“When we launch a product, we're already working on the next one. And possibly even the next, next one.” – Said Current CEO of Apple Tim Cook

Mad Hedge Technology Letter

October 6, 2021

Fiat Lux

Featured Trade:

(GEMS TO SCOOP UP ON THE CHEAP)

(ADBE)

I know everyone's gotten into a tizzy because of tech stocks falling off the proverbial cliff.

It won’t always be like this.

Tech stocks won’t plunge this dramatically simply because their growth stories are mainly intact.

External events sometimes do this to our sector, and we must brace for the impact, but readers should look forward to a rosier future.

That is why readers must start to plan for which stocks to scoop up on the cheap after the selling subsides.

One ironclad name that readers must dip into is software company Adobe (ADBE).

This stock has been historically hard to find entry points and we are on the way to getting an optimal one.

Creativity has always played a central role in the human experience.

Over the last year, we have all witnessed the way creativity has sustained us.

We've shared photographs with loved ones on different continents, taught art classes to students at their kitchen tables, and launched entirely new businesses online.

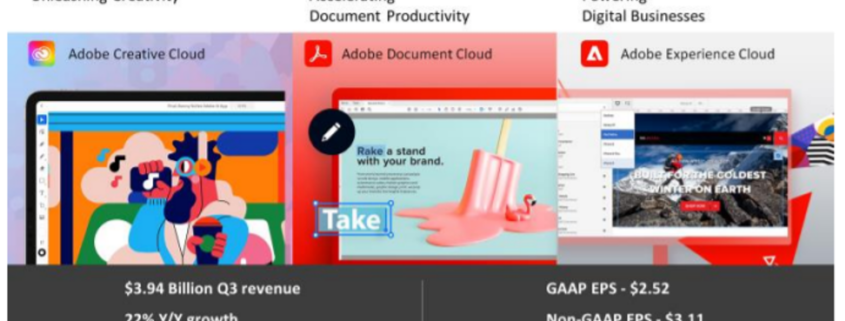

Building on decades of leadership, Adobe continues to pave the way in core creative categories, including digital photography and design, while pushing the boundaries across a wide range of emerging categories such as AR and 3D.

Whether it's the latest binge-worthy streaming plus series, a social media video that sparks a movement, or a corporate video, creation and consumption of video is experiencing explosive growth while Adobe is core to these businesses.

In August, they announced an agreement to acquire Frame.io, a leading cloud-based video collaboration platform. Video editing is rarely a solo activity and it's traditionally been highly inefficient. Frame.io streamlines the video production process by enabling editors and key project stakeholders to seamlessly collaborate using cloud-first workflows.

In the digital economy, companies are relying on digital presence and commerce as the dominant channels to drive business growth.

According to the Adobe Digital Economy Index, U.S. consumers spent over $541 billion in e-commerce from January through August, 58% more than what we saw two years ago.

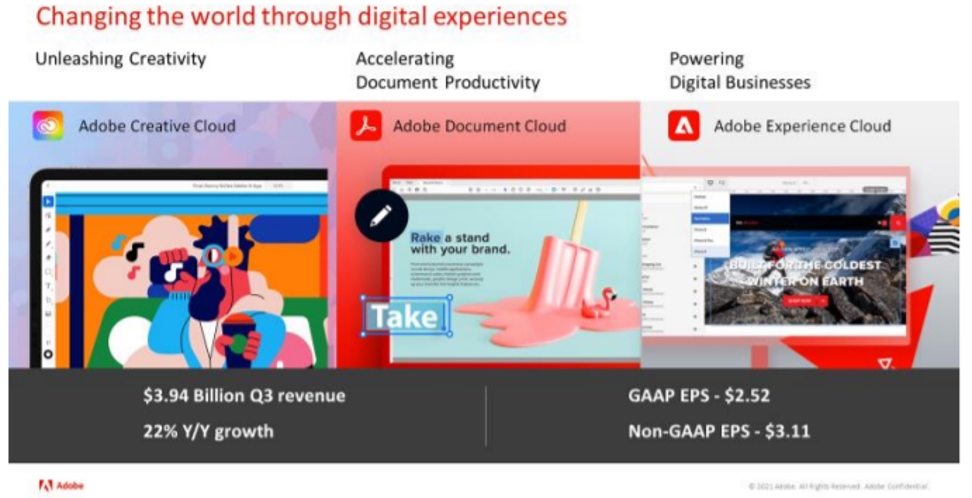

As a result, in Q3, Adobe achieved record revenue of $3.94 billion, which represents 22% year-over-year growth.

The company isn’t just performing in terms of raw revenue, but the 3-Year EPS Growth Rate has stayed in the mid-20% and snowballing in terms of dollars accumulated.

Just to validate what I just said, in 2017, annual earnings were $1.7 billion and fast forward to 2020 and earnings surged to $5.26 billion.

Adobe’s consistency is also the talk of the town with their 3-year revenue growth rate in the mid-20%.

