The consensus of AI and robotics only taking “blue-collar” jobs is now steadily morphing into a new type of rhetoric.

It was once seen that heavy labor, like Amazon’s robots hauling away heavy items in a warehouse, was the widespread case for robots and AI.

However, I’ve been talking to many industry experts who have privately confided that it could be white-collar jobs that receive the most dramatic cuts.

Think about it, can AI and a robot really do the same job as an HVAC repairman or even a plumber?

If tech is able to solve that level of complexity, then the sky is the limit for tech, but I don’t believe we are anywhere near that yet. It is more likely that people typing simple code into computers will be swapped out for an algorithm, which would be an easy one-to-one switch. Jobs that don’t require a physical presence will always be first in line to be cut.

AI has proven that it operates with limited common sense or street smarts, and in some jobs, these 2 skills are essential to performing well.

By analyzing over 24,000 AI-related patents filed between 2015 and 2022, the researchers were able to identify which occupations might be most affected by emerging AI technologies.

Surprisingly, some of the occupations with the highest scores were white-collar jobs requiring advanced education and specialized skills. Topping the list were cardiovascular technologists and technicians, sound engineering technicians, and nuclear medicine technologists. Other jobs at high risk of automation included air traffic controllers, magnetic resonance imaging (MRI) technologists, and even neurologists.

In the information technology sector, 47% of software developers’ tasks and 40% of computer programmers’ tasks were found to align closely with recent AI patents. These patents focused on automating programming tasks and developing workflows, suggesting that even highly skilled tech jobs may not be immune to AI’s influence.

The least likely to be impacted by AI in the near future tended to be blue-collar jobs requiring physical labor or manual dexterity, such as pile driver operators, dredge operators, and aircraft cargo handling supervisors.

Just looking at the new increases in amount of robots suggests that job replacement is coming thick and fast.

Slightly more than 10% of South Korea's workforce has been replaced with robots.

The country has increased its use of robots by 5% each year since 2018.

China, with 470 robots per 10,000 employees, has overtaken Germany and Japan and landed in third place behind Singapore.

The United States ranked 10th with 295 robots per 10,000 employees.

North America's robot density is 197 units per 10,000 employees – up 4.2%.

America has lost around half a million jobs to robots so far, but I believe this concept isn’t linear, and we won’t be able to just extrapolate our current trends into the future.

Once it rains, it will really pour.

It is no coincidence that software companies are firing software engineers in large groups. Silicon Valley has really trimmed the fat off the boat, taking the cue from Elon Musk firing 80% of Twitter and functioning meaningfully better.

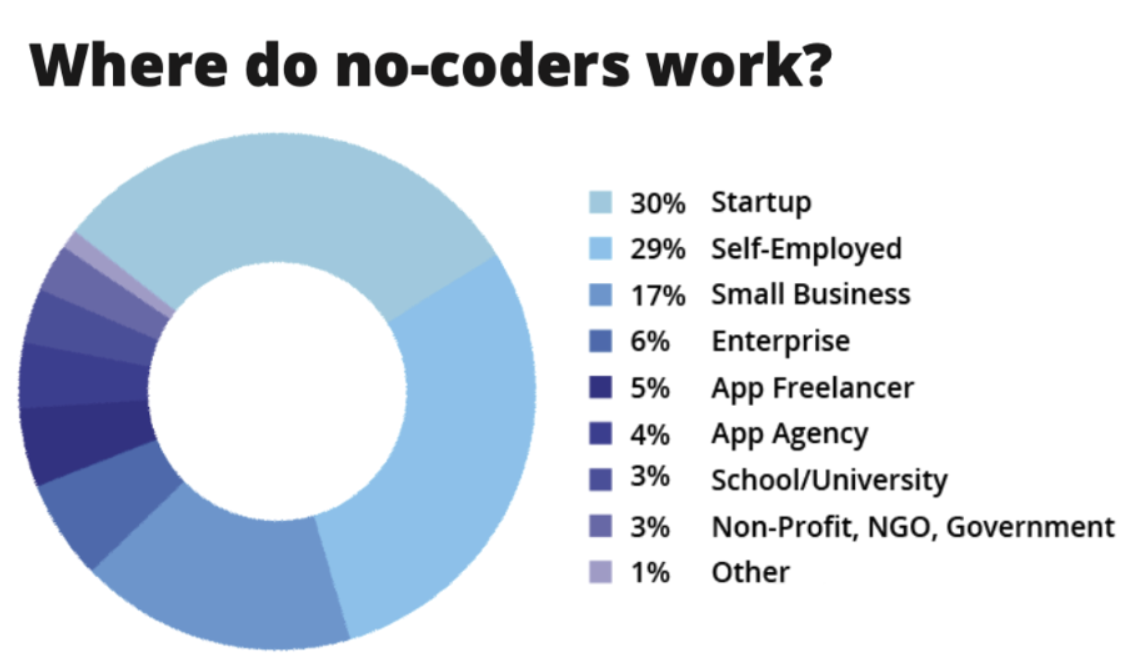

I come back to this concept of tech companies operating with algorithms powered by AI with a few “managers” and executives.

