Tech Stocks Launched Into Orbit By Jerome

The job is done – The Fed won against inflation.

When is the parade?

That was largely the message that was delivered to us this morning by U.S. Federal Reserve Chairman Jerome Powell.

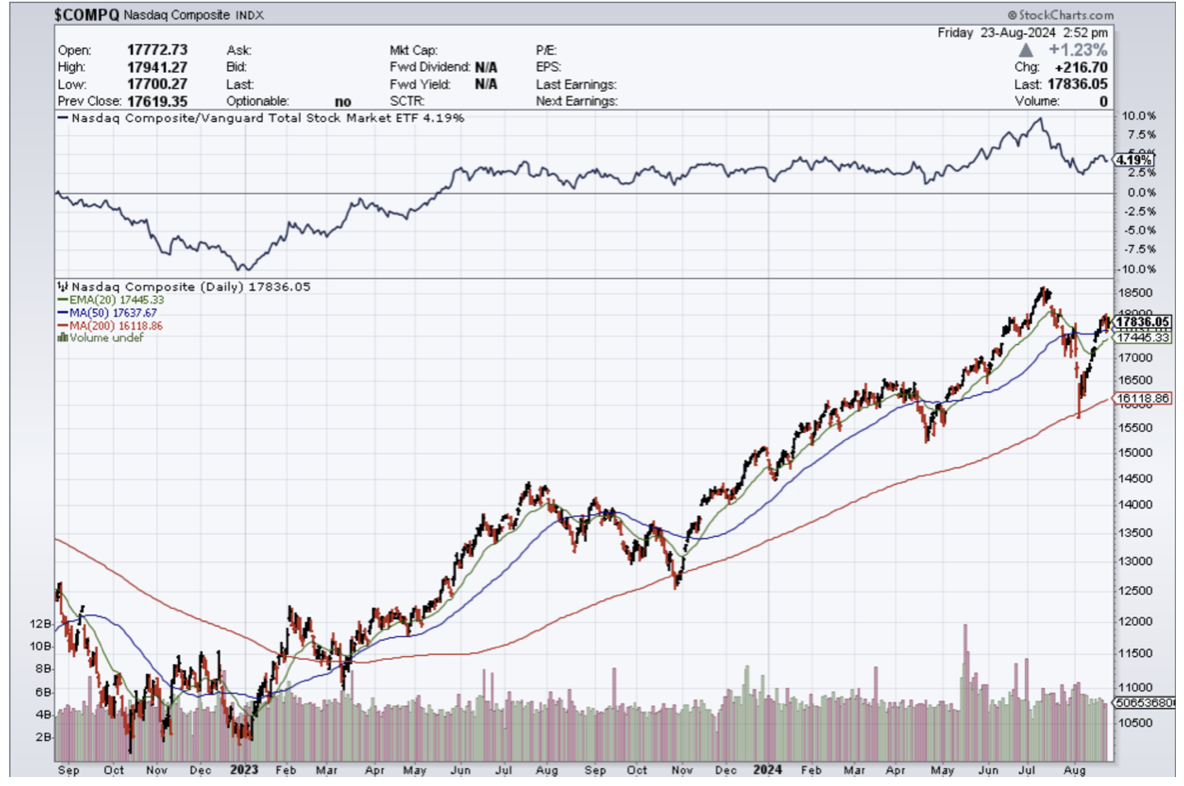

Migrating into rate-cutting mode means that tech stocks ($COMPQ) are about to explode into orbit.

We will only know how much higher tech stocks will go when we can understand how much Powell’s Fed will cut.

If he cuts the Fed Funds rate from 5.25% to 2% then tech stocks will be up at least another 50% from these levels.

