to offset all the negativity about inflation and interest rates.

There is a good chance we don’t even get one rate cut this year with all the hot job numbers, because the data is just too good to ignore.

In the recent stretch of the bull run, investors looked past higher rates, based in part on their belief that policy cuts were around the corner.

With wage growth starting to cool and excess savings draining, asset markets have seemingly stepped in to help sustain US consumption, adding more than $10 trillion to household net worth in the past year.

Companies need to show that they’re capitalizing on economic strength to expand earnings.

The tech market needs to show in the upcoming earnings season that the artificial intelligence optimism that started with the launch of ChaptGPT is more than hype.

Not all earnings outlooks are created equal, of course, and one can imagine a scenario in which AI darlings Nvidia and Microsoft fan optimism.

Consensus is that we will experience about 5% earnings growth for the S&P 500 from the same period last year excluding the volatile energy sector.

Meanwhile, the economy probably grew about 2.9% in the first quarter, according to the Atlanta Fed’s GDP Now tracker, and that should translate into encouraging earnings and outlooks.

I am of the opinion that all the heavy lifting will be done by several tech behemoths that also double-dip in the AI narrative.

This has also created a massive vacuum of weakness after the likes of MSFT and NVDA.

The narrowness of leadership is a result of a winner takes all of the economy and just several corporations consolidating at the top.

Competition is so fierce that it has left Apple and Tesla by the wayside.

We will reach that 5% earnings growth, but strip out a few tech stocks, and that number is likely to be flat or minus.

I believe the narrowness of leadership will be a hallmark of the future bull market and not just some one-off exception.

Some readers have no idea how ultra-competitive it is at the top of the stock market pyramid with companies fighting for the incremental investment dollar.