We aren’t a few days or months from this coming to fruition, but we are years.

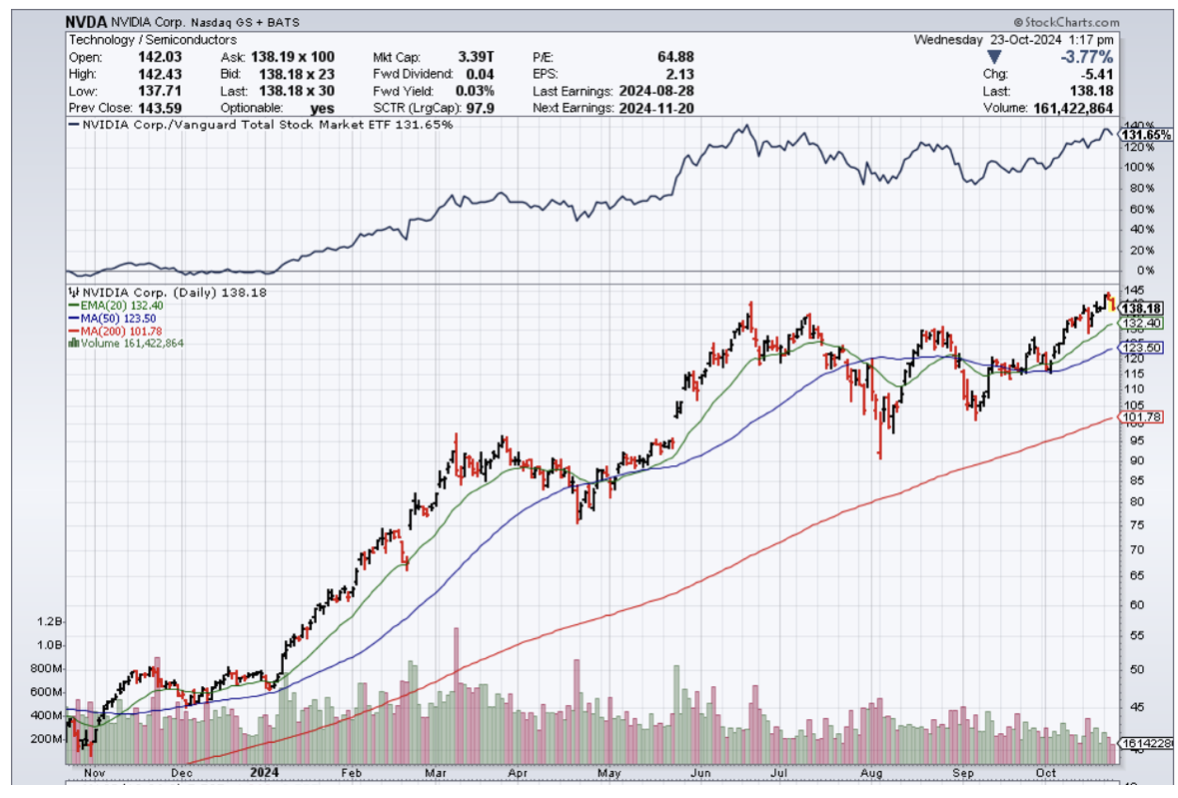

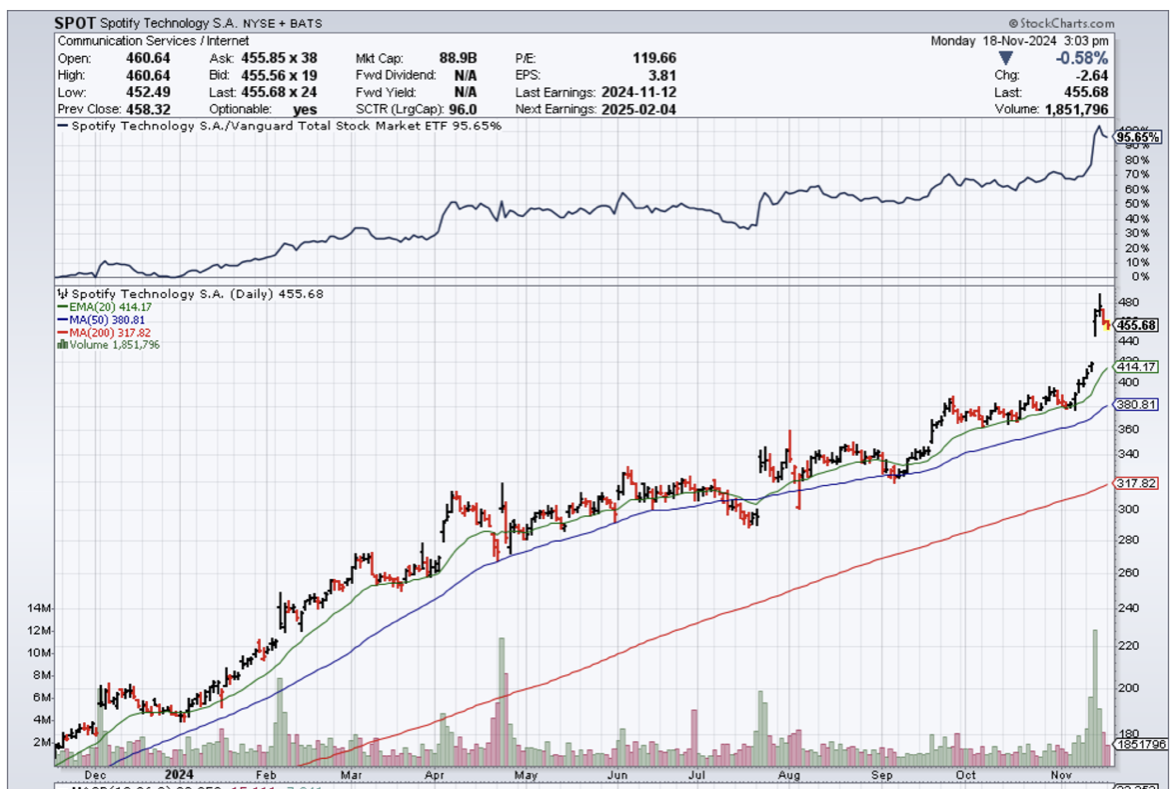

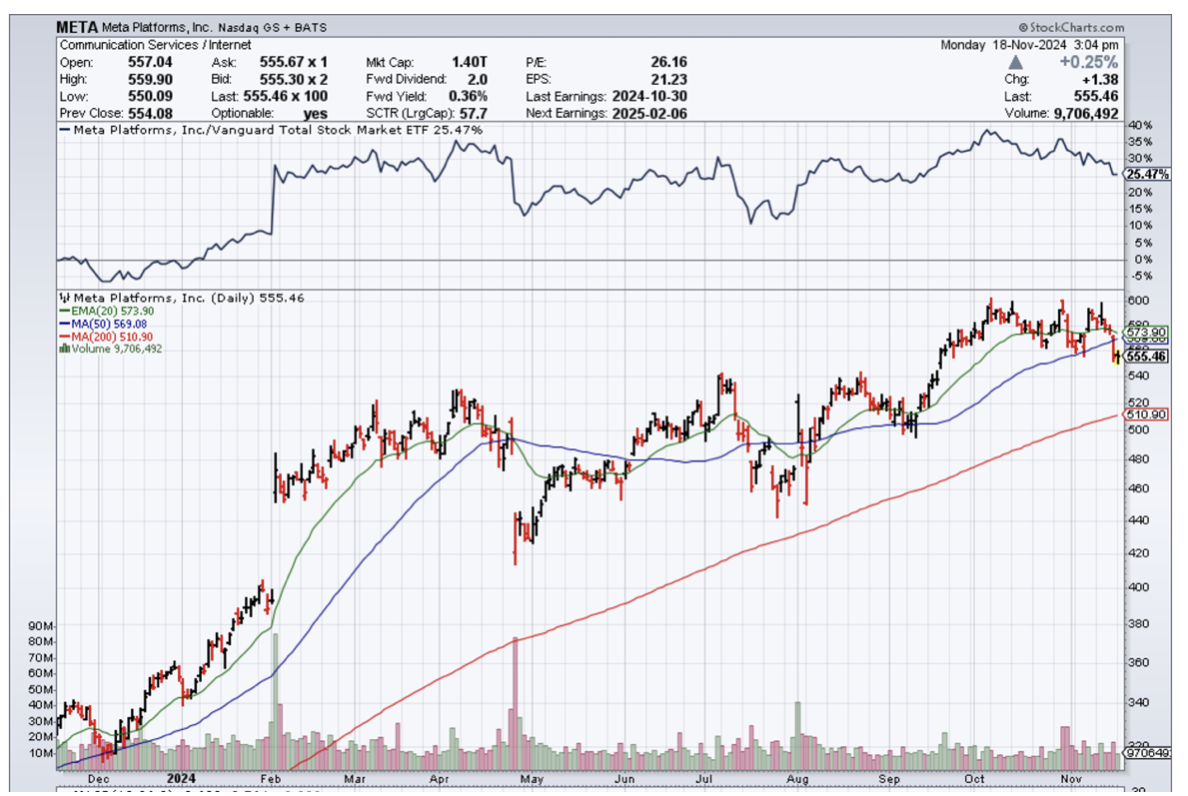