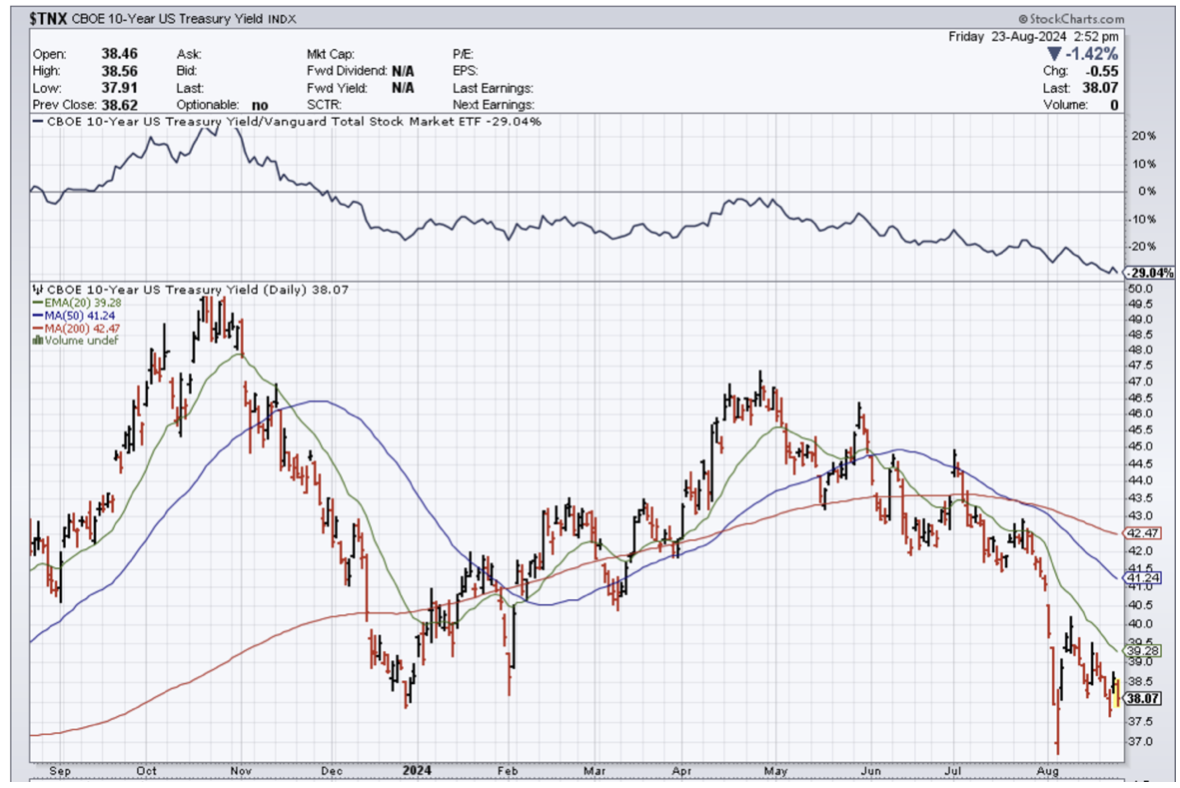

What is bizarre is that Powell is cutting rates ($TNX) with housing prices, grocery costs, stock market, and a price for one ounce of gold at all-time highs.

Things are about to get more expensive – that is guaranteed.

Ironically, the Fed is planting the seeds for the next rip-roaring wave of inflation, because 3% inflation levels will be the new floor and not the ceiling.

Once the CPI hit 2.9% just a few days ago, the Fed went into the “the job is done” mode which is extremely dangerous.

Either way, tech stocks are in for a spectacular monster rally heading into the year's close and we just added a big position in chip stock Micron (MU).

There should be two to three .25% cuts by the end of the year which is highly bullish for equities.

"The direction of travel is clear," Powell added.

Powell acknowledged recent softness in the labor market in his speech and said the Fed does not "seek or welcome further cooling in labor market conditions."

The July jobs report rattled markets earlier this month, revealing that there were just 114,000 jobs added to the economy last month while the unemployment rate rose to 4.3%, the highest since October 2021.

Data earlier this week also showed that 818,000 fewer people were employed in the US economy as of March, suggesting reports have been overstating the strength of the job market over the last year.

Powell's remarks on Friday were reminiscent of those he delivered at Jackson Hole in 2022, in which the Fed chair offered a direct assessment of the economic outlook and, at the time, the need for additional rate increases.

The similar part of the speech was his call to action to change the direction of policy and he did just that.

We are about short-term trading and trade alerts here in what moves the market with tech trades.

I do believe long-term, what Fed chair Jerome Powell did, will turn out to be a policy mistake that will result in a lot higher bond yields.

The Fed's slow walking the rate hikes on the way up and then now slow walking the rate cuts on the way down is a recipe for disaster and the wrong way to approach this problem.

The ironic thing here is that tech stocks are the only equities, apart from energy and supermarket stocks, to do well in a higher inflation backdrop and part of that has to do with their monopolistic power which continues unabated.

Not that tech needed any help, but help is arriving in terms of lower rates and I do believe tech stocks will do well as we move closer to year-end.

Buckle up, put on your cowboy hat, and enjoy the tech rally!