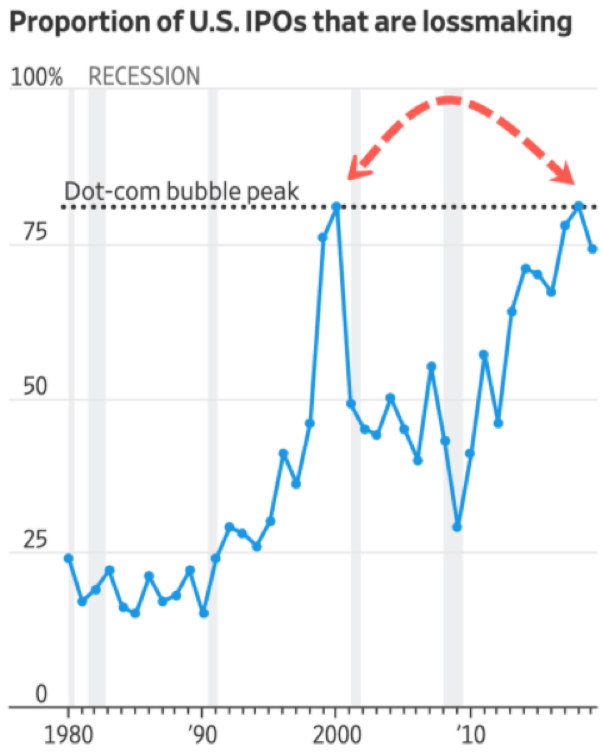

A report from a prominent new source reveals that in the past 12 months, 40% of all US-listed companies were losing money and of these, 17% were tech firms, the highest level since the Dot Com bubble.

That is why software gems like Zoom Video Communications, Inc. (ZM) should be bought and held, never to see the light of day ever again.

The company makes money at such an early stage of their development that it's hard not to get excited about the future.

Readers can indulge themselves in this high caliber tech growth stock, especially after they demonstrated that they are hitting on all cylinders after a high-flying earnings report.

Another prominent new source recently said that this company’s products are “changing the entire landscape” of U.S. business.

Just one instance they have infiltrated deep into real American business is the U.S. Postal Service.

They are starting to deploy Zoom Meetings more broadly across the organization after an extensive proof-of-concept.

The USPS is Zoom’s first major agency and major business win since they received FedRAMP approval in May.

Why did they pick Zoom?

Easy! Simply for Zoom’s high-quality video and audio.

Zoom’s share price cratered 40% since hitting the heights of $102 in July 2019 which was coincidentally the high for most post-IPO tech stocks of 2019.

It was an elevator straight down to no man’s land – but investors would be foolish to paint all hyper-growth companies with the same brush.

Filtering out the wheat from the chaff is critical and Zoom is the stock that still has the gloss on its outside package buttressed by its best-in-show video conferencing software.

There are no other proper alternatives in this sub-sector of software.

The volatility can be extreme making this name difficult to trade and constantly has dips of 7% even though the company crushes expectations.

I called for readers to scoop up shares in the low $60s and the stock is now healthily trading in the upper $70s as we hit the back half of January.

Remember that this company grew 96% just 3 quarters ago and it would be illogical to believe that the stock is being penalized from faltering to 85% today.

The report on January 6th showed a strong quarter as evidenced by a combination of high revenue growth of 85%, with increased profitability and free cash flow of $54.7 million.

They continue to have success with customers of all sizes and one metric that has continued to stick out is customers with more than $100,000 of trailing 12 months revenue – that metric grew 97% from Q3 last year.

Any tech company would give a left thigh for 85% growth in this climate which is why many have resorted to inorganic growth.

Buying growth is not necessarily a bad strategy now but buying growth at this point in the economic cycle naturally means that companies will need to overpay for growth because of expensive valuations.

Zoom is perfectly positioned to outperform in the next 1-3 years.

The advancing runway is wide open with no competition in sight and a generous growth trajectory is firmly on their side.

At some point, this software company could become a takeover target for a larger corporate.

I am impressed with Zoom's superior products, growth prospects, and scalable business model, and the stock’s near-term risk/reward trade-off is mildly bullish after the jump from $62.

There is an actionable and manageable clear path to a $2 billion revenue run rate with strong margin expansion potential and with its flagship product growing around 80-90%, its next growth driver in Zoom Phone could translate well into a meaningful revenue stream.

Zoom Phone is the next springboard to further success for this company, meaning there won’t be any cliff edge with future revenue streams.

Anyone that has used Zoom as a product can confirm the veracity of its superior performance standards.

This isn’t the type of stock to trade short-term - the volatility undermines any potential entry points.

If the broader market holds up in 2020, Zoom’s value extraction potential is substantially robust, and shares should reach $90.

Growth stocks can only be pinned down for so long before the beast is unleashed.

Buy this stock on any short-term dip.