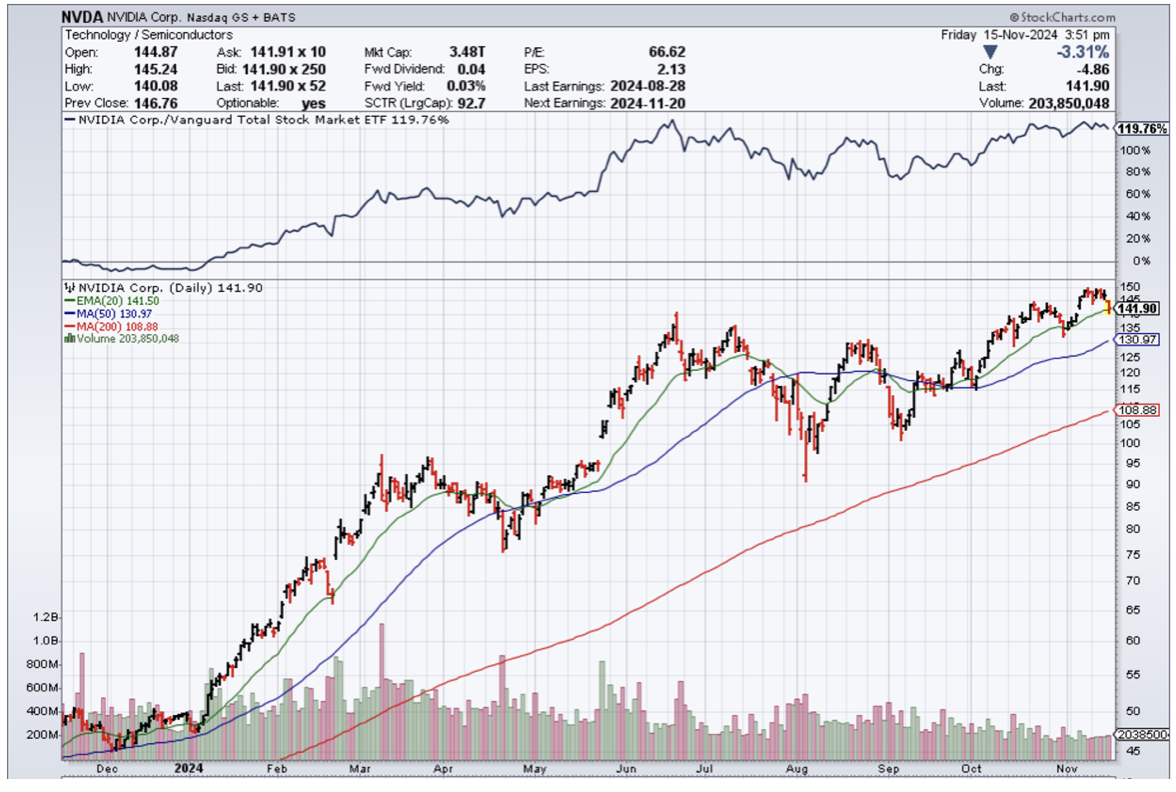

The complete overhaul in staff numbers would mean that tech stocks would enjoy a renaissance and rise 5X to 10X from today’s levels to the joy of shareholders.

American society has never held such a high portion of its wealth in tech stocks, and that will continue as tech stocks get bid up and tech companies doing anything under the sun to massage the stock higher.