Adobe is really at the sweet spot of their earnings profile, and I can easily see this company growing from a $270 billion market cap today into half a trillion-dollar stock within 4 years with earnings of $8 billion per year.

Naturally, the bread and butter to Adobe is the small and medium-sized businesses (SMB).

The SMB’s scoop-up products like imaging and video continue to do well — the Acrobat business, which is reflected both in the Creative Cloud and the Document Cloud, is doing well.

Net-net, I would say that the growth prospects for these particular businesses are running smoothly as can be and this is how positive the feedback is from these creative products.

At the end of the day, I think the macro trend that everybody is finding is that a digital presence in commerce, data and insights, and analytics is an x-factor now for anybody doing business.

The behavioral data that Adobe collects in real-time for the productivity division correlates with the marketing message associated with telling creators that they really need to focus on getting their first-party data to be an asset.

Then you add that to the creative products and wow — what a stellar company.

These are seminal trends Adobe is flying on the coattails of, and the robustness of Adobe’s tools significantly differentiates itself relative to competition.

I am bullish Adobe in the long term.

“Microsoft isn't evil, they just make really crappy operating systems.” – Said Finnish-American software engineer Linus Benedict Torvalds who is the creator of Linux, Android, and Chrome OS

Mad Hedge Technology Letter

October 4, 2021

Fiat Lux

Featured Trade:

(IT WILL JUST TAKE LONGER)

(ROKU), (TSLA), (FB), (AMZN), (AAPL)

The “Buy the Dip” strategy in tech stocks hasn’t failed — it will just take longer than it used to.

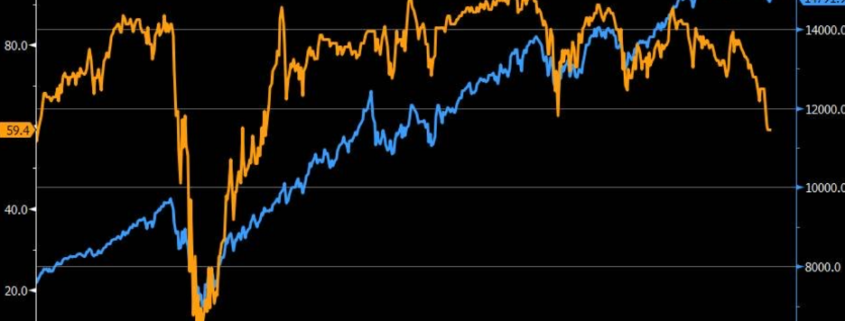

Much of this Nasdaq rally has been represented by the resiliency of large cap tech stocks — every mini dip was bought with a vengeance.

This go-to playbook drove tech shares higher after the March 2020 meltdown.

These past 30 days have really tested that thesis and signals that we, as market participants, have arrived at a crossroads because if the dip isn’t bought soon, we could either fall off a ledge and barrel into a harrowing correction or we could initiate a sideways correction and trade in a fixed range.

It’s hard to ignore the near-term weakness in many of the household names like Apple (AAPL), Amazon (AMZN), and Facebook (FB).

The upper echelon of tech leadership is signaling imminent decelerating growth and tightening financial conditions.

I do believe much of it is in the price, yet it’s cognizant to know there could be meaningful spillover from the Evergrande debt implosion in China into other asset classes.

External events are shaping the narrative around the Nasdaq dip buyers.

It also doesn’t help that a Facebook whistleblower came forward to tell the press about its malpractices and less than ideal tendencies to put profit over safety, but everyone already knew that about Facebook.

What I am surprised about is that investors usually look through the bad Facebook press and prioritize the metrics which hasn’t been happening the past month.

Facebook shares are still waiting to be bought after the dip.

The lack of Facebook shoppers on the pullback is definitely one area of concern because the U.S. government still has done very little to stop Facebook in its stubborn practices.

The U.S. government will not crack down through legislation on social media companies in the short term.

Much of the negative Nasdaq price action in the short term can be attributed to the worries about China taking a machete to its susceptible tech sector and crushing it even more.

Many don’t think the cudgeling is over.

In this scenario, a flight to safety could be in the cards, which would suppress interest rates offering an olive branch for the dip-buyers.

Ultimately, I do believe it’s a matter of time before we get some recovery price action in the leadership tech stocks; but yes, it could take 1-3 weeks.

Much of this second half of the year was consolidating tech shares that overshot themselves last year.

That’s why tech firms like Tesla (TSLA) had almost a zero percent chance of repeating last year’s performance.

Take ad tech stock Roku (ROKU) for instance, shares are down 23% YTD and that doesn’t mean it’s a bad stock.

Hardly so.

When one considers that Roku shares ended 2020 up 300%, then giving back 23% or 50% in 2021 is worth the annoyances.

These stocks can’t go up in a straight line even if they almost feel like they can sometimes.

This all sets up for a brilliant 2022, as many of these high-quality names will finally have gotten through the consolidation phase and will be buttered up to initiate their next leg up in early 2022.

In the broad scheme of things, tech won the pandemic over any other sector, and 2021 is turning into a rest year.

Sometimes one needs to go backwards one step to take the next three forward.

“Creativity is just connecting things.” – Said Co-Founder of Apple Steve Jobs

Mad Hedge Technology Letter

October 1, 2021

Fiat Lux

Featured Trade:

(CONNECTED TV IS ON FIRE)

(TTD), (DIS), (FUBO)

One of my favorite ad tech companies has to be The Trade Desk (TTD).

They are a middleman of sorts, using an in-house platform to match the inventory of digital ads with the advertisers themselves.

They have been extremely effective at harnessing data to deliver the right ads to the right people and many major streaming companies and Fortune 500 companies are reaching out to them to figure out how to deploy ads in the most systematic way possible.

Let’s just say there is a lot of slippage going on in the linear industry where wrong ad placement is common.

Performance of late has been strong in TTD — more of the world's top advertisers and their agencies signed up or expanded their use of TTD’s platform, which just continues to validate their business strategy.

Companies are now increasingly embracing the opportunities of the open Internet in contrast to the limitations of walled gardens.

The highlight of last quarter’s performance is led by Connected TV (CTV) and premium video.

What is CTV in advertising? CTV is short form, skippable online advertising targeted to relevant content channels and/or audience groups. Connected TV (CTV) refers to any TV that can be connected to the internet and access content beyond what is available via the normal offering from a cable provider.

The CTV growth coincides with a broad move from broadcast and cable to digital on-demand content that is happening all over the world.

CTV as a percentage of TTD’s business continues to grow very rapidly and is, by far, their fastest-growing channel.

Overall, total revenue was up 101% from a year ago to $280 million, significantly surpassing in-house expectations.

Growth occurred mainly because of TTD’s latest platform launch, Solimar, which is the result of more than two years of engineering work, and it addresses many of the opportunities in front of agencies and brands today.

Just to provide some context on growth in CTV, through just the first half of this year, the number of brands spending more than $1 million in CTV to TTD has already more than doubled year over year.

And it's not just larger advertisers that are taking advantage of CTV anymore. The number of advertisers spending over $100,000 has also doubled. In total, TTD has nearly 10,000 CTV advertisers, up over 50% compared to last year.

That exponential growth speaks to how rapidly the TV landscape is evolving. The accelerated consumer shift to digital video is real, including CTV. And that shows no signs of slowing down.

In fact, TTD reached more households via CTV in the U.S. today than are reachable through linear TV. Today, TTD reaches more than 87 million households. Those trends are now well established.

MoffettNathanson recently reported that the ad-supported video-on-demand market is growing from $4.4 billion in 2020 to about $18 billion as early as 2025.

And every major ad-supported platform, whether it's Disney's Hulu, Peacock, Discovery Plus, ViacomCBS' Paramount and Pluto, FOX's 2B or fuboTV and many others, all are reporting record viewership or ad spend figures.

Broadcasters recognize that the traditional upfront process is a mismatch. It doesn't work in a digital world where data and personalization are required to succeed.

The legacy upfront process is really hard to run in an environment with lots of change and lots of uncertainty. I believe that this year will mark a turning point in how the process is managed. In today's fragmented TV environment, linear audiences continue to erode, linear supply is shrinking and the prices are rising simply because of the scarcity. This year, broadcasters use that scarcity to their advantage and lock up commitments as the demand for growth intensifies.

When compared to parallel linear TV ad campaigns, CTV delivered a 51% incremental reach and a four times improvement when analyzing cost per household reach. These are not isolated cases.

Retail is a point of emphasis this year with Walmart integrating Walmart shopper data on TTD’s platform. This is a leading example of how TTD is working with advertising customers to help unlock the value of retail data estimated at $100 billion to $200 billion market.

This is a highly volatile stock and 2021 has been a year of consolidation.

If TTD comes down to $60 from the $70 today, that should represent an optimal entry point into one of the hottest sub-industries in tech.

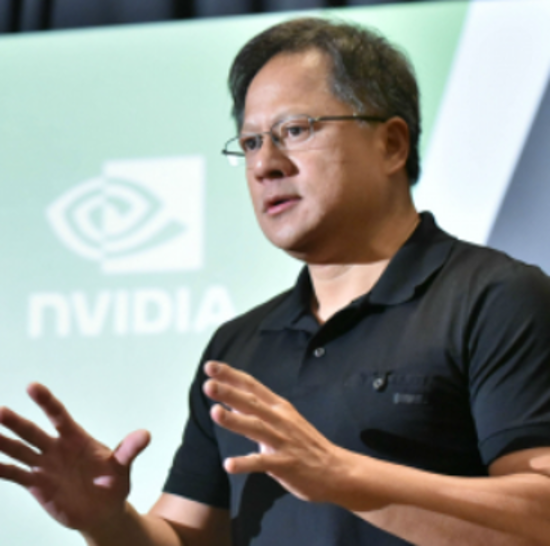

“The AI technology will keep you out of harm's way. That is why we believe in an AI car that drives for you.” – Said CEO of Nvidia Jensen Huang

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.