Tech Shares Recover on Macro News

Expect this type of showmanship to be the new normal as the U.S. government goes pedal to the medal hoping to extract better trade terms.

In the short term, expect wild swings in the prices of US tech stocks.

U.S. President Trump unilaterally raised the US tariff rate on China (FXI) to 125% and instituted a 90-day pause on steep 'reciprocal' tariffs.

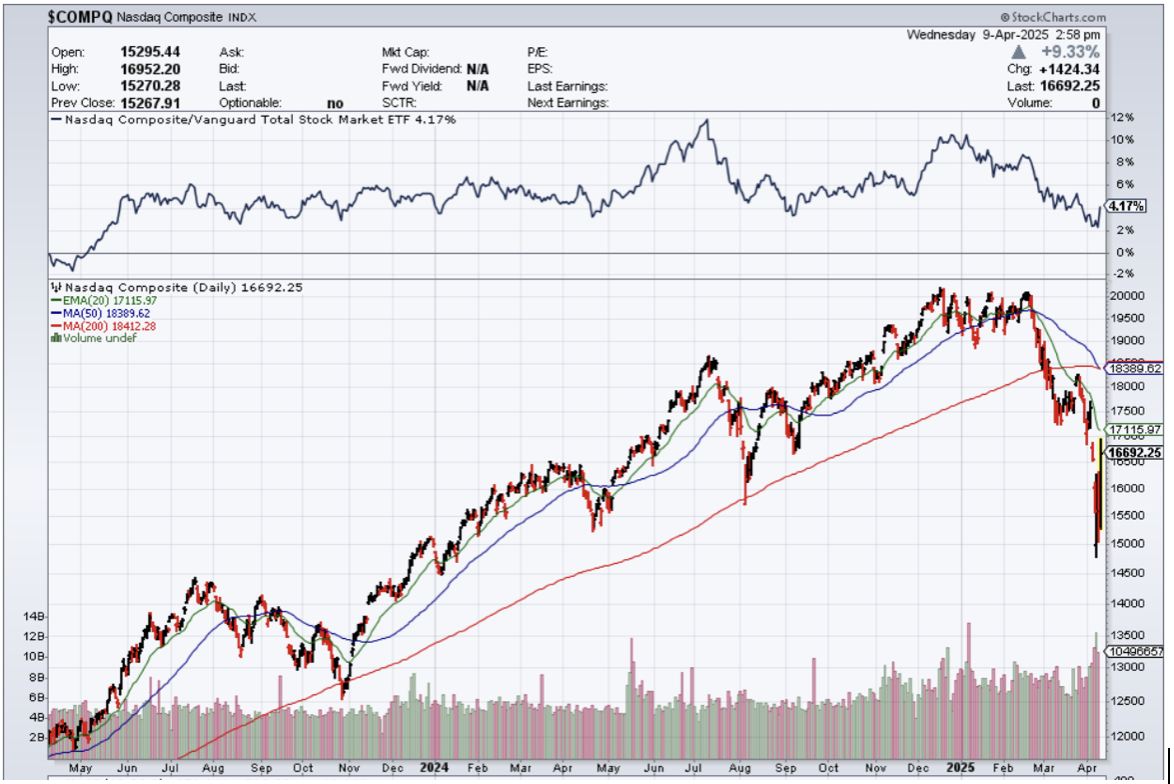

The Nasdaq shot up by an intraday 10% - an unprecedented type of market reaction stemming from short-covering.

The entire tech index was heavily weighted for lower Nasdaq ($COMPQ) share prices and this one announcement torpedoed the short-term momentum to the downside.

2025 is presenting itself to be one of the hardest environments to trade in the last two decades plus as tech shares are the trajectory of them are reliant on the whims of an aggressive new federal government.

People are scared – scared more about the uncertainty this presents.

Uncertainty creates an environment to sell stock resulting in meaningful lower-tech shares.

Additionally, it is very obvious the federal government will target China and the way it does business to reign them in. They are the big fish.

Remember that China has a massive youth unemployment rate problem inching towards 30% and the Chinese Communist Party (CCP) knows they are playing with fire if Trump’s tariffs result in millions of new job layoffs.

Trump on Tuesday claimed that China, as well as other countries, are keen to negotiate. Those talks have reportedly begun with Japan and South Korea. But he has remained defiant as members of his own party and Wall Street billionaires start to push back.

On the negotiations front, both markets and trading partners still seem to be searching for what exactly Trump is seeking.

The president’s approach has prompted retaliation from China and caused other countries to draw up their own plans to hit American exports. As a result, economists have raised their expectations for a recession in the United States, and many now consider the odds to be a coin flip.

During the trade fight with China in Mr. Trump’s first term, U.S. agricultural exports plummeted after China imposed high retaliatory duties on soybean, corn, wheat, and other American imports, and the United States spent about $23 billion to support American farmers.

The Retail Industry Leaders Association, which represents major companies like Walmart, Target, and Best Buy, said this could drive up prices for the American consumer.

In the short term, this should first alleviate the pressure on the U.S. dollar and the price hikes for tech products.

I would stay away from companies that have exposure to China like Tesla and Micron.

Gradually, we will see countries come to the table and if this gets through, even in diluted form, it would be considered a victory for US tech stocks.

Sure, the Federal Government could again jump back on its horse and go insane with the tariffs, but I do believe this pause highlights the fact that they aren’t willing to nuke the economy and tech sector just yet.

I also believe there is a roadmap to claim victory in all of this.

It starts with East Asian countries like Japan and South Korea which will take a “bad deal” in exchange for stability.

We have seen this a few times with Japan and I don’t believe they will reject America’s approach when Japan’s economy, society, and direction are even worse than Europe and America combined.

Once we get a little bit more settled and predictable, it should be a great buy-the-dip opportunity in tech